Building a diversified forex portfolio is crucial for any trader looking to manage risk effectively and enhance potential returns. Forex trading, often perceived as high-risk due to the volatility of currency pairs, can become a more stable and rewarding endeavour when approached strategically. Diversification is one of the best tools for managing these risks and maximizing profit potential. In this article, we’ll explore what diversification in forex means and how to apply it to build a robust portfolio.

Table of Contents

ToggleBuilding a Diversified Forex Portfolio: Overview

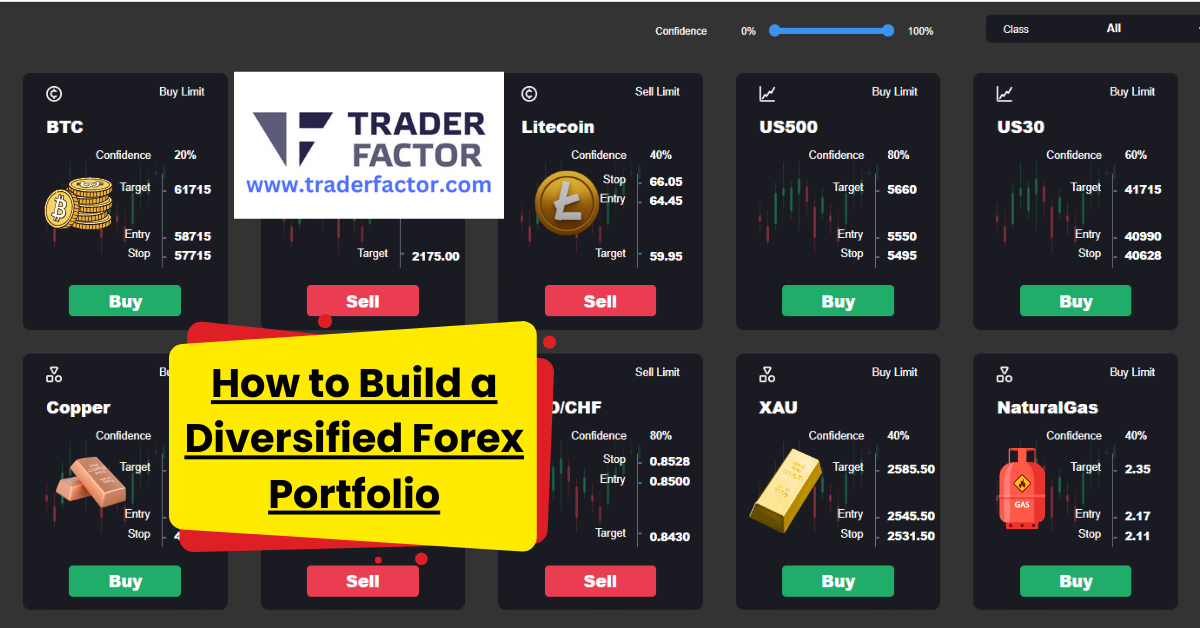

Building a diversified forex portfolio involves trading multiple currency pairs across various regions, which minimizes risk and maximizes potential returns. Utilizing a forex portfolio tracker and implementing effective forex portfolio management strategies are essential to monitor performance, adjust allocations, and ensure a balanced exposure to different economic conditions and market trends.

What is a Portfolio in Forex Trading?

Before diving into diversification strategies, it’s essential to understand what a portfolio is in forex trading. A forex portfolio consists of various currency pairs that a trader holds simultaneously to spread risk across different trades. Much like a stock portfolio, a forex portfolio aims to balance assets to maximize returns while mitigating risks. Instead of just one currency pair, you can hold a mix of pairs that respond differently to global economic events.

Tools and Resources

Managing a diversified forex portfolio requires the right tools and resources. Trading platforms such as MetaTrader 4(MT4) and MetaTrader 5 (MT5) offer advanced portfolio management features, including detailed analytics and automated risk management tools. You can also get more info on using these platforms to build and manage your forex portfolio.

Why Diversify Your Forex Portfolio?

