Harness the power of a Forex PIP calculator to enhance your trading strategy and understand the value of a single PIP. Understanding the smallest changes in currency values can make a significant difference. One such change is denoted by “PIP” – an acronym for Price Interest Point. This concept might seem daunting at first, but with the right tools and knowledge, it can become a powerful ally in your trading journey.

A Forex PIP profit calculator is one such tool. It helps traders understand the value of a single PIP move in their currency pair, which is crucial for risk management and profit optimization.

Overview: Forex PIP Calculator

In this discussion, we’ll demystify the concept of a PIP, explain how to use a Forex PIP calculator, and provide practical examples to illustrate its importance in real-world trading scenarios.

Let’s assume you’re trading the EUR/USD pair, one of the most traded currency pairs in the Forex market.

The current exchange rate is 1.1800, and you decide to buy 1 standard lot (which equals 100,000 units) anticipating that the Euro will strengthen against the Dollar.

Now, let’s say the exchange rate rises to 1.1801. This means the value of the Euro has increased compared to the Dollar. In Forex terms, the pair has moved up by 1 PIP.

Using a Forex PIP calculator, you can quickly determine the monetary value of this 1 PIP move.

Here’s how:

- Input the size of your trade (in this case, 1 lot or 100,000 units).

- Input the currency pair you’re trading (EUR/USD).

- Input the PIP change (in this case, it’s an increase of 1 PIP).

The calculator will then compute the value of the 1 PIP move for you. In this scenario, a 1 PIP move equates to a $10 change in your trading position. This means that you’ve made a profit of $10 from this trade.

This example illustrates how understanding the value of a single PIP can aid in making informed trading decisions. With a Forex PIP calculator, this process becomes much simpler and quicker, allowing you to focus more on your trading strategy.

Table of Contents

ToggleUnderstanding Pip Calculators

To truly grasp the concept of pip calculators, you first need to understand what a pip is in the context of forex trading. A pip, or point in percentage, is a unit used to measure changes in a currency pair’s exchange rate. It’s a crucial aspect of forex trading as it helps determine your profits and losses.

As noted, the most common way to calculate pip value is by using the formula: (0.0001/Exchange Rate) x Lot Size. But, with a pip calculator, you don’t have to do any manual calculations. The calculator does the heavy lifting for you, providing accurate pip values instantly.

Understanding the importance of pip value is essential. It’s the base for calculating your potential gain or loss. A common misconception about pips is that they’re always the same value, which isn’t true. The value of a pip varies depending on the currency pair and trade size.

The advantages of using a pip calculator are numerous. It saves you time, reduces the risk of calculation errors, and allows for efficient trade planning. For effective use, ensure you input the correct values into the calculator and double-check the results.

The Value of a Pip

While a pip calculator does the math for you, it’s still essential to understand the value of a pip and how it’s calculated. The value of a pip is crucial for calculating your profits and losses accurately, and plays a significant role in forex risk management.

Different currency pairs have different pip values. For instance, for the EUR/USD pair, a pip is roughly equal to $0.0001. Your pip calculator’s accuracy is vital in getting these values right, as even slight inaccuracies can significantly affect your trading decisions.

Here’s a simplified table for a clearer understanding:

| Currency Pair | Pip Value |

| EUR/USD | 0.0001 |

| USD/JPY | 0.01 |

| GBP/USD | 0.0001 |

| USD/CHF | 0.0001 |

Calculating pip value is a critical step in profit/loss calculation. It helps you understand the value of each move in the currency pair you’re trading. This understanding enables you to manage your trading risk effectively and make more informed trading decisions.

Exploring Other Calculators for Trading

Beyond the pip calculator, you’ll find several other useful tools on our platform designed to enhance your trading strategies and decision-making. These tools facilitate everything from calculating profit/loss with the pip calculator to understanding the invest profit calculator.

Margin Calculator

The Margin Calculator is a vital tool for any trader. It helps you determine the margin needed to open and maintain your positions. By doing so, it significantly reduces the risk of a margin call, which occurs when the broker demands that an investor deposit additional money or securities to cover possible losses.

Let’s say you want to open a position in the EUR/USD pair with a lot size of 0.1 and leverage of 1:100. Inputting these values into the margin calculator will give you the required margin to open and maintain this position. By knowing this beforehand, you can ensure you have sufficient funds in your account to avoid a margin call.

Currency Converter

The Currency Converter is another invaluable tool in Forex trading. It allows traders to convert one currency into another at the current exchange rates, providing a clear understanding of trading costs.

