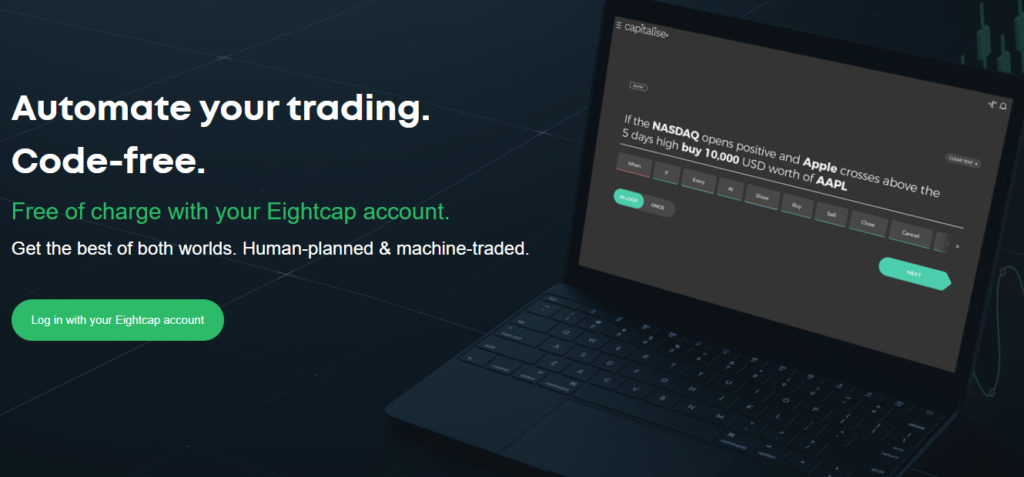

Automate your trading Code-free

Get the best of both worlds. Human-planned & machine-traded

Make informed strategic decisions based on aggregated data sources

How does it work?

For the first time, traders with zero technical skills can automate their trading using free style. Use plain English to give instructions on how you want Capitalise.ai to handle your daily trades using automated multiplex systems.

1. Trade At A Specific Timing

Time your entry & exit so that only if a certain event happens at a certain time will your orders be triggered.

For Example:

ENTRY Between 9:35 am and 10:00 am Eastern time. If EURUSD crosses above the BB (20, 5m, 2, High), then buy 10K EURUSD.

EXIT Close position if profit is at 5% or at 15:59 Eastern time.

2. Cut Your Losses, Maximize Your Profits

Close your position automatically at a profit or loss – the first to occur.

For Example:

ENTRY Buy 10k EURUSD.

EXIT Close position at a profit of 3% or a loss of $100.

3. Dynamic Entry Price

Set a limit order at a price that is equal to another term. For example: set the limit price to equal the lower Bollinger Band.

For Example:

ENTRY Buy 10K EURUSD at a limit equal to the lower BB(20, Day, 2, Close)

EXIT Close position if EURUSD trades above the Middle Bollinger Band(20, 5m, 2, Close)

4. Smart Notifications

Let Capitalise.ai monitor the markets for you and get an email or mobile notification once your conditions are met.

For Example:

ENTRY Notify me if the current 1-hour bar change of EURUSD is negative by more than 0.05%

5. Monitor For Patterns

Refer to historical bars and set your trades to execute only when a specific pattern occurs. See this example where we monitor for when the Stochastic is below 12 for 3 consecutive 5 min bars.

For Example:

ENTRY If the USOUSD Stoch(14, 3, Fast, 5m) with an offset of 2 bars is below 12 and the USOUSD Stoch(14, 3, Fast, 5m) with an offset of 1 bar is below 12, and USOUSD Stoch(14, 3, Fast, 5m) is below 12 buy 10,000 of USOUSD

EXIT Close position, if profit is above 2% or loss is at 2%

6. Trade The News

Use macro-economical events to trigger your entries.

For Example:

ENTRY If the Unemployment Claims (US) results are below forecast and the SPX daily change crosses below -1%, sell 10K EURUSD

7. Trailing Stop Loss

Manage your risk with trailing stop loss. Adjust the price of your stop-loss automatically according to price changes.

For Example:

ENTRY Buy 10k EURUSD

EXIT Close position at trailing stop of 2%

8. Assets Correlation

Buy or sell any asset based on the price of another asset.

