This week, the stock market demonstrated resilience as major indexes climbed despite ongoing tensions in the Middle East. Investors reacted positively to a ceasefire between Israel and Iran, which helped de-escalate fears of broader conflict. President Trump’s involvement in brokering and enforcing the agreement, alongside cautious optimism from Federal Reserve Chair Jerome Powell on monetary policy, provided further momentum. Declining oil prices eased supply concerns, while technology stocks led the charge to new highs. Below, we break down the week’s key market drivers, sectoral changes, and what these developments mean for traders.

Table of Contents

ToggleStock Market Indexes Post Strong Gains

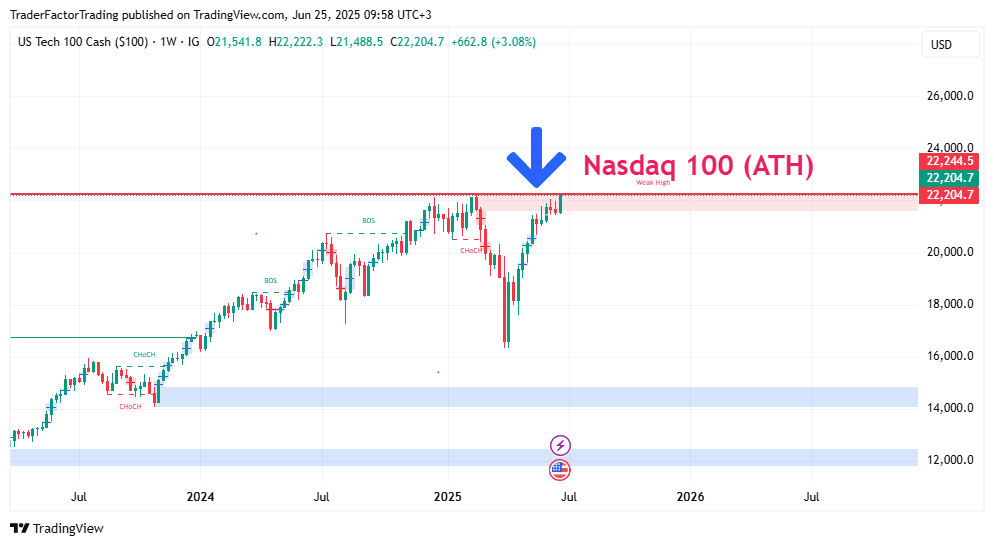

Nasdaq 100 Reaches Record High

The Nasdaq 100 soared to its highest close ever, touching 22,190.52, an increase of 1.5%. Technology stocks played a pivotal role in driving this rally, reflecting broad investor confidence in the sector’s fundamentals amidst de-escalating geopolitical tensions.

S&P 500 Nears All-Time High

The S&P 500 closed at 6,092.18, up 1.1%, placing it less than 1% below its all-time record from February. This gain marked the second consecutive strong session, fueled by improved risk appetite and optimism surrounding global stability.

Dow Jones Advances Significantly

The Dow Jones Industrial Average rose by 1.2%, or 507 points, ending at 43,089.02. The robust performance underscored broad-based gains across various sectors, particularly in industrials and consumer discretionary stocks.

Broad Sector Performance Highlights

Technology Stocks Dominate

Tech was the standout sector, with strong performances from mega-cap companies like Nvidia and Broadcom. Broadcom surged nearly 4% after earning an analyst upgrade, while chipmakers, buoyed by cooling tensions, added to earlier gains.

Energy Sector Declines

Energy stocks lagged as crude oil prices dropped. Shares of major producers like Chevron and Exxon Mobil fell sharply, reflecting diminishing fears over supply disruptions in the Middle East. The sector ended the week as the worst performer in the S&P 500, down roughly 1.5%.

Crypto and Financial Technology Stocks Gain

Cryptocurrency-adjacent stocks enjoyed a rally, following Bitcoin’s rebound to above $105,000 after briefly dipping below $99,000. Coinbase increased by 12%, while financial tech firms leveraged renewed risk-on sentiment.

Geopolitics Stabilize, Boosting Markets

Ceasefire Cools Middle East Tensions

President Trump’s announcement of a ceasefire between Israel and Iran brought immediate relief to markets. While intermittent violations raised concerns, the settlement has largely held, dispelling fears of a prolonged conflict.

Investor Sentiment Recovers

The easing geopolitical risks reassured investors, allowing them to pivot attention back to broader market fundamentals. Traders viewed this de-escalation as an opportunity to re-enter riskier assets, further fueling upward momentum in equities.

Oil Prices Normalize

Crude oil, initially spiking during the height of Middle East tensions, corrected sharply as fears of supply chain disruptions waned. Brent crude and WTI both fell over 7% intraday before stabilizing near pre-conflict levels.

Powell’s Testimony Sparks Rate Cut Optimism

Federal Reserve’s “Wait-and-See” Approach

Federal Reserve Chair Jerome Powell reiterated the central bank’s plan to maintain its current policy stance. However, his comments on inflation containment opened the door to potential rate cuts in the coming months, contingent on clearer data regarding tariffs and economic conditions.

Market Reaction to Potential Easing

Markets began pricing in increased odds of a rate cut, with a 20% likelihood for action in July and a 70% probability by September. Powell’s cautious tone reassured traders of the central bank’s commitment to adapting policy to evolving economic realities.

Commodities Reflect Ebbing Risks

Oil’s Wild Ride

Oil prices demonstrated extreme volatility this week. Brent crude settled at $68.09 per barrel, while WTI hovered near $65.31. Both benchmarks erased the “war premium” that briefly lifted crude to five-month highs earlier in the week.

Safe Havens See Mixed Performance

Gold prices, which briefly spiked amid heightened uncertainty, retraced to $3,330 per ounce, while U.S. Treasury yields nudged lower. The dollar index showed limited movement, reflecting general investor confidence.

Conclusion

The cooling of geopolitical tensions coupled with supportive monetary policy signals propelled global equity markets to impressive gains this week. While traders remain vigilant for potential flare-ups in the Middle East or unexpected inflationary pressures, sentiment has notably improved. Key factors to watch in the coming weeks include ongoing compliance with the Israel-Iran ceasefire, Powell’s evolving guidance, and Friday’s anticipated PCE inflation report.

Disclaimer:

TraderFactor or partners have prepared all the information. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not regard the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.