Bitcoin price volatility ahead of halving event. The realm of cryptocurrency has once again piqued the interest of traders worldwide as Bitcoin, the leading digital asset, exhibits price volatility leading up to its much-anticipated halving event. Amid the ebb and flow of prices, traders and investors are closely monitoring the latest developments, seeking to leverage market conditions.

On Thursday, Bitcoin’s price experienced a modest decline, adhering to a trading range that has persisted throughout the week. The fluctuation is attributed to a mix of market anticipations, including potential signals regarding U.S. interest rates and apprehensions about heightened regulatory scrutiny of cryptocurrencies.

Having surged to record highs in early March, Bitcoin has traded within bounds over the past two weeks. The slow pace of capital inflows into spot exchange-traded funds hints at a waning enthusiasm for the cryptocurrency.

A soaring dollar, reaching one-month highs, further constrained Bitcoin’s gains, as traders appeared to favor the U.S. currency for its higher yields and lower risks, following dovish remarks from global central banks.

Market Analysis

With the financial markets eyeing the upcoming release of the Fed’s preferred inflation gauge, the PCE price index data, on Friday, there are implications for future interest rate trajectories. The Fed’s projection of a 75 basis point rate cut in 2024 could be reconsidered if persistent high inflation is detected, which could unfavorably impact Bitcoin prices.

Remarks from Fed officials Jerome Powell and Mary Daly, following the PCE data release, will be under close surveillance for further insights into the Federal Reserve’s monetary policy stance.

Simultaneously, the legal developments in the SEC’s case against Coinbase Global Inc (NASDAQ:COIN) have left the crypto markets on tenterhooks. The SEC’s ongoing lawsuit has significant implications for the definition of cryptocurrencies within the U.S. securities laws, thereby adding to market uncertainties.

Bitcoin Price Today

Bitcoin consolidates gains above the $69,000 support, confronting resistance near $71,500. A break above this threshold could signal a steady uptick. A bullish trend line provides support at $69,120 on the hourly BTC/USD chart.

BTC/USD Chart

Trader Guidance

USD/CAD: Traders may consider buying around the pivot point of 1.3565 with targets at 1.3590 and 1.3605, and a recommended risk limit of 2% per trade. The RSI indicates potential momentum on the upside, suggesting an intraday opportunity.

BTC/USD Daily Chart

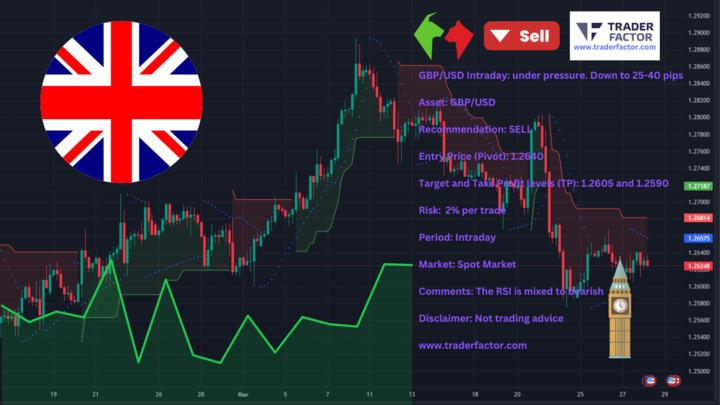

GBP/USD: The Pound is potentially selling under pressure with a pivot point at 1.2640. Take-profit levels could be set at 1.2605 and 1.2590. Intraday trading could benefit from a 2% per trade risk strategy, informed by a mixed to bearish RSI.

GBP/USD Daily Chart

EUR/USD: After the German Retail Sales data indicated a downturn, the EUR/USD pair has seen a dip below the 1.0800 level. The US Dollar’s resurgence, spurred by Waller’s hawkish comments, adds downward pressure.

Looking ahead, upcoming U.S. economic reports such as the unemployment data and PCE Price Index report are likely to play a significant role in influencing the movement of the EUR/USD pair. Traders and investors will closely monitor these reports for insights into the strength of the US economy and any potential impact on currency markets.

EUR/USD Daily Chart

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.