The Australian dollar has faced further downward pressure this Tuesday morning, driven by disappointing Chinese import and export numbers.

These figures highlight the economic challenges faced by the region. The close trade ties between Australia and China, particularly in commodities, have caused the Australian dollar to weaken more than other G10 currencies against the US dollar.

Adding to the AUD decline, the Westpac consumer confidence index for August reflects a deteriorating outlook from a consumer perspective.

Looking ahead, attention will shift to US data, including the balance of trade and speeches by Fed officials Barkin and Harker.

While these events may not have a significant impact on the currency pair, market participants will be closely watching the upcoming US CPI release on Thursday, which could result in limited price movement leading up to the announcement.

Table of Contents

ToggleStrong Dollar Puts Pressure On EUR/USD

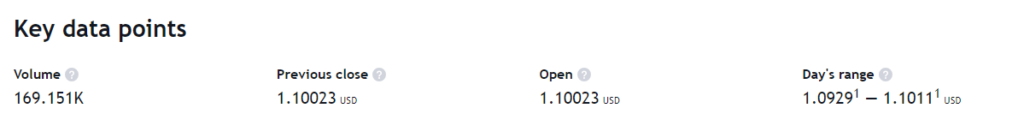

In the early American session on Tuesday, the EUR/USD pair dropped below the key level of 1.0950. The ongoing strength of the US Dollar, due to a cautious market atmosphere, is pushing the pair further down.

Technical indicators suggest a bearish extension, with the EUR/USD trading at fresh weekly lows and approaching the previous weekly bottom at 1.0911.

The daily chart shows downward momentum, with indicators declining within negative levels. The 20 Simple Moving Average (SMA) is also declining, signaling downward pressure.

The 100 SMA provides support at around 1.0920. If the pair breaks below the 1.0910/20 price zone, it could test the July 6 low of 1.0833.

The 4-hour chart reinforces the bearish outlook, with the Relative Strength Index (RSI) and Momentum indicator both indicating downward movement.

The EUR/USD is currently below all its moving averages, with the 20 SMA hovering around 1.0975. Even if there is a recovery, the bearish case will hold as long as sellers reject advances around the 1.1000 level.

Key support levels to watch are 1.0910, 1.0870, and 1.0830, while resistance levels can be found at 1.1005, 1.1065, and 1.1105.

Frequently Asked Questions About Currencies In Forex

What does the EURUSD currency pair represent?

The EURUSD currency pair represents the exchange rate between the Euro (EUR) and the US Dollar (USD). It shows how much one Euro is worth in US Dollars.

Why is EURUSD considered one of the major currency pairs?

EURUSD is considered one of the major currency pairs because it involves two of the world’s largest economies – the European Union and the United States. The Euro and the US Dollar are widely used and have a significant impact on global financial markets.

Which other currency pairs belong to the ‘Majors’ group?

Other major currency pairs include GBP/USD (British Pound and US Dollar) and USD/JPY (US Dollar and Japanese Yen).

What is the significance of GBP/USD in the forex market?

GBP/USD holds significance in the Forex market as it represents the exchange rate between the British Pound and the US Dollar. It is heavily influenced by economic factors, monetary policies, and political developments in both countries.

Why is GBP/USD also known as ‘The Cable’?

GBP/USD is also known as ‘The Cable’ because, historically, the exchange rate between the British Pound and the US Dollar was transmitted through a transatlantic cable in the 19th century.

How did the Brexit referendum affect GBP/USD?

The Brexit referendum, where the United Kingdom voted to leave the European Union, had a significant impact on GBP/USD. The uncertainty surrounding the outcome caused volatility in the currency pair, leading to sharp fluctuations in its value.

What is the relationship between GBP/USD and the European and American economies?

GBP/USD reflects the relationship between the British and American economies. Economic indicators, such as GDP growth, inflation rates, employment data, and central bank policies, can influence the exchange rate between these two currencies.

Why is USD/JPY known as the ‘ninja’ or the ‘gopher’?

A: USD/JPY is referred to as the ‘ninja’ or ‘gopher’ in trading. These nicknames highlight its liquidity and the active involvement of Japanese and American traders in this currency pair.

Why is the Japanese Yen often used in carry trades?

Japanese Yen is often used in carry trades, where investors borrow in a low-interest-rate currency (like the Yen) to invest in higher-yielding assets elsewhere. This practice influences the demand for Yen and impacts USD/JPY.

What is the correlation between USD/JPY and USD/CHF?

USD/JPY and USD/CHF have a positive correlation because both pairs involve the US Dollar. However, the correlation is not always perfect, and other factors, such as economic events and market sentiment, can cause deviations.

How does the Bank of Japan and the Federal Reserve Bank impact USD/JPY?

The value of USD/JPY is influenced by interest rate differentials between the Bank of Japan and the Federal Reserve Bank. Changes in monetary policy decisions, economic indicators, and geopolitical events also play a role in shaping the currency pair’s movement.

What is the trading volume of EUR/USD compared to other currency pairs?

The trading volume for EUR/USD is very high compared to other currency pairs. Its liquidity makes it less likely for gaps or breakaway gaps to occur, ensuring smoother price continuity.

When is the most active trading session for EURUSD?

The most active trading session for EURUSD is when traders in Europe start their day, usually between 8:00 AM and 4:00 PM GMT. During this time, there is increased market activity and volatility in the currency pair.

How does U.S. economic news impact the EURUSD pair?

U.S. economic news can have a significant impact on the EURUSD pair. Key indicators, such as Non-Farm Payrolls, GDP growth, inflation data, and Federal Reserve announcements, can influence market sentiment and drive price movements.

Are there any gaps or breakaway gaps in the EURUSD pair?

Gaps or breakaway gaps are less likely to occur in the EURUSD pair due to its high trading volume. Gaps happen when there is a significant difference between the closing price of one trading session and the opening price of the next session. However, in rare cases, gaps can occur during periods of extreme market volatility or unexpected news events.

Read These Next

The Winning Mindset for Weekend Forex Trading

Essential Education for Taxes on Forex Trading

What is a Margin Level in Forex?

Forex Breakout Strategy: A Guide for Profitable Trading

Forex Consolidation Breakout Strategies for Traders

Master Forex Flag Pattern Strategy for Profit

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.