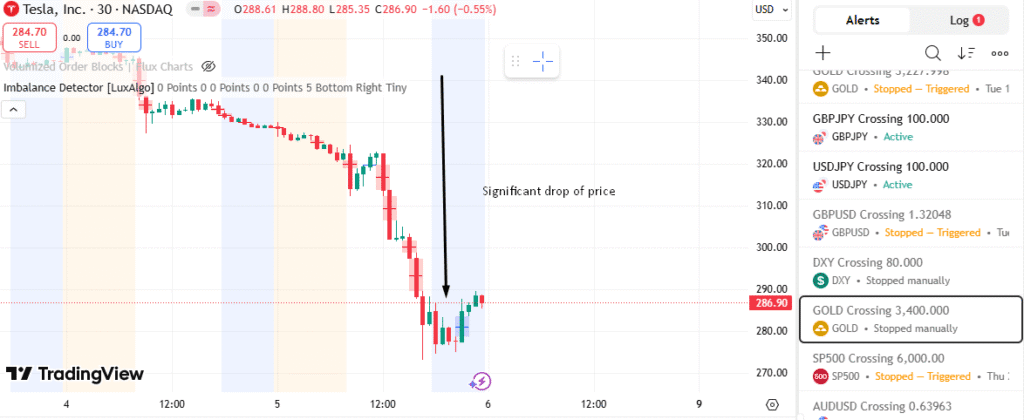

Tesla stock price experienced a significant decline on Thursday, falling 14% and closing at $285. This sharp drop erased approximately $150 billion in market capitalization, removing Tesla from the $1 trillion market cap threshold. The drop coincided with public tensions between Tesla CEO Elon Musk and President Donald Trump, which appeared to have amplified market attention toward the company. Meanwhile, the market is awaiting the Nonfarm report news later today during the NewYork Session.

Table of Contents

ToggleTesla’s Performance in 2025

Beginning the year with momentum, Tesla Inc.’s stock saw steady gains through the first quarter, supported by record-setting vehicle deliveries. The first quarter of 2025 saw Tesla delivering over 450,000 vehicles globally, driven by increased production capabilities in its Shanghai and Berlin Gigafactories. By early May, Tesla’s stock had climbed over 20% on the back of this operational success.

Milestones during this period included expanded rollout of the Model Y and Model 3 into additional international markets, alongside Tesla’s February announcement of advancements in next-generation battery technology. The battery developments, which promise lower costs and improved vehicle ranges, marked a notable achievement for Tesla’s engineering focus this year.

Despite these achievements, by the middle of the second quarter, Tesla’s momentum began to falter. Rising global material costs and competitive pricing pressure within the electric vehicle (EV) market started to place strain on the company. Tesla introduced price reductions for several of its models throughout various regions to maintain demand, a move that increased sales volumes but significantly impacted revenue per unit.

Recent Developments

The fallout between Elon Musk and President Trump this week brought renewed scrutiny to Tesla. While the particulars of their disagreement center around policy and critical statements, the timing of these events has coincided with a significant sell-off in Tesla stock. Analysts noted that the market reaction placed Tesla among the biggest daily losers in the tech sector this week.

Tesla’s stock price performance in 2025 underscores the dynamic environment in which the company operates amid competitive, economic, and geopolitical pressures. The market will likely assess Tesla’s next financial results for further insights into its ability to maintain strong operational outcomes under rapidly evolving conditions.

Telsa Stock Outlook

Tesla’s 14% stock decline on Thursday marks a significant moment in the company’s performance for 2025, erasing substantial market value. The drop followed public tensions between Tesla CEO Elon Musk and President Donald Trump, adding to the market’s focus on the company. Earlier this year, Tesla saw gains due to record vehicle deliveries and advancements in battery technology, but recent challenges, including rising production costs and price reductions, have impacted its trajectory. The fallout highlights both the competitive and external pressures Tesla faces as it navigates an increasingly challenging EV market while maintaining its operational growth and innovation efforts.

Latest Updates on NFP News Today

The much-anticipated NFP report today highlights a projected addition of 126,000 jobs for May 2025, while the unemployment rate is expected to remain steady at 4.2%. April’s figures, which exceeded predictions at 177,000 new jobs, showcased solid gains in healthcare, transportation, and financial activities. For real-time insights, follow NFP news today live to see how this data impacts market dynamics. The time for today’s NFP release is set for 8:30 AM ET, making it a pivotal event for traders and economists monitoring payroll data.

NFP news today prediction remains centered on moderate job growth, with experts emphasizing its influence on Federal Reserve policy and market sentiment. For those seeking NFP signals or wondering how to get NFP news quickly, reliable sources like government releases and financial platforms provide live updates and expert analyses. Exploring NFP news date specifics can offer clarity on shifts within the labor market. The NFP news today payroll data holds vital clues about economic resilience, shaping financial strategies across various sectors.

Frequently Asked Questions

Is Tesla a buy or sell today?

Tesla stock remains a topic of debate among analysts, with opinions varying based on recent developments. For detailed insights, consult Tesla stock news today and updated market analyses.

What if I invested $1000 in Tesla 10 years ago?

An investment of $1,000 in Tesla 10 years ago would now be worth tens of thousands, depending on stock splits and growth. Tesla stock has exponentially increased in value over the last decade.

Does Tesla pay a dividend?

No, Tesla Inc.’s stock does not currently pay a dividend. The company reinvests its profits back into growth and innovation initiatives.

How much will Tesla stock be worth in 5 years?

Tesla Inc.’s stock price prediction for five years depends on factors like EV market conditions, competition, and technological advancements. Tesla Inc.’s stock forecast 2025 suggests it may see significant movement if expansion plans succeed.

When was Tesla stock the highest?

Tesla stock reached its highest adjusted closing price of $409.97 in November 2021. This followed a rally fueled by strong earnings and market optimism.

Was Tesla stock ever at $1000?

Yes, Tesla’s pre-split stock traded above $1,000 in 2020, making headlines for its sharp rise. Post-stock split adjustments reflect its current Tesla Inc.’s stock price target.

Is Tesla good for long-term investment?

Tesla stock is often seen as a strong long-term investment due to its leadership in the EV market. However, Tesla Inc.’s stock prediction depends on competition and global demand in the years ahead.

What will Tesla shares be worth in 2030?

Tesla Inc.’s stock prediction for 2030 varies widely among analysts, with forecasts ranging considerably based on assumptions. Major milestones in EV adoption and energy solutions will likely influence Tesla’s long-term valuation.

Disclaimer:

TraderFactor or partners have prepared all the information. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not regard the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.