ByBit is a Singapore-based crypto derivatives exchange that enables traders to buy/sell cryptos. It opened its doors in 2018 to offer crypto trading services.

Currently, it has 2 million + customers and Over 160 currencies traded on this platform.

It has won several awards, proving it is a reliable and trusted option for traders. These include;

- Most reliable crypto trading platform in 2020

- Investor Award Winner 2020

Here, we take you through an in-depth ByBit review along with its various products, fees, and how to get started. Keep reading.

Table of Contents

ToggleProducts and services

ByBit has multiple products in its growing suite. These include;

- Spot Trading, where you can trade cryptos easily and take advantage of favourable rates thanks to one of the most competitive liquidity.

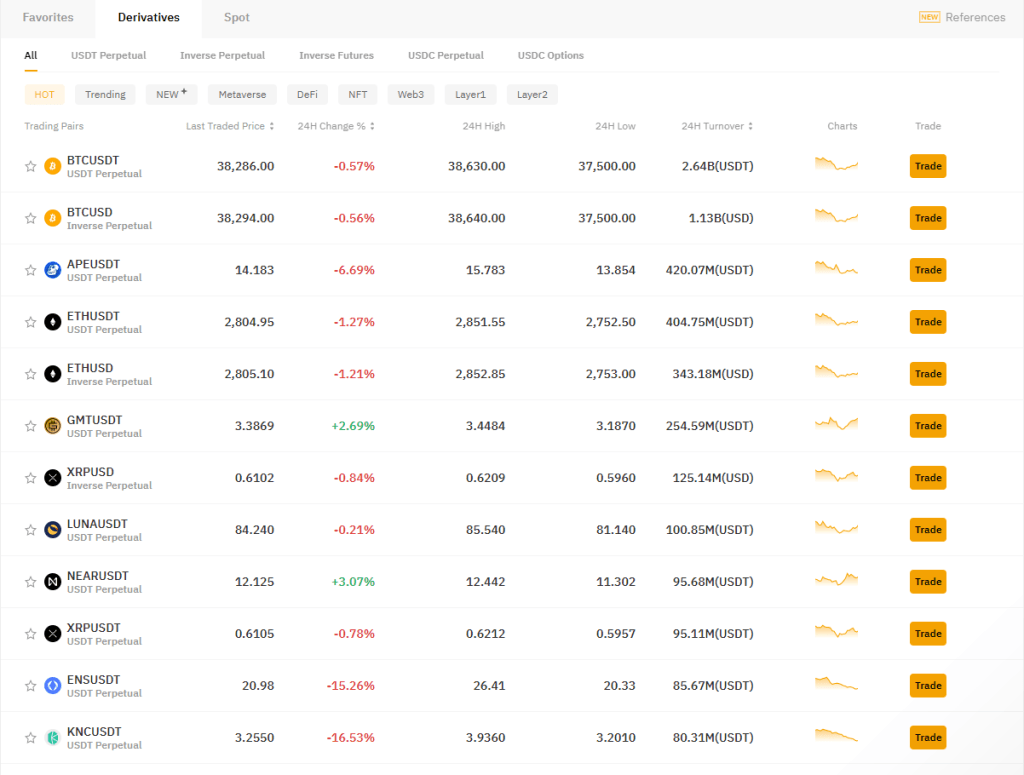

- Derivatives trading is where you can hedge, increase leverage on futures or speculate.

- Bybit earn allows you to stake products.

The Bybit app is downloaded from the App Store or Google Play, and can buy and sell cryptocurrencies anytime, anywhere.

Pros

- Offers 100x leverage on cryptos

- Has highly advanced tools of trading supported by the state of the art technology

- It has in-depth resources

- The test environment is risk-free

Cons

- The exchange is only available for non-US residents

- It’s not suitable for spot trading

.

Bybit Exchange Trading Instruments

ByBit exchange has a wide array of tools for easy trading, as explained here.

Derivatives Trading

As noted earlier, ByBit is a derivative trading exchange that gives you the power to trade financial instruments like crypto that you don’t own. With this platform, you can sell/buy contracts in a hassle-free process

100x Leverage on Cryptos

With Bybit, you can sell/buy cryptos at up to 100x leverage. Therefore, with just a $100 investment, you can trade a $ 10,000 position. If you are an advanced trader, this is the best option because you can go long or short on the 15 currencies by betting on a high or low price.

Without a doubt, it has multiple options for advanced crypto trading.

Advanced Technologies

The Bybit trading platform can manage more than 100,000 transactions every second and is highly unlikely to experience server downtime, as is common in some exchanges when there are so many people trading.

Many traders on the Bybit crypto exchange love the charting tools due to the availability of many features and extra functionality. If you wish, you can download data in multiple formats.

With Bybit, you can sell/buy cryptos at up to 100x leverage

Test Environment is Risk-free

Another thing to note is that the Bybit crypto exchange offers traders a test environment that is devoid of any risks. Therefore, you can test your Bybit trading strategies without using real currency or money. This is a great opportunity to learn how the exchange operates without risking your money.

