You’ve likely come across various trading platforms in your search for a reliable financial partner, but MultiBank Group stands out with its extensive offerings and regulatory rigor. Since its inception in 2005, it’s been lauded for stringent compliance and client protection mechanisms. Utilizing platforms like MT4, MT5, and its unique MultiBank-Plus, it caters to your diverse trading needs with an appealing fee structure and no withdrawal fees.

This might sound promising, but have you wondered how these features actually stack up against the competition and what real users think? Let’s explore how MultiBank Group really holds up under scrutiny.

Table of Contents

ToggleCompany Profile

MultiBank Group, established in 2005, is a reputable global financial institution known for its robust regulatory framework and expansive market offerings. As you explore the competitive landscape, you’ll find that MultiBank has strategically positioned itself through technological innovations and a deep understanding of trading strategies. This adaptability has facilitated their market expansion, allowing them to serve a diverse client base worldwide.

Client testimonials often highlight the personalized trading strategies supported by MultiBank’s dynamic tools and resources. These testimonials not only reflect customer satisfaction but also underscore the effectiveness of MultiBank’s offerings in a competitive market. The company’s commitment to incorporating cutting-edge technology enhances your trading experience, ensuring you stay ahead in fast-moving markets.

Moreover, MultiBank’s continuous growth in new and emerging markets demonstrates their ability to adapt to various regulatory environments and client needs. This isn’t just about expanding their geographic footprint; it’s about refining the services and tools you rely on for trading success.

Whether you’re a beginner or a seasoned trader, MultiBank provides a robust platform where your trading strategies can thrive amidst the global competitive landscape.

Trading Platforms

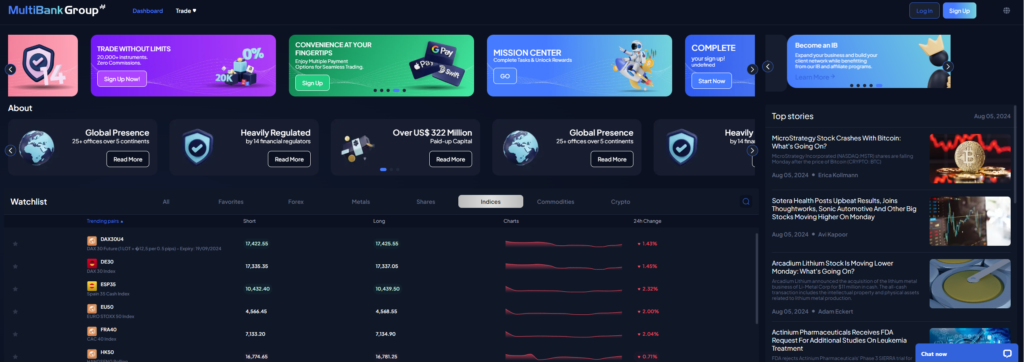

Offering a choice between popular third-party platforms like MT4 and MT5, as well as their proprietary MultiBank-Plus, you’ll find the right tools to suit your trading style. Each platform boasts unique features that enhance your trading experience, whether you’re a novice or a seasoned trader.

MT4 and MT5 are renowned for their robust platform features, including advanced charting tools and a plethora of technical indicators. These platforms offer exceptional user experience with customizable interfaces, allowing you to tailor the layout to your preferences. Platform compatibility is another strong point, with both platforms running smoothly on desktop, web, and mobile versions.

MultiBank-Plus, on the other hand, differentiates itself with exclusive trading tools and enhanced platform security. It integrates cutting-edge technology to protect your trading activities, guaranteeing that your data and transactions are secure from unauthorized access. Furthermore, the platform is designed to optimize your trading speed and efficiency, which is vital in the fast-paced trading environment.

Regardless of your choice, MultiBank Group has guaranteed that all platforms are equipped with the necessary tools and security measures to facilitate a reliable and safe trading environment.

