Gold price today witnessed a dramatic sell-off, sending shockwaves through the financial world. The precious metal recorded its most significant single-day decline since 2020, plunging over 5% from its recent record highs. After an impressive rally that saw prices surge nearly 60% year-to-date, this abrupt correction has left investors and market analysts questioning the underlying factors and what this means for the future of gold.

Table of Contents

ToggleMutiple Catalysts Behind the Gold Crash

The sharp downturn in gold prices was not the result of a single event but rather a combination of powerful market forces converging simultaneously. A deep dive into these factors reveals a market that was primed for a correction after a period of exceptional growth.

Profit-Taking and a Stronger Dollar

A major driver behind the sell-off was widespread profit-taking. Following a remarkable rally that pushed gold to an all-time high of $4,381 per ounce, many investors who had enjoyed substantial gains opted to liquidate their positions and lock in profits. This created significant selling pressure. Compounding this effect was the strengthening of the US dollar. The U.S. Dollar Index (DXY) rose by 0.4%, making dollar-denominated assets like gold more expensive for holders of other currencies.

Easing Geopolitical Tensions and Shifting Risk Appetite

Market sentiment also played a crucial role in gold’s decline. Recent signs of easing trade tensions between the United States and China reduced the immediate demand for safe-haven assets. As optimism grew around potential trade agreements and global relations showed signs of improvement, investors shifted their capital from the security of gold toward riskier assets, such as equities. This change in risk appetite contributed to a broad-based reallocation of funds, pulling support away from the precious metals market and fueling the downward price momentum that characterized the trading session.

Why is Gold Price Down Today?Broader Market Impact

The turbulence in the gold market was not an isolated event; its effects reverberated across the financial landscape, most notably within the precious metals and cryptocurrency sectors.

A Domino Effect on Precious Metals

The sharp drop in gold triggered a synchronized decline across other precious metals. Silver was hit particularly hard, plummeting nearly 7.5% in its worst single-day performance in recent years. Platinum and palladium also experienced significant losses, falling 7% and 6.6%, respectively. This widespread correction underscores the interconnectedness of the precious metals complex, where a major move in gold often sets the tone for the entire sector. The sell-off confirmed a broad shift in sentiment away from these traditional safe havens as market participants adjusted their portfolios in response to the changing economic and geopolitical environment.

The Gold-Bitcoin Connection

Interestingly, the gold crash also dragged down Bitcoin, highlighting the growing correlation between the physical and digital safe-haven assets. The correlation between gold and Bitcoin has reached a notable 0.85, indicating that their price movements are becoming increasingly linked. Initially, some capital appeared to rotate from gold into Bitcoin, but this effect was short-lived. The overarching risk-off sentiment eventually pulled the cryptocurrency lower, with its price falling over 2% to test critical support levels.

Key Support and Resistance Levels

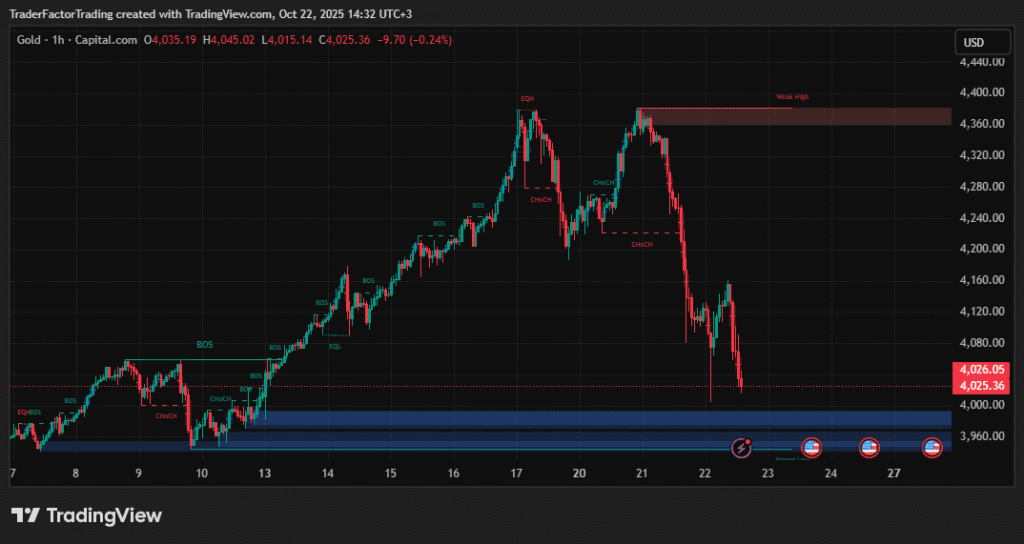

From a technical standpoint, gold is now testing a critical psychological support level at $4,000 per ounce. Should the price break below this floor, it could trigger further selling and push the metal down toward the next major support zone around $3,800. On the other hand, if buyers step in to defend the $4,000 level, the first hurdle for a recovery would be the resistance area at approximately $4,140. A sustained move above this level would be necessary to signal that the corrective phase is over and that bullish momentum is returning to the market.

Long-Term Prospects and Market Volatility

Despite the severity of the recent correction, many analysts believe the long-term bullish case for gold remains intact. The fundamental drivers that propelled its rally, including persistent central bank purchasing, underlying inflationary pressures, and the potential for renewed geopolitical instability, have not disappeared. This pullback could be viewed as a healthy consolidation after an unsustainable rally. Nevertheless, investors should brace for continued volatility. Upcoming economic data, particularly the U.S. Consumer Price Index, and future guidance from the Federal Reserve will be pivotal in shaping gold’s direction in the weeks ahead.

Wrapping Up Gold Price Today

The dramatic plunge in gold prices serves as a stark reminder of market volatility. While the event was triggered by a confluence of profit-taking, a stronger dollar, and shifting sentiment, the fundamental appeal of gold as a long-term hedge remains. Prudent investors will continue to monitor key indicators.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.