When it comes to forex trading, high leverage brokers can be a powerful tool for maximizing potential profits. High leverage forex brokers offer traders the opportunity to magnify their trading positions and take advantage of market movements. With leverage ratios ranging from 1:400 to an impressive 1:2000, these brokers provide traders with the ability to control larger positions with a smaller amount of capital.

Finding the best high leverage limits and forex broker can be a daunting task, as there are numerous options available in the market. To help you make an informed decision, we have compiled a list of some of the best high and maximum leverage limits and forex brokers for 2023. These no leverage limits and brokers have been selected based on their reputation, trading conditions, customer support, and regulatory compliance.

Whether you are an experienced forex trader looking to amplify your trading strategies or a novice trader exploring the world of forex, choosing a reliable high leverage broker forex broker is crucial for your success. So, without further ado, let’s dive into the world of the best high leverage broker forex brokers and discover which ones are worth considering for your trading journey.

Table of Contents

ToggleImportance of Choosing Regulated Brokers

When it comes to selecting a high leverage forex broker, one of the most crucial factors to consider is regulation. Opting for a regulated best high leverage broker, also provides several benefits that ensure investor protection, financial stability, and transparency in trading operations.

In this section, we will delve into the significance of choosing regulated best high leverage brokers, and explore various aspects that both writers and readers should be aware of.

Investor Protection

Regulation plays a vital role in safeguarding the interests of investors. Regulated forex brokers are required to adhere to strict rules and standards set by regulatory authorities, which aim to provide a safe and fair trading environment.

These regulations often include measures such as segregating client funds, offering negative balance protection, and maintaining adequate capital reserves. By choosing a regulated broker, investors can have peace of mind knowing that their funds are protected and that the broker operates with integrity.

Segregation of Funds

One key aspect of regulation is the requirement for brokers to segregate client funds from their own operational funds. This means that traders’ funds are kept in separate bank accounts, ensuring that they are not used for any other purpose, including covering the broker’s own expenses or obligations.

Segregation of funds provides an additional layer of security, as it reduces the risk of misappropriation or misuse of retail or professional client’ funds.

Financial Stability

Regulated brokers are subjected to capital adequacy requirements imposed by regulatory authorities. These requirements ensure that brokers maintain sufficient financial resources to meet their obligations, including client withdrawals.

By choosing a regulated broker, investors can minimize the risk of their broker facing financial difficulties or insolvency, which could result in potential loss of funds.

Transparent Pricing and Execution

Regulated brokers are obligated to provide transparent pricing and execution to their clients. They are required to disclose all relevant information regarding spreads, commissions, and fees, ensuring that traders have a clear understanding of the costs associated with their trades.

Additionally, regulated brokers are expected to execute trades fairly and without any conflicts of interest, providing traders with a level playing field.

Dispute Resolution Mechanisms

Regulated brokers often have established mechanisms for handling client complaints or disputes. Regulatory authorities typically have procedures in place to ensure that grievances are addressed in a fair and impartial manner.

This provides investors with a recourse option in case they encounter any issues or conflicts with their broker, enhancing trust and confidence in the trading relationship.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Regulated brokers are required to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These regulations aim to prevent illicit activities such as money laundering, terrorist financing, and fraud by implementing robust identification and verification processes for clients.

By adhering to these regulations, regulated brokers contribute to the overall integrity of the financial system and help create a safer trading environment.

Access to Investor Compensation Schemes

In some jurisdictions, regulated brokers may be members of Investor Compensation Schemes (ICS). These schemes provide an additional layer of protection for investors by offering compensation in the event of a broker’s insolvency.

The specific details and coverage of these schemes vary depending on the regulatory framework of each jurisdiction. Nevertheless, being part of an ICS can provide investors with an added sense of security.

Pros of High Leverage in Forex Trading

High leverage in forex trading can offer several advantages to traders, allowing them access leverage and to potentially amplify their profits and maximize their return on investment (ROI).

Amplified Profits

One of the primary benefits of such a high leverage move is the potential for amplified profits. Leverage allows traders to control larger positions in the market with a smaller amount of trading capital.

By leveraging their trading capital, traders can increase their exposure to price movements and potentially generate higher profits compared to trading with lower leverage. However, it is important to note that while high leverage can magnify profits, it can also increase losses.

Increased Market Exposure

High leverage enables traders to access a greater portion of the forex market with their available capital margin trading alone. With higher leverage, traders can open larger positions and participate in more significant market movements.

