The EUR/USD pair is currently trading below the 1.0600 level, reflecting a market that is evidently risk-averse amidst disappointing US consumer confidence data and looming fears of a possible recession. The single European currency has been under pressure, remaining in a tight range for several days.

Table of Contents

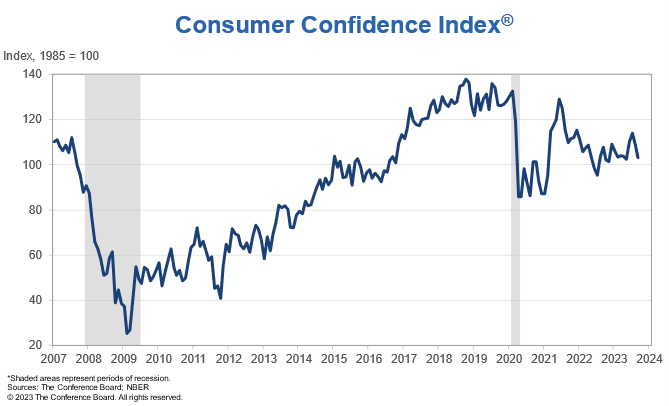

ToggleUS Consumer Confidence Dips in September Amid Recession Fears

US consumer confidence took another hit in September with consumers expressing concerns about rising prices, political instability, and higher interest rates. The Expectations Index declined to 73.7 this month, down from 83.3 in August, according to a report released by the Consumer Confidence Board.

| Indicator | September | August | Remarks |

|---|---|---|---|

| Expectations Index | 73.7 | 83.3 | Declined due to concerns about rising prices, political instability, and higher interest rates |

| Business Conditions (“Good”) | 20.9% | 21.5% | Decreased |

| Business Conditions (“Bad”) | 16.4% | 17.3% | Decreased |

| Future Business Conditions (Improvement Expected) | 40.9% | N/A | N/A |

| Future Business Conditions (Worsening Expected) | 9.8% | N/A | N/A |

| Jobs (“Hard to Get”) | 13.6% | 13.2% | Increased |

| Future Job Availability (Increase Expected) | 15.5% | 17.5% | Decreased |

| Future Job Availability (Decrease Expected) | 18.9% | 18.0% | Increased |

| Income Expectations (Increase Expected) | 16.3% | 18.7% | Decreased |

| Income Expectations (Decrease Expected) | 14.4% | 11.9% | Increased |

| Recession Likelihood | Increased | N/A | Fears of recession have resurfaced |

| Purchasing Plans (Autos) | Flat | N/A | Remained at an elevated level |

| Purchasing Plans (Appliances) | Upward Trend | N/A | Continued to trend upward |

| Purchasing Plans (Homes) | Downward Trend | N/A | Continued to show a downward trend |

In terms of business conditions, only 20.9% of consumers believe they are “good”, a decrease from the 21.5% recorded in August. Simultaneously, those who stated the conditions were “bad” also fell to 16.4% from 17.3%. Looking ahead, 40.9% of consumers expect business conditions to improve over the next six months, while 9.8% anticipate a worsening scenario.

The job market outlook was mixed. There was a slight increase in consumers who said that jobs were “hard to get,” up to 13.6% from 13.2% last month. Conversely, those expecting more jobs to be available in the future decreased to 15.5%, down from 17.5% in August. Meanwhile, 18.9% anticipate fewer jobs, a slight increase from the previous 18.0%.

Income expectations have also taken a hit. The percentage of consumers expecting an increase in their incomes dropped to 16.3% from 18.7% in August. At the same time, those foreseeing a decrease in income rose to 14.4%, up from 11.9% a month ago.

Fears of an impending recession have resurfaced with a higher proportion of consumers stating a recession is ‘somewhat’ or ‘very likely’ in September. This sentiment has been reflected in their purchasing plans. Plans to purchase autos remained flat but at an elevated level, while plans for appliance purchases continued to trend upward. However, plans to buy homes continued to show a downward trend.

Despite these concerns, assessments of the present situation were little changed overall. Fewer consumers said that business conditions were good, but fewer also said they were bad. Similarly, slightly more consumers said that jobs were “plentiful,” but also slightly more said that jobs were “hard to get.”

The decline in consumer confidence is a significant indicator of the country’s economic health, reflecting consumers’ short-term outlook on income, business, and labor market conditions. Policymakers, economists, and businesses closely monitor these trends as they can indicate potential shifts in the economy.

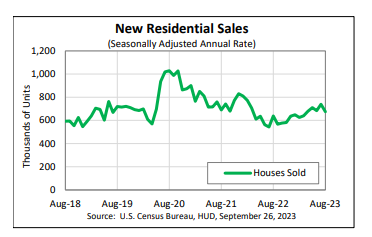

U.S. New Residential Sales Decline in August 2023, But Year-Over-Year Increase Noted

Sales of new single-family houses in the United States saw a dip in August 2023, falling by 8.7 percent from the revised July rate of 739,000 to a seasonally adjusted annual rate of 675,000. This data was released today in a joint statement by the U.S. Census Bureau and the Department of Housing and Urban Development.

Despite the month-over-month decline, the August figure is 5.8 percent higher than the estimate for the same period in the previous year, which stood at 638,000. This indicates a positive year-over-year trend.

The median sales price of new houses sold in August 2023 came in at $430,300, while the average sales price was significantly higher, at $514,000. These figures reflect the current market conditions, which are characterized by high demand and limited supply.

As for inventory, the seasonally adjusted estimate of new houses for sale at the end of August was 436,000. This represents a supply of 7.8 months at the current sales rate, indicating that the market has more than half a year’s worth of supply at the current pace of sales.

While the monthly decline might cause some concern, the year-over-year increase suggests an overall positive trend in the new residential sales market. However, market watchers will keep an eye on these trends as they evolve in the coming months.

| Month | Seasonally Adjusted Annual Rate | % Change from Previous Month | % Change from Previous Year | Median Sales Price | Average Sales Price | New Houses for Sale |

|---|---|---|---|---|---|---|

| July 2023 | 739,000 | – | – | – | – | – |

| August 2023 | 675,000 | -8.7% | +5.8% | $430,300 | $514,000 | 436,000 |

Note: The percentage changes are based on the seasonally adjusted annual rate of new single-family house sales. The median and average sales prices reflect the prices of new houses sold in August 2023. The number of new houses for sale is the seasonally adjusted estimate at the end of August 2023. This represents a supply of 7.8 months at the current sales rate. The next data release is scheduled for October 25, 2023.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.