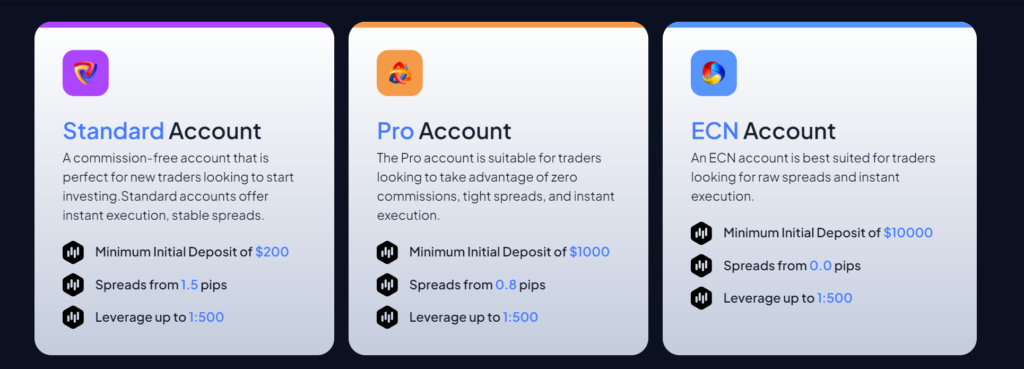

MultiBank Group Account Types

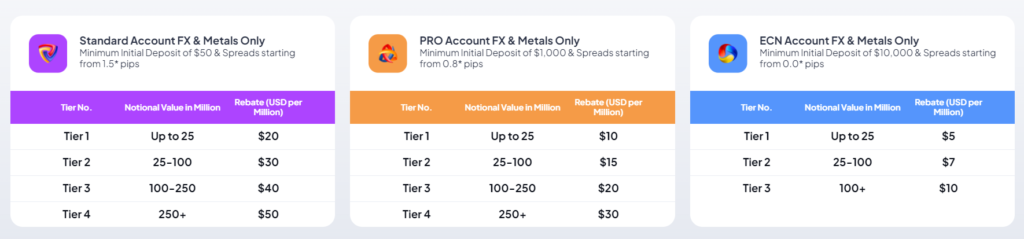

You’ll find that MultiBank Group provides three distinct account types designed to meet various trading needs and experience levels. Each account comes with unique features and trading conditions that enhance your trading strategy and market access. Whether you’re a beginner or an experienced trader, there’s something here for you.

The Standard account is great if you’re just getting started. It offers basic account features and straightforward account management tools, making it easier for you to navigate the trading world. You’ll enjoy direct market access with minimal complexity, ideal for learning the ropes without overwhelming details.

For more seasoned traders, the Pro account steps up the game with more advanced client benefits and trading conditions. This account type provides access to deeper liquidity and faster execution speeds, which are essential for taking advantage of market movements.

Lastly, the ECN account is tailored for high-volume traders who need the best possible trading conditions. With this account, you get the lowest spreads and commissions, ensuring that you maximize your trading efficiency. Account management is streamlined and more robust, allowing for a more sophisticated approach to market access and risk management.

Choose wisely to match your trading style and growth aspirations!

Fee Structure

Understanding MultiBank Group’s fee structure is vital for managing your trading costs effectively. Let’s explore how this impacts your trading experience. To start, MultiBank’s commission rates are quite competitive, particularly in forex trading where you’re looking at a commission of just $3.00 per lot per trade. This fee comparison with other brokers shows that MultiBank often ranks better, especially for active traders.

However, it’s not all about trading costs. You’ll also need to evaluate withdrawal fees and inactivity charges, which can sneak up on you if you’re not careful. MultiBank prides itself on having no withdrawal fees, which is a huge plus. But watch out for the inactivity charges. If your account is dormant for too long, you’ll face a monthly fee of $60. This is quite steep compared to some competitors, so keeping your account active is essential.

