The forex market witnessed a significant shuffle today following the latest PMI data releases from the Eurozone and the UK, with an added spotlight on upcoming economic data from the US. Traders across the globe adjust their strategies as the EUR/USD and GBP/USD pairs show promising movements, reaffirming the dynamic nature of currency markets.

Table of Contents

ToggleMixed Eurozone PMI Delivers a Boost for EUR/USD

EUR/USD Intraday: further upside

The EUR/JPY crosses its winning streak into the third session, reaching around 165.20 amidst mixed PMI data from Germany and the broader Eurozone. The initial Manufacturing PMI in the Eurozone fell short of expectations, dropping to 45.6 compared to the forecasted 46.5. However, the Services and Composite PMIs outperformed, hinting at underlying strength in the economy.

This mixed bag of results provided the Euro with a favorable ground, aiding its advance against the dollar. With the US Dollar easing, buoyed by the Euro’s gains driven by unexpectedly upbeat PMI data from France, Germany, and the Eurozone, the EUR/USD pair sees potential for further upside. Current recommendations suggest a bullish stance with a pivot at 1.0671, targeting 1.0793, while maintaining a cautious stop-loss at 1.0621.

GBP/USD Gathers Momentum Amidst Positive PMI Readings

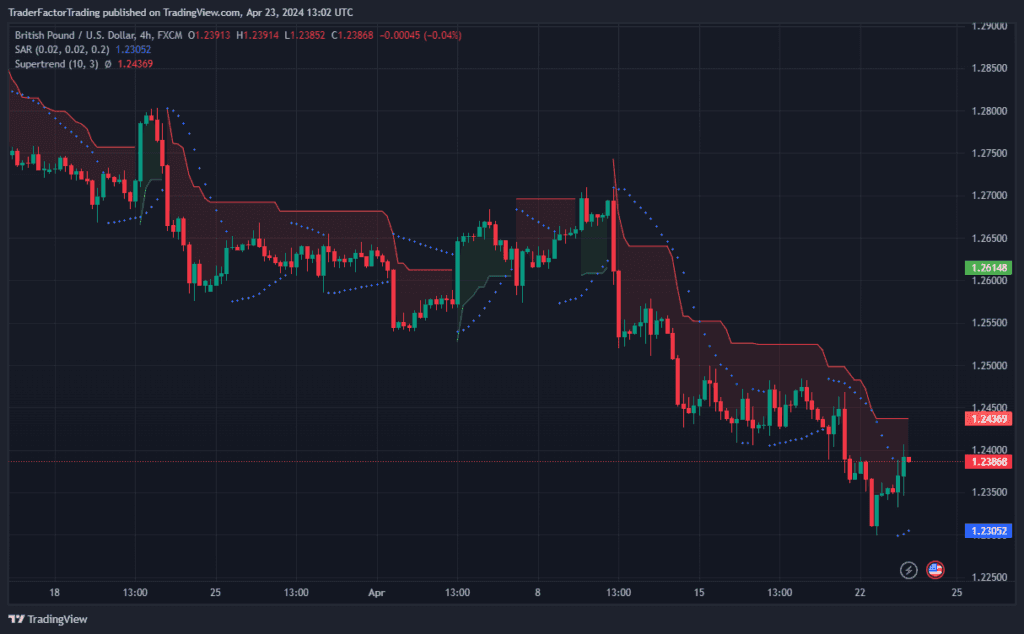

GBP/USD Intraday: A higher correction is expected

On the other side of the pond, the GBP/USD pair maintains its recovery momentum trading near the 1.2400 mark. The S&P Global/CIPS Manufacturing PMI showed a contraction in the UK’s manufacturing sector, but the Services PMI painted a brighter picture, indicating a continued recovery and providing the Sterling a leg-up against competitors.

GBPUSD Daily Chart

The currency pair geared upwards following these releases, exceeding the 1.2350 mark in European trading hours. Key resistance lies at 1.2400, with a current trade sentiment leaning towards selling on rallies, reflected by a recommended sell entry at 1.2390, and a cautious stop-loss at 1.2420.

Anticipated US PMI Data and Its Impact on Market Dynamics

Today also highlights important data releases from the US, including PMI and New Home Sales reports. Traders are keenly awaiting these figures, eyeing possible shifts in the US Dollar’s trajectory, primarily influenced by the robustness of the US economy. The outcome of these reports could potentially sway market sentiment, prompting recalibrations in trading approaches across USD currency pairs.

Cross-Market Analysis: USD/JPY, AUD, and Chinese Monetary Policy

USD/JPY and Global Monetary Influences

Market analysts are closely monitoring the USD/JPY pair ahead of the Bank of Japan’s policy meeting, with speculations about adjustments in the bank’s bond-buying program stirring investor interest. Additionally, the Federal Reserve’s anticipated interest rate cuts may place the JPY in a position to strengthen against the USD later in the year.

Australian Dollar and Chinese LPR Unchanged

The Australian Dollar rides on a wave of positive sentiment, bolstered by a surge in Australia’s Judo Bank PMI data indicating significant private sector expansion. Meanwhile, the People’s Bank of China’s decision to maintain its Loan Prime Rate underscores the interconnectedness of global economies, with monetary policies in China indirectly affecting AUD market movements through economic ties between the two nations.

Market Responses and Adjustments

The day’s flurry of PMI reports, coupled with critical US economic data releases, sets an intriguing stage for currency traders. These developments reiterate the importance of staying attuned to geopolitical and economic indicators, guiding informed trading decisions in an ever-volatile market landscape.

In this dynamic climate, traders are advised to closely monitor these shifts and prepare for potential volatility, leveraging the insights gained from today’s releases to optimize their trading strategies.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.