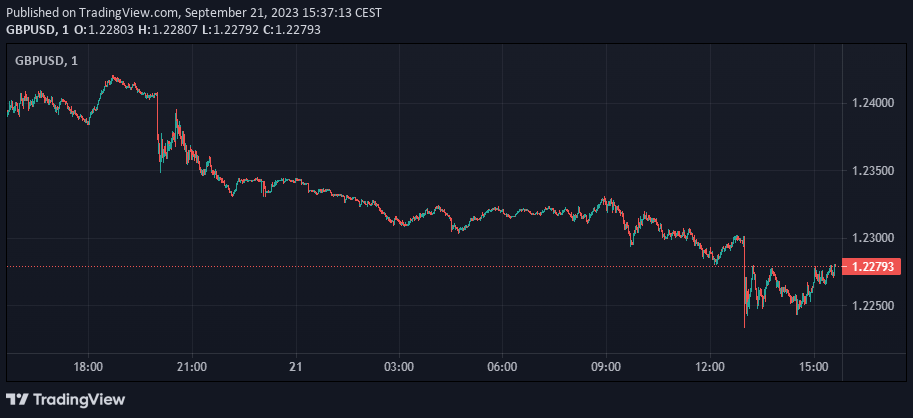

The Bank of England (BoE) has decided to hold its main interest rate at 5.25%, effectively pausing after 14 consecutive rate hikes. This decision has led to a weakening pound, with the currency last seen down around 0.8% against the dollar.

The decision to freeze interest rates has ended a run of 14 straight hikes, following a surprising slowdown in UK inflation. Early Thursday morning, money markets were split roughly 50-50 on whether the Bank would pause or opt for another 25 basis point hike.

This move provides relief to millions and is seen as a boost for Rishi Sunak, suggesting that the central bank sees an end to the cost-of-living pain. Despite a sharp fall in core inflation, price pressures remain well above the BoE’s 2% target.

The decision to pause follows the example of the US Federal Reserve, which recently kept its base rate steady at a 22-year high.

Following the BoE’s decision, the GBPUSD trades below 1.2300 under heavy selling pressure.

Decision Details

In a surprising move, the Bank of England has chosen to maintain its Bank Rate at 5.25% in September 2023, despite four members of the Monetary Policy Committee (MPC) voting in favor of an increase to 5.5%. The decision was a close one, with the MPC voting 5-4 to keep the Bank Rate unchanged.

Inflation and the Economy

This unexpected decision comes at a time when the Consumer Price Index (CPI) inflation is anticipated to fall significantly further in the near term, reflecting lower annual energy inflation, despite the renewed upward pressure from oil prices, and further declines in food and core goods price inflation. At the same time, services price inflation is projected to remain elevated in the near term, with some potential month-to-month volatility.

Bond Purchases Reduction

The MPC has also unanimously decided to reduce the stock of UK government bond purchases by £100 billion over the next twelve months. This move signifies the committee’s serious response to the inflationary pressures that the economy is currently facing.

Monitoring and Future Expectations

Despite the current state of the economy, the MPC will continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole, including the tightness of labor market conditions and the behavior of wage growth and services price inflation.

Market expectations for the Bank Rate beyond September imply a peak of around 5.5% over the next three years. However, further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.

GDP Growth and Labor Market

Meanwhile, GDP growth in the UK is expected to be weaker than previously projected, with GDP estimated to rise only slightly in 2023 Q3. There have also been signs of a loosening in the labor market, with a decline in the vacancies-to-unemployment ratio and rising unemployment.

Contrary to these trends, Annual private sector regular Average Weekly Earnings (AWE) growth increased to 8.1% in the three months to July, above expectations. Additionally, CPI inflation fell to 6.7% in August, below expectations.

The MPC’s Strategy

The MPC sets monetary policy to meet the 2% inflation target and sustain growth and employment. This decision to maintain the Bank Rate may seem surprising, but it is part of the MPC’s strategy to manage inflation while supporting the UK economy.

The Bank of England’s decision underlines the complexity of the current economic situation. While there are signs of persistent inflationary pressures, there are also indications of resilience in the economy as a whole. The Bank’s cautious approach indicates its commitment to carefully managing these competing challenges.

Federal Reserve Maintains Status Quo on Interest Rates at 5.25%-5.50%

In an anticipated move, the Federal Open Market Committee (FOMC) of the Federal Reserve has decided to keep interest rates unchanged at 5.25%-5.50%. This decision is based on the committee’s careful assessment of the current economic conditions and its commitment to support the economy and promote price stability.

Decision Details

The FOMC, in its latest meeting, made the unanimous decision to maintain the target range for the federal funds rate. The decision reflects the committee’s ongoing efforts to support the health of the U.S. economy amidst a complex global economic landscape.

Economic Assessment

The Fed’s decision was influenced by a comprehensive assessment of various economic indicators. Despite the economic recovery, the Fed acknowledges that risks to financial stability remain, warranting continued vigilance.

Financial Stability and Stress Tests

To ensure the resilience of the U.S. financial system, the Fed will continue to conduct stress tests. These tests are designed to assess the ability of major financial institutions to withstand severe economic shocks. They are a critical tool for the Fed to ensure financial stability and protect the economy from potential crises.

Ensuring Smooth Functioning of the Payment System

Beyond its role in monetary policy, the Fed also plays a vital role in the functioning of the country’s payment system. As part of its mandate, the Fed will continue to provide financial services and oversight to ensure the smooth operation of this system. This includes ensuring that transactions are processed efficiently and securely, and that financial institutions have access to the services they need.

Ongoing Monitoring

The Fed has reiterated its commitment to closely monitor the implications of incoming information for the economic outlook. The committee will continue to assess the appropriate path for the federal funds rate, taking into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Concluding Remarks

The decision of the Federal Reserve to maintain the status quo on interest rates reflects its careful evaluation of current economic conditions and its commitment to fostering maximum employment and price stability. As we move forward, it will be crucial to keep a close eye on the Fed’s actions and their implications for the U.S. economy.

Read These Next

Creating an Effective Forex Trading Plan

The Winning Mindset for Weekend Forex Trading

Essential Education for Taxes on Forex Trading

What is a Margin Level in Forex?

Master Forex Flag Pattern Strategy for Profit

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.