Headlines

- Bitcoin Flat at $21,000

- Ether Gain Over 3% in a Day to outperform BTC

- Crypto traders and investors nervous about Powell’s speech

Bitcoin (BTC) was trading lower early Wednesday, while US index futures and European stocks struggled to find direction as the global economy appears to be heading for a recession.

Ether (ETH), the world’s second-largest cryptocurrency by market capitalization, has gained 2% in the last 24 hours, along with other altcoins.

Ether has significantly outperformed bitcoin in recent months, with its market share of the total cryptocurrency market exceeding 20% just a week ago.

Here are the top ten cryptocurrencies and their prices as of Wednesday, August 24;

- Bitcoin $21,426.82 up 1.22%

- Ethereum $1,644.0 up 3.63%

- Tether $1.00 up 0.02%

- USD Coin $1.00

- BNB $298.22 up 00.35%

- Binance USD $1.00

- XRP $0.3442 up 2.65%

- Cardano $0.4607 up 2.60%

- Solana $35.26 up 1.45%

- Dogecoin $0.06795 up 2.99%

Jackson Hole Symposium’s FOMC

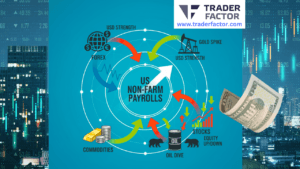

Crypto investors’ attention seems to be on global macroeconomic developments and how growth and inflation will affect crypto assets.

Will the head of the US Federal Reserve and other central bankers abroad hint at a change in their monetary policies? And how might the results of this meeting impact the cryptocurrency markets?

Investors will also be watching the remarks made by Fed Chair Jerome Powell at the Economic Policy Symposium later this week in Jackson Hole for clues as to what the central bank will do at its meeting in September.

At the symposium on Friday, Powell will discuss the rate at which the Federal Open Market Committee (FOMC) will raise rates for the remainder of the year.

The likelihood of an interest rate increase of 75 basis points has increased, according to the CME FedWatch tool, from 47% to 54.5% the previous day.

Tech Earnings Release

As investors brace for fed hike news, top tech companies prepare to release their quarterly earnings reports.

Vmware, Inc.

On August 25, 2022, after the close of business, VMware, Inc. is anticipated to report earnings. The report will cover the accounting quarter that ends in July 2022. According to analysts, the consensus EPS forecast for the quarter is $1.06. During the same quarter last year, the reported EPS was $1.18.

HP Inc.

HP Inc. is expected to report earnings after the market close on August 30, 2022. The report will cover the fiscal quarter that ends in July 2022. The consensus EPS forecast for the quarter is $1.04, according to analyst estimates. Last year, the reported EPS for the same quarter was $1.

Dell Technologies Inc.

Dell Technologies Inc. is expected to report earnings after the market close on August 25, 2022. The report will cover the fiscal quarter that ends in July 2022. The consensus EPS forecast for the quarter is $1.38, according to investment analysts. Last year, the reported EPS for the same quarter was $2.24.

Disclaimer

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.