European shares experienced a rise on Thursday, driven by optimism surrounding potential U.S. interest rate cuts following weak economic data amidst UK Elections and U.S. Independence Day. London markets also saw gains as voting began in the UK, with opinion polls predicting a historic win for the Labour Party. The pan-European STOXX 600 index rose 0.4% by 8:16 GMT, led by a 1.3% increase in the automobiles and parts sub-index.

Key Performers

- Continental AG: German automotive supplier Continental saw its shares jump by 10.1% to a three-week high, following positive pre-close comments on its auto unit.

- Smith & Nephew: The UK’s Smith & Nephew rose by 6.3% after activist investor Cevian Capital disclosed a 5% stake in the medical equipment maker.

- Redcare Pharmacy: This German pharmaceutical retailer surged 10.4% after posting a 33% jump in second-quarter preliminary sales.

Political Climate and Market Impact

The UK’s FTSE 100 advanced by 0.7% as markets awaited the outcome of the general election. Analysts suggest that the expected Labour victory has already been factored into market prices. French stocks also rose for a second day, with a 0.6% increase as efforts intensified to prevent the far-right National Rally party from gaining power.

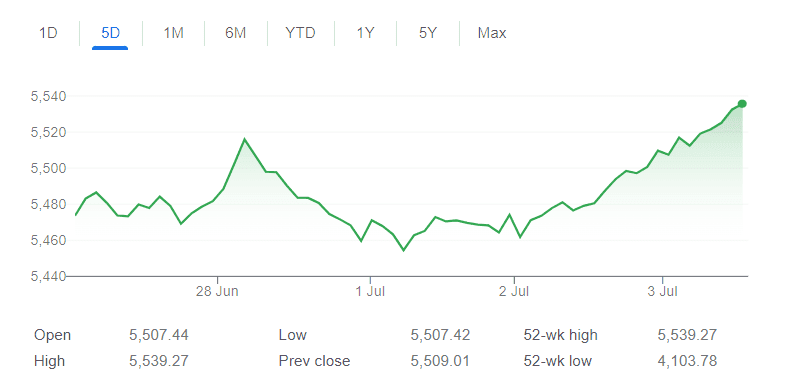

FTSE 100 Index (5-day Chart)

Source: Yahoo

Table of Contents

ToggleU.S. Market Overview

In the United States, trading volumes were muted due to the upcoming Independence Day holiday. The S&P 500 rose to new highs during Wednesday’s shortened trading session, despite sluggish economic data. The New York Stock Exchange closed early at 1 p.m. ET and will remain closed on Thursday for the holiday.

S&P 500 5-day Chart

Source: Yahoo

Economic Data and Rate Cuts

Weak U.S. data bolstered sentiment for rate cuts. First-time applications for U.S. unemployment benefits increased last week, indicating a cooling labor market. Additionally, German industrial orders fell unexpectedly in May, declining by 1.6% on a seasonally and calendar-adjusted basis.

Individual Movers

- Roche: Roche dropped by 2.2% after announcing plans to halt a trial for its experimental lung cancer drug due to lackluster results.

- Pluxee: France’s Pluxee fell by 10% after reporting weaker-than-expected third-quarter sales in Europe.

- Ericsson: Sweden’s Ericsson slipped by 0.9% after recording an impairment charge of 11.4 billion Swedish crowns ($1.09 billion) in the second quarter of 2024.

Upcoming Events and Low Trading Volumes

Investors are keeping an eye on comments from European Central Bank officials for more clues on the future path of interest rates. Trading volumes are expected to be low due to the public holiday in the United States. The U.S. bond market will also close early on Wednesday and remain closed on Thursday, resuming regular operations on Friday.

Key Focus on Friday: Non-Farm Employment Change Report

Tomorrow, all eyes will be on the Non-Farm Employment Change report in the United States. This crucial economic indicator measures the change in the number of employed people during the previous month, excluding the farming industry. It is a key metric for gauging the health of the U.S. labor market and can significantly impact financial markets. A higher-than-expected reading typically strengthens the U.S. dollar, while a lower-than-expected reading can weaken it.

Conclusion

With the UK general elections and U.S. Independence Day celebrations affecting market activities, traders should remain vigilant. The combination of political events and economic data will likely shape market movements in the coming days. Stay informed and keep an eye on key indicators to make well-informed trading decisions.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.