This increased market exposure allows traders to take advantage of various trading opportunities and potentially capitalize on favorable market conditions.

Flexibility in Trading Strategy

High leverage provides traders with greater flexibility in implementing their trading strategies. With leverage, traders can allocate their capital efficiently and optimize their risk-reward ratio.

Traders have the flexibility to enter and exit trades as per their strategy, take advantage of short-term price fluctuations, or hold positions for longer-term trends.

High leverage offers the freedom to adapt trading strategies to changing market conditions and maximize profit potential.

Enhanced ROI

Utilizing the best high leverage brokers can lead to an enhanced return on investment (ROI). By leveraging their capital, traders can potentially achieve higher returns compared to trading without leverage.

A successful trade with the best high leverage broker can result in a significant increase in the trader’s initial investment. However, it is crucial to exercise caution and employ risk management strategies best high leverage brokers to protect against potential losses.

Cons of High Leverage in Forex Trading

While high leverage in forex trading can offer potential advantages, such as amplified profits, it is important to consider the associated risks and drawbacks of highest leverage.

Heightened Risk

One of the primary drawbacks of high leverage is the heightened risk it presents to traders. While leverage can amplify potential profits, it also magnifies losses. A small adverse movement in the market can result in significant losses, potentially wiping out a trader’s entire account.

Traders must exercise caution and implement effective risk management strategies to mitigate these risks.

Potential for Margin Calls

High leverage increases the likelihood of margin calls. A margin call occurs when a trader’s account equity falls below the required margin level set by the broker.

In such cases, the trader may be required to deposit additional funds into their account to maintain their positions. Failure to meet a margin call can lead to the closure of positions, resulting in realized losses.

Emotional Pressure

Trading with high leverage can induce emotional pressure on traders. The potential for significant gains or losses can create a heightened sense of excitement and stress, which may impact decision-making.

Emotional trading decisions driven by fear or greed can lead to poor judgment and impulsive trades that may not align with a trader’s strategy.

Limited Margin for Error

High leverage leaves traders with limited margin for error. Even a small mistake or miscalculation can result in substantial losses. Traders must be meticulous in their analysis, risk management, and trade execution.

Failing to make precise and informed trading decisions can have severe consequences lose money when trading or using high leverage.

Overtrading Tendency

The accessibility of high leverage can potentially lead to an overtrading tendency among traders. The allure of amplified profits may tempt traders to open multiple positions without proper analysis and risk assessment.

Overtrading can expose traders to increased market risks and potentially lead to poor trading performance.

Increased Financial Obligations

Using high leverage in forex trading requires traders to have a sufficient capital base. The higher the leverage, the more substantial the financial obligations become.

Traders must ensure that they have enough funds to cover potential losses and meet margin requirements.

It is essential to assess personal financial circumstances and only trade forex, with leverage that aligns with one’s risk tolerance and financial capabilities.

Best High Leverage Forex Brokers

When it comes to high leverage forex trading, there are several brokers in the market that offer competitive services.

XM

XM is a well-known forex broker that offers high leverage options to its clients. They provide maximum leverage ratio of up to 1:888, allowing traders to amplify their positions in the market.

With a strong reputation in the industry, XM offers a wide range of trading instruments, educational resources, and excellent customer support.

ActivTrades

ActivTrades is a high leverage forex broker that provides high leverage options. They offer leverage of up to 1:200, allowing traders to maximize their trading potential.

With a robust trading platform, competitive spreads, and a comprehensive range of trading tools, ActivTrades is a popular choice among traders.

IronFX

IronFX is a global forex broker known for its high leverage offerings. They provide leverage of up to 1:1000, giving traders the opportunity to control larger positions with less capital.

IronFX offers a wide range of trading instruments, multiple account types, and various trading platforms to cater to the needs of different traders.

Eightcap

Eightcap is a high leverage forex broker that offers high leverage options. They provide leverage of up to 1:500, allowing traders to access increased market exposure.

Eightcap offers competitive pricing, fast execution, and a user-friendly trading experience.

Admirals

Admirals is a popular forex broker that offers high leverage options. They provide leverage of up to 1:500, enabling traders to magnify their trading positions.

With a wide range of trading instruments, advanced analysis tools, and educational resources, Admirals caters to both beginner and experienced traders.

