The PCE Price Index today live is a much-anticipated event that holds the potential to shift financial markets. Traders are particularly focused on this inflation gauge, as it is a favored metric of the Federal Reserve. The release of the Core PCE Price Index today could impact risk sentiment, gold prices, and forex trading. With the PCE data today time approaching, traders are bracing for volatility, especially as they interpret the PCE price index today graph and search for clues about monetary policy direction.

Table of Contents

ToggleWhy the PCE Price Index Matters

The PCE (Personal Consumption Expenditures) Price Index is more than just another economic data point. It’s a benchmark used by the Federal Reserve to assess inflation trends in the US.

Core PCE vs. Headline PCE

The Core PCE Price Index today excludes volatile items like food and energy, offering a clearer view of underlying inflation. This core metric is vital to understanding whether inflationary pressures are persistent or transitory.

PCE Expectations and Federal Reserve Policies

Current PCE expectations suggest inflation may remain elevated. If the data surprises to the upside, it could solidify the Fed’s hawkish stance. This could then lead to stronger USD demand as markets anticipate tighter monetary policies.

PCE Price Index’s Influence on Gold

The PCE Price Index today USD serves as a critical barometer for inflation, directly influencing the strength of the US dollar and the value of gold. When the index reflects a significant uptick in inflation, it often signals a likelihood of tighter monetary policies by the Federal Reserve. This potential for increased interest rates tends to enhance the appeal of the dollar, as higher yields make it more attractive to global investors. Consequently, a stronger dollar can undermine gold’s value, as it becomes more expensive for holders of other currencies, reducing its allure as a safe-haven asset.

A higher PCE reading might also indicate persistent inflationary pressures, boosting the Federal Reserve’s commitment to maintaining aggressive rate hikes. This would further diminish gold’s competitiveness compared to interest-bearing assets like bonds. Gold traditionally thrives during periods of low yields or economic instability, but under conditions of a strong dollar and rising rates, it often struggles to gain traction.

Potential market scenarios could include significant gold price resistance around technical levels, particularly if the dollar strengthens beyond market expectations. Conversely, if the PCE Index remains subdued, gold may find renewed buying interest as inflationary concerns ease and the dollar faces downward pressure.

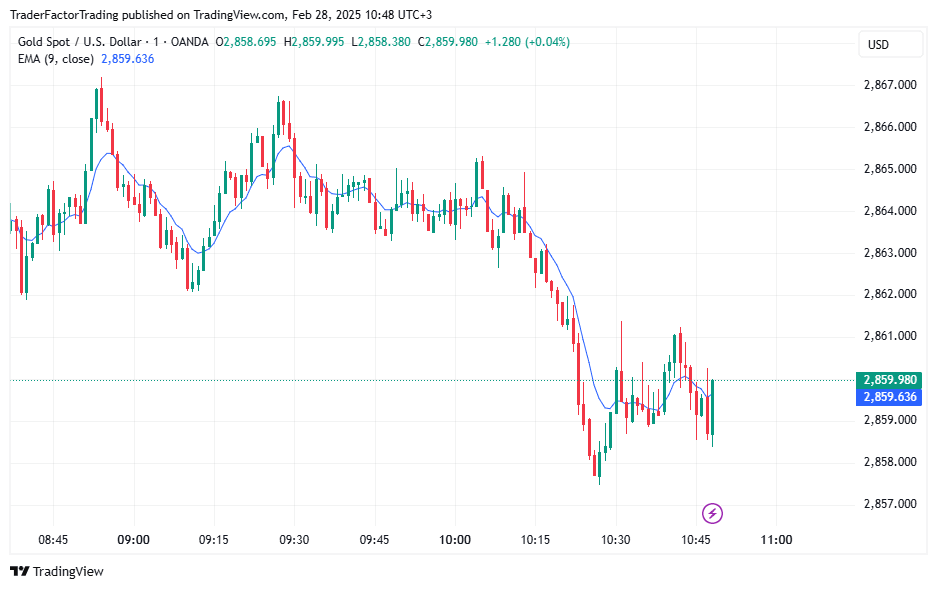

Gold’s Technical Picture

Recent price action shows gold hovering below $2,860. Resistance levels, such as $2,867, and support points near $2,855, are key areas for traders. The directional move could correlate strongly with the PCE price index today graph, as it reflects changing inflation.

Impact on Currency Markets

Currencies, especially EUR/USD and GBP/USD, are deeply tied to inflation readings like the PCE.

EUR/USD Trends

The Euro faces pressure, trading near 1.0390, as traders focus on US dollar strength ahead of the PCE release. Risk aversion, compounded by US-EU trade tensions, adds to the pair’s challenges.

GBP/USD and PCE Insights

GBP/USD struggles amidst US trade policy uncertainty and USD strength. A softer PCE reading could provide relief for the Pound, while a higher-than-expected index may deepen its recent decline.

Technical and Fundamental Expectations

Key market levels, supported by 100-day SMAs and weekly lows, will guide traders in decoding the PCE’s impact. Additionally, technical indicators like RSI and Fibonacci retracement levels add context for potential movements in major forex pairs and commodities.

Closing Thoughts

The release of the PCE Price Index today live is pivotal for traders across markets. Gold prices, forex pairs, and USD momentum will all respond to this critical data. Whether aligned or deviating from PCE expectations, the index’s release will shape trading strategies and market sentiment for the near term.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance