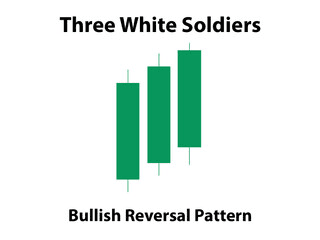

The three white soldiers candlestick pattern is a powerful bullish reversal signal that forex traders and market enthusiasts monitor closely. Understanding this formation is key to identifying potential shifts from a downtrend to an uptrend. It consists of three consecutive long-bodied green or white candles, each opening within the previous candle’s body and closing progressively higher.

This staircase-like structure indicates a strong surge in buying pressure, suggesting that the market sentiment is turning positive. For traders, recognizing this formation can provide valuable entry signals and insights into market psychology. Mastering how to interpret the three white soldiers candlestick pattern is a crucial skill for technical analysis.

Table of Contents

ToggleUnderstanding the Three White Soldiers Candlestick Pattern

The three white soldiers candlestick pattern is a visual representation of a strong shift in market momentum. After a period of decline or consolidation, this pattern signals that buyers are taking control from sellers. Its appearance on a price chart often precedes a sustained upward move. The strength of this signal is one of its most defining features. It is not just a momentary blip but a sequence of three strong trading sessions that build on each other. This progressive climb shows that conviction is growing among buyers. You can use this pattern to gauge the potential for a new uptrend and make more informed trading decisions.

The Basic Structure of the Three White Soldiers Candlestick Pattern

To correctly identify the three white soldiers candlestick pattern, you need to recognize its specific structure. The first candle is a bullish candle that appears after a downtrend, marking the initial push from buyers. The second candle must also be bullish, opening within the body of the first candle and closing above it, which confirms the growing strength. Finally, the third candle continues this momentum, opening inside the second candle’s body and closing at a new high. This formation of the three white soldiers candlestick pattern, with its minimal upper shadows, shows that buyers maintained control throughout each session, a very strong bullish signal.

Psychology Behind the Three White Soldiers Candlestick Pattern

The psychology behind the three white soldiers candlestick pattern reveals a clear shift from fear to confidence in the market. During a downtrend, seller dominance creates a pessimistic atmosphere. The first candle of the pattern is the first sign of hope for buyers, suggesting that selling pressure is starting to weaken. As the second and third candles form, this hope turns into conviction. This visual progression of the three white soldiers candlestick pattern encourages more buyers to enter the market, while sellers are forced to cover their short positions, which adds more fuel to the upward rally.

Identifying a Valid Three White Soldiers Candlestick Pattern

Not every series of three green candles qualifies as a three white soldiers candlestick pattern. For a valid formation, certain criteria must be met. The pattern must emerge after a distinct downtrend, as it is a reversal signal. Each of the three candles should be bullish with a long body, indicating strong buying pressure. Short upper wicks are also a key characteristic, showing that buyers held the price near the session’s high. Furthermore, increasing trading volume during the formation of the three white soldiers candlestick pattern adds significant confirmation, suggesting broad participation in the new upward trend.

Key Confirmation Criteria for the Three White Soldiers Candlestick Pattern

Confirming the three white soldiers candlestick pattern is crucial to avoid false signals. The most important confirmation is context; the pattern should appear after a clear price decline. Volume is another critical factor. A noticeable increase in trading volume across the three candles validates the strength of the reversal. Also, look at where each candle opens. The second and third candles should open within the real body of the previous candle, creating the characteristic staircase effect of the three white soldiers candlestick pattern. This orderly progression signifies sustained and organized buying pressure.

Common Misinterpretations of the Three White Soldiers Candlestick Pattern

Traders can sometimes misinterpret the three white soldiers candlestick pattern, leading to poor decisions. One common mistake is identifying the pattern during a sideways or choppy market, where it loses its reversal significance. Another error is ignoring the size of the candles. If the candles have very long upper wicks, it indicates that sellers are still fighting back, which weakens the signal of the three white soldiers candlestick pattern. Finally, if the pattern forms near a major resistance level, it might not lead to a breakout and could instead be a trap.

How to Trade the Three White Soldiers Candlestick Pattern

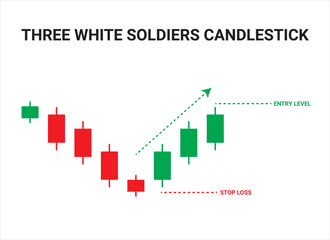

Trading the three white soldiers candlestick pattern effectively requires a clear strategy. Once you have identified a valid pattern after a downtrend, you can plan your entry. A common approach is to enter a long position after the third candle closes, confirming the pattern is complete. This ensures you are not acting on an incomplete signal. Managing your risk is equally important. When trading the three white soldiers candlestick pattern, you should always use a stop-loss to protect your capital in case the market unexpectedly reverses against your position.

