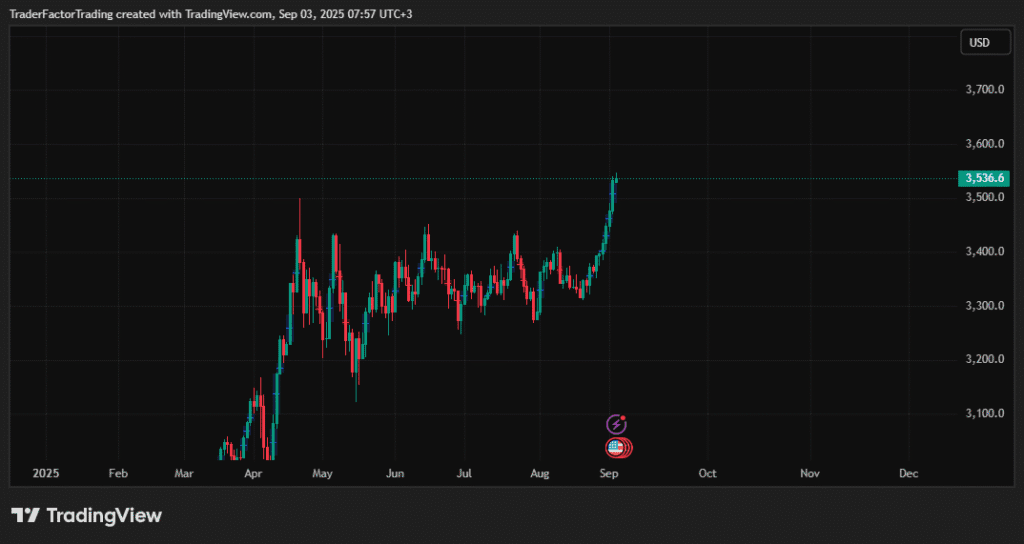

Gold price today have surged to unprecedented levels, reaching a record high of $3,546 per ounce as investors closely monitor gold price today and respond to major shifts in gold price news. This remarkable climb reflects growing confidence in Federal Reserve rate cuts this month. Additionally, a weakening dollar and declining UK bond yields have amplified gold’s appeal. Central bank purchases and heightened safe-haven demand continue supporting the rally. Recent ETF inflows have further strengthened this upward momentum. The 34% year-to-date gain underscores gold’s resilience during uncertain economic times, positioning it as a preferred hedge against market volatility and fueling robust gold price prediction discussions.

Table of Contents

ToggleMarket Dynamics Drive Gold’s Historic Rally

Federal Reserve Rate Cut Expectations Fuel Demand

Financial markets are pricing in a 92% probability of a Federal Reserve rate cut at the September meeting. This expectation has significantly boosted gold’s attractiveness since the metal offers no yield. Lower interest rates reduce the opportunity cost of holding gold compared to interest-bearing assets. Consequently, investors are shifting funds toward precious metals in anticipation of monetary policy easing. Recent gold price news highlights how speculation around rate cuts has created a perfect storm for gold’s ascent and influenced many analysts to revise their gold price prediction models higher.

Weakening Dollar Enhances Global Appeal

The declining US dollar has made gold more affordable for international buyers, impacting gold price today across global markets. Currency weakness typically correlates with stronger gold performance since the metal is priced in dollars worldwide. Foreign investors find gold purchases more attractive when their local currencies strengthen against the dollar. This dynamic has contributed substantially to the current price surge. Moreover, dollar weakness often signals broader economic concerns that drive safe-haven demand and prompt heightened investor interest, reflected in both current gold price news and outlooks for gold price prediction.

Global Economic Factors Supporting Gold Price Today

UK Bond Yield Decline Accelerates Rally

Yesterday’s release of UK bond data showed declining yields, which helped push gold above the $3,500 threshold. Lower bond yields reduce the appeal of fixed-income investments for yield-seeking investors. This shift encourages capital flows toward alternative assets like gold that serve as stores of value. The UK yield decline aligns with broader global trends of falling government bond returns. Subsequently, this environment makes gold more competitive against traditional income-generating investments and is an important factor cited in current gold price news coverage.

Central Bank Buying Provides Structural Support

Central banks worldwide continue their sustained purchasing of gold reserves. This institutional demand gives a solid foundation for price stability and future growth. Many banks diversify their reserves away from traditional currencies, particularly the US dollar. The trend reflects growing concerns about currency debasement and geopolitical tensions. Therefore, central bank activity creates consistent buying pressure that supports long-term appreciation, reinforcing positive gold price prediction narratives.

Investment Flows and Market Sentiment

ETF Inflows Reinforce Bullish Momentum

Exchange-traded fund inflows have significantly contributed to gold’s recent performance. SPDR Gold Trust reported its holdings increased to 977.68 tons, the highest level since August 2022. These flows indicate growing retail and institutional interest in gaining gold exposure, a key theme in gold price news this quarter. ETF purchases create direct demand for physical gold, supporting spot prices and informing current gold price today. Additionally, increased ETF activity suggests broader market confidence in gold’s outlook and future gold price prediction.

Safe-Haven Demand Amid Uncertainty

Geopolitical tensions and economic uncertainties continue driving investors toward gold. The metal serves as a traditional hedge during times of market stress and volatility. Trade frictions and political developments have heightened investor anxiety about traditional asset classes. Gold’s role as a store of value becomes more pronounced during such periods, which is featured in recent gold price news, reaffirming safe-haven demand as a driver in many gold price prediction scenarios.

Technical and Seasonal Factors

Seasonal Consumption Patterns Support Prices

Gold markets are entering a seasonally strong period for consumption demand. This timing coincides with wedding seasons in major consuming countries like India. Cultural and religious festivals also drive jewelry purchases during this period. The combination of investment and consumption demand creates additional upward pressure on prices. Analysts expect this seasonal strength to continue supporting the current trend, and many gold price prediction reports account for this recurring pattern.

Price Momentum Attracts Trend Followers

The sustained upward movement has attracted momentum-based investors and algorithmic trading systems. Technical analysts point to strong chart patterns supporting continued gains. Trend-following strategies often amplify existing price movements in commodity markets. This technical support complements the fundamental drivers behind gold’s performance and is frequently cited in gold price news. However, momentum-driven buying can also increase price volatility, a point raised in many gold price prediction discussions.

Analyst Outlooks and Price Targets

Bullish Projections Drive Optimism

Major investment banks have raised their gold price targets following the recent breakout. JPMorgan analysts project gold could reach $4,250 by the end of 2026. Standard Chartered expects continued record highs as rate cut expectations solidify. These projections reflect confidence in the underlying factors supporting gold demand, and their updates make regular headlines in gold price news. Nevertheless, analysts acknowledge potential volatility around key economic data releases that could impact any gold price prediction.

Risk Factors and Potential Headwinds

Despite the bullish outlook, several factors could pressure gold prices lower. Stronger-than-expected economic data might reduce rate cut expectations and support the dollar. Additionally, profit-taking by investors could trigger short-term corrections after such substantial gains. Market volatility around the upcoming non-farm payrolls data could influence near-term direction. Therefore, anyone considering gold price today or making a gold price prediction should factor in these risks.

Gold’s ascent to $3,546 reflects a confluence of monetary policy expectations, currency weakness, and safe-haven demand. Central bank purchases and ETF inflows provide structural support while seasonal factors add momentum. However, economic data releases and gold price news trends could influence the trajectory of this historic rally and a range of gold price predictions.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.