The market outlook for this week promises significant trading opportunities as markets digest key economic events. US CPI figures will take center stage, influencing Fed policy expectations. China’s economic challenges, the RBA’s rate decision, and the ECB’s monetary actions will also drive market movements. Traders should watch closely for forex impacts and potential volatility.

Table of Contents

ToggleMonday: Quiet Start and China’s Disappointing Reports

The trading week kicked off with subdued activity during the London and New York sessions, leaving traders to focus on developments in the Asian markets. China released its Consumer Price Index (CPI) y/y and Producer Price Index (PPI) y/y figures for November, both of which highlighted continuing economic challenges for the nation.

China’s CPI rose just 0.2% from a year ago, falling short of analyst expectations for a 0.5% increase. This marks a slowdown from October’s 0.3% rise, indicating that consumer demand remains sluggish. Meanwhile, the PPI recorded its 26th consecutive month of decline, contracting by 2.5% y/y. While this was slightly better than the predicted 2.8% drop, it underscores ongoing disinflationary pressures and weak wholesale prices.

The repercussions were felt in the forex market as the AUD/USD fell below 0.6400 during Asian trading hours. This was driven by risk-averse sentiment in reaction to China’s soft economic data and supported by demand for the US Dollar. Market attention now shifts to the Reserve Bank of Australia’s (RBA) interest rate decision on Tuesday, as China remains Australia’s key trading partner.

Tuesday: RBA Rate Decision, China New Loans Data, and OPEC Meetings

The RBA’s cash rate decision is highly anticipated, especially in light of last week’s weak GDP figures. Australia’s annual GDP fell to a 4-year low of 0.8%, with a quarterly growth rate of just 0.3%. These disappointing numbers have fueled speculation about rate cuts in 2024, with markets already pricing in three 25 bps cuts for next year. That said, there’s only a 9% chance of a cut on Tuesday, as the RBA is likely to maintain rates at 4.35% given its cautious stance. The central bank is expected to wait for further data, including Thursday’s employment figures and January’s quarterly inflation report, before considering any policy changes.

Elsewhere, China will release its New Loans data, which provides insights into the country’s credit growth and economic activity. Given the close trade ties with Australia, any surprises in this report could impact the AUD.

Additionally, Tuesday will see OPEC meetings, where member countries will discuss oil production levels. For traders, these meetings are crucial as any changes to oil output can significantly influence crude oil prices, which in turn affect commodity currencies like the CAD and NOK due to their dependence on energy exports.

Wednesday: US CPI Figures and Bank of Canada Decision

While the Asian and European trading sessions are expected to remain calm, major movements could occur in the New York session following the release of the US Core CPI m/m, CPI m/m, and CPI y/y figures. The CPI is a critical measure of inflation and directly influences the Federal Reserve’s monetary policy decisions. With the Fed scheduled to meet on December 18, traders will closely monitor Wednesday’s inflation data for clues on whether another rate hike could be on the table.

Currently, US inflation has cooled compared to earlier in the year, but the core numbers remain sticky. A higher-than-expected CPI print could lead to US Dollar strength as markets price in a more hawkish Fed stance.

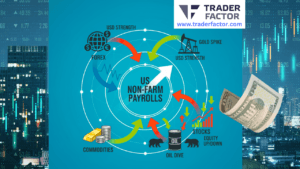

The Impact of US Consumer Price Index (CPI) on Financial Markets

The US Consumer Price Index (CPI) is a critical economic indicator that measures changes in the prices of goods and services commonly purchased by households. As one of the most closely watched metrics for inflation, CPI can significantly shape financial markets. Here’s an expanded breakdown of its influence:

CPI and Federal Reserve Policy

The CPI plays a central role in determining the Federal Reserve’s monetary policy because it provides a clear measure of inflation, one of the Fed’s dual mandates along with employment. If CPI indicates that inflation is running too high, the Fed may raise interest rates to cool demand and slow price increases. Conversely, softer inflation data might lead to a more dovish policy stance, with rate cuts or pauses to support economic activity.

For example, recent CPI trends show that while headline inflation has eased, core CPI—which excludes volatile food and energy prices—remains stubbornly elevated. This has kept the Fed cautious, balancing the need to control inflation without pushing the economy into a downturn. Traders often look to CPI data as an early signal of whether the central bank might continue with a hawkish or dovish bias, making it a pivotal event for market participants.

The Ripple Effect on Interest Rate Expectations

CPI data can alter interest rate expectations almost immediately. If inflation comes in higher than forecasted, markets may anticipate further rate hikes, leading to an increase in Treasury yields and borrowing costs. Conversely, weaker-than-expected CPI often lowers expectations for rate increases, causing bond yields to drop. These fluctuations have broader implications for currency markets, equity indices, and even commodity prices.