Entry Strategies for the Three White Soldiers Candlestick Pattern

When it comes to entry points for the three white soldiers candlestick pattern, you have a few options. The most direct method is to place a buy order at the market price once the third candle closes. An alternative is to wait for a small pullback. Sometimes, after a strong three-day rally, the price may retrace slightly before continuing its upward journey. Entering during this dip can offer a better risk-to-reward ratio. Regardless of your entry, confirming the three white soldiers candlestick pattern with other indicators can increase the probability of a successful trade.

Setting Stop-Loss and Take-Profit Levels for the Three White Soldiers Candlestick Pattern

Proper risk management is essential when trading the three white soldiers candlestick pattern. A logical place for a stop-loss order is just below the low of the first candle in the pattern. This level acts as a clear point of invalidation; if the price drops below it, the bullish signal has failed. For take-profit targets, you can look for the next significant resistance level on the chart. Using a predefined risk-to-reward ratio, such as 1:2 or 1:3, is another structured way to plan your exit when trading the three white soldiers candlestick pattern.

The Three White Soldiers Bullish Candlestick Pattern in Context

The three white soldiers bullish candlestick pattern is most reliable when considered within the broader market context. Its location on the chart is paramount. A pattern forming at a significant support level or after breaking a downtrend line carries more weight. Traders should analyze the overall trend on higher timeframes to ensure they are not trading against a powerful, long-term bearish move. The three white soldiers candlestick pattern is a potent signal, but its predictive power is magnified when it aligns with other technical factors, confirming a genuine shift in market control from sellers to buyers.

Combining with Support and Resistance Levels

Using support and resistance levels can greatly enhance the effectiveness of the three white soldiers bullish candlestick pattern. When this pattern forms directly on or just above a major support zone, it provides a strong confirmation that the downtrend has found a floor. This confluence of signals gives you more confidence to enter a long position. The support level acts as a logical foundation for the reversal, making the signal from the three white soldiers bullish candlestick pattern much more robust and dependable as a trading setup.

Using Volume as Confirmation

Volume analysis is a key component when trading the three white soldiers bullish candlestick pattern. An increase in trading volume during the formation of the three candles indicates strong buyer commitment. This rising volume suggests that the upward price movement is backed by genuine market interest and is not just a temporary fluctuation. When you see the three white soldiers bullish candlestick pattern accompanied by high or increasing volume, it adds a significant layer of confirmation to the bullish reversal signal, making it a higher-probability trade.

Three White Soldiers Pattern Examples on Charts

Seeing three white soldiers pattern examples on actual price charts helps solidify your understanding. For instance, on a daily chart of a forex pair like EUR/USD, you might see a prolonged downtrend followed by three consecutive long bullish candles. Each candle opens within the prior candle’s body and closes higher, often with increasing volume. These real-world three white soldiers pattern examples show how the pattern can precede a significant price rally. Studying these occurrences helps you become more adept at spotting the pattern and developing the confidence to trade it when it appears.

Bullish Reversal Example

This is a classic application of the three white soldiers candlestick pattern as a powerful buy signal.

In a bullish reversal example, a stock may have been in a downtrend for several weeks, making lower lows and lower highs. Suddenly, a three white soldiers pattern examples formation appears. The first candle signals a potential bottom, the second confirms the growing momentum, and the third solidifies the reversal. A trader entering after the third candle’s close, with a stop-loss below the first candle’s low, would be positioned to capture the subsequent uptrend.

Failed Pattern Example

It is also important to study situations where the signal fails. A failed three white soldiers pattern examples might occur if the pattern forms just below a strong resistance level. Despite the three bullish candles, the price is unable to break through the overhead supply. Another scenario for failure is when the pattern forms on low volume, suggesting a lack of conviction from buyers. Recognizing these warning signs can help you avoid trades where the three white soldiers candlestick pattern is likely to fail, saving you from potential losses.

