Due to the Thanksgiving holiday in the U.S., markets will have a quiet trading week. The US Dollar gained some momentum last week against its key competitors as a result of increasing Fed rate rise odds. Despite a fiscal tightening budget statement to help fend off increasing inflation, the British Pound largely escaped harm.

Last week’s market attitude was uneven across the board. Wall Street had a somewhat dismal five days as the tech-heavy Nasdaq 100 fell 1.57% and the S&P 500 fell 0.69%. In Europe, things appeared to be reasonably good.

The DAX 40 and FTSE 100 each had gains of 1.46% and 0.92%. The Hang Seng increased by 3.85% while the Nikkei 225 fell by 1.29% in the Asia-Pacific region.

Though Wall Street will only be closed on Thursday, the days prior and following should see decreased activity and liquidity. Although the economic calendar is light, this does not necessarily indicate that volatility will be reduced.

Table of Contents

ToggleUS Dollar Index

The US dollar index (DXY), which recently reached a new weekly high of 107.40, is still showing no signs of weariness.

The 10-year US Treasury yields have decreased to close to 3.79% in the meantime as investors don’t expect the Federal Reserve (Fed) to continue raising interest rates at a faster pace in the foreseeable future.

The most important event this week will be the disclosure of the US Durable Goods Orders data, which is scheduled for release on Wednesday. The economic statistics is anticipated to increase by 0.4%, in line with the previous improvement.

Jerome Powell, the chairman of the Federal Reserve, has been up all night formulating a strategy to reduce consumer spending.

XAU/USD

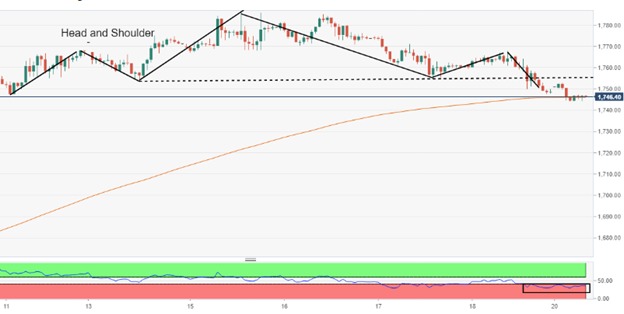

After the hourly Head and Shoulder chart pattern broke down, the price of gold fell precipitously. A significant move is anticipated now that the precious metal has dipped to close to the 200-period Exponential Moving Average (EMA) at roughly $1,744.50.

Gold Hourly Chart

The downside momentum has been activated, as seen by the Relative Strength Index (RSI) (14) moving into the bearish region of 20.00-40.00.

EUR/USD

The EUR/USD did rather well to maintain its value over the last week, and support has unquestionably appeared sturdy close to the 1.03000 region. Certainly of interest is the pair’s ability to trade within a price range that it hasn’t been able to maintain since early July.

When the EUR/USD opens for trading this Monday morning, the idea that selling was seen before the weekend will prove intriguing.

The EUR/USD has paralleled many other major currencies after experiencing a large increase in value over the past few weeks. However, some resistance did emerge when the 1.04000 level was tested, slowing the rising price momentum.

The more important question is whether a climb above this percentage can be sustained.

However, traders should be prepared for holiday trading conditions to emerge, which could cause choppy conditions that are difficult to assess even for quick-hitting wagers. Early trading on Monday and Tuesday will provide hints regarding behavioral sentiment.

GBP/USD

GBP/USD is off to a bad start this week due to the US Dollar’s resurging safe-haven demand. The higher-yielding Pound Sterling suffers from risk aversion brought on by China’s economic troubles ahead of BoE policymaker Jon Cunliffe’s speech.

The US Dollar bulls are showing off their strength as risk-off flows are starting to resurface, keeping pressure on the GBPUSD toward 1.1800 after being rejected at the 1.1900 barrier.

Following the rising tensions over the reinstated lockdowns in China despite an increase in COVI cases, markets become risk apprehensive. In moments of panic, investors flee to the safety of the US Dollar and stay away from riskier currencies like the pound sterling.

Additionally, despite recession warnings, the UK Autumn Budget failed to impress, continuing to erode the British Pound.

The US Federal Reserve (Fed) policymakers’ comments, who continue to advocate for higher terminal rates to support the US Dollar, continue to have an impact on the pair.

Week Ahead: Earnings and Economic Reports

Investors will be busy this week, which is typically quiet before Thanksgiving because of another batch of retail profits to analyze before the start of the post-holiday shopping season. Among the businesses ready are Best Buy, Nordstrom, Dick’s Sporting Goods, and Dollar Tree.

Abercrombie & Fitch, American Eagle Outfitters, and Burlington will report earnings on Tuesday before the bell, followed by Nordstrom, making it a big week for clothing retailers as well.

A rush of economic indicators, including durable goods, new home sales, unemployment claims, and consumer sentiment, will also be released, as will the minutes from the previous Federal Reserve meeting.

The coming week will be brief. The market will be closed on Thanksgiving Day. The stock markets will close at 1 p.m. ET on Friday, while the bond market will close at 2 p.m. ET.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.