Skilling is a Scandinavian-owned CFD, Stock and forex broker providing trading opportunities via the industry-recognized cTrader, MT4, and a proprietary. Available on iOS and Android, the company also provides three web and two mobile platforms.

This review explores Skilling’s range of account fees, account types and previews of its in-house platform. Follow through to find out whether to open an account and start trading.

Launched in 2018, Skilling is an innovative broker founded with the purpose of making trading simple and accessible. Skilling features excellent trading options, four simple account options, a plethora of tradable assets and unique trading platforms.

Currently, this fintech broker is headquartered in Cyprus with additional offices in Malta and Spain. With over 70+ employees, the company boasts cutting-edge technology, transparent pricing, close to 1000 financial instruments, and ultra-fast execution speeds.

The Skilling group also has a team of developers, specialists, and marketers who are constantly striving to ensure traders enjoy the best possible experience. More so, it advertises its services in such a way that beginners can understand while remaining also focusing on experienced traders.

With over 900 available instruments, the company offers a huge amount of trading opportunities and accounts tailored to satisfy the needs of most traders. It’s also an easy-to-navigate and rich website that makes trading a fulfilling experience.

As a regulated broker, the firm requires traders to pass anti-money laundering (AML) and know your customer checks. To register, you must provide details such as;

- Name, date of birth, and country

- Tax identification number

- Address

- Information like employment status, annual income and source of funds

- Occupation

- Reason for the trading

- Copy of ID or passport

- Utility bill and driving license

In nutshell, Skilling is an excellent broker with a client centered and transparent approach that attracts both experienced and beginner traders.

- The platform is used by over 5000 traders

- Spreads from 0.2 pips

- Micro-lots

- EAs supported

- Cryptocurrency cashback

- Trade assistant

- No inactivity fee

- Multi-regulated broker

- Cryptocurrency cashback

- Multilingual support team

- Offers beginner-friendly resources

- Execution speed under 5ms

- Edging and scalping supported

- Limited, stop and trailing stop orders

- Beginner-friendly educational materials

- Live trading alerts and notifications

- Up to 1000 strategies available for copy trading

- No commissions on Standard and MT4 accounts

- Over 900 assets and multiple trading platforms and investing app

- Regulated by Cyprus Securities and Exchange Commission

- Min. deposit from $100

- No bonuses for EU clients

- No trading signals

- No cryptocurrencies or trading stocks

- No MetaTrader 5 (MT5) trading platform

- Only a few individuals can access premium accounts

Skilling is a custom-built platform which is both flexible and easy to navigate. With charts integrated directly, it has one of the best charting websites on the web. If you’re a seasoned trader, you can test your trading prowess on MetaTrader4 or cTrader, which are some of the most popular platforms out there.

Forex trading beginners on the other hand can choose the broker’s copy trading options that allow them to copy other successful and experienced traders.

Skilling Trader platform comes with multiple indicators such as MACD and moving average that allows one to carry out convenient technical analysis. It also has a range of chart styles to suit the visual preference plus complete order management with access to previous trades, account balances and brokerage withdrawal history.

One useful feature is being able to analyze historical trading patterns. By looking at historical data, you can make better predictions and forecasts. Compared to other solutions, investors have more customisable elements, faster access to data, and a range of filters that help them make the right trades quickly.

Due to its browser-based format, the platform is available on every major browser. It also functions on mobile, specific iOS and Android apps.

Available for download on the broker’s website, the WebTrader version is provided, alongside a mobile app and offers over 200 instruments, fast execution speeds, expert advisors and 2000 customizable indicators.

Overall, this is among the most popular investing platforms that will meet the needs of most traders.

cTrader is a unique investment platform meant to satisfy the needs of both experienced and beginner investors alike. It features advanced charting tools, fast execution, order types, and level II pricing among others.

It also boasts a user-friendly interface and allows traders to invest through mobile phones, web browsers or by downloading the software from the website.

Unlike MT4 which has one level, cTrader offers three different levels of market depth.