The Bearish 3 Candle Pattern and Its Relatives

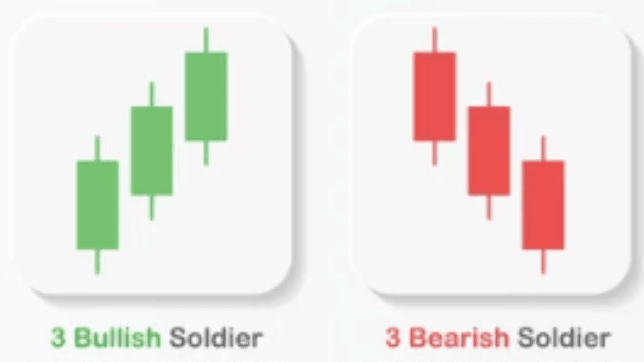

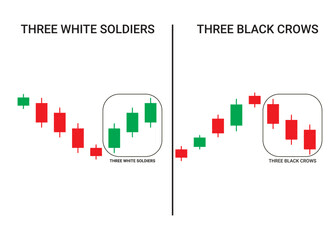

While the three white soldiers is a bullish 3 candle pattern, it is helpful to know its bearish counterpart, the Three Black Crows.

This bearish 3 candle pattern signals a potential reversal from an uptrend to a downtrend and consists of three consecutive long red or black candles. Understanding both patterns gives you a more balanced view of the market. There are also other related formations, like the Three Inside Down candlestick pattern, which is another bearish reversal signal. Knowing these variations helps you interpret market sentiment more accurately.

The Three Black Crows: The Opposite of a Three White Soldiers Candlestick Pattern

The Three Black Crows pattern is the direct opposite of the three white soldiers candlestick pattern. It appears after an uptrend and signals that sellers are taking control. This bearish 3 candle pattern consists of three long, consecutive bearish candles, with each closing lower than the last. Each candle also opens within the body of the previous one. Just as the three white soldiers candlestick pattern is a strong bullish signal, the Three Black Crows pattern is a powerful bearish signal that warns of a potential trend reversal to the downside.

Three Inside Down Candlestick Pattern

The Three Inside Down candlestick pattern is another bearish reversal formation that traders should be aware of. It is a three-candle pattern that starts with a long bullish candle during an uptrend. The second candle is a small bearish candle contained within the first candle’s body. The third candle is a long bearish candle that closes below the first candle’s low, confirming the reversal. While different in structure, its bearish implication contrasts with the bullish signal of the three white soldiers candlestick pattern, providing another tool for market analysis.

Advanced Trading with the 3 Candle Pattern Strategy

An advanced 3 candle pattern strategy involves combining candlestick signals with other technical indicators for higher-probability trades.

For example, you can use oscillators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) to confirm the momentum shift indicated by the three white soldiers candlestick pattern. A bullish divergence on the RSI, where price makes a new low but the RSI makes a higher low, preceding the pattern can be a very powerful confirmation. This multi-layered analysis helps filter out weaker signals and improves the overall effectiveness of your trading.

Using Oscillators to Confirm the Three White Soldiers Candlestick Pattern

Oscillators are excellent tools for confirming signals from the three white soldiers candlestick pattern. When the pattern appears, you can check the RSI to see if it is moving up from oversold territory (below 30), which supports the idea of a bullish reversal. Similarly, a bullish crossover on the MACD indicator, where the MACD line crosses above the signal line, provides additional confirmation of a shift in momentum. Using these indicators alongside the three white soldiers candlestick pattern helps you build a more robust and reliable 3 candle pattern strategy.

Backtesting the Three White Soldiers Candlestick Pattern

Backtesting is a critical step in developing a reliable 3 candle pattern strategy. This process involves applying your trading rules to historical data to see how the three white soldiers candlestick pattern would have performed in the past. By doing this, you can gather statistics on its success rate, average profit, and maximum drawdown. You can also test different entry, exit, and risk management rules to optimize your approach. Backtesting the three white soldiers candlestick pattern provides objective data that can build your confidence in the strategy before you risk real capital.

The Three Soldiers Pattern Bearish Variation

While the primary “three soldiers” pattern is bullish, some discussions mention a Three Soldiers pattern bearish variation, though this is less common and often refers simply to the Three Black Crows.

The concept of a bearish three soldiers formation is essentially the Three Black Crows pattern, which acts as a strong indicator of a potential downturn. Understanding this bearish counterpart is crucial for a comprehensive trading approach, as it helps you recognize when an uptrend might be losing steam. It is effectively the mirror image of the three white soldiers candlestick pattern.

Recognizing a Weakening Uptrend

The Three Soldiers pattern bearish equivalent, the Three Black Crows, is a key signal of a weakening uptrend. When you see three consecutive long bearish candles after a sustained rally, it suggests that sellers have decisively taken control. This pattern indicates that the buying pressure that drove the uptrend is exhausted, and a reversal is likely. Unlike the strength shown by the three white soldiers candlestick pattern, this formation signals the start of a potential decline, prompting traders to consider exiting long positions or looking for shorting opportunities.

