EUR/USD stays resilient amid mixed economic signals. In Wednesday’s European trading session, the EUR/USD pair maintains its consolidation phase, trading just shy of the 1.0700 mark. This stability comes in the wake of Germany’s IFO survey data release, which has provided the Euro with some support. Investors are now eagerly awaiting the U.S. Durable Goods Orders data for March, scheduled for release later in the day. Should this data fall short of expectations, the U.S. Dollar (USD) may see a dip in its value in the latter half of the trading day.

The actions within the U.S. stock markets also remain under close scrutiny by investors. With the continuation of the risk rally, the USD may face additional downward pressure.

German IFO Sentiment Data Lends Support to Euro, PMI

The Euro gained modest traction following the release of the German economic sentiment IFO survey data for April. The report exceeded expectations with the Business Climate index rising to 89.4 and the Current Assessment to 88.9. Additionally, the Expectations component reached 89.9, meeting forecasts and contributing to the Euro’s resilience.

US Economic Data Underperform

The EUR/USD pair saw an uptick early Wednesday as the USD lost ground following tepid growth in the private sector and U.S. business activity. The disappointing performance has cast doubts on the previously held belief in the U.S. economy’s exceptional resilience, particularly in light of relatively high interest rates.

In contrast, the Euro benefitted from positive developments in the services sector as revealed by Tuesday’s HCOB Eurozone Services PMI data for April. This contrasts sharply with April’s PMI indices from the U.S., which fell for both Services and Manufacturing, surprising investors and suggesting the economy is struggling more than anticipated.

Interest Rate Expectations and Market Impact

The stubborn price momentum in the services sector in both the U.S. and Europe delays the timeframe for anticipated interest rate cuts by the Federal Reserve and the European Central Bank. While ECB officials seem unified in their intent to cut rates as soon as June, the Federal Reserve’s stance remains ambiguous, contributing to the USD’s recent superiority and the bearish momentum of the EUR/USD.

However, the unexpectedly high preliminary Services PMI data from the Eurozone introduced uncertainty regarding the ECB’s rate cut intentions.

Coming Up: ECB Commentary and US Durable Goods Data

Market participants will be closely monitoring remarks from ECB officials throughout Wednesday for further direction. Additionally, the upcoming U.S. Durable Goods data is set to provide further insight into the state of the “Captain American Economy” during the U.S. trading session.

Trade Recommendations

EUR/USD: Analysts recommend a BUY stance with an entry price (pivot) at 1.0671, targeting 1.0793 for take profit levels and setting a stop loss at 1.0631. This intraday position focuses on buying dips in the spot market, aiming for a 2% risk per trade.

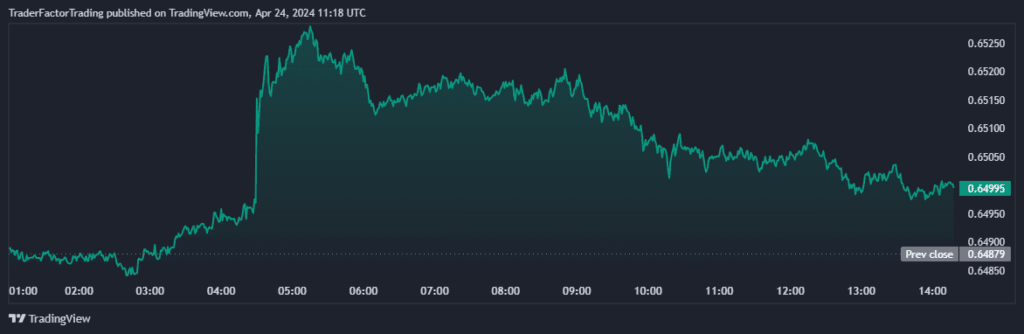

AUD/USD: The recommendation for AUD/USD is also to BUY, considering dip-buying for good risk/reward ratios. The entry point is suggested at 0.6480, with the target set at 0.6520 and a tight stop loss at 0.6470. This intraday strategy is based on the formation of a potential bottom in the spot market, also with a 2% risk per trade.

Investors and traders alike will be closely watching these developments as they unfold, adjusting their strategies accordingly in what promises to be another intriguing day in the forex market.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.