Michele Bullock, the governor of the Reserve Bank of Australia (RBA), addressed the factors influencing Australia’s economy, emphasizing consumer spending and China’s slowdown over government expenditure. Her insights shed light on the economic trajectory and its implications for traders.

The Role of Government Spending

Governor Bullock remarked that public demand is not the principal factor affecting inflation. Instead, she highlighted consumption, residential construction, and trade as critical elements shaping the nation’s economic landscape over the coming year.

Monetary Policy Outlook

In her recent address, Bullock noted that the RBA had kept the cash rate steady for six consecutive meetings. Despite this stability, she warned that a rate cut was unlikely this year, stressing the bank’s readiness to raise rates if inflation targets are not met.

Revised Government Spending Forecasts

The RBA adjusted its projections for government spending growth, anticipating a rise to 4.3% by December and 4.1% by next June. This adjustment sparked discussions about whether increased public spending might undermine the central bank’s efforts to control inflation.

Persistent Inflation Concerns

Bullock acknowledged that inflation remains “too high,” having decreased only slowly from a peak of 7.8% at the end of 2022. She indicated that the board does not foresee conditions favorable for reducing rates in the near term.

China’s Economic Impact

China’s economic slowdown presents a significant risk to Australia’s economy, according to Bullock. With China being a major trading partner, especially for commodities like iron ore, developments there could significantly influence Australia’s trade dynamics and growth prospects.

Insolvencies and Sectoral Stress

RBA officials downplayed the recent rise in insolvencies, attributing it to historically low levels during the pandemic. The construction sector, in particular, has been impacted, although there are signs of stabilizing stress levels, with emerging pressures in the arts, hospitality, and retail sectors.

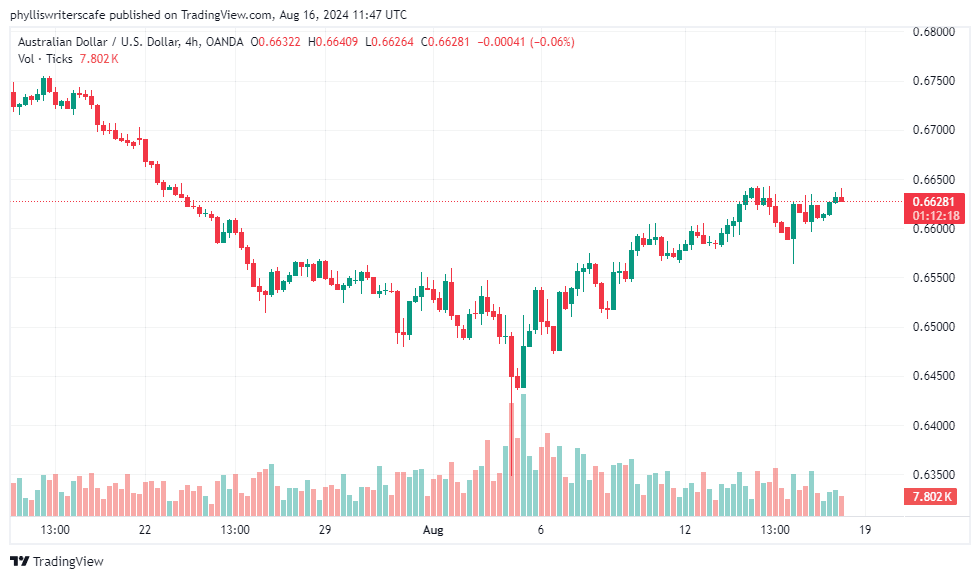

Market Reactions and Currency Movements

Hawkish remarks from Governor Bullock have bolstered the Australian Dollar, particularly against the Japanese Yen. The AUD/JPY appreciated as risk sentiment improved amid reduced fears of a US recession, while the Bank of Japan’s potential rate hikes could also influence currency movements. As of this writing, the AUD was trading at 0.66303 against the dollar as shown below.

AUDUSD 4-hour Chart

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.