For Example:

ENTRY Buy 10K of GBPUSD if EURUSD crosses above 1.15

EXIT Close position if GBPUSD is below 1.19 or EURUSD is below 1.12, or if profit is at $500

9. Correlation To Index

Buy or sell any asset based on the price of any index.

For Example:

ENTRY Sell 100 units of GBPUSD if EUSTX50 crosses above 1234 pts

EXIT Close position if EUSTX50 is below 2345 pts or loss is at $250, or profit is at $500

10. Set Trades Size In USD

Send a market order with a trade size calculated in USD value.

For Example:

ENTRY Long EURUSD for the worth of 10,000 USD

11. ATR Indicator

Enter & exit positions based on the Average True Range.

For Example:

ENTRY Buy 100 EURUSD if EURUSD 1-hour ATR is higher by more than 10% from EURUSD 14-day ATR

12. MACD Cross

Enter & exit positions based on the MACD indicator. In this example, we will enter a long position if the MACD line is above 0 and crossing above the signal line.

For Example:

ENTRY Enter & exit positions based on the MACD indicator. In this example, we will enter a long position if the MACD line is above 0 and crossing above the signal line

EXIT Close position, if the MACD Line(12, 26, 9, 15m, Close) of EURUSD is below the signal line or profit, is at 15%, or the loss is at 6%

13. Simple MA Cross Over

Enter & exit positions based on the moving average (MA) or the exponential moving average (EMA).

For Example:

ENTRY If the JPN225 Moving Average(30, 30m, Close) crosses above the JPN225 Moving Average(30, 30m, Close) then buy 100K JPN225

EXIT Close position if the Moving Average(10, 30m, Close) of JPN225 crosses below the JPN225 Moving Average(10, 30m, Close) or at profit above 5%

14. Buy One, Sell One Around The Pivot

Enter & exit positions based on the Pivot indicator.

For Example:

ENTRY Sell 10,000 of FRA40 and Buy 10,000 of US30 if FRA40 crosses below the Pivot(Week) and US30 is above the Pivot(Week)

EXIT Close position if FRA40 Candlestick(1, Day, High) is below the Pivot(Week)

15. Buy At Drop Below The Bollinger

Enter & exit positions based on the Bollinger bands.

For Example:

ENTRY Buy 10K of EURUSD if EURUSD trades above the Pivot(Week) and EURUSD crosses below the Middle Bollinger Band(20, 5m, 2, Close)

EXIT Close position if EURUSD trades above the Middle Bollinger Band(20, 5m, 2, Close)

16. Reverse SRSI Cross Under RSI

Enter & exit positions based on the RSI/SRSI.

For Example:

ENTRY If the SRSI(14, 1, Fast, 15m, 14, Close) of EURUSD crosses below the EURUSD RSI(14, 15m, Close) buy EURUSD 10K

EXIT Close position at a profit of 2% or a loss of 3%

Automate your Trading. Apply here…

FAQs on Automate Your Trading Code-free With Capitalise.ai

What is Capitalise.ai?

Capitalise.ai is a platform that allows traders to automate their trading strategies without writing any code. It enables traders to create and deploy sophisticated trading algorithms using a simple and intuitive interface.

How does Capitalise.ai work?

Capitalise.ai uses natural language processing (NLP) technology to analyze and interpret trading instructions in plain English. Traders can input their desired trading conditions, rules, and actions, and the platform will convert them into executable code.

Do I need any coding skills to use Capitalise.ai?

No, you don’t need any coding skills to use Capitalise.ai. The platform is designed to be user-friendly and accessible to traders of all skill levels.

What trading platforms does Capitalise.ai support?

Capitalise.ai supports various popular trading platforms, including MetaTrader 4, MetaTrader 5, and Interactive Brokers. This allows traders to seamlessly integrate their automated strategies with their preferred trading environment.

Can I backtest my trading strategies on Capitalise.ai?

Yes, Capitalise.ai provides a built-in backtesting feature that allows traders to test their strategies using historical market data. This helps traders evaluate the performance and effectiveness of their automated strategies before deploying them in live trading.

Can I customize my trading strategies on Capitalise.ai?

