Gold price today have surged to seven-week highs, fueled by heightened geopolitical tensions and above-target US inflation data. The year-over-year CPI inflation reached 2.4%, exceeding the Federal Reserve’s 2.0% goal, reinforcing gold’s appeal as a hedge. Meanwhile, escalating hostilities between Israel and Iran have further driven a flight toward safe-haven assets like gold. Market participants are also wagering on potential Federal Reserve rate cuts, adding momentum to gold’s bullish trend. With geopolitical risks and macroeconomic factors intertwined, gold’s trajectory is under intense scrutiny, particularly as it edges closer to historical price records. Below, we analyze recent developments driving gold prices.

Table of Contents

ToggleUS Inflation and Its Influence on Gold

CPI Data Continues to Exceed Fed Expectations

The recent CPI report has highlighted a persistent inflationary pressure, with the CPI rising 2.4% on a year-over-year basis. This figure is notably above the Federal Reserve’s long-term target of 2.0%, signaling limited success in cooling price growth. Although May’s month-over-month inflation only edged up by 0.1%, the annual rate indicates underlying price pressures remain. Such dynamics bolster demand for real assets like gold, often seen as a safeguard against monetary instability.

The implications of persistent inflation extend to Federal Reserve policy. While market participants predict rate cuts due to slowing monthly inflation, the yearly figure could complicate such decisions. A cautious Fed may refrain from aggressive cuts to avoid overheating the economy, introducing potential turbulence in gold price dynamics.

Higher Inflation Fuels Market Uncertainty

For investors, above-target inflation reinforces the argument for owning gold. Inflation erodes purchasing power, which typically boosts safe havens like gold. Meanwhile, real yields on bonds have dipped, making non-yielding assets more appealing. If inflation persists above 2.0%, gold could face sustained support alongside subdued bond yields.

Rate-cut expectations could diminish if inflationary risks rise. Markets must now reconcile the Fed’s dilemma between inflation management and supporting economic growth. This ongoing uncertainty adds an extra layer of interest for gold, particularly with fiscal risks abroad also feeding into the metal’s allure.

Geopolitical Tensions Amplify Gold’s Safe-Haven Appeal

Intensifying Israel-Iran Conflict Drives Gold Demand

The escalating Israel-Iran conflict has spurred gold buying as investors seek haven assets. Recent Israeli attacks on Iranian nuclear sites, coupled with Tehran’s threats of retaliation, have destabilized regional and global security outlooks. Such heightened tensions invariably lead to a flight from riskier assets to safety, with gold front-and-center in these moves.

Gold’s safe-haven status grows stronger when global conflicts intensify. The metal thrives during uncertainty, with geopolitical risks creating ideal price conditions. Recent trading data confirms this, with gold comfortably breaching key resistance levels. If further retaliations occur, gold’s path toward new highs could solidify.

Broader Geopolitical Risks Echo Beyond the Middle East

The Israel-Iran crisis is not the only geopolitical factor influencing markets. Rising global defense budgets and persistent trade uncertainties also play a role. These interconnected issues contribute to rising market volatility, intensifying investor demand for stable assets. Gold has historically served as a reliable hedge when macroeconomic dynamics worsen.

Additional tensions in domains like US-China trade disputes indirectly support gold. Combined with growing energy uncertainties following Middle Eastern disruptions, gold benefits from the compounding effects of widespread risk aversion. Such events highlight gold’s robust importance within diversified portfolios during crises.