It is worth noting that leveraging is risky, and therefore, it’s important to test first.

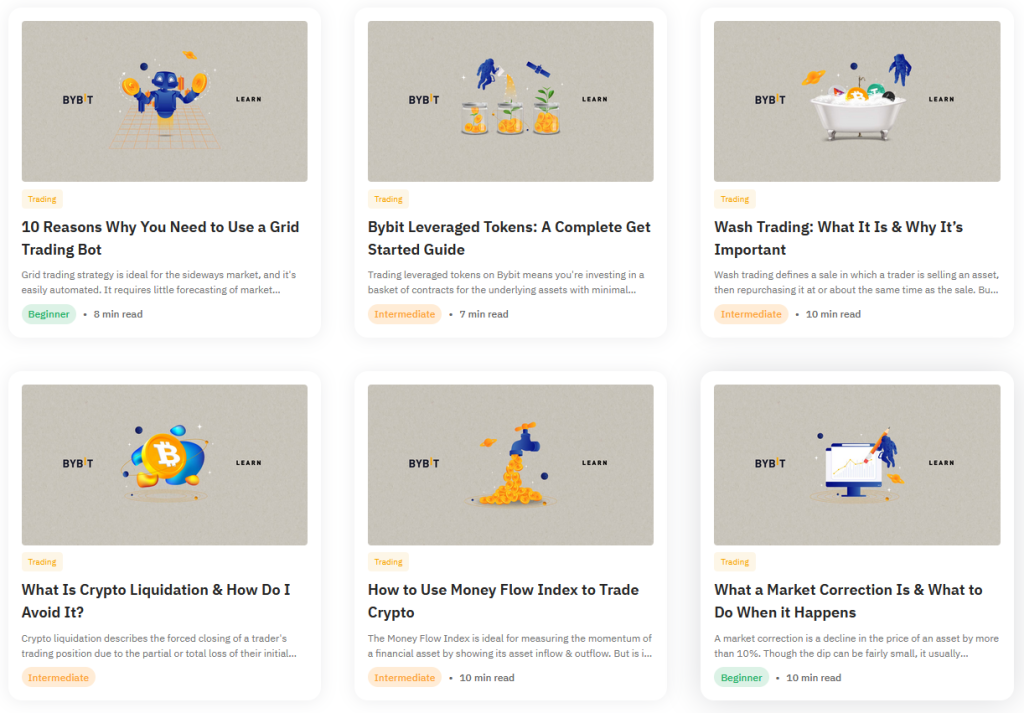

Multiple Resources

The Bybit exchange has multiple resources for traders, including news and FX information.

For example, you learn to interpret charts and use the available tools. You also learn about Defi, or what is popularly known as decentralized finance, and learn more about coins. The best part is that the exchange also has classes every week on its social media pages.

These are top advantages because Margins and Futures are complex, and therefore, it’s important to understand them fully.

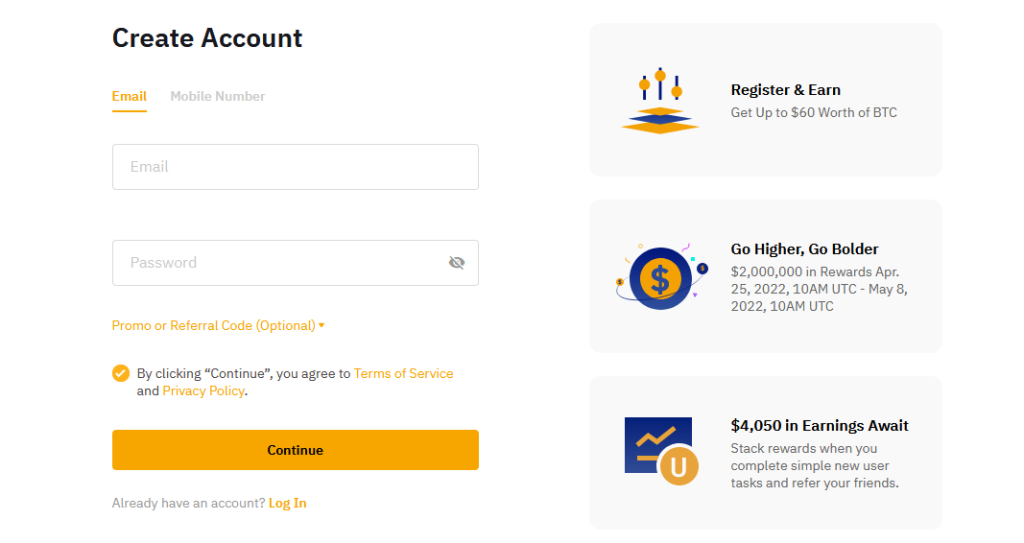

How to Get Started

The Bybit crypto trading platform is easy to join Because it doesn’t have KYC or Know Your Customer requirements.

To open a Bybit account, sign up using your email or phone number.