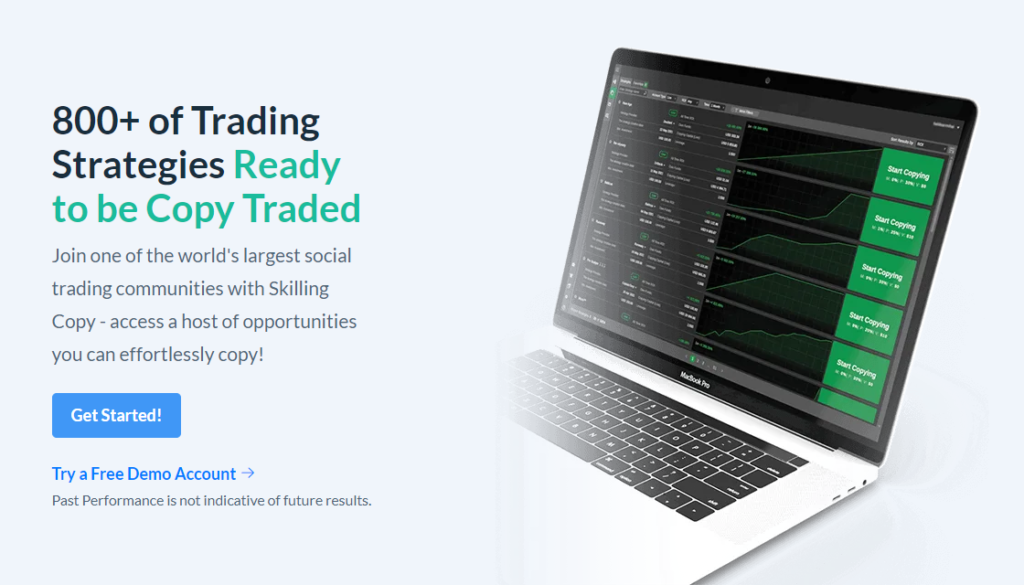

A social trading service, Skilling Copy features up to 1,000 strategies and allows beginner traders to copy successful investors. The strategy provider in return takes some fee for their effort.

A web-based and integrated platform, it also helps clients research different trading strategies. With this platform, you can view performance results, trading style and the track record of strategy providers. Unfortunately, Skilling Copy is not available for the residents of France, Belgium, and Italy.

Skilling has an extensive collection of materials and research tools to help you maximize your potential in the market. The platform allows access to over 800 financial instruments with advanced drawing tools and user-defined multiple trade indicators.

While the skilling website lacks standalone trading tools, the Skilling cTrader platform Skilling Trader has a vast array of built-in trading tools, which are designed to help investors.

Among the tools it has, the primary ones are technical indicators such as oscillators and moving averages. With these tools, you can do technical analysis and even accurately predict upcoming price changes. In addition, Skilling supports timeframes, a variety of charts, and automated trading scripts.

Unlike other platforms, Skilling has limited educational resources. Apart from their “What is CFD trading?’ section which covers the basics, the broker does not provide more. This leaves a lot to be desired about the platform especially since their goal is that everyone with an interest in trading should be able to access the website and harness their full potential.

Skilling provides access to 900+ global assets including:

Commodities: Skilling offers up to 12 trading commodities including oil, gold, silver, oil and natural gas.

Cryptocurrency: Skilling offers up to 57 cryptocurrencies which are quite impressive compared to other platforms. These include Ethereum, Bitcoin,Tron, Dash, and Dash Ripple, among others. Since the spreads vary a lot, significantly, it’s not unusual for spreads to be as far as 75 pips on Bitcoin. Meaning if you trade in these currencies, you need to watch your margins.

Currencies: The platform also supports up to 73 different currency pairs including EUR/JPY, GBP/PLN, and GBP/PLN with 53 available on MetaTrader. However, one can only trade with 53 pairs on the MT4 platforms.

Stocks: When it comes to stock, Skilling speculates on over 750 international companies including Apple, Google, Amazon, Facebook, Tesla and Uber.

