As the Federal Reserve plans to increase interest rates by 75 basis points this week, bringing them to 3.25%, all eyes will be on them this week. The most recent CPI data showed that hot inflation remained, which may oblige the Fed to increase interest rates more quickly.

The market would be shocked and the USD would probably move strongly if the Fed increases rates by more than 75bps. Ahead of the FOMC meeting on Monday, for the Nasdaq today open, Dow futures, and S&P 500 all fell sharply.

This week, the BoJ will release its statement on monetary policy, which may include a discussion of planned interventions. Recently, the JPY has recovered and displayed strength against weaker currencies in shorter time frames. If the BoJ discusses intervention and the risk-off sentiment persists, this strength might continue.

The Swiss National Bank is expected to increase rates once more by 75 basis points to 0.5%. Since 2011, the bank hasn’t had any negative interest rates after this. Since the most recent hike, the Swiss Franc has been strong, and this trend will probably continue after this announcement.

This week, the Bank of England plans to raise interest rates by 50 basis points. As the central bank attempts to combat the rate of global stock market inflation, rates will rise to 2.25% as a result. A little reaction followed the GBPUSD price decline to a 40-year low, which may portend that lower lows are still to come.

USD Index Analysis

In the 4hr time frame, the price of the USD Index is currently within a short-term trading range. The price fluctuates between 109.28 and 110.26. Until the rate announcement this week, the USD may trade in a range. The USD Index may break recent highs of 110.80 and possibly retest the September 2001 lows at 111.31 if the USD responds strongly to the news.

EURUSD Analysis

If the USD Index is in a range, then the EURUSD price is going to highlight the same. The weekly volume profiles show a gap resting above the CPI data around 1.0060 to 1.0100. If the price breaks out of its current trading range, there could be a move higher toward this gap. If the USD remains strong then a break lower is more likely and the lows could be tested at 0.9863.

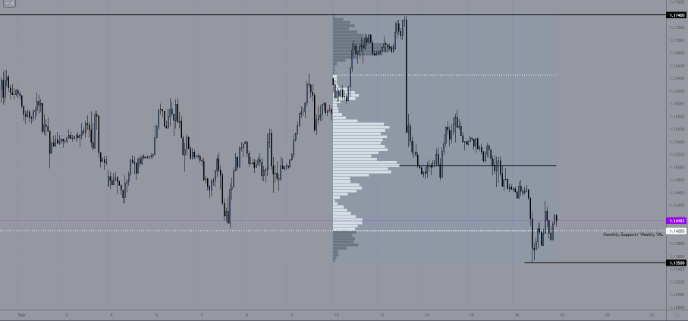

GBPUSD Analysis

The lack of buyers in the GBP was demonstrated last week when the GBPUSD fell to 40-year lows. The GBPUSD price is under pressure as a result of this and the USD’s strength. After reaching new lows of 1.1350, the price is currently trading back above the 1.1400 lows. It’s anticipated that sellers will be drawn to any opportunities to seek out lower prices once more if the price were to rally this week.

GBPJPY Analysis

In the 4hr time frame, the GBPJPY price hit new lows as the risk sentiment changed. The JPY strengthened as stocks declined, which caused the price of the GBPJPY to buck the trend. With major lows resting at 160.65, the recent impulsive phase of the price saw a pause around 164.00; this could serve as resistance going into next week.

Expected Earnings

In other news, investors are taking interest in upcoming earnings reports to determine stocks to buy before earnings this week. Here are the major expected earnings this week investors are looking out for as the earnings calendar 2022 nears a close.

FedEx (FDX): On Thursday, September 22, before the market closes, FedEx is expected to announce its earnings report. Wall Street analysts anticipate that FedEx will generate $23.58 billion in revenue and earn $5.14 per share. This contrasts with the prior-year quarter’s $4.37 per share earnings on $21.93 billion in revenue. This stock dropped more than 24% in one day, leaving Wall Street looking for explanations on Friday.

Accenture (ACN): On Thursday, September 22, before the market opens, Accenture is anticipated to release its earnings report. Analysts anticipate Accenture to generate $15.4 billion in revenue and earn $2.58 per share. This contrasts with the prior-year quarter’s $1.95 per share earnings on $11.9 billion in revenue. The stock has dropped 16% over the last 30 days and 17% over the last six months.

Costco (COST): On Thursday, September 22, Costco is expected to announce its earnings report prior to the market opening. Costco is anticipated by Wall Street to earn $4.16 on every share of its revenue of $72.06 billion. When compared to the prior quarter, which had revenue of $62.67 billion and earnings of $3.90 per share. The business recently revealed a 10.1% increase in comparable sales growth for August, with net revenue of $17.55 billion increasing 11.4% year over year.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.