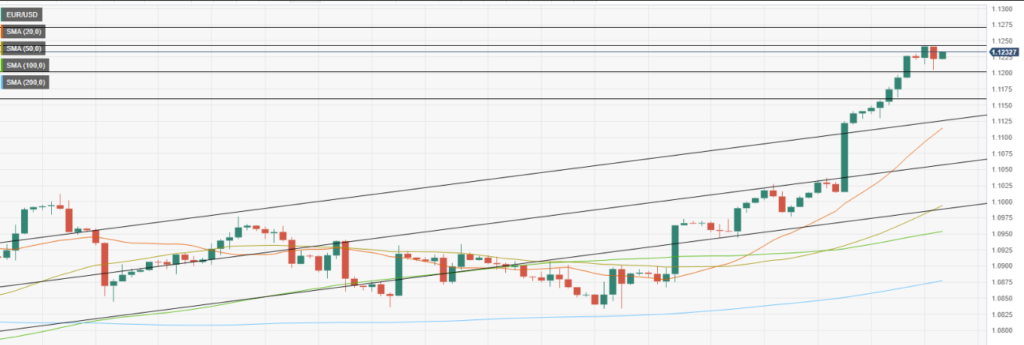

There’s caution in the air regarding the EUR/USD forecast as a potential correction may be on the horizon. The pair witnessed a new high above 1.1200, but technical indicators are flashing signals of overbought conditions. Weekend trading could hinder further gains.

During Friday’s Asian session, the EUR/USD skyrocketed to its highest point since March 2022, reaching 1.1244 before experiencing a minor pullback. At present, the pair comfortably holds above 1.1200.

The US Dollar faced selling pressure after disappointing inflation data. However, despite some hawkish remarks from Federal Reserve officials, the EUR/USD retains its bullish momentum.

The Fed’s blackout period commences on Saturday, implying potential pushback against market expectations of a rate hike in July. Yet, convincing the market of two more rate hikes this year will require more than mere words.

Investors need to tread carefully and consider securing profits ahead of the weekend. A strong recovery in the US Dollar seems improbable without concrete labor market and inflation data to shape the Fed’s rate outlook.

From a technical standpoint, the short-term analysis suggests that the EUR/USD is in overbought territory. Initial support levels are identified at 1.1200, followed by 1.1160 and 1.1120. On the upside, resistance levels are observed at 1.1240, 1.1270, and 1.1300.

What Does It Mean When A Currency Is Overbought

Overbought territory in currency trading refers to a situation where a currency pair is trading above its true value, usually due to an extended bullish rally.

When a currency is overbought, it means that the demand for that particular currency has exceeded its supply, which could lead to a potential reversal in trend. This situation occurs when investors and traders push the price of the currency pair higher based on excessive optimism or hype.

The key indicators that signal a currency is overbought include technical analysis tools such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These indicators help traders and investors to identify when a currency pair is overbought and likely to experience a market correction.

When traders and investors identify a currency pair in an overbought territory, they can respond by taking steps to minimize their risk, such as setting stop-loss orders or reducing their position size.

Alternatively, traders can consider exploring profit-making opportunities through short-selling or taking advantage of the impending reversal.

One well-known incident of a currency being overbought occurred during the Dot-com bubble in the late 1990s, where the US Dollar was heavily overbought against the Japanese Yen.

The USD/JPY pair rose from around 110 to nearly 150 between 1995 to 1998, mainly due to the strong demand for US stocks and bonds by Japanese investors, who were chasing high yields in a low-interest-rate environment.

However, the situation eventually reversed, and the USD/JPY pair plunged to below 80 in 2011, resulting in huge losses for investors and traders who failed to read the signs of impending market correction.

While Overbought territory in currency trading may provide opportunities for profits, it can also pose risks for traders and investors.

Traders and investors should remain vigilant, apply sound risk management principles, and always keep track of critical market indicators to avoid potential losses.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.