Yes, Capitalise.ai allows for extensive customization of trading strategies. Traders can define their own conditions, rules, and actions, and set parameters for risk management, position sizing, and more.

Is my data secure on Capitalise.ai?

Capitalise.ai takes data security seriously and employs industry-standard security measures to protect user data. Your trading strategies and personal information are encrypted and stored securely.

Can I monitor and manage my automated strategies in real-time?

Yes, Capitalise.ai provides real-time monitoring and management of your automated strategies. You can track performance, make adjustments, and even pause or stop strategies as needed.

Does Capitalise.ai provide any support or assistance?

Yes, Capitalise.ai offers comprehensive support to its users. They provide documentation, tutorials, and a dedicated support team to assist you with any queries or technical issues you may encounter.

Is there a cost associated with using Capitalise.ai?

Capitalise.ai offers different pricing plans to suit the needs of different traders. You can visit their website to learn more about their pricing options and choose the one that best fits your requirements.

What is the relationship between Capitalise.ai and Eightcap?

Capitalise.ai and Eightcap have partnered to provide traders with an integrated solution for automated trading. Eightcap is a popular online broker, and Capitalise.ai’s advanced automation platform can be directly accessed within Eightcap’s trading environment.

How does the integration between Capitalise.ai and Eightcap work?

The integration between Capitalise.ai and Eightcap allows traders to automate their trading strategies using Capitalise.ai’s code-free platform, directly from within Eightcap’s trading platform. Traders can access Capitalise.ai’s features seamlessly without the need to switch between different platforms.

Can I use Capitalise.ai with Eightcap if I don’t have an account with Eightcap?

No, in order to use Capitalise.ai within Eightcap’s trading environment, you will need to have an account with Eightcap. You can create an account with Eightcap through their website and then connect it with Capitalise.ai for automated trading.

What are the benefits of using Capitalise.ai with Eightcap?

Using Capitalise.ai with Eightcap provides several benefits. It allows you to automate your trading strategies without coding, saving time and effort. The integration also provides access to enhanced risk management tools, real-time monitoring, and the ability to execute trades directly from your automated strategies.

Do I need to pay separately for Capitalise.ai when using it with Eightcap?

Yes, Capitalise.ai and Eightcap are separate services, and you will need to pay for each service according to their respective pricing plans. You can visit the websites of both Capitalise.ai and Eightcap to get more information about their pricing structures.

Is there any additional setup required to use Capitalise.ai with Eightcap?

To use Capitalise.ai with Eightcap, you will need to connect your Eightcap account with Capitalise.ai. This typically involves linking your trading account credentials with Capitalise.ai to enable seamless integration between the two platforms. Detailed instructions can be found on the Capitalise.ai and Eightcap websites.

Is support available for using Capitalise.ai with Eightcap?

Yes, both Capitalise.ai and Eightcap provide support to their users. Capitalise.ai offers comprehensive documentation, tutorials, and a dedicated support team to assist with any queries related to their platform. Eightcap also provides customer support for account-related inquiries and technical issues.

Can I use Capitalise.ai with other brokers besides Eightcap?

Yes, Capitalise.ai supports multiple brokers and trading platforms, not just Eightcap. You can check Capitalise.ai’s website or contact their support team to see the full list of supported brokers and trading platforms.

Are there any limitations or restrictions when using Capitalise.ai with Eightcap?

While Capitalise.ai aims to provide seamless integration with Eightcap, it’s important to note that certain limitations or restrictions may exist based on each platform’s specific features and capabilities. It is advisable to review the documentation and support resources provided by both Capitalise.ai and Eightcap to understand any potential limitations.

Are there any additional fees associated with using Capitalise.ai with Eightcap?

Both Capitalise.ai and Eightcap may have their own fee structures. While Capitalise.ai’s pricing primarily covers the automation platform, Eightcap’s fees would apply for trading and account-related services. It is recommended to review the pricing details on both platforms to understand the complete cost structure.

Get started today by reading the following in the Forex Education Section

- Beginners Guides and Tips For Forex Trading

- Read A Beginners Guide To Forex Trading

- Mistakes Most Beginner Forex Traders Make and How To Avoid Them

- A 2023 Beginners Guide To Buying And Selling Currencies

- Can You Make Money Trading Forex In 2022 and 2023: Here Are The Facts

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.