Traders focus on currency markets before crucial US data releases. Stay updated on market movements and trends for strategic trading decisions.

Table of Contents

ToggleEUR/USD Steady with US CPI and Fed Decisions on the Horizon

The currency markets are bracing for potential volatility as traders fixate on upcoming critical US economic data, including the Consumer Price Index (CPI), Federal Open Market Committee (FOMC) Minutes, and the 10-year Treasury bond auction—all of which could significantly sway market dynamics.

EUR/USD in Focus Ahead of US Data

Currently, the Euro to US Dollar (EUR/USD) exchange rate treads water near the 1.0850 level, reflecting a broader market hesitation that has left the pair in a state of indecision. The US Dollar’s pause in its upward trajectory has granted the Euro a temporary reprieve from further losses. That said, recent multi-week highs for EUR/USD hint at underlying market tentativeness owing to expected monetary policy shifts from the central banks.

Traders now await the release of the US CPI—closely watched as an inflation gauge—with expectations leaning towards an easing cycle initiation by the Federal Reserve, possibly in line with the European Central Bank (ECB).

Divergence in Central Bank Policies May Impact Dollar Strength

The anticipated alignment in easing strategies between the Fed and the ECB gives rise to speculation that despite the ECB not significantly lagging behind the Fed, the US Dollar may assert strength over the medium term. A stronger Dollar narrative is further supported by the eurozone’s relatively subdued fundamentals, alongside the increasing possibility that the US may achieve a soft economic landing without aggressive interest rate cuts.

Indications of such an economic scenario could see EUR/USD facing a more marked correction, initially towards the year-to-date lows around the 1.0700 mark and potentially revisiting late October or early November’s sub-1.0500 levels.

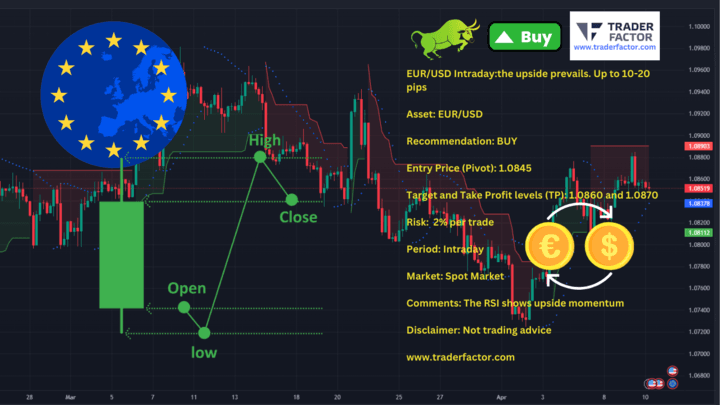

EUR/USD Intraday: The Upside Prevails

The focus turns to the short-term trading outlook for the EUR/USD pair, where the current technical analysis suggests a bullish inclination.

Asset: EUR/USD

Recommendation: BUY

Entry Price (Pivot): 1.0845

Target and Take Profit levels (TP): 1.0860 and 1.0870

Risk: 2% per trade

Period: Intraday

Market: Spot Market

Comments: The Relative Strength Index (RSI) displays an upward momentum, with an anticipated movement of 10-20 pips in this trade scenario.

USD/CAD Calm Before Central Bank Decisions

Similarly, USD/CAD exhibits minimal movement as attention turns towards the Bank of Canada’s (BoC) imminent policy decision, which is widely expected to hold interest rates steady at 5.0%. However, results from the BoC’s rate decision and US CPI figures could provoke changes in the pair’s current subdued trading range.

The Canadian Dollar’s standing is further complicated by fluctuating Crude oil prices, with geopolitical tensions in the Middle East fanning supply security fears. In contrast, the US Dollar’s traction is hindered by diminishing US Treasury yields, suggesting a more complex environment for the currency pair.