Regulatory Compliance

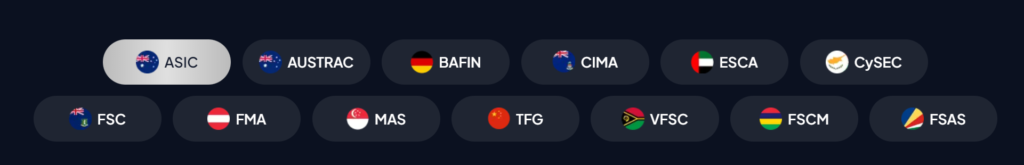

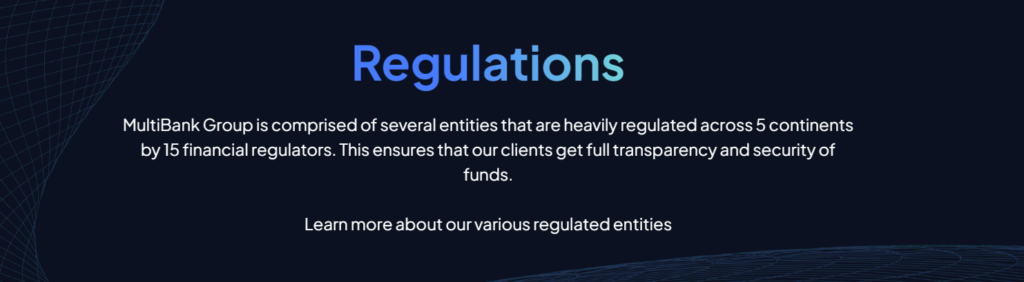

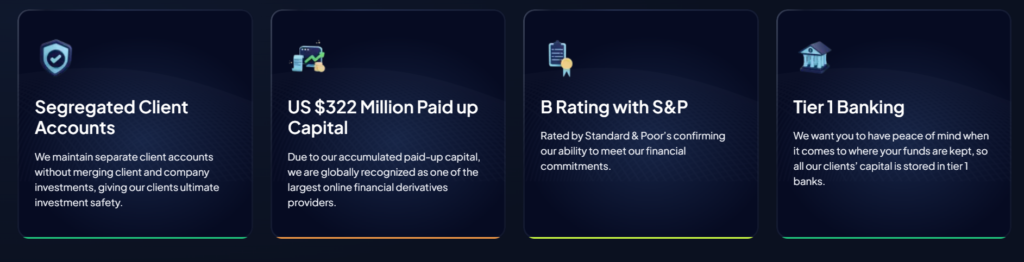

MultiBank Group strictly adheres to international regulatory standards to guarantee your investments are protected. Steering through the complex regulatory landscape, they ascertain compliance with the highest standards set by global regulatory authorities. This commitment not only enhances risk management but also maximizes client protection.

Here’s why you can trust MultiBank Group’s compliance framework:

- Global Regulatory Oversight: MultiBank is regulated by top-tier authorities including ASIC, MAS, and MiFID. These bodies enforce strict guidelines that MultiBank follows diligently.

- Robust Compliance Standards: They maintain a rigorous compliance protocol that includes regular audits, transparent reporting, and adherence to international financial laws.

- Advanced Risk Management Systems: By implementing cutting-edge risk management technologies and protocols, MultiBank ascertains that your capital is safeguarded against unforeseen market volatility.

You’re investing with a broker that places your security at the forefront. Their proactive approach in adapting to regulatory changes and their continual investment in technology to protect your interests sets them apart in the financial service industry. Rest assured, your investments are in compliant and capable hands with MultiBank Group.

Safety Measures

Guaranteeing your investments are secure, MultiBank implements multiple safety measures to safeguard against financial risks. You’ll find that their commitment to trading security and fraud prevention is evident through stringent risk management protocols and thorough insurance policies.

By focusing on client protection, MultiBank guarantees that your trading environment is not only secure but also resilient against unforeseen adversities. They’ve set up robust measures to detect and prevent any fraudulent activities, giving you peace of mind as you trade.

