Pound in Peril Amid Retail Sales Disappointment, Powell Speech Awaited. Traders brace for an action-packed day as significant data releases align with Fed Chair Powell’s speech, a potential market mover. Eyes are set on the GBP/USD, EUR/USD, and gold prices, interconnected with today’s economic events.

Table of Contents

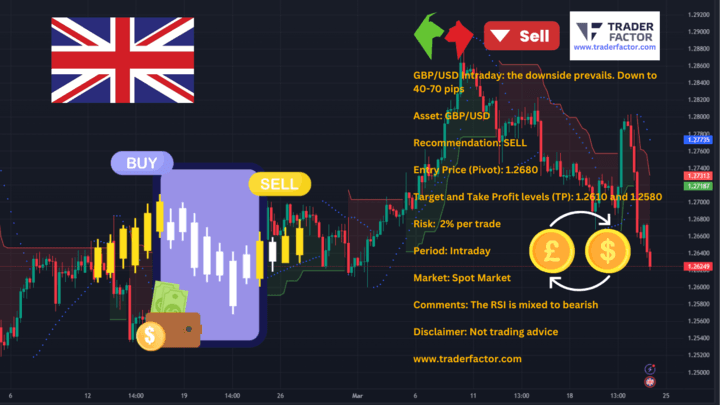

ToggleGBP/USD – Pound in Peril Amid Retail Sales Disappointment

Surrendering 1.2600 Amid Strong USD Demand

Sterling took a plunge following the latest retail sales report from Britain, appearing lackluster and failing to meet expectations. The GBP/USD currency pair struggles to maintain its footing, surrendering the 1.2600 level. A blend of a sturdy US Dollar and persisting Brexit woes continues to pressure the Pound.

Central Bank Decisions Stir Volatility

The recent dovish stance by the Bank of England (BoE) sparked a reversal in market sentiment, pushing GBP/USD to a new two-week low. Traders remain vigilant ahead of Powell’s address. The chart analysis recommends a SELL position at 1.2680, targeting levels at 1.2610 and 1.2580. Risks are cautioned at 2% per trade with the RSI indicating bearish momentum.

GBPUSD Daily Chart

EUR/USD – Retreat from Highs

Fading Optimism in the European Market

EUR/USD faces downward pressure as the US Dollar rises on the back of burgeoning optimism for the US economy, reflected by PMI surveys indicating continued expansion. Traders now watch the Euro Summit’s outcomes to gauge future impacts on the currency pair. Technical recommendations call for a SELL position starting at 1.0875 with targets positioned at 1.0810 and 1.0790. The RSI’s downturn suggests a negative outlook.

EURUSD Daily Chart

Gold – Precious Metal Loses Its Luster

Gold Faces Resistance Amid Market Optimism

XAU/USD (gold) extends its descent amidst a robust US Dollar and general market optimism, potentially eyeing further retractions from recent peaks. Hopes for a peaceable resolution in Gaza and bullish US economic cues are driving the commodity down. Nonetheless, Fed expectations could provide some resistance to the downtrend. A key resistance has been spotted at 2187.00 with a recommendation to SELL, aiming for 2167.00 and 2160.00. Risks are maintained at 1% per trade.

XAUUSD Daily Chart

USD/CAD – Climbing as Bears Eye Canadian Data

Loonie Takes a Back Seat to the Greenback

The USD/CAD pair witnesses a notable surge, lifted by the soaring demand for the safe-haven US Dollar. Anticipated Canadian Core Retail Sales could further influence the currency’s trajectory. Current market sentiment supports a positive performance for the USD/CAD, aided by strong housing market data from the United States.

Expert Analysis

Today’s flurry of data releases and Powell’s much-anticipated speech set the tone for an event-driven trading session. With the Fed hinting at a less restrictive policy and potential rate adjustments, markets remain cautious,” stated by Phyllis Wangui, a seasoned analyst.

The US Dollar’s strength represents a central theme, affecting currency pairs and commodities alike, as reflected in the pragmatic intraday recommendations provided above. Traders are advised to approach the market with vigilance, providing due consideration to the ongoing events and their widespread implications.

—

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.