Thursday’s trading session closed with the Dow and Nasdaq Composite each up 0.6%, marking the first impressive streak for the Nasdaq since July, thanks to investors snatching up bargain on tech stocks in light of December’s softer consumer price report.

To close out what looks to be a strong week for stocks, financial heavyweights JPMorgan, Bank of America, Citigroup and Wells Fargo will report their quarterly earnings tomorrow.

After the consumer price data for December revealed a decrease in inflation for the month, stocks increased Thursday, fueling hopes that the Federal Reserve will once more be able to hold off on interest rate increases.

To close at 34,189.97, the Dow Jones Industrial Average rose 216.96 points or 0.64%. The S&P 500 finished up 0.34% at 3,983.17.

The Nasdaq Composite recorded a five-day winning run as it closed up 0.64% at 11,001.10. The technology-heavy index has not experienced a surge of that duration since July.

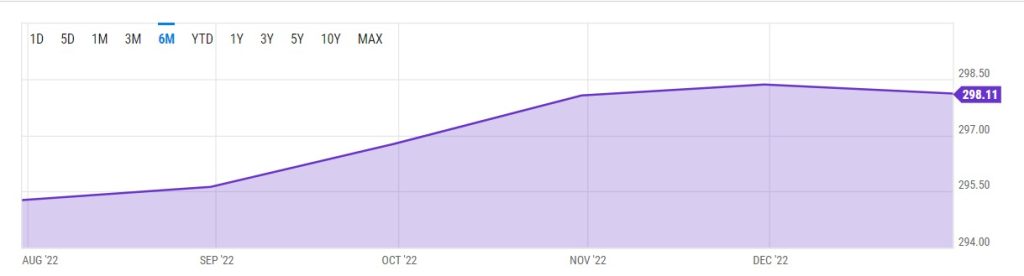

Nasdaq Composite 5D

The Nasdaq is on track for the three indexes’ largest weekly gain, rising 4.1% so far as speculators purchased undervalued growth stocks in advance of the CPI report. The S&P 500 and Dow are also expected to gain by about 2.3% and 1.7%, respectively, each week.

Table of Contents

ToggleSofter US CPI Data

The CPI report for December indicated a 0.1% decrease in prices from November, although prices were 6.5% higher than they had been the year before. That matches what economists surveyed by Dow Jones anticipated. The data for November indicated a 0.1% monthly increase and a 7.1% yearly rate.

The CPI that excludes the cost of food and energy increased by 0.3% from one month to the next, which was also in line with forecasts. Compared to December last year, the supposedly “core” indicator increased by 5.7%.

The US Consumer Price Index is currently at 298.11, up from 280.13 one year ago and down from 298.35 last month. The difference from the previous month and one year ago is -0.08% and 6.42%, respectively.

Investors bet that the CPI report would confirm a pattern of declining inflation, and stocks have risen recently. In recent months, investors have been keeping an eye out for data indicating a decline in inflation in the hopes that it will provide the Fed with rationale for future gradual interest rate hikes.

In an interview with the New York Times on Wednesday, Boston Fed President Susan Collins said that she is leaning toward a smaller, quarter-point rate hike at the next meeting. On Friday, investors will analyze Collins’ and two other top Fed officials’ scheduled statements.

How Inflation, Interest Rates Affect Stocks

The amount of inflation is a measurement of how much prices have risen over the past year. Central banks are likely to adopt specific actions to guide inflation toward their target if the number is high, as it has been during the past year. The Federal Reserve currently targets an increase in inflation of 2% from one year to the next.

The Fed will raise interest rates and has done so when inflation is as high as it has been. Due to this measure, borrowing money will now be significantly more expensive.

Businesses are being encouraged to take fewer financial risks and conserve money because interest rates have been at their highest levels since the 2008 financial crisis. Even though it may not be perfect for everyone, if things go according to plan, there will almost certainly be a recession, which might result in thousands of individuals losing their jobs.

The inflation report often has little impact on stock markets, but it occasionally does since slower economic growth may result from higher interest rates. a consequence of fewer consumer spending and lower earnings for businesses. Stock values decline as a result of investors selling because they fear receiving lesser returns on their assets.

US Weekly Jobless Claims Edge Down

In November, there were 1.7 jobs for every unemployed individual. Initial claims for state unemployment benefits decreased by 1,000 to a seasonally adjusted 205,000 for the week ending January 7, according to a separate Labor Department report released on Thursday.