Suppose you are trading a USD/JPY pair but your account is in Euros. You want to know how much a profit of 500 USD is in Euros. A currency converter quickly provides you with the equivalent value in Euros based on the current exchange rate, allowing you to accurately calculate your profits.

Invest Profit Calculator

The Invest Profit Calculator is a tool that enables traders to compute potential profits or losses before making a trade. This aids in setting realistic profit targets and controlling risk.

If you’re considering a trade on the GBP/USD pair and you want to know what your potential profit would be for a 50 PIP move in your favor, you can use the invest profit calculator. Inputting the relevant details such as entry price, exit price, position size, etc., will give you an estimate of your potential profit.

Risk Management with the Pip Calculator

Lastly, the Pip Calculator is a crucial tool for risk management. It helps traders calculate the risk per trade, which is fundamental for successful trading.

If you’re trading the EUR/USD pair with a stop loss of 20 PIPs and a lot size of 0.1, you can use the pip calculator to determine the exact risk in your account currency. Knowing this value helps you manage your risk effectively and ensure it aligns with your overall trading strategy.

Common Questions on Pips

You might have some questions regarding pips and their role in forex trading, so let’s dive right in and tackle some of the most common queries.

| Question | Short Answer | Detailed Answer |

| How is pip size calculated? | By understanding the standard pip value. | For most pairs, one pip is a change of 0.0001. For pairs involving JPY, it’s 0.01. |

| What is the pip value formula? | Pip value = (1 pip/Exchange rate) * Lot size | This formula helps you understand the value of a pip in your base currency. |

| What are the advantages of using pips? | They allow for risk management and precise calculation of profits and losses. | Pips help you set stop loss and take profit levels, aiding in effective risk management. |

| How do pips contribute to risk management? | By allowing precise control over trade sizes. | By calculating pip size, you can choose the exact trade size that suits your risk tolerance. |

| How does leverage impact pip value? | It amplifies it. | Leverage lets you control larger positions with a smaller capital. This means that the value of each pip will be higher, increasing both potential profits and losses. |

The Role of the Pip Calculator

In the world of forex trading, a pip calculator plays a crucial role in helping you determine the value of a pip based on specific trade details. This tool is essential in providing vital information that aids in calculating profits, managing risks, and determining the appropriate position size.

Here are some key functions of a pip calculator in forex trading:

- It assists you in accurately calculating potential profits or losses for various currency pairs.

- It aids in effective risk management by providing the pip value, which is crucial in setting stop-loss and take-profit points.

- It helps determine the correct position size based on your risk tolerance and trade strategy.

- It simplifies the process of understanding the impact of pip movements on your trading portfolio.

In essence, a pip calculator is a significant tool in your forex trading toolkit. It contributes to making informed trading decisions, allows for strategic risk management, and facilitates effective trading across different currency pairs. Always remember, understanding the value of a single pip is a step towards successful forex trading.

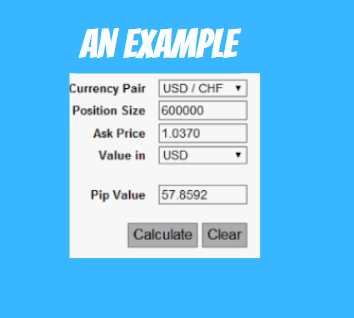

Guide to Using the Pip Value Calculator

To effectively use the pip calculator, start by selecting your account currency from the available options. Then, choose the currency pair you’re interested in and enter the trade size. You’ll find the pip value for that pair displayed. Remember, the accuracy of the pip calculator is essential for precise trading decisions.

| Pip Calculator Benefits | Pip Calculator Limitations |

| Accurate pip value calculations | Limited by the available currency pairs |

| Quick and easy to use | Depends on accurate market data |

| Helps in risk management | May not account for pipette values |

Despite its limitations, the pip calculator remains an invaluable tool in forex trading. However, don’t rely solely on it for all your trading decisions. Consider alternatives like manual calculations or other trading software to cross-verify the results.

Deep Dive Into Pips

While the pip calculator is a crucial tool for forex trading, understanding the nuts and bolts of pips themselves is equally important. In the world of forex, a pip is the smallest price move that a currency pair can make.

- The pip location varies among currency pairs. It’s typically the fourth decimal place for most pairs but the second decimal place for pairs involving the Japanese Yen.

- Fractional pips, or ‘pipettes,’ are one-tenth of a pip and offer more precision in quoting rates.

- Pip value calculation is key to managing risk and potential profit. It represents the change in value between two currencies.

- Pip value conversion into your account’s base currency is necessary to keep track of your profits and losses.

