The forex market in 2026 is faster, more competitive, and more technologically advanced than ever before. For a trader, your broker isn’t just a service provider; they are your gateway to the global markets. Choosing the wrong one can mean slower execution, higher costs, and missed opportunities. This brings us to a crucial question for anyone looking to upgrade their trading setup: Is ActivTrades the right platform for you?

In this comprehensive ActivTrades review 2026, we’re going beyond the surface level. We will dissect the platform’s core features, analyze its cost structure, and evaluate its technology to help you decide if it aligns with your trading goals. Whether you are a scalper looking for tight spreads or a swing trader needing robust analysis tools, this guide covers everything you need to know.

Table of Contents

ToggleIs ActivTrades Good? An Honest ActivTrades Review 2026?

Before diving into the technical specs, it’s essential to understand who benefits most from this broker. ActivTrades has carved out a niche by balancing professional-grade tools with an accessible user experience.

- The Serious Retail Trader: If you have moved past the “gambling” phase and treat trading as a business, you will appreciate the regulatory security and reliable execution.

- The Tech-Savvy Trader: With its proprietary platform and support for automated strategies, it appeals to those who leverage technology for an edge.

- The Cost-Conscious Trader: Competitive spreads without hidden commissions on forex pairs make it a strong candidate for high-volume traders.

Regulatory Safety and Trust

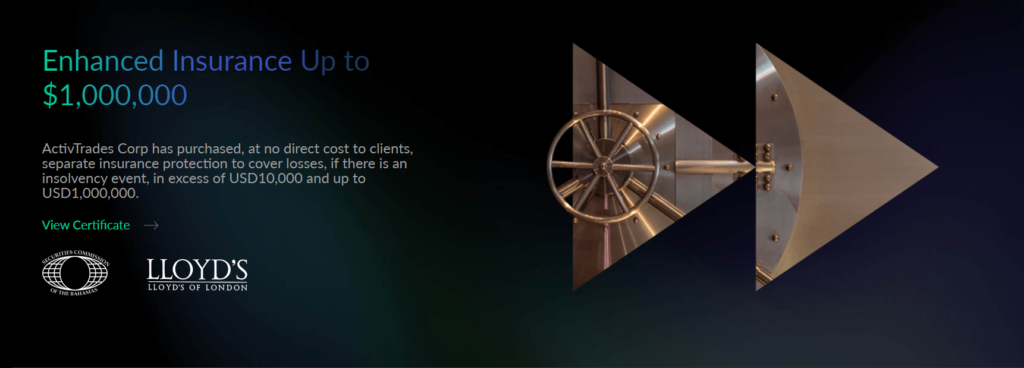

In the world of online trading, safety comes first. No matter how good the spreads are, they mean nothing if your funds aren’t secure. ActivTrades boasts a robust regulatory framework that should put most minds at ease.

The broker is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the UK. This is one of the strictest financial watchdogs globally, ensuring that the broker adheres to rigorous standards regarding capital adequacy and client fund segregation.

Additionally, they are regulated by the CSSF in Luxembourg and the SCB in the Bahamas.

For 2026, this multi-jurisdictional regulation remains a massive selling point. It signals that ActivTrades is not a “here today, gone tomorrow” operation but a stable financial institution committed to transparency.

Analyzing the Trading Platforms

A forex trading platform is your cockpit. It needs to be comfortable, responsive, and packed with the right gauges. ActivTrades offers a compelling mix of industry standards and proprietary innovation.

ActivTrader: A Modern Solution

While many brokers rely solely on third-party software, ActivTrades has developed its own platform, ActivTrader. In 2026, this platform has matured into a serious competitor to legacy software.

Key Features:

- Progressive Trailing Stop: Unlike a standard trailing stop, this feature allows you to secure profits more aggressively as the market moves in your favor.

- Market Sentiment Indicators: You can instantly see how other traders on the platform are positioned, giving you a quick read on market psychology.

- Hedging Capabilities: For advanced strategies, the ability to hedge positions directly within the platform is a significant advantage.