Trading the Three Black Crows

Trading the Three Black Crows pattern is the inverse of trading the three white soldiers candlestick pattern. After confirming the pattern at the top of an uptrend, you would look to enter a short position after the close of the third bearish candle. A stop-loss can be placed above the high of the first candle in the formation to manage risk. Take-profit targets can be set at nearby support levels. This Three Soldiers pattern bearish strategy is a powerful way to capitalize on shifts in market sentiment from bullish to bearish.

FAQs about the Three White Soldiers Candlestick Pattern

This section addresses frequently asked questions about the three white soldiers candlestick pattern, offering quick and concise answers. It covers topics from backtesting and trading rules to the success rate and what actions to take after identifying the pattern. These insights are designed to provide clarity and help you effectively integrate this pattern into your trading. Understanding these nuances is important for any trader looking to use candlestick analysis, including the popular bullish 3 candle pattern. You can also find some helpful information by searching for a 3 candlestick patterns pdf online for further study.

How to backtest the 3 white soldiers pattern?

To backtest the three white soldiers candlestick pattern, you need historical price data and a platform that allows you to simulate trades. Define your entry and exit rules, such as entering after the third candle closes and setting a stop-loss below the first candle’s low. Run this strategy across the historical data to analyze its performance metrics, like win rate and profitability.

What is the 3 trading rule?

The “three-day rule” is a general trading guideline, not specific to one pattern, suggesting that you should wait for three days of confirmation before acting on a major market signal. When applied to the three white soldiers candlestick pattern, the pattern itself fulfills this rule by consisting of three consecutive bullish days. This built-in confirmation is one reason why the pattern is considered a reliable signal.

What volume confirms 3 white soldiers?

Ideally, you want to see increasing trading volume across the three candles of the three white soldiers candlestick pattern. Higher volume on the second and third candles compared to the first indicates growing buyer conviction and participation. This confirms the strength of the bullish reversal and increases the reliability of the signal.

What is the power of 3 pattern trading?

The “power of three” in trading often refers to triple-candlestick patterns that signal strong market conviction, like the three white soldiers candlestick pattern. These patterns are considered powerful because they represent a sustained, multi-session push in one direction, filtering out short-term noise. Their structure provides a clearer and more reliable indication of a potential trend change compared to single or double candlestick patterns.

How to trade Three White Soldiers pattern?

To trade the three white soldiers candlestick pattern, first identify it after a downtrend. Enter a long position after the third candle closes for confirmation. Set a stop-loss below the low of the first candle and target a nearby resistance level for your take-profit.

What should you do after seeing Three White Soldiers?

After seeing a three white soldiers candlestick pattern, you should assess the market context and look for confirmation from other indicators. If the signal is strong, consider entering a long trade with a clear risk management plan. Monitor the position closely to see if the bullish momentum continues as expected.

How to trade based on candlestick patterns?

To trade based on candlestick patterns, you must first learn to identify reliable formations like the three white soldiers candlestick pattern. Always consider the market context, use other indicators for confirmation, and apply strict risk management. Practice on a demo account to build experience before trading with real money.

What is the success rate of the Three White Soldiers?

The success rate of the three white soldiers candlestick pattern is generally considered to be high, often cited as being above 70% in ideal conditions. However, its reliability increases significantly when it appears after a clear downtrend and is confirmed by rising volume. Backtesting the pattern in your specific market and timeframe is the best way to determine its historical effectiveness.

Can ChatGPT read candlestick charts?

No, AI models like ChatGPT cannot directly read or interpret live candlestick charts in the way a human trader or specialized software can. While they can process and explain the definitions and criteria for patterns like the three white soldiers candlestick pattern, they do not perform real-time technical analysis. You should rely on proper charting platforms for analysis.

What is the most successful candlestick pattern?

There is no single “most successful” candlestick pattern, as effectiveness varies by market conditions, timeframe, and trading strategy. However, patterns like the Bullish Engulfing, Hammer, and the three white soldiers candlestick pattern are widely regarded as some of the most reliable reversal signals. The key to success is confirming these patterns with other forms of analysis.

Conclusion

In summary, the three white soldiers candlestick pattern is a formidable bullish reversal signal that every technical trader should learn to identify and trade. Its structure of three consecutive bullish candles provides a clear and reliable indication of a shift from bearish to bullish sentiment. By combining this pattern with other analytical tools like volume, support and resistance levels, and oscillators, you can significantly enhance its effectiveness. Remember to always apply sound risk management to protect your capital. Mastering the three white soldiers candlestick pattern will undoubtedly be a valuable addition to your trading arsenal.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.