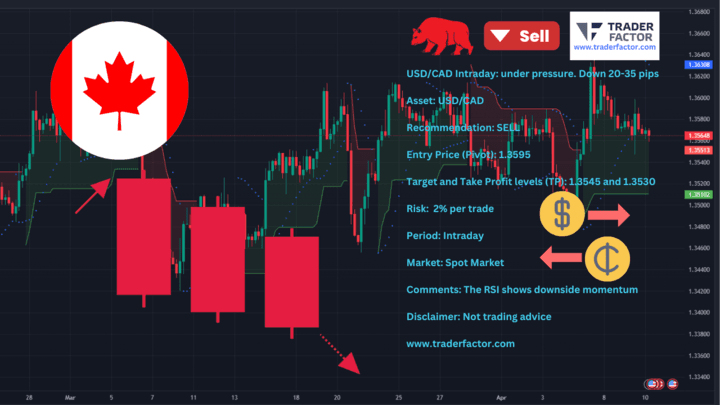

USD/CAD Intraday: Under Pressure

Investor attention pivots to the immediate prospects for the USD/CAD currency pair, where indications point to a bearish outlook for the session.

Asset: USD/CAD

Recommendation: SELL

Entry Price (Pivot): 1.3595

Target and Take Profit levels (TP): 1.3545 and 1.3530

Risk: 2% per trade

Period: Intraday

Market: Spot Market

Comments: The RSI illustrates a downward momentum, with expectations for a decline in the range of 20-35 pips.

Upcoming Economic Data and Potential Implications

Attention now turns to significant economic announcements:

US CPI and Market Sentiment

The US Consumer Price Index (CPI) is a crucial measure of inflation, indicating how much prices for consumer goods and services have changed over a specified period. High inflation rates typically pressure central banks to implement tightening measures such as interest rate hikes. Conversely, lower-than-expected inflation may result in a dovish outlook, potentially weakening the dollar as prospects for rate increases diminish.

The Impact of Inflation Data on EUR/USD

Speculation mounts as analysts predict the CPI could reaffirm the Federal Reserve’s inflationary concerns or introduce a new narrative of moderating price pressures. A higher CPI may strengthen the USD as it signals continued inflation, potentially prompting the Fed to maintain or even escalate its aggressive rate hikes. Conversely, a CPI read below expectations could soften the USD, as it might suggest easing inflation and, consequently, a less aggressive Federal Reserve.

The Significance of the 10-Year Bond Auction

The US 10-year Treasury bond auction is another pivotal event that reflects investors’ long-term confidence in the economy and has implications for interest rate movements. High demand for bonds usually corresponds with lower yields, reflecting bearish sentiments and suggesting investors are seeking safe-haven assets possibly due to economic uncertainty.

Implications for the Currency Market

The outcome of the bond auction could impact currency pairs as the bond yields set a benchmark for global borrowing costs and risk sentiment. An increase in bond yields might attract inflows into the USD, considering the relative safety and return of US Treasury bonds, potentially elevating the greenback against other currencies like the euro.

Anticipating the FOMC Minutes

FOMC meetings offer valuable insights into federal monetary policy and future interest rate decisions. The publication of their minutes provides a deeper understanding of the Fed’s stance on economic conditions and inflation, widely influencing currency valuation.

Market Reactions to Fed’s Discourse

Depending on the minutes’ tone, whether hawkish or dovish, market sentiment can shift. A hawkish set of minutes, expressing concerns over persisting inflation and the need for ongoing rate hikes, would likely boost the USD as traders anticipate a stricter monetary policy. On the flip side, if the minutes reveal a softer stance towards inflation or economic growth, the USD could weaken, potentially serving as a tailwind for currencies like the euro.

BoC Rate Statement

This statement will highlight the Canadian central bank’s take on the economy, providing traders hints on future rate decisions. A dovish stance could weaken the CAD, while any surprise hawkish tilts could support the currency.

Key Takeaways

Today’s packed economic calendar promises to be a significant determinant of short-term currency market movements. Traders would do well to brace for potential volatility as these data releases could not only inform immediate trading strategies but also set the tone for market direction in the foreseeable future.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.