Diversification is the practice of holding a range of different investments to reduce overall risk. In the context of forex portfolio management, diversification involves investing in various currency pairs with differing risk profiles. The primary reasons for diversifying your portfolio include:

Forex trading involves high volatility, and putting all your capital into one or two currency pairs can be incredibly risky. If the market moves against you, you could suffer substantial losses. By spreading your investments across several currency pairs, you reduce the impact of each currency pair’s performance on your overall portfolio.

Diversification also enhances your return potential. Currencies from different regions can respond differently to economic data, geopolitical events, and central bank policies. Exposure to a range of currencies allows you to capture profit opportunities from various global trends.

Political events, such as elections, trade deals, and changes in government policies, often influence currencies. Holding a diversified forex portfolio can help you weather economic or political shocks in one region by balancing it with positions in other less affected areas.

Key Strategies for Building a Diversified Forex Portfolio

When building a diversified forex portfolio, it’s essential to balance different types of currency pairs:

- Major Pairs include pairs like EUR/USD, USD/JPY, and GBP/USD. They offer high liquidity and typically lower volatility, making them less risky.

- Minor Pairs: Examples include EUR/GBP and AUD/NZD. These tend to be more volatile than majors, with higher risk and reward potential.

- Exotic Pairs are pairs like USD/TRY (Turkish Lira) or EUR/ZAR (South African Rand). While they can offer significant profit opportunities, they are much riskier due to lower liquidity and higher volatility.

The key is to balance your portfolio with a mix of major, minor, and exotic pairs to gain exposure to different markets while managing risk levels.

Balancing Long and Short Positions

To diversify further, it’s crucial to balance your long and short positions. A long position means you expect the base currency in a pair to appreciate, while a short position anticipates a decline. Having both types of positions in your portfolio helps you hedge against market fluctuations.

Diversifying Across Geographic Regions

Regional allocation is another core component of diversification. It is essential to include currency pairs from different parts of the world, such as North America, Europe, Asia, and emerging markets. Geographic diversification helps because regions may experience growth or recession cycles at different times. For instance, when Europe is undergoing an economic downturn, Asian markets might be booming, and currency pairs like AUD/JPY could offer stability.

Using Fundamental and Technical Analysis

A well-diversified forex portfolio is not just about holding a range of currency pairs; it’s also about making informed decisions. Fundamental analysis involves looking at economic indicators like GDP, interest rates, inflation, and political stability to predict the direction of a currency. Technical analysis, on the other hand, focuses on price charts, trends, and technical indicators like moving averages and RSI to forecast price movements. Both approaches allow for better-informed portfolio management and help decide when to enter or exit trades.

Frequently Asked Questions (FAQs)

How to diversify a forex portfolio?

To diversify a forex portfolio, consider trading multiple currency pairs across different economic regions. Use a forex portfolio tracker to monitor and balance your exposure effectively.

How do you structure a diversified portfolio?

A diversified portfolio should include a mix of asset classes like currencies, stocks, and commodities, tailored to your risk tolerance and investment goals. Implementing forex portfolio management strategies can help maintain balance and optimize returns.

How do you build a well-diversified portfolio?

To build a well-diversified portfolio, invest in a variety of asset types and sectors, balancing risk and reward. Leverage tools like a forex portfolio tracker to ensure diverse exposure and manage potential risks.

How many stocks are needed for a diversified portfolio?

Generally, owning between 15 to 25 stocks across various industries can help achieve diversification in an equities portfolio. This approach reduces unsystematic risk while optimizing potential returns.

How many stocks should I own?

The number of stocks you should own depends on your investment strategy and risk appetite, but typically 15 to 25 stocks can provide adequate diversification. Consider integrating forex portfolio management techniques to further enhance your investment strategy.

Conclusion

Building a diversified forex portfolio is a smart strategy for managing risk and enhancing return potential in the volatile world of currency trading. By selecting a mix of currency pairs, balancing long and short positions, and applying sound risk management practices, you can create a portfolio that maximizes opportunities while protecting against market downturns. Keep refining your strategy and stay updated with the latest economic and political developments to ensure long-term success in forex trading.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.