Choch and BOS in trading are two powerful trading strategies, which gives insight into market shifts and trends. These strategies are like a trader’s secret weapon, helping you spot market trends and make smarter decisions. Whether you’re a newbie or a seasoned pro, understanding CHoCH (Change of Character) and BOS (Break of Structure) can transform the way you trade. Ready to dive in and unlock their potential? This discussion provides a detailed guide on choch and BOS in trading, explaining their application, meaning, and strategies for effective use. Let’s break it all down together.

Table of Contents

ToggleWhat Are CHoCH and BOS in Trading?

Understanding the Meaning of CHoCH and BOS

To get started, it’s important to define choch and BOS in trading. The term “CHoCH” stands for Change of Character, while “BOS” means Break of Structure. CHoCH identifies when price action shifts from a bullish trend to bearish or vice versa. BOS occurs when a key structural level is broken, confirming a new trend direction.

Both concepts are vital in trading analysis. CHoCH and BOS in trading signal market transitions, helping you spot opportunities. They are particularly useful in forex, where price changes are frequent. Whether you’re analyzing a bullish CHoCH or focusing on a BOS in trading, the aim is consistency in understanding market behavior.

Why CHoCH and BOS Are Critical to Trading

Every successful trader must focus on market structure. CHoCH and BOS in trading provide critical clues that help you identify trend reversals and continuations. For example, CHoCH indicates a potential reversal, while BOS confirms ongoing momentum. Using these tools, you can build profitable strategies like the choch forex strategy or the bos strategy gold trading.

Bullish CHoCH and Bullish BOS

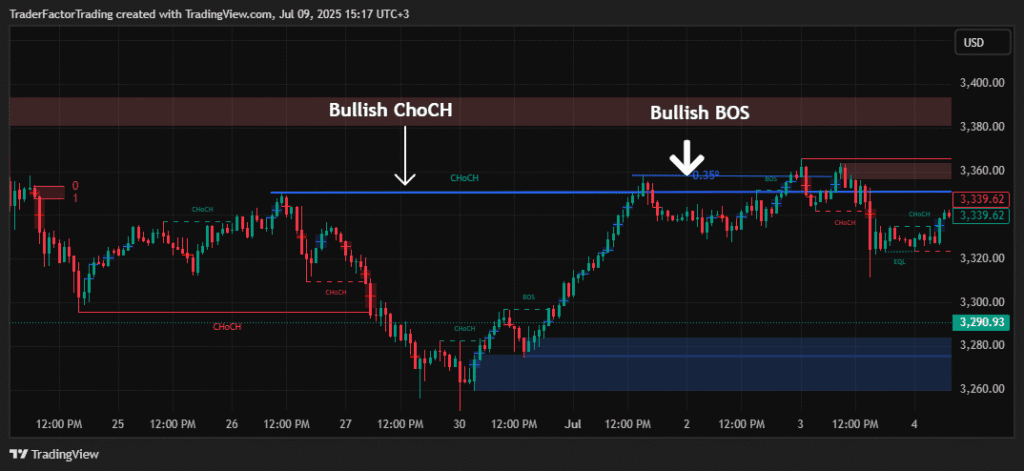

A Bullish CHoCH, or Change of Character, signals a market reversal from bearish to bullish. This occurs when price action transitions from consistently lower lows and lower highs to forming higher highs and higher lows. Spotting this shift helps you identify when the prevailing downtrend is losing momentum and an uptrend may be starting. For example, if a currency pair in a bearish trend stops making lower lows and instead creates a significantly higher high, that could indicate a Bullish CHoCH. This structural change is an early warning sign of improving market sentiment, giving you an edge in identifying potential buying opportunities.

The importance of a Bullish CHoCH lies in its ability to signify the first stage of a trend reversal. By recognizing this shift early, you can anticipate bullish moves and position yourself accordingly. Take a forex trade on EUR/USD as an example. If the pair has been trending down but forms a higher low followed by a higher high, these patterns suggest a Bullish CHoCH. Acting on this pattern allows you to enter the market near the start of an uptrend, maximizing profit potential while minimizing risk.

What Is a Bullish BOS and Its Role in Trading

A Bullish BOS, or Break of Structure, occurs when price breaks a key resistance level, confirming an uptrend. Unlike a Bullish CHoCH that signals potential, a Bullish BOS validates the change in direction. For instance, after identifying a Bullish CHoCH, you may wait for price to break a significant resistance level to confirm a new bullish structure. This break signifies that buyers are in control, and the market is likely to continue moving upward. The Bullish BOS serves as a confirmation point that reduces the risk of acting on false signals.

Imagine trading gold after spotting a Bullish CHoCH. Once the price rises and pushes through a resistance zone, breaking prior highs, the Bullish BOS confirms the new bullish trend. This structured approach allows you to confidently add positions, knowing the market is trending upward. The Bullish BOS helps align your trading plan with clear confirmation, ensuring you don’t prematurely enter or exit trades. With practice, combining the Bullish CHoCH and Bullish BOS can enhance your ability to capitalize on upward market movements.

Bearish CHoCH and Bearish BOS

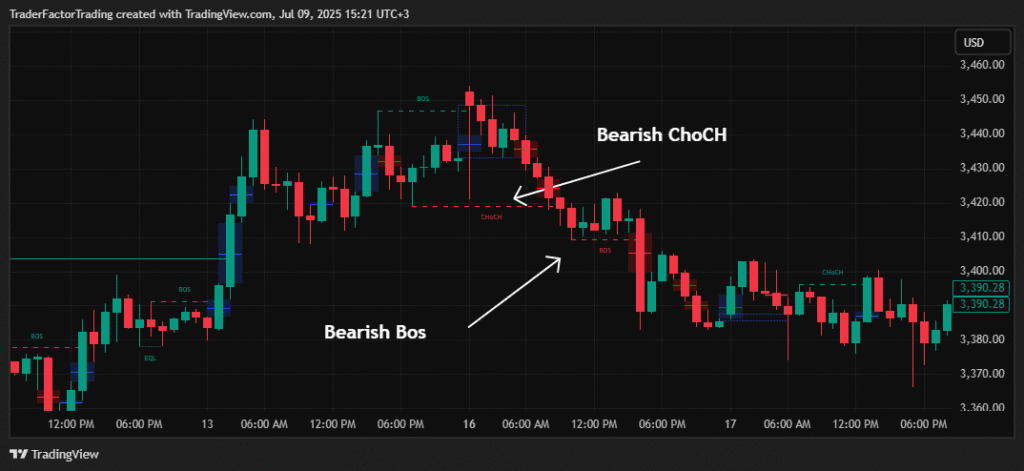

What Is a Bearish CHoCH and How to Use It

A Bearish CHoCH, or Change of Character, signals a reversal from bullish to bearish market conditions. It marks the point where a trend begins to lose upward momentum, transitioning into a possible downward pattern. Observing a Bearish CHoCH involves identifying when the price, previously forming higher highs and higher lows, suddenly shifts to creating lower highs and lower lows. For instance, if a currency pair in an uptrend forms a lower high followed by a lower low, this indicates a Bearish CHoCH. This change is a warning sign of weakening bullish strength and a potential entry point for traders betting on a downtrend.

The significance of a Bearish CHoCH lies in its ability to alert you to early market reversals. Recognizing this pattern can help you exit long positions or prepare to short the market before larger downward moves occur. Suppose you’re analyzing a forex pair like GBP/USD that has been rising steadily. Upon observing a shift where the price struggles to reach new highs and then drops to a significant low, it indicates a Bearish CHoCH. Acting on this signal puts you one step ahead in adapting to changing market dynamics and potentially profiting from the emerging bearish trend.

What Is a Bearish BOS and Its Role in Trading

A Bearish BOS, or Break of Structure, serves as confirmation of a new bearish trend. It occurs when the price decisively breaks below a key support level, affirming that selling pressure is dominating the market. While a Bearish CHoCH signals potential reversal, a Bearish BOS solidifies this by validating the new downtrend. For example, after noting a Bearish CHoCH, observe the market for a major support break. If this happens, you can confirm that the bearish sentiment is now fully in control, and the price is likely to continue its downward trajectory.

The primary role of a Bearish BOS is providing traders with a clear confirmation of trend continuation. Consider a scenario where gold has been trading within a steady uptrend but eventually faces resistance and begins to lose momentum. Once a Bearish BOS is identified, the price breaks below a crucial support level previously tested multiple times it confirms a bearish breakout. This point offers an opportunity for you to strengthen your trade planning, either by entering new short positions or scaling into existing ones. Combining a Bearish CHoCH with a Bearish BOS creates a robust strategy for capitalizing on bearish trends with confidence.

CHoCH vs BOS: Understanding the Differences

How CHoCH Differs from BOS

While closely related, CHoCH and BOS serve different purposes. CHoCH and BOS in trading work in tandem, with CHoCH focusing on initial changes and BOS validating trend continuation. This difference is essential when applying them to a choch forex strategy or creating a customized gold trading plan.

For example, CHoCH alerts you to a reversal, but BOS ensures the trend persists. Understanding this separation is critical in executing a balanced approach, whether it’s a bearish choch signal or a bullish bos movement.

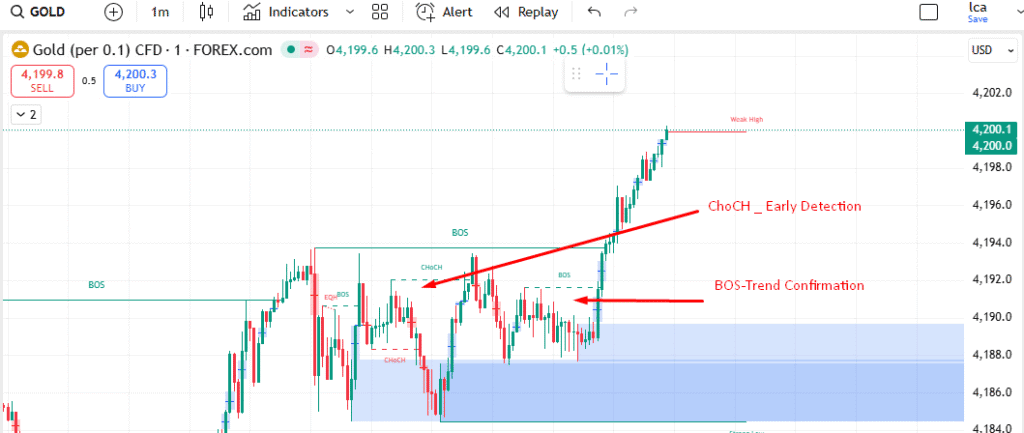

When to Use CHoCH or BOS in Your Trades

Timing is key for traders. CHoCH is for early detection, while BOS is for trend confirmation. Applying choch and BOS in trading together ensures you don’t jump the gun or miss opportunities. Beginners using a choch trading strategy free should first identify simple setups to refine this skill.

CHoCH and BOS Indicators Explained

Automating Detection with Tools

Indicators can simplify choch and BOS in trading. One example is the choch and bos indicator, which automates detection, saving time during fast-paced sessions. Tools like this differentiate between choch forex setups and complex BOS movements.

Indicators reduce human error. By pinpointing reversals or breakouts, they help you execute actions based on reliable signals. This is especially useful in advanced techniques like choch SMC trading strategy.

Manual Chart Analysis vs. Automated Indicators

Although indicators are convenient, manual analysis often offers more control. A seasoned trader might detect nuances missed by algorithms. Whether you’re using the choch forex strategy or honing a choch strategy gold trading method, understanding the principles behind indicators is paramount.

How to Use CHoCH and BOS in Different Markets

CHoCH and BOS in Forex Trading

Forex is a perfect market to apply choch and BOS in trading. It’s volatile, offering ample opportunities for strategies like the choch trading strategy for beginners. By focusing on minor trends, you align with market fluctuations. When preparing for major sessions, tools like CHoCH SMC trading strategy can prove invaluable.

Using CHoCH and BOS in Commodities

Trading commodities like gold also benefits from choch and BOS in trading. Employing the bos strategy gold trading ensures you spot trends early, maintaining an edge in speculative markets. Similarly, choch strategy gold trading techniques help identify crucial entry and exit points.

Best Practices for CHoCH and BOS Strategies

Combining CHoCH and BOS for Better Results

When used correctly, choch and BOS in trading can significantly enhance performance. For example, pairing a bullish choch with a confirmatory bos strategy works well during upward trends. Every choch meaning or bos meaning brings precision to your overall plan.