The user interface is sleek and intuitive, making it a great choice for traders who find older platforms clunky or outdated.

MetaTrader 4 and 5 (MT4/MT5)

For the purists, ActivTrades continues to support both MetaTrader 4 and MetaTrader 5. These platforms remain the gold standard for many because of their vast ecosystem of custom indicators and Expert Advisors (EAs).

If your strategy relies on automated trading bots or specific custom indicators coded in MQL4 or MQL5, ActivTrades provides a stable, low-latency environment to run them. The inclusion of Smart Tools—a set of add-ons developed by ActivTrades to enhance the MetaTrader experience—adds value that standard vanilla MT4 brokers often lack.

The Cost of Trading: Spreads and Fees

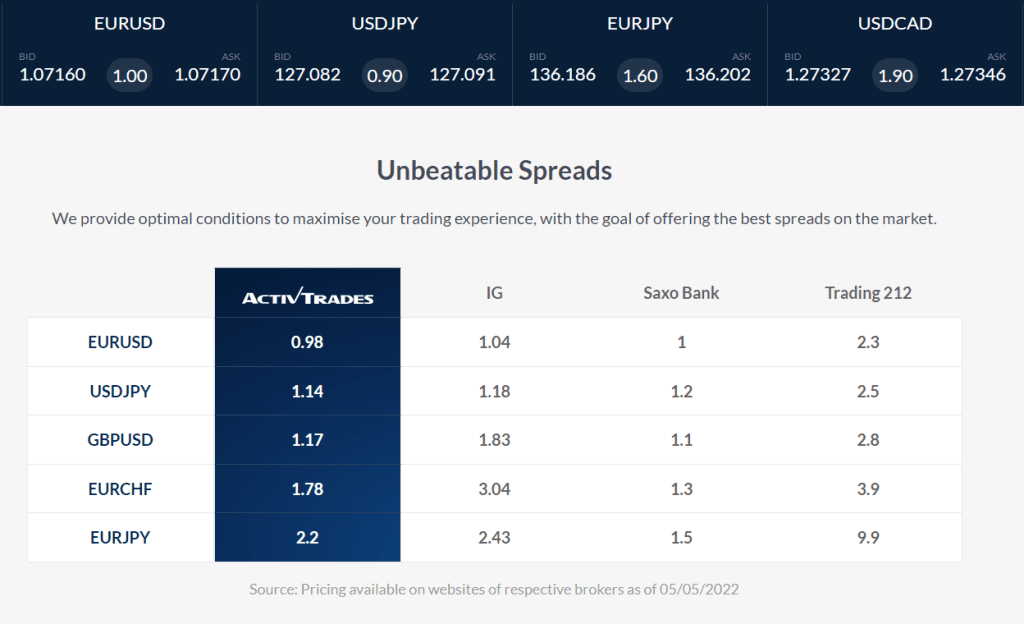

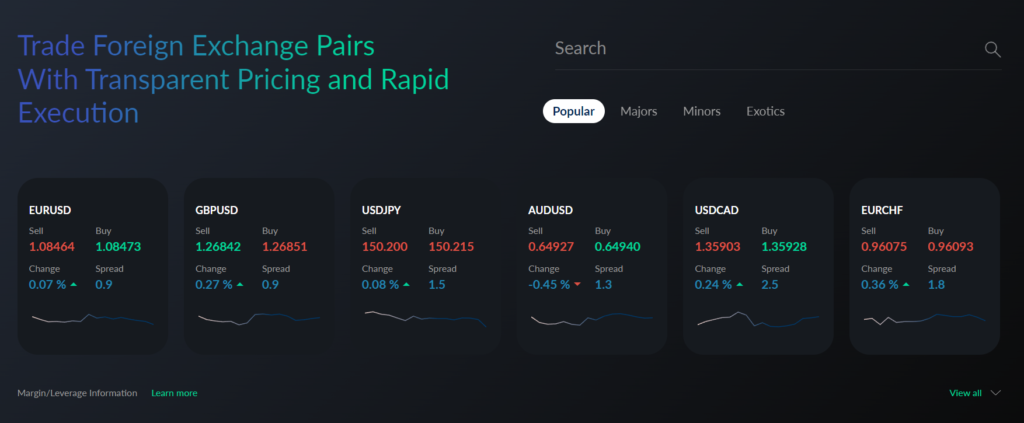

Is ActivTrades a cost-effective option? In 2026, fees are more transparent than ever, and traders are increasingly sensitive to the “cost of doing business.”