Indices: Skilling also has 16 different indices which are almost the same ones offered to others available at other similar brokers. The most common ones are basically the ones that combine the shares of some of the largest globally acknowledged companies. Indices available include the UK 100, S&P 500, the NASDAQ 100, and the Dow Jones 30, among others.

Share CFDs: Skilling offers over 750 share CFDs for trading, a broader range than other large international brokers. The ones available include those from the major UK, US, and European Exchanges.

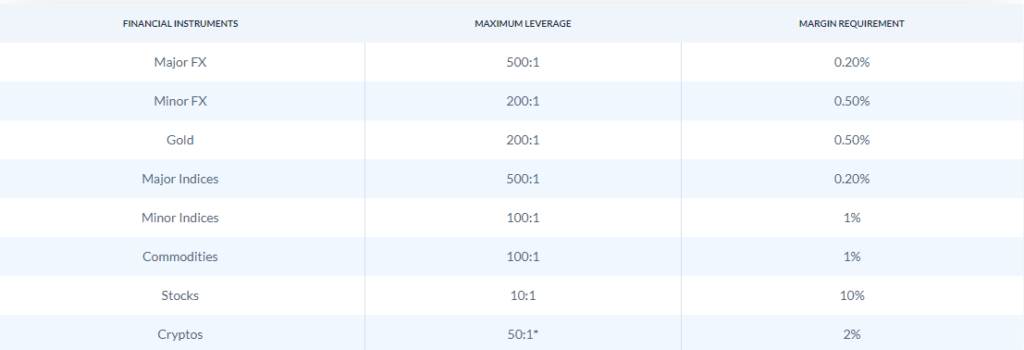

Regarding leverage, the maximum Skilling leverage is 1:30. This means, forex majors are available at 1:30 while the minors start at 1:20. Major indices are also available at 1:20, compared to minor indices which are available at 1:10.

Global investors trading under the FSA-regulated entity can access leverage up to 1:500. While leverage increases your exposure to the markets, it brings lots of risks hence careful risk management is very critical.