Technical Outlook for Gold Price Today

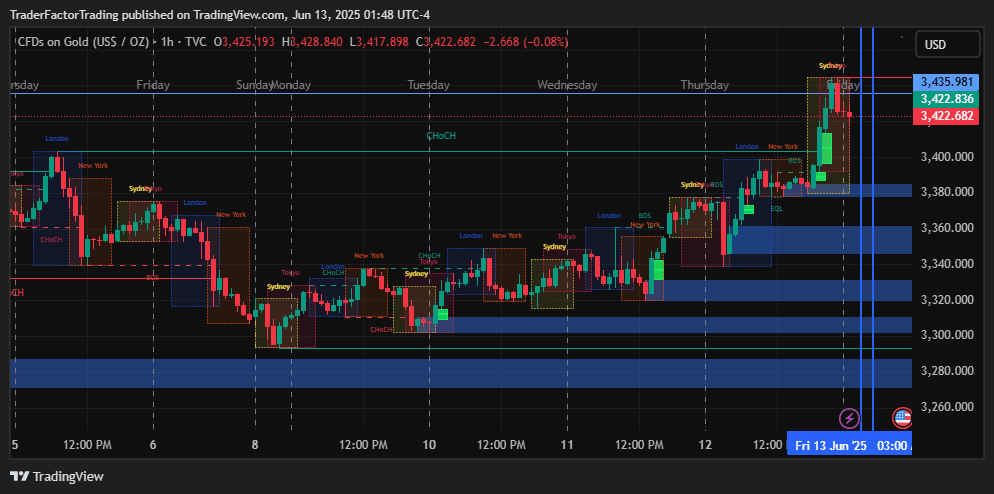

Gold Price Today USD Breaks Key Resistance Levels

XAUUSD current run has seen it scale above $3,400, breaking past significant technical resistance. Bullish momentum has been accompanied by falling Treasury yields and a weaker US dollar. These elements make gold more attractive to international buyers, further sustaining price gains.

Immediate resistance now lies at $3,450, with $3,500 as the next target. Technical indicators like the RSI continue signaling strength, leaving room for further advances. Analysts anticipate gold’s bullish trend could continue short-term, particularly if geopolitical and economic uncertainties persist amid elevated safe-haven demand.

Implications for Diversified Investment Portfolios

The developing gold rally has implications for portfolio construction. Amid suppressed bond yields and higher gold prices, cash allocations may also shift toward the yellow metal. Gold exchange-traded funds (ETFs) are seeing increased inflows, reflecting this shift in sentiment toward less volatile assets.

For traders, leveraged gold products are becoming particularly compelling amid volatility. These dynamics illustrate gold’s relevance during monetary policy uncertainty, geopolitical tensions, and fragile risk-on trades. Investors continue rebalancing strategies as gold’s outlook remains tied to major global events beyond technical milestones.

Federal Reserve Policy Adds Uncertainty

Rate Cut Expectations Provide Temporary Boost

Markets are betting heavily on significant Fed rate cuts, tied to subdued monthly inflation and easing economic conditions. Such expectations have weakened the US dollar, further boosting gold prices. Declining interest rates reduce opportunity costs, making gold more favorable relative to yield-dedicated investments.

However, if yearly inflation forces the Federal Reserve toward hawkishness, these expectations may waver. For now, gold enjoys positive momentum, but policy inflections would introduce resistance. Fed activity remains a wildcard, keeping gold exposed to sudden sentiment shifts depending on mid-summer data revisions.

Monetary Policy and Gold Correlations

Gold’s long-term relationship with global monetary policy continues evolving. Throughout recent economic cycles, the yellow metal tracks policy flips toward monetary easing closely. Consequently, Fed decisions in coming weeks could heavily impact gold’s path toward or away from record highs.

Even minor revisions in rate expectations send ripples across asset classes. Gold bulls benefit significantly from dovish trends, particularly amid broader market volatility. Traders should closely monitor upcoming economic releases that may recalibrate monetary views further, with bond flows shifting on rate optimism.

Conclusion

Gold prices remain in focus, driven by persistent inflation, escalating geopolitical risks, and an expectant market. The interplay between these forces makes gold’s trajectory complex but compelling. Investors and traders alike will watch gold’s behavior closely, particularly as macroeconomics and global politics unfold further.

Disclaimer:

TraderFactor or partners have prepared all the information. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not regard the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.