Tesla has released its second-quarter 2025 earnings, presenting mixed financial outcomes. The automotive leader reported revenue of $22.50 billion, falling short of the projected $22.74 billion. Adjusted earnings per share came in at $0.40, missing analysts’ expectations of $0.43. Tesla’s net income also declined 16% compared to the prior year. This performance raises questions about the company’s growth trajectory amid industry challenges, including fluctuating demand and evolving competition. Analysts are closely watching Tesla’s strategy, which includes plans for more affordable vehicles and expansion into autonomous driving technology. .

Table of Contents

ToggleTesla Inc. Stock Drops

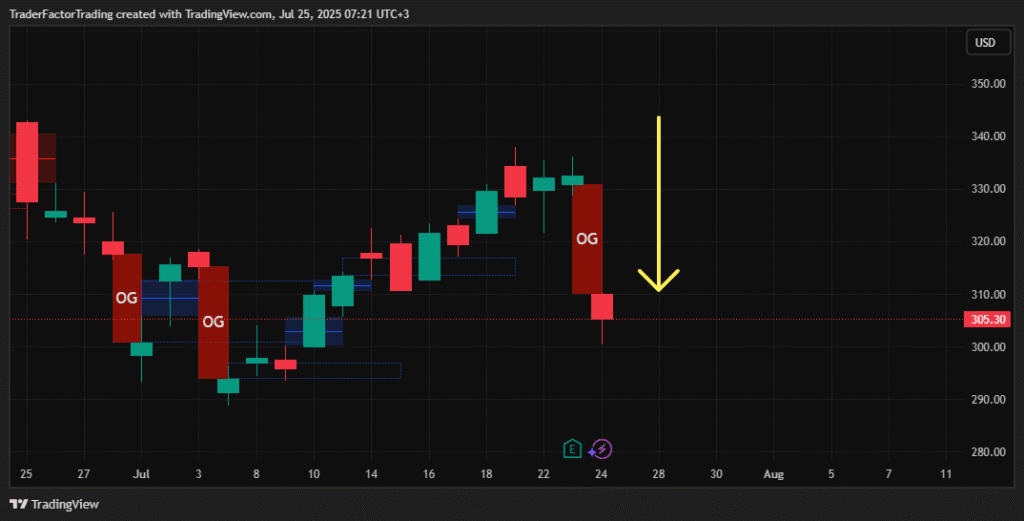

Tesla’s stock (NASDAQ: TSLA) experienced notable volatility following the Q2 2025 earnings release. After the revenue and earnings miss, the share price dipped by over 4% in after-hours trading. Throughout the quarter, trading volumes remained elevated, indicating active participation from both institutional and retail investors. Technical indicators show that Tesla’s stock has been fluctuating within a defined range, reacting to macroeconomic news and sector developments. Market sentiment, while generally supportive of Tesla’s innovation pipeline, has become cautious amid mounting competition and narrower profit margins. Analysts are watching for a potential breakout or further correction depending on the company’s next steps.

Revenue and Profit Analysis

Tesla’s revenue for Q2 2025 dropped to $22.50 billion, down from the $25.05 billion reported in the same quarter of 2024. This represents a 12% year-over-year decline. The shortfall was attributed to weaker sales volume and pricing adjustments aimed at boosting consumer demand. Net income also took a hit, falling by 16%, signaling reduced profitability in a competitive electric vehicle market. Analysts are now examining Tesla’s cash flow and operational efficiencies. The company’s ability to maintain growth despite declining profits remains a key focus in the coming quarters.

Adjusted Earnings Per Share (EPS)

Tesla’s adjusted EPS of $0.40 was below Wall Street’s forecast of $0.43. This miss highlights challenges in balancing operational costs with consumer-focused initiatives. Higher expenditures on research, development, and infrastructure weighed on the company’s profit margins. Industry watchers are now questioning whether Tesla can sustain long-term profitability while scaling autonomous driving systems and battery innovations. Investors were cautious following the release, leading to a 4% dip in Tesla’s stock during after-hours trading.

Implications for Market Competition

Tesla’s financial performance comes amid increasing competition in the EV sector. Rivals are scaling production of affordable electric models, targeting Tesla’s core customer base. This competitive pressure has forced Tesla to rethink pricing strategies to protect its market share. The firm has also emphasized plans to launch a more affordable vehicle model in 2025. Analysts believe these decisions could help improve Tesla’s market positioning, though the short-term impact on revenues remains uncertain.

Strategic Initiatives and Challenges

Tesla continues to invest heavily in future technologies. The company’s focus on autonomous driving systems and energy innovations underscores its long-term vision. However, challenges remain in delivering these projects while staying competitive. Tesla’s rising R&D expenses and capital investments may restrict profitability in the short-term but are seen as essential for sustained growth. Additionally, Elon Musk highlighted plans for future robotaxi integration, which could bring new revenue streams. Stakeholders are keeping a close watch on how these bold moves unfold.

Broader Financial Strategies

The second quarter also highlighted Tesla’s diversified financial approach. Bitcoin holdings surged 30% in value, reaching $1.2 billion, providing a cash reserve cushion. This cryptocurrency strategy continues to prove lucrative, though its volatility adds risk. Balancing core automotive operations with ancillary financial strategies will be pivotal for Tesla’s performance. Analysts underscore the need for Tesla to focus on improving the operational efficiency of its vehicle production to strengthen its bottom line.

Industry Outlook

Tesla faces varying industry headwinds, including tightening regulations, consumer demand shifts, and raw material costs. Despite the revenue shortfall, the company remains at the forefront of electric innovation. Investors and analysts alike await Tesla’s roadmap execution for growth into newer, more cost-efficient models. The upcoming months will be critical for the company’s reputation in maintaining market leadership under growing scrutiny from competitors and stakeholders.

Conclusion

Tesla’s Q2 2025 earnings reveal a mixed financial picture with declining revenue and profits. The company’s strategic investments in innovation and affordability are noteworthy but risky. While the competitive landscape becomes increasingly challenging, Tesla’s long-term commitment to progress could reshape its trajectory. Investors remain cautiously optimistic as Tesla navigates these complexities to sustain its market dominance.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.