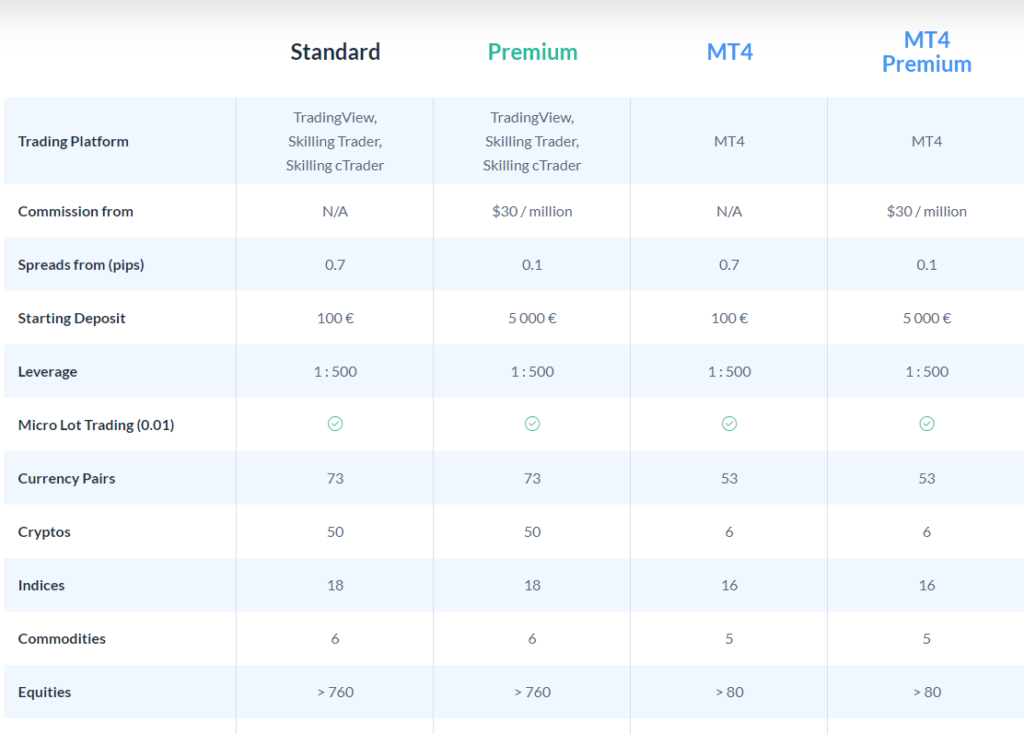

While the Spreads start from 0.7 pips on Standard accounts, Premium accounts can access spreads from 0.2 pips provided they have a minimum deposit of $5000.

The Premium accounts also attract a fee of $35/million dollar volume traded on forex compared to standard accounts which do not attract any fees.

When trading with Skilling Forex broker, you can either choose the Standard or Premium with both of them having their advantages and disadvantages.

To get started with Skilling’s Standard account, you need to deposit a minimum of 100 USD and enjoy trading. With this deposit, you can access all three trading platforms including MetaTrader 4, cTrader, and Skilling Trader. This also allows you to go up to 1:500 on leverage, protect your negative balance and do scalping.

If you intend to take your trading to the next level, you need to sign up for a Premium account. With this account, you’re required to deposit at least 5,000 USD for as low as 0.1 pips on spreads.

Like the Standard account, the Premium account allows you to trade all available instruments including stocks, currencies, indices, or cryptocurrencies. Plus, you can open positions for the micro lot.

MT4 Account: For The MT4 Account, you need to deposit at least 100 EUR for a maximum leverage of 500:1 with no commissions being charged.

MT4 Premium Account: Similar to the Premium account, this account only offers leverage of up to 500:1 and spreads that start at 0.1 pips traded. The minimum deposit on this account is also 5000 EUR.

To sign up at Skilling, you need to;

- Go to the website and enter your registration details

- Verify your ID by registering with BankID or uploading your documents

- Make a deposit using the options available and download the platform you wish to use

- Select an asset from the menu

- Finally, filter the trade parameters, including position type, execution type, plus stop loss and take profit levels

Skilling has a customer support team that works 24/7 from 8 AM to 9 PM EET. You can reach them through different channels including;

- Email: support@skilling.com

- Webchat

- Customer help desk

- United Kingdom: +44 208 080 6555

- Phone: Cyprus: +357 2227 6710

- Norway: +47 2195 03000

- Sweden: +46 40 6450 022

- Germany: +49 322 2999 010

You can also access dozens of articles including legal terms, funding information, and general trading guides.

According to Skilling’s business model, it makes its money through commissions and spreads. Besides offering low-cost trading opportunities, its spreads start from 0.2 pips while commissions come in at $35 per million traded on forex.

Yes. Skilling is regulated by the Financial Services Authority (FSA) in Seychelles and the Cyprus Securities & Exchange Commission.

For more information, log in to the website. You can also visit their social media channels for news on platform upgrades, promotions, and other investing tools.

Unlike other brokerage firms, Skilling does not charge any fees for depositing or withdrawing money from your account.

Skilling offers a range of accounts including;

- Skilling Trader Standard Account

- Skilling Trader Premium Account

- Skilling Trader Unleveraged Account

- MT4 Standard Account

- MT4 Premium Account

- cTrader Standard Account

- cTrader Premium Account

- cTrader Unleveraged Account

Skilling

Skilling is an excellent trading platform meant for both beginners and professionals. Filled with basic educational resources, it’s not only easy to use, but also has one of the most competitive fees.

Since it is authorized and regulated by the CYSEC and FSA, you can rest assured your funds are insured, segregated, insured, and secure. While the only area still lacking is resources, it’s a solid platform that stacks up well against other forex brokers. Whether you are a beginner or an experienced trader, this platform is highly recommended.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.