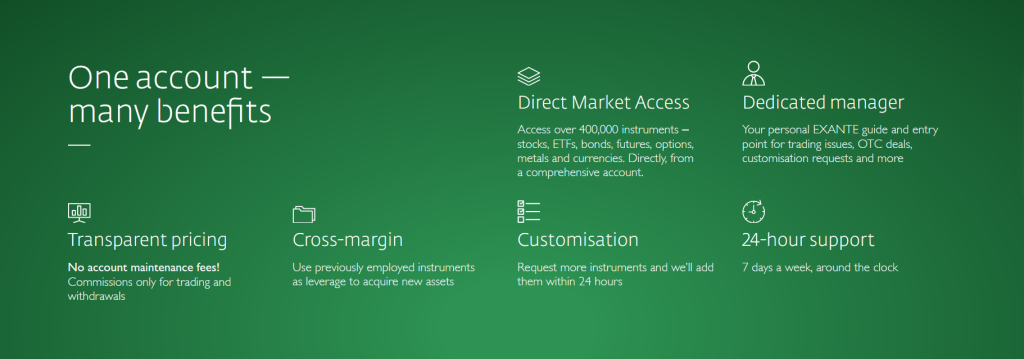

Exante

Exante is a multi-asset broker that offers high leverage trading options for forex trading. They provide leverage of up to 1:200, allowing traders to trade larger positions with a smaller capital outlay.

With a focus on transparency and cutting-edge technology, Exante provides a reliable trading environment for high leverage forex trading.

FXTM

FXTM (ForexTime) is a renowned forex broker that offers high leverage options to traders and options for trading cfds. They offer leverage of up to 1:1000, providing traders with the opportunity to maximize their trading potential.

With a wide range of trading instruments, educational resources, and competitive trading conditions, FXTM is a popular choice among traders.

HotForex

HotForex is a well-established forex broker that offers high leverage options. They provide leverage of up to 1:1000, allowing traders to access enhanced trading opportunities.

With a variety of account types, tight spreads, and a wide range of aggressive trading strategies and tools, HotForex caters to the needs of different traders.

Exness

Exness is a reputable forex broker that offers high leverage options to traders. They provide maximum leverage, of up to 1:2000, enabling traders to control larger positions with a smaller capital investment.

With competitive trading conditions, fast execution, and a range of trading platforms, Exness is a popular choice for high leverage forex trading.

FBS

FBS is a well-known forex broker that offers high leverage options to its clients. They provide leverage of up to 1:3000, allowing traders to amplify their trading positions.

With a range of trading instruments, multiple account types, and educational resources, FBS caters to the needs of both beginner and experienced forex traders.

OctaFX

OctaFX is a forex broker that offers high leverage options for trading and multiple trading platforms. They provide leverage of up to 1:500, enabling traders to have direct market access and increased market exposure.

OctaFX is a popular choice among traders thanks to its competitive spreads, fast execution, and a user-friendly trading environment,

Pepperstone

Pepperstone is a leading forex broker that offers high leverage options to traders. They provide leverage of up to 1:500, allowing traders to maximize their trading potential.

This brokerage offers competitive pricing, fast execution, and a range of trading platforms.

IC Markets

IC Markets is a well-regarded forex broker that offers high leverage options. They provide leverage of up to 1:500, enabling traders to control larger positions with less capital.

With competitive spreads, low latency execution, and a wide range of trading tools, IC Markets caters to the needs of various other currency traders.

AvaTrade

AvaTrade is a trusted forex broker that offers high leverage options for trading. They provide leverage of up to 1:400, allowing traders to amplify their trading positions.

Axi

Axi is a well-established forex broker that provides high leverage options to traders. They offer leverage of up to 1:500, allowing traders to trade larger positions with a smaller capital outlay.

The broker offers competitive spreads, fast execution, and a range of trading platforms. This explains why Axi is a popular choice for high leverage forex trading.

.

Guidance on Selecting a Reliable and Reputable High Leverage Forex Broker

Selecting a reliable and reputable high leverage forex broker is crucial for traders who wish to engage in leveraged trading.

Regulation and Licensing

One of the most important factors to consider is whether the forex broker is regulated and licensed by a reputable financial authority.

Regulation ensures that the broker operates in compliance with strict guidelines, providing a level of security and protection to traders.

Regulatory bodies such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC) are examples of respected authorities.

Security of Funds

Traders should prioritize the security of their funds when selecting a high leverage forex broker. It is essential to choose a broker that segregates client funds from its own operational funds, keeping them in separate accounts with trusted financial institutions.

Additionally, brokers that offer negative balance protection can help safeguard traders from incurring losses greater than their account balance.

Trading Platform

A user-friendly and reliable trading platform is crucial for executing trades efficiently. Consider whether the broker offers a trading platform that suits your needs and preferences.