The pip calculator aims to offer accurate pip value calculations. However, its accuracy depends on the current market rates and the details you input. Always double-check the results for precision. Remember, understanding pips is an essential part of your forex trading journey. It not only helps you assess the market but also aids in making informed trading decisions.

Calculating Pip Value Manually

Often, you might find yourself needing to calculate the pip value manually, especially when you don’t have access to a pip calculator. Calculating pip value isn’t as daunting as it seems, and it’s a skill that’s invaluable in forex trading.

The pip value formula is straightforward: Pip value = (One Pip/Exchange Rate) * Lot Size. For example, if you’re trading EUR/USD at an exchange rate of 1.1100 and with a lot size of 100,000, one pip will equal 9.01 USD.

Pip value examples like this one can help you understand the process better. Remember, the pip value is always calculated in the quote currency (the second currency in a pair), then converted to the base currency if needed.

The importance of pip value can’t be overstated. It helps you manage your risk and understand the potential profit or loss from each trade. By using pip calculation methods, you can decide how many lots to trade and set your stop loss and take profit levels appropriately. Mastering this manual calculation is a step towards becoming a more informed and effective forex trader.

Frequently Asked Questions

What Are the Potential Risks Associated With Not Understanding the Value of a Pip in Forex Trading?

Not understanding pip value can upend your risk management, potentially causing heavy trading losses. It can affect your understanding of leverage, increase chances of margin calls, and hinder effective strategy formulation. It’s crucial to comprehend this concept.

Can the Forex Pips Calculator Be Used for Trading Other Financial Instruments Apart From Forex?

Yes, you can use the pip calculator for other financial instruments. Its versatility extends to cryptocurrency pip calculation, commodities trading application, and equity market relevance, thanks to its customizability.

Is There a Mobile Version of the Pip Calculator Forex Available for On-The-Go Trading?

Yes, there’s a mobile version of the pip calculator for on-the-go trading. It offers full app functionality, easy user interface, and platform compatibility. However, offline usage might not be available. Always check mobile accessibility.

How Frequently Should a Trader Update the Exchange Rate in the Pip Calculator for Accuracy?

You should update the exchange rate in your pip calculator frequently due to market volatility. Regular updates ensure accurate calculations, improving your trading efficiency amid exchange fluctuations.

How Can a Trader Determine the Value of a Pip for Exotic Currency Pairs Using the Pip Calculator?

You can use the forex trading pip calculator to determine the value of a pip for exotic currency pairs. Remember, due to exotic pairs’ volatility and liquidity, it’s crucial to ensure the calculator’s accuracy in calculations.

When Can I Get Forex pip calculator free?

A free Forex pip calculator helps traders quickly understand the value of 1 pip across various currency pairs to optimize their strategies.

1 pip is equal to how many dollars?

In forex, 1 pip is typically equal to $10 when trading a standard lot, but this can vary based on the currency pair.

How much is 1 pip in forex or how to calculate pips in forex?

How do i calculate pips in forex? The value of 1 pip in forex is contingent on the currency pair and the size of the trade, commonly $10 for a standard lot.

What is a XAUUSD pip calculator?

An XAUUSD forex calculator pip assists in determining the pip value specifically for gold trading against the US dollar.

How to calculate pips with lot size?

How to calculate pips on forex? To calculate pips with lot size, multiply the number of pips by the lot size and the pip value of the currency pair.

How to calculate pips profit?

Pips profit is determined by multiplying the number of pips gained or lost by the pip value and the number of lots traded.

1 pip is equal to how many points?

In most forex pairs, 1 pip is equal to 10 points, although this can differ based on the market.

Which is the best pip calculator mt5?

The best pip calculator MT5 offers precise calculations and integrates seamlessly within the MetaTrader 5 platform for efficient trading.

Where can I get pip calculator mt5 free?

A pip calculator MT5 free version provides essential pip value calculations without any cost, enhancing trading decisions.

Where can I get pip calculator mt5 free download?

Traders can enhance their MT5 platforms by accessing a pip calculator MT5 free download for accurate pip value assessments.

What is a pip calculator MT4?

Pip value calculator mt4 is a tool designed to help traders calculate the pip value directly within the MetaTrader 4 platform. The mt4 pip value calculator is a popular tool prefered by many traders.

Conclusion

So, you’re now equipped with a deeper understanding of PIPs and their value in Forex trading. You’ve learned how to calculate PIP value manually and leverage the forex pip value calculator for precise results. You’re aware of the impact of PIP values on risk management and position sizing. With this knowledge, you’re set to make more informed trading decisions. Don’t forget, continuous learning is key in Forex trading. Happy trading, folks!

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.