XAUUSD prices remained relatively stable on Thursday, trading near $4,197.02 as market participants weighed conflicting economic data against cemented expectations for a Federal Reserve interest rate cut. While the precious metal has faced some headwinds from a recovering US Dollar, the downside risk appears limited by strong investor conviction that the central bank will ease monetary policy next week.

Traders are currently navigating a complex landscape where labor market signals and manufacturing data are failing to provide a unified direction for the economy, leaving Gold confined within a narrow weekly trading range as it awaits fresh catalysts.

Table of Contents

ToggleCurrent Market Performance and Technical Analysis

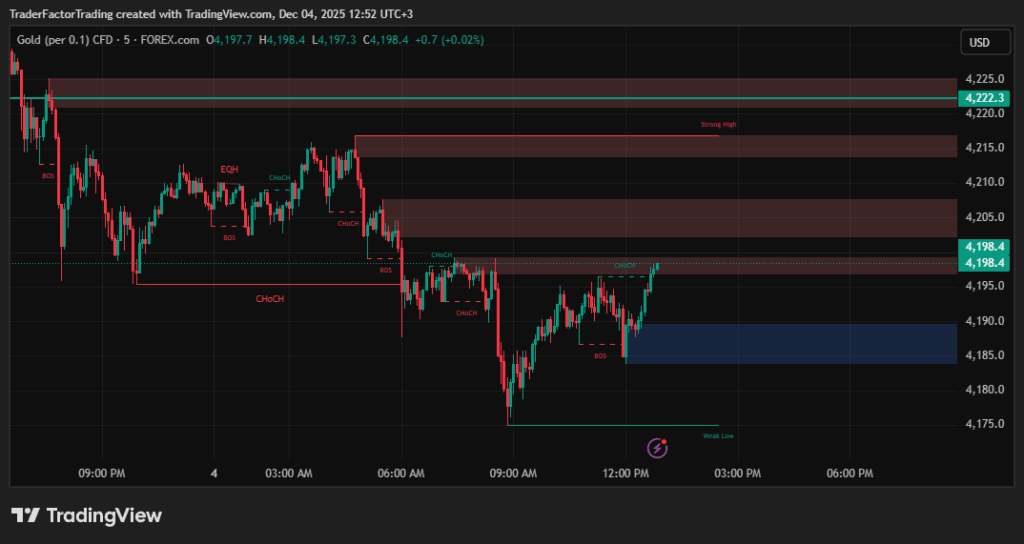

The XAU/USD pair is currently trading with a slight negative bias during the Asian session, though it lacks significant bearish momentum. The price action remains supported above key technical indicators, specifically the 21-day Simple Moving Average (SMA) which is currently positioned at $4,126.81. This level serves as immediate dynamic support for the metal.

On the daily chart, the moving averages are rising in a bullish sequence, with the 21-day SMA situated well above longer-term gauges. This technical configuration suggests that despite the current consolidation, the broader near-term bias remains tilted to the upside for the time being.

Furthermore, technical oscillators indicate that momentum remains firm without being overstretched. The Relative Strength Index (14) is currently reading at 59.83, which signals that buying pressure is present but the asset is not yet in overbought territory.

Recent price action shows the metal reclaiming the 61.8% retracement level at $4,191.95, measured from the recent high of $4,381.17 to the low of $3,885.84. If Gold can sustain a close above this crucial level, it would effectively weaken the preceding bearish leg and potentially open the door for a test of the 78.6% retracement level near $4,275.16.

Fundamental Drivers Influencing Gold Prices

US Economic Data Fails to Impress

Recent economic releases from the United States have served little to alter the market’s established view on Federal Reserve policy. The ADP Employment Change and the ISM Services PMI data released on Wednesday showed an economy that is cooling but not collapsing. Specifically, US private payrolls unexpectedly declined by 32,000 in November, missing analyst estimates for a gain of 5,000.

Meanwhile, the ISM Services PMI showed only marginal improvement, rising to 52.6 from 52.4 in October. These figures reinforce the narrative that the labor market is softening, which typically supports the case for lower interest rates and benefits non-yielding assets like Gold.

Federal Reserve Expectations Remain High

Despite the mixed data, markets are pricing in a very high probability of a rate reduction at the upcoming Federal Reserve meeting. According to the CME Group’s FedWatch Tool, there is an approximate 90% chance that the central bank will deliver a 25 basis points rate cut next week.

This dovish outlook acts as a significant cushion for Gold prices, preventing deep corrections even when the US Dollar attempts to rally. However, with a December cut now viewed as almost certain, investors are already looking past next week to scout for hints regarding the central bank’s easing trajectory heading into early 2026.

The Dollar Rebound Factor

Acting as a primary counterweight to Gold’s bullish potential is the recent performance of the US Dollar. The Greenback has attempted a modest recovery from its lowest levels since late October, gaining traction alongside US Treasury bond yields. Because Gold is priced in dollars, a strengthening currency makes the metal more expensive for holders of other currencies, typically exerting downward pressure on its price.

This dynamic explains why XAU/USD has struggled to break out of its current range despite the supportive interest rate outlook. The tug-of-war between a recovering Dollar and dovish Fed expectations is largely responsible for the current restricted price action.

Future Outlook and Key Watch Levels for XAUUSD

Looking ahead, market participants will be closely monitoring incoming data for clarity on the US economic trajectory. In the absence of major surprises, the weekly Initial Jobless Claims report and general sentiment on Wall Street will likely drive short-term price action.

Sellers have been observed lurking near the $4,250 region, capping bullish attempts, while buyers appear ready to step in on dips. Unless there is a significant shift in the fundamental backdrop or a surprise in the inflation data, Gold moves are likely to remain restricted within established technical boundaries for the remainder of the week.

Conclusion

In summary, Gold remains resilient near $4,197 despite a recovering US Dollar. The market is heavily pricing in a Federal Reserve rate cut next week, which limits downside risk. While mixed economic data has created a consolidation phase, the technical outlook remains constructive as long as prices hold above key support levels.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.