The trading community is holding its breath in anticipation of the upcoming Non-farm Payrolls (NFP) data, with significant implications for currency and commodity markets.

Table of Contents

ToggleEUR/USD Rally Fueled by USD Weakness Ahead of NFP Data

After reaching a seven-week high above 1.0950, the EUR/USD has entered a consolidation phase beneath the peak as the market shifts its gaze towards the US labor data. Despite the European Central Bank (ECB) maintaining key rates and showcasing a downward revision in growth and inflation forecasts for 2024, the Euro struggled for momentum during ECB President Christine Lagarde’s address to the press.

However, weaker USD sentiment later in the day saw another surge in the EUR/USD pair. All eyes are now on February’s US jobs report, which could potentially send the pair climbing further if the NFP underwhelms.

Forex Analysis

In the forex domain, the EUR/USD has shown a bullish posture that could potentially seek levels at 1.0970 and 1.0990 intraday, provided the NFP data supports the prevailing sentiment. A deviation from forecasts could cause fluctuations, leading traders to potentially capitalize on these moves.

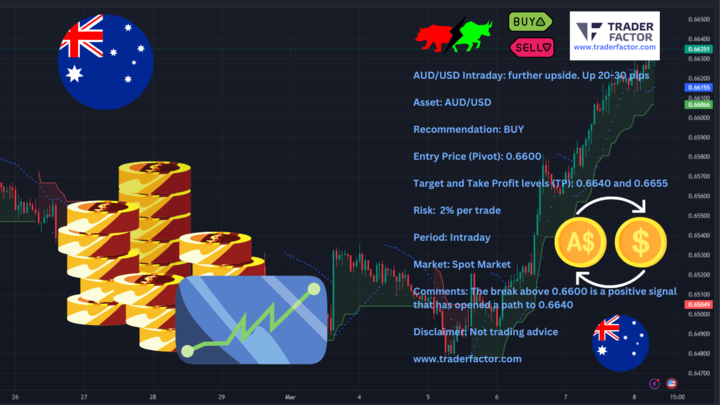

Similarly, the AUD/USD pair projects an uptrend prospect after breaking through the 0.6600 threshold, while the GBP/USD retains its strength near a multi-month peak, propelled by a weakened dollar and positive risk appetite.

Conversely, the USD/JPY has dipped to 147.00 propelled by rising rate hike bets from the Bank of Japan (BoJ) and soft US Dollar activity ahead of the NFP release.

In North America, the USD/CAD treads lower as market players anticipate employment reports from both the US and Canada; however, a hawkish Bank of Canada (BoC) stance captures trader attention.

Commodity Markets Await Employment Data

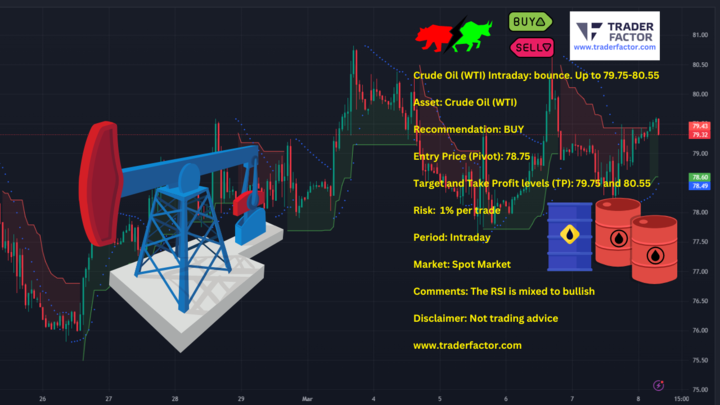

The oil sector sees a recovery in West Texas Intermediate (WTI) which hovers around $78.80, benefiting from a softer US Dollar and anticipated Fed rate cuts this year. The day’s trade could witness a rebound in crude oil, with technical indicators favoring bullish sentiment.

The precious metals market remains attentive as Gold continues its rally beyond $2,160, capturing the imagination of investors with a fresh all-time high in sight. The subdued yield on the benchmark 10-year US Treasury bond, lingering below 4.1%, complements the upward trajectory of XAU/USD.

Today marks a pivotal moment for traders across various markets, with US labor market data being the linchpin capable of catalyzing substantial market reactions. Whether the news will bolster the current bullish sentiment or lead to a course correction remains to be seen as the countdown to the release of the NFP report continues. Keep a close watch and position yourself wisely in the volatile trading environment.

So what does this mean for traders? It means that there are ample opportunities to make profitable trades, but also a need to exercise caution and proper risk management. As always, it is important to stay informed about market news and data releases, as they can have a significant impact on currency and commodity prices.

Moreover, it is important to have a solid understanding of technical analysis and utilize key indicators to make informed trading decisions. Keeping an eye on market sentiment and staying updated on economic developments can also provide valuable insights for traders.

In such a dynamic and ever-changing market environment, it is crucial for traders to stay adaptable and agile, able to adjust their strategies as market conditions evolve. By staying disciplined and informed, traders can navigate the markets with confidence and potentially capitalize on profitable opportunities as they arise.

The upcoming NFP data has the potential to drive significant movements in various currency and commodity markets. Traders should remain vigilant and stay informed as they prepare for potential trading opportunities around this highly anticipated event.

Top Forex Brokers for 2024

When you’re ready to venture into Forex trading, finding the right broker is crucial for your success in 2024. A broker comparison is handy to identify the best one that suits your needs. Look for trading platforms that are user-friendly, have fast execution speeds, and offer a variety of trading tools.

Consider the account types brokers offer. Some might cater better to beginners with micro or mini accounts, while others might suit experienced traders with standard or VIP accounts. Decide based on your trading style, risk tolerance, and investment size.

Regulation standards are critical. Ensure reliable authorities like the FCA, ASIC, or CySEC regulate your broker. This provides security for your funds and peace of mind.

Here are some recommended multiregulated forex brokers:

- OneRoyal: Known for its social trading platform, OneRoyal offers many educational resources and a convenient demo account for practice.

- IronFx: This broker provides a simple platform and a risk management tool, helping you better control your trading risks.

- Admirals: Admirals stands out with exceptional customer support and a wide range of educational resources.

- ActivTrades: Offers a user-friendly platform, extensive educational resources, and versatile demo accounts.

- EightCap: EightCap wraps it up with an intuitive platform, top-notch educational materials, and an effective customer support team.

Lastly, never underestimate the power of good customer support. Forex markets operate 24/5, so ensure your broker offers round-the-clock support, ideally through multiple channels like live chat, email, or phone.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.