Look for platforms with advanced charting tools, real-time market data, and order execution capabilities. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Product Range

Check the product range offered by the broker to ensure they provide a diverse selection of currency pairs and other financial instruments beyond forex.

Subsequently, this allows traders to diversify their portfolios and take advantage of different market opportunities.

Customer Support

Reliable customer support is vital, especially for traders who may require assistance or have questions regarding their trading activities.

Look for brokers that offer multiple channels of communication, such as phone, email, and live chat. Prompt and knowledgeable customer support can greatly enhance the trading experience.

Transaction Costs

Consider the transaction costs associated with trading, including spreads, commissions, and overnight financing charges.

Compare these costs across different brokers to ensure they are competitive and align with your trading strategy.

Educational Resources

A reputable broker should provide educational resources to professional clients to help traders improve their knowledge and skills.

Look for brokers that offer webinars, tutorials, articles, and other educational materials that can assist in enhancing trading proficiency.

Reputation and Reviews

Research the reputation of the broker and read reviews from other traders. Reliable brokers with a positive track record and good client feedback are more likely to provide a trustworthy trading environment.

Account Types and Minimum Deposit

Consider the various account types offered by the broker, including standard accounts, mini accounts, mutual funds, or accounts tailored for specific trading strategies.

Evaluate the minimum deposit requirements and ensure they are reasonable based on your financial capabilities.

Transparency and Disclosure

Choose a broker that is transparent in its operations, providing clear information on fees, trading conditions, and other relevant details.

Transparent brokers are more likely to uphold ethical standards and foster trust with their clients.

FAQs About High Leverage Forex Brokers

What are high leverage forex brokers?

High leverage forex brokers are brokerage firms that offer traders the opportunity to trade forex with a higher amount of borrowed capital than their own invested funds, allowing for more leverage limits potentially larger profits or losses.

Which high leverage forex brokers offer the best trading conditions?

Most forex brokers that offer competitive trading conditions include: XM, ActivTrades, IronFX, OneRoyal, Eightcap, and Admirals.

It is important to research and compare the trading conditions offered by different brokers to find the best fit for your trading strategy and risk tolerance.

How can I find reliable high leverage forex brokers?

Finding reliable high leverage forex brokers involves conducting thorough research and due diligence in supported markets.

Look for brokers that are regulated and licensed by reputable financial authorities like the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

Reading reviews and seeking recommendations from experienced traders can also be helpful.

What should I consider when choosing a high leverage forex broker?

When choosing a high leverage forex broker from the financial markets, consider factors such as regulation and licensing, security of funds, trading platform, product range, customer support, transaction costs, educational resources, reputation and reviews, account types and minimum deposit requirements, as well as transparency and disclosure.

Are there any risks associated with trading with high leverage forex brokers?

Yes, trading with high leverage forex brokers carries inherent risks. The use of the highest leverage ever amplifies both potential profits and losses.

It is important to have a solid understanding of risk management principles and employ appropriate risk management tools to mitigate the risks associated with high leverage trading.

Can I trade major currency pairs with a high leverage broker?

Yes, high leverage forex brokers typically offer a wide range of trade currency pairs, including major currency pairs such as EUR/USD, GBP/USD, and USD/JPY.

What are the benefits of trading with high leverage forex brokers?

Trading with high leverage forex brokers allows traders to control larger positions with a smaller amount of capital, in low volatility markets potentially maximizing profit potential. However, it is essential to use leverage responsibly and have a solid risk management strategy in place.

Do high leverage forex brokers provide multiple trading platforms?

Yes, high leverage forex brokers often provide full access leverage multiple trading platforms to cater to the diverse needs of traders. Popular trading platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer advanced charting tools, real-time market data, and order execution capabilities.

How does high leverage trading work in the foreign exchange market?

High leverage trading in the foreign exchange market allows traders to control a larger position in the market using a smaller amount of their own capital.

For example, with a maximum leverage using ratio of 1:500, a trader can control $50,000 worth of currency with only $100 of their own funds.

Are there any regulations in place for high leverage forex brokers?

Yes, high leverage forex brokers are regulated by financial authorities in the countries where they operate. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) in Australia oversee and regulate the activities of forex brokers to ensure fair and transparent trading practices.

Can retail investor accounts lose money when trading with high leverage forex brokers?

Yes, retail investor accounts can potentially lose money when trading with high leverage forex brokers. The use of high leverage brokers amplifies both profits and losses, and it is important for traders to have a solid understanding of risk management and employ appropriate strategies.