Here’s a quick overview of the key safety features at MultiBank:

| Safety Feature | Description |

| Risk Management | Advanced monitoring systems to manage and mitigate risks associated with market volatility. |

| Client Protection | Secure client data with high-level encryption and privacy protocols. |

| Insurance Policies | Coverage includes indemnity and excess loss insurance, securing clients against potential financial losses. |

| Fraud Prevention | Thorough checks and balances to detect and prevent fraudulent activities in real-time. |

These safety measures are tailored to protect you and guarantee that your trading experience is not just profitable but also completely secure. So, you can focus on your trading strategies, knowing that MultiBank has your back every step of the way.

Deposit and Withdrawal

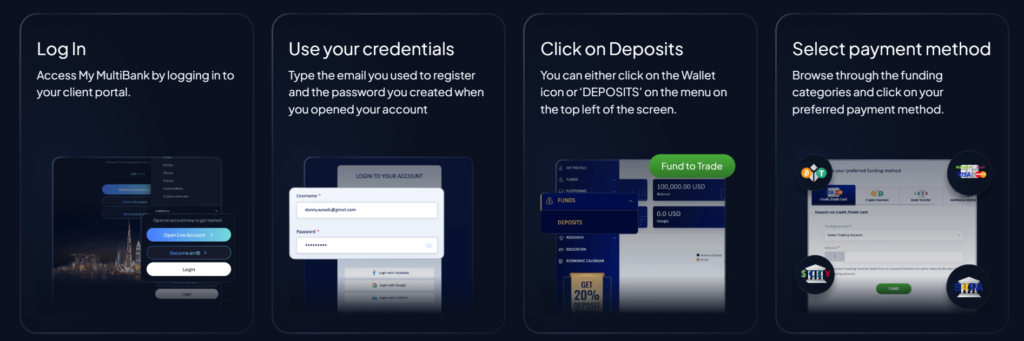

You’ll appreciate how seamless and flexible the deposit and withdrawal processes are at MultiBank. The platform guarantees that your financial transactions are handled with utmost efficiency and security. Here’s what you need to know:

- Diverse Deposit Methods:

- MultiBank supports a wide array of deposit methods including credit/debit cards, bank wire transfers, and even cryptocurrencies. This variety caters to your preference and convenience, making funding your account straightforward.

- Quick Withdrawal Processing:

- When it comes to accessing your funds, efficiency is key. MultiBank prides itself on fast withdrawal processing, typically within 24 to 48 hours. This quick turnaround is essential for maintaining liquidity and managing your investments effectively.

- Transparent Transaction Fees:

- You won’t be caught off guard by hidden fees. MultiBank is transparent about any transaction fees, which are competitive within the industry. This transparency helps in planning your financial strategies without unexpected costs.

Through these features, MultiBank not only prioritizes fund security but also enhances client experiences by making financial transactions as smooth as possible. Whether you’re depositing or withdrawing, you can trust that your assets are managed with care.

Educational Resources

After exploring the streamlined deposit and withdrawal processes, let’s focus on how MultiBank equips you with educational resources to enhance your trading skills. Whether you’re just starting out or looking to refine your strategies, MultiBank’s extensive educational suite offers a wealth of knowledge to help you navigate the complexities of trading.

Here’s a quick overview of what you can find:

| Type of Resource | Description |

| Beginner Tutorials | Step-by-step guides on trading basics |

| Educational Webinars | Live sessions on market analysis |

| Trading Strategies | Techniques for effective risk management |

You’ll find beginner tutorials particularly useful if you’re new to trading. These are designed to get you up to speed with the fundamentals, ensuring you understand how the markets operate. For more seasoned traders, the educational webinars provide deep insights into market trends and allow you to ask real-time questions from experienced market analysts.

Moreover, the section on trading strategies is indispensable. It covers everything from basic techniques to advanced risk management protocols. Whether you’re planning your first trade or looking to diversify your portfolio, these resources are tailored to help you make informed decisions and manage your investments wisely.