For instance, stronger CPI readings earlier this year prompted the Fed to sustain its tight monetary policy, which strengthened the US Dollar as rate differentials widened against other major currencies. Any release that deviates from expectations has the potential to create abrupt and significant market movements.

Influence on the US Dollar

The US Dollar has an inverse relationship with CPI-driven interest rate expectations. A higher CPI suggests the Fed may act more aggressively, boosting the Dollar’s value relative to other currencies. Conversely, softer inflation data typically places downward pressure on the Dollar as rate hike expectations diminish.

Recent examples include August 2023, where a slightly hotter-than-expected CPI pushed the Dollar Index (DXY) higher in response to speculation about prolonged Fed tightening. The forex markets, particularly pairs like EUR/USD and USD/JPY, can experience heightened volatility around CPI announcements due to their sensitivity to US inflation data.

Market Sentiment and Volatility

CPI also influences overall market sentiment, acting as a barometer for economic health. Higher-than-expected inflation can lead to risk-off sentiment, with investors retreating to safe-haven assets like the Dollar, gold, or US Treasuries. On the other hand, lower CPI readings encourage risk-on behavior, benefiting equities and higher-yielding currencies like the AUD or NZD.

For example, a sharp drop in CPI earlier this year spurred a brief stock market rally, as investors grew optimistic that the Fed might ease off its aggressive tightening cycle. However, core inflation staying elevated tempered this enthusiasm, underscoring the nuanced market reactions to CPI changes.

A Leading Indicator of Economic Health

Since CPI measures changes in the cost of living, it acts as a leading indicator of broader economic health. Persistently high inflation can erode purchasing power, dampen consumer confidence, and slow economic growth. On the other hand, deflationary tendencies might signify weak demand, creating a different set of policy challenges for the Fed.

The upcoming CPI release will be especially important as it sets the stage for the Federal Reserve’s meeting on December 18. Traders will scrutinize the report for signs of whether inflation is retreating rapidly enough to justify an extended pause or if the Fed might consider another rate hike. Markets will be quick to react, particularly in forex, where the USD is likely to see sharp movements against other major currencies.

Key Takeaways for Traders

- Interest Rates: Higher CPI promotes expectations of Fed rate hikes, lifting Treasury yields and strengthening the USD.

- Forex Impacts: Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, often see heightened volatility around CPI releases.

- Market Sentiment: CPI influences risk appetite, with higher inflation leading to safe-haven demand and lower inflation inspiring risk-on movements.

- Trading Opportunities: The interplay between CPI and market sentiment offers traders numerous opportunities to take positions based on the data’s impact on equities, forex, and bond markets.

Given its widespread implications, the US CPI remains one of the most anticipated releases on the economic calendar, driving decision-making across financial markets. For traders, staying informed and preparing for its potential impacts is key to navigating volatility and leveraging trading opportunities.

BOC Overnight Rate

On the same day, the Bank of Canada (BOC) will release its Overnight Rate. While the BOC has signaled a pause in rate hikes recently, any surprise moves could significantly impact the CAD.

Thursday: Employment Data from Australia, SNB and ECB Rate Decisions

Thursday brings a flurry of economic reports and central bank decisions.

- Australia Employment Data

The release of Employment Change and Unemployment Rate figures for Australia will be closely watched. A weaker-than-expected jobs report could weigh on the already pressured AUD, especially against the backdrop of subdued GDP growth. - Switzerland’s SNB Rate Announcement

The Swiss National Bank (SNB) will announce its policy rate. Switzerland’s central bank has displayed hawkish tendencies in efforts to mitigate inflation, so any surprises could influence the CHF and safe-haven demand. - ECB Rate Decision

The European Central Bank (ECB) will release its Main Refinancing Rate. Currently, the rate is at 4.5%, with the ECB having maintained a cautious tightening stance to fight inflation without stifling growth. Recent ECB communications suggest no immediate cuts are on the horizon, but the market will look for further guidance during the press conference. - US PPI Release

The US will also publish its Producer Price Index (PPI) m/m and Core PPI m/m figures. The PPI gauges inflation at the producer level, often acting as a leading indicator for consumer inflation trends. A hotter-than-expected PPI print could fuel US Dollar strength as traders weigh its potential impact on Fed policy.

Friday: UK GDP Report

The week wraps up with the UK releasing its monthly GDP report. This data is expected to influence the GBP, as market participants assess the health of the UK economy amid ongoing uncertainties. Any signs of slowing growth could weaken the sterling, particularly as the Bank of England weighs its options for monetary policy moving forward.

Traders, keep a close eye on these releases and events for potential shifts in key currency pairs and trading opportunities!

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.