Forex Spreads:

ActivTrades operates on a spread-only model for forex. This means you won’t pay a separate commission per lot; the fee is built into the bid/ask spread. For major pairs like EUR/USD, spreads are highly competitive, often dipping as low as 0.5 pips during peak liquidity hours.

For high-frequency traders, these savings add up significantly over hundreds of trades.

Non-Trading Fees:

One of the most attractive ActivTrades features is the absence of hidden nasties. There are no deposit fees, and the broker absorbs transfer fees for most withdrawal methods.

Furthermore, they do not charge an inactivity fee, which is a relief for casual traders who might take breaks from the markets without wanting to be penalized.

Leverage and Margin Requirements

Leverage is a double-edged sword—it can amplify gains but also magnify losses. ActivTrades offers flexible leverage options tailored to your regulatory jurisdiction and experience level.

- Retail Clients (FCA/EU): Due to strict regulations, leverage is typically capped at 1:30 for major currency pairs. This protects less experienced traders from excessive risk.

- Professional Clients: If you meet specific criteria demonstrating experience and capital, you may qualify for “Professional” status, unlocking higher leverage limits.

- International Clients: Traders under the SCB regulation may have access to higher leverage ratios, providing more flexibility for those who understand risk management.

Regardless of the level, ActivTrades provides automated margin close-out protections to help prevent your account from going into a negative balance, a critical safety net in volatile markets.

Execution Speed and Reliability

In 2026, a “requote” is a dirty word. You want your trade executed at the price you clicked, instantly. ActivTrades utilizes a fully automated execution model. There is no dealing desk intervention, which minimizes the conflict of interest often seen with market maker brokers.

Their execution speed is generally excellent, leveraging robust server infrastructure to ensure low latency.

For scalpers and news traders, where milliseconds matter, this reliability is a non-negotiable requirement for a best forex broker contender.

Customer Support and Education

Even the best platform can have issues, or you might just have a question about a withdrawal. This is where customer support becomes vital. ActivTrades offers 24/5 support via live chat, email, and phone.

Reviews in 2026 highlight the responsiveness of their team. Unlike some competitors who rely heavily on chatbots that send you in circles, ActivTrades connects you with human agents relatively quickly.

Educational Resources:

For those looking to sharpen their skills, the broker offers:

- Webinars: Live sessions with market experts analyzing current trends.

- 1-to-1 Training: A unique offering where you can get personalized guidance on how to use the platforms effectively.

- Archive: A library of manuals and video tutorials covering everything from technical analysis to platform navigation.

Verdict: Is ActivTrades the Best Forex Broker for You?

As we wrap up this ActivTrades review 2026, the verdict is positive. ActivTrades has successfully evolved to meet the demands of modern traders. It avoids the trap of being “just another MT4 broker” by offering a superior proprietary platform, excellent insurance protection for client funds, and highly competitive trading costs.

It is the right platform for you if:

- You value regulatory safety and fund protection above all else.

- You want a choice between industry-standard MT4/5 and a modern, web-based platform.

- You are looking for tight spreads without paying commission on forex trades.

It might not be for you if:

- You are looking for a broker that offers massive deposit bonuses (which are often restricted by top-tier regulators anyway).

- You trade exclusively in obscure, illiquid micro-cap stocks not covered by their CFD offering.

Ultimately, ActivTrades offers a professional, transparent, and high-tech trading environment. If you are serious about your trading performance in 2026, opening an account with ActivTrades is a strategic move worth considering.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.