Common Mistakes to Avoid

Not every signal is reliable. Many traders overuse indicators or misinterpret choch forex signals. The key is consistency. Focus on clear setups like bearish choch combined with structural breaks for effective outcomes.

Examples of CHoCH and BOS in Action

Forex Scenario Analysis

Imagine a scenario in Forex where price action initially trends upward. Suddenly, there’s a break to lower highs, signaling a bearish choch. Following this, BOS occurs when support levels collapse, confirming a downward trend. Using this setup ensures you fully leverage choch and BOS in trading.

Commodity Market Examples

On gold charts, a choch forex strategy might detect market reversals before a breakout. If paired with a bos trading approach, the chances of profitability rise. Reviewing past setups and simulations refines this dual approach.

Refining Your CHoCH and BOS Skills

Learning CHoCH for Beginners

For new traders, a choch trading strategy for beginners helps lay the foundation for consistent gains. Practice in demo accounts to strengthen your knowledge of choch and BOS in trading before trading live.

Advanced Tips for Professionals

Professional traders might explore choch SMC trading strategy, adapting it for more complex setups. Tailoring these strategies to specific asset classes enhances alignment with your goals.

Key Takeaways

Understanding choch and BOS in trading allows you to stay ahead of trends. From CHoCH SMC strategies to simple BOS setups, applying these techniques sharpens your ability to analyze market shifts. Remember, the key lies in combining CHoCH’s detection capabilities with BOS’ validation.

How Can You Start Using CHoCH and BOS Today?

Now that you’ve learned about choch and BOS in trading, it’s time to put it into practice. Start by analyzing small setups in a controlled environment. The more you practice CHoCH vs BOS, the more natural it becomes. Whether you’re focused on choch forex strategies or experimenting with gold trading, these tools promise actionable outcomes.

Frequently Asked Questions

What Is CHoCH in Trading?

CHoCH, or Change of Character, is a key trading concept used to identify potential trend reversals. It signals a shift in market sentiment, helping traders spot new opportunities. Recognizing CHoCH can improve your entry and exit strategies.

What Does BOS Mean in Trading?

BOS, or Break of Structure, occurs when the market breaks a significant price level, confirming a trend continuation. It’s a critical tool for understanding market momentum. Traders use BOS to validate their trading setups.

How Do CHoCH and BOS Work Together?

CHoCH identifies potential trend reversals, while BOS confirms trend continuations. Together, they provide a comprehensive view of market movements. Using both can enhance your trading accuracy.

Why Are CHoCH and BOS Important for Traders?

These concepts help traders make informed decisions by analyzing market structure. They reduce guesswork and improve timing for entries and exits. Mastering them can lead to more consistent trading results.

Can CHoCH and BOS Be Used in Any Market?

Yes, CHoCH and BOS are versatile and can be applied to forex, stocks, crypto, and more. They work across different timeframes and trading styles. This makes them valuable tools for traders in any market.

How Do You Identify CHoCH on a Chart?

Look for a shift in market highs and lows that indicates a change in trend direction. For example, a higher low in a downtrend could signal CHoCH. Use technical analysis tools to confirm the pattern.

What Are Common Mistakes When Using CHoCH and BOS?

One common mistake is misinterpreting false signals without proper confirmation. Another is relying solely on these tools without considering other market factors. Always combine them with a solid trading plan.

Are There Tools to Help Spot CHoCH and BOS?

Yes, many trading platforms offer indicators and charting tools to identify CHoCH and BOS. These include trendline tools, moving averages, and custom indicators. Using these can simplify your analysis.

How Can CHoCH and BOS Improve Risk Management?

By identifying key market shifts, these tools help you set better stop-loss and take-profit levels. They allow for more precise entries and exits, reducing unnecessary risks. This leads to more disciplined trading.

Final Thoughts

Mastering choch and BOS in trading is crucial for both beginners and pros. By focusing on trend shifts and structural breaks, you develop a better grasp of market behavior. Try combining a choch trading strategy for beginners with advanced BOS confirmations to refine your expertise. With time and practice, choch and BOS in trading can transform your approach, making you a more confident and effective trader.

Disclaimer:

TraderFactor or partners have prepared all the information. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not regard the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.