What are some popular trading strategies used in high leverage trading?

Popular trading strategies used in high leverage trading include trend following, breakout trading, range trading, and carry trading. When trading forex, traders should choose a strategy that suits their risk tolerance and market conditions.

What is the role of the Commodity Futures Trading Commission (CFTC) in high leverage trading?

The Commodity Futures Trading Commission (CFTC) is a regulatory body in the United States that oversees and regulates the futures and options markets, including forex trading. They aim to protect traders and ensure fair and transparent trading practices.

Which high leverage regulated trading platform offer advanced trading tools?

High leverage trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer a wide range of advanced trading tools, including technical indicators, charting capabilities, automated trading systems, and customizable interfaces.

What are major currency pairs in forex trading?

Forex major pairs in forex trading include EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CHF, USD/CAD, and NZD/USD. These six currency pairs represent the most actively traded currencies worldwide trade forex alone.

Can I trade multiple forex currency pairs on the same trading platform?

Yes, most high leverage trading platforms allow traders to trade multiple currency pairs simultaneously. This provides flexibility and opportunities currency traders to diversify trading strategies for fx pairs max leverage.

What is leverage trading in forex?

Leverage trading in forex refers to the practice of borrowing capital to increase the potential return on investment. It allows traders to control larger positions with a smaller amount of their own capital.

What are the risks associated with trading CFDs?

Most beginner traders worry about losing money rapidly when trading major forex pairs. Trading contracts for difference (CFDs), including forex CFDs, carries risks such as market volatility, leverage risk, counterparty risk, and overnight financing charges. It is important for traders to fully understand these risks before engaging in CFD trading.

What is the role of international market regulators in high leverage forex trading?

International market regulators, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) in Australia, oversee and regulate high leverage forex trading to ensure fair and transparent trading practices, protect investors, and maintain market integrity.

How can I choose the best high leverage trading platform and broker?

To choose the best high leverage brokers reviewed, retail traders should consider factors such as regulation, trading conditions, customer support, reputation, trading platforms, product range, and educational resources.

It is important to research and compare different high leverage brokers, to find the one that aligns with your trading needs.

Which forex broker has the highest leverage?

Specific leverage ratio offered by each broker may vary.

Which forex broker has 5000 leverage?

It is important to note that extremely high leverage ratios like 5000 are uncommon and may carry significant risks.

Which forex brokers have 1:1000 leverage?

It is recommended to research individual brokers’ offerings as leverage ratios can vary.

Which broker gives 20x leverage?

Many forex brokers offer leverage ratios around this range.

Is 1 500 leverage high?

Yes, a leverage ratio of 1:500 is considered high in forex trading. It means that for every $1 of your own capital, you can control $500 in the market. High leverage ratios like 1:500 allow traders to potentially amplify their profits, but it also increases the risk of significant losses.

How does stop-loss work?

A stop-loss is a risk management tool used by traders to limit potential losses on a trade. It is an order placed with a broker to automatically sell or close a position if the price reaches a specified level. When the market reaches the stop-loss level, the trade is executed, helping to protect the trader from further losses.

What is an example of a stop-loss?

Let’s say you enter a long position on a currency pair at 1.2000. To manage your risk, you might set a stop-loss order at 1.1950. If the price declines and reaches 1.1950, the stop-loss order will be triggered, automatically closing your position and limiting your loss to 50 pips.

What is the golden rule for stop-loss?

The golden rule for stop-loss is to set it at a level that aligns with your trading strategy and risk tolerance. It should be placed at a point where, if reached, it indicates a significant change in the market conditions or invalidation of your trading thesis.

What is a margin call?

A margin call occurs when a trader’s account no longer meets the required margin level set by the broker. It happens when the account’s equity falls below a certain threshold, typically due to losses on open positions.

What happens if you get a margin call?

If you receive a margin call, it means you need to deposit additional funds into your trading account to meet the required margin level. Failure to do so may result in the broker forcefully closing some or all of your open positions to prevent further losses.

What is an example of a margin call?

Let’s say you have a trading account with a leverage ratio of 1:100 and you open a position worth $10,000. If the margin requirement for that trade is $1,000 (10% of the position size), and your account equity falls below that amount due to losses, you may receive a margin call.

What happens if you can’t pay a margin call?

If you are unable to meet a margin call and cannot deposit additional funds into your account, the broker may forcibly close your open positions to recover the necessary margin. This is done to limit the risk exposure for both the trader and the broker.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.