Economists anticipated close to 215,000 claims for the most recent week. The difficulty in correcting the data for seasonal swings at the beginning of the year can be partially blamed for the unexpected decline in claims. Despite high-profile layoffs in the IT sector and job cuts in interest rate-sensitive industries like banking and real estate, claims have remained low.

According to economists, businesses are currently hesitant to send employees home because of the difficulty in filling jobs during the epidemic. However, they anticipate an increase in claims in the second half of the year as higher borrowing prices stifle demand and cause the economy to enter a recession.

The claims data also revealed that, in the week ending December 31, the number of people getting benefits following a first week of aid—a proxy for hiring—fell by 63,000 to 1.634 million.

In December, the economy added 223,000 jobs, more than double the 100,000 that economists believe the Fed wants to see in order to be satisfied that inflation is slowing down, according to government data released last week. In 2022, 4.5 million new jobs were created.

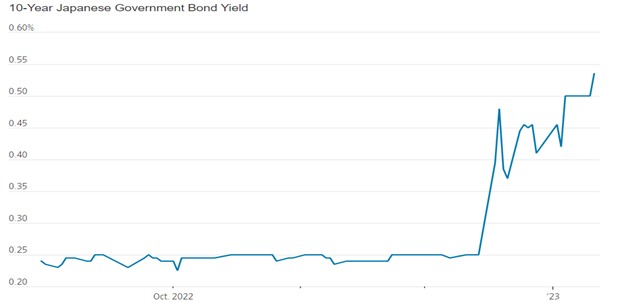

Japanese Bond Yields Surge

On Friday, markets raised pressure on the central bank to further modify a key tenet of its ultra-loose monetary policy as long-term Japanese government bond yields and the yen rose sharply.

According to analysts, the abrupt movements highlighted the market for Japanese government bonds’ growing dysfunction over the past month and increased anxiety before the policy board meeting of the Bank of Japan next week.

Last month, the central bank altered its long-standing yield curve management policies in an effort to bring order back to the Japanese government bond market, which had become chaotic as a result of the BoJ’s asset-buying program.

Instead, the YCC adjustment, which increased the range in which the bonds might move, has increased volatility recently, forcing the BoJ to further alter its policy.

After the market opened in Tokyo on Friday, the 10-year bond yield momentarily surpassed 0.53 percent, breaking the BoJ’s new 0.50 percent cap and reaching its highest level since June 2015. The yen’s value against the US dollar reached 128.66, its highest level in almost seven months.

In place of the prior range of 0.25 percentage points, the BoJ announced in December that it would henceforth permit 10-year bond rates to move by a maximum of 0.5 percentage points above or below its aim of zero. It maintained overnight interest rates at -0.1%.

Since then, the assertion made by Kuroda that the central bank was not tightening its monetary policy has come under fire from the markets, leading the Bank of Japan to spend tens of trillions of yen on impromptu purchases of government bonds in order to stem a rise in yields.

Q4 2022 Earnings: What to Expect

US banks will kick off the fourth quarter earnings season as usual on Friday, January 13, when we will have results from JPMorgan, Bank of America, Wells Fargo, Citigroup, and the Bank of NY Mellon. That will be followed by updates from Morgan Stanley and Goldman Sachs on Tuesday, January 17.

The interest rate environment remains favorable after the Federal Reserve said it will continue to raise rates and signaled it won’t start to come down until 2024. The latest nonfarm payrolls report out last week showed more additions than anticipated, fuelling fears of a more hawkish Fed as the central bank has said it needs employment to cool down to lower inflation.

However, there were some bright spots considering wage growth eased, and the services sector softened after the ISM Non-Manufacturing PMI for December contracted for the first time since May 2020.

Markets are hoping that the combination of lower wage growth and a contracting services sector will allow the Fed to slow its pace of interest rate increases to 25bps (or less) next month.

The result is expected to be a sharp drop in adjusted earnings in the fourth quarter. All major US banks are set to underperform the wider market, with the S&P 500 as a whole forecast to see earnings slide some 4.1% this quarter. Notably, only the Bank of NY Mellon is expected to grow its bottom line this season.

Read the following in the Forex Education Section

- Beginners Guides and Tips For Forex Trading

- Read A Beginners Guide To Forex Trading

- Mistakes Most Beginner Forex Traders Make and How To Avoid Them

- A 2023 Beginners Guide To Buying And Selling Currencies

- Can You Make Money Trading Forex In 2022 and 2023: Here Are The Facts

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.