Customer Support

While trading can sometimes be complex, MultiBank’s customer support team is readily available to guide you through any challenges you encounter. This dedicated team guarantees that you’re never left in the dark, no matter your issue. Here’s what you can expect:

- Support Availability: Access customer service 24/7 via phone, email, or live chat. Whether it’s a weekday or weekend, help is always just a call or click away.

- Response Times: MultiBank prides itself on fast response times. Typically, emails are answered within a few hours, while live support responds almost instantly.

- Agent Professionalism: Expect highly professional service. Agents are not only responsive but also knowledgeable and courteous, making certain that your queries are handled with expertise.

Client feedback consistently praises MultiBank for its effective support system. Traders appreciate the swift and accurate assistance they receive, which greatly enhances their trading experience. Remember, a robust customer support system is essential in trading environments, as it directly affects your ability to manage and execute trades efficiently. With MultiBank, you’re covered on all fronts, guaranteeing a smoother and more confident trading journey.

Comparative Analysis

Let’s compare MultiBank’s offerings to those of other leading brokers in the industry to see how it stacks up. You’re probably keen on understanding how market trends influence the services provided. MultiBank, with its broad array of tradable markets and advanced platforms, aligns well with the latest technology advancements, offering you a competitive edge in your trading strategies.

Risk management is vital, and MultiBank guarantees robust measures are in place. Compare this to others who may not provide as thorough insurance or negative balance protection. Let’s dive deeper with a table that outlines some key differences:

| Feature | MultiBank | Other Brokers |

| Trading Platforms | MT4, MT5, MultiBank-Plus | Often limited to one option |

| Market Trends Coverage | Extensive with 20,000+ instruments | Typically narrower |

| Risk Management | Insurance, balance protection | Varies, often less extensive |

| Technology | Latest upgrades, fast execution | May lag in updates |

| Client Testimonials | Strong positive feedback | Mixed reviews |

From this comparison, you can see that MultiBank seems to offer a more robust package, particularly when it comes to technology and risk management, which are essential for staying ahead in rapidly changing markets.

Frequently Asked Questions

Can I Trade Cryptocurrencies on Weekends With Multibank?

Yes, you can trade cryptocurrencies on weekends with MultiBank. They offer weekend trading, providing market accessibility with competitive trading fees and various platform features tailored to enhance your cryptocurrency trading options.

Are There Any Loyalty Programs or Rebates for Frequent Traders?

Yes, there are loyalty programs and rebates for frequent traders.

You’ll find various trader incentives, including a structured rebate system, enhancing rewards based on your trading frequency and program eligibility.

Does Multibank Offer Any Partnership or Affiliate Programs?

Yes, you can benefit from MultiBank’s partnership and affiliate programs here, which offer a competitive commission structure, extensive marketing strategies, and attractive revenue sharing. Confirm you meet the affiliate requirements to maximize partnership benefits.

How Does Multibank Handle Slippage During High Volatility?

When trading during high volatility, you’ll notice slippage impacts your trades. Effective volatility management and adapted trading strategies help mitigate risks, ensuring you respond efficiently to market reactions. Always assess risks thoroughly.

Are There Tools for Tax Reporting and Management Available?

You’re seeking tools for tax reporting and management. While specific platforms offer reporting tools for tax compliance and financial documentation, it is crucial to verify if these features meet your individual or business needs.

Conclusion

As you investigate your trading options, MultiBank Group stands out with its extensive offerings. You’ll find the platforms like MT4 and MultiBank-Plus both versatile and user-friendly. Whether you’re starting out or scaling up, the varied account types and competitive fees cater to all. Plus, their commitment to regulatory compliance and robust client protection guarantees a secure trading environment. Immerse yourself in their rich educational resources and enjoy reliable customer support. Comparatively, MultiBank Group is a top contender in the trading world.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.