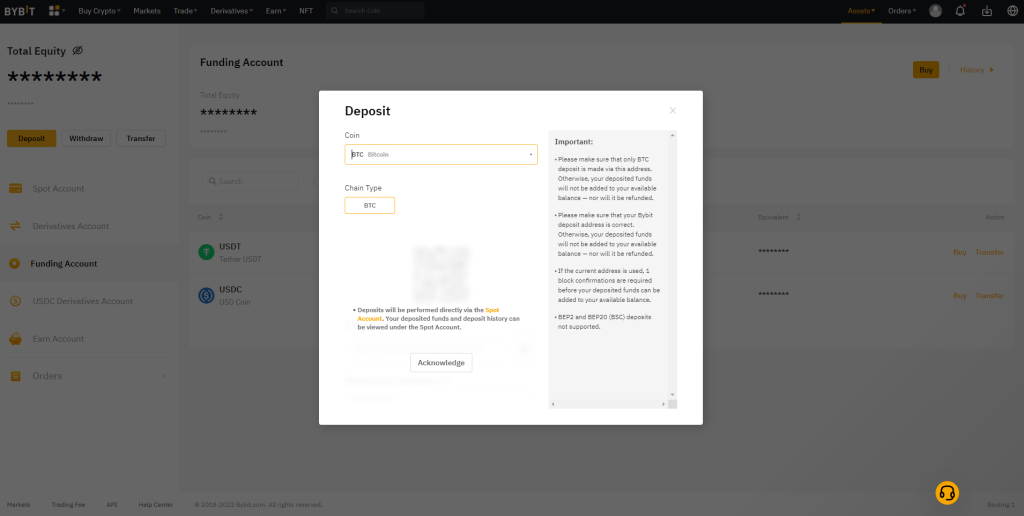

How to Deposit Money With Bybit

To deposit on this crypto trading platform, you can use that party app and buy Bitcoin using Fiat money.

Other Offers

Bybit exchange has other offers like;

- 100x leverage on Bitcoin

- 50x leverage on other coins

- Insurance against losses

Leveraging is amplifying your potential and or buying on a margin. It’s best for advanced Bybit trading. However, it’s important to know that you can also amplify your losses. Therefore, you should not start leveraging as a beginner.

With Bybit crypto exchange, you can make three types of orders;

- Limits

- Market

- Conditional

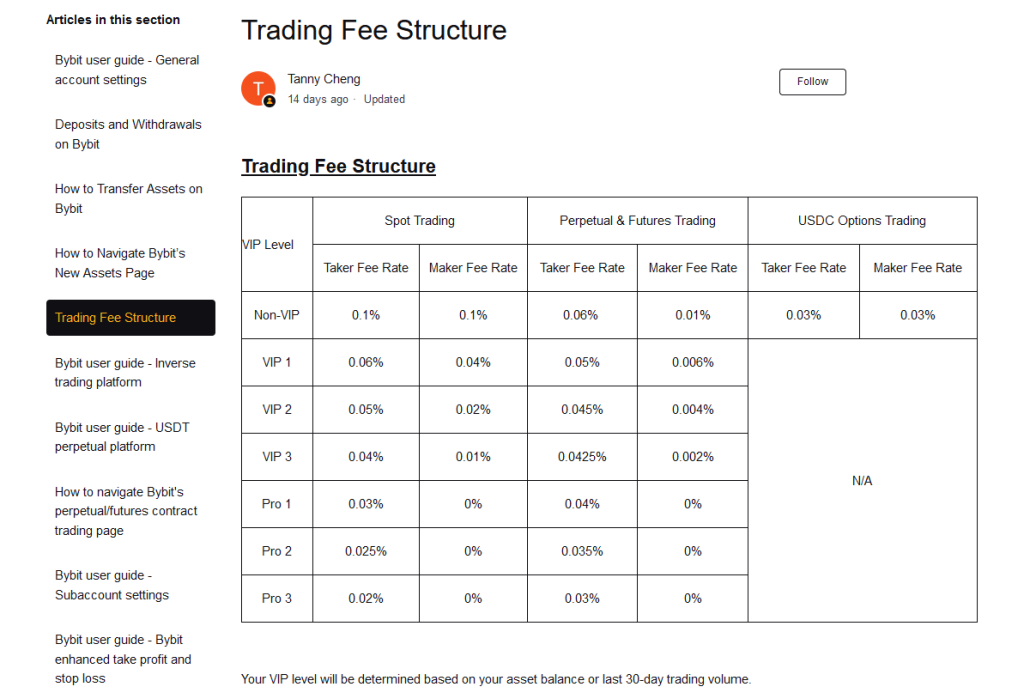

The bybit crypto trading platform has three fees or charges: withdrawal deposits and trading fees. There is also the maker/taker fee, which depends on the volume of the liquidity in the market.

Traders can also pay fees depending on the type of currency.

Here is an example of the fees;

- Spot trading 0.1%

- Derivatives trading (0.06% for takers and 0.01% for markers)

The withdrawal fees on the Bybit blockchain may also differ depending on the platform that you are trading. For example, for BTC, you can pay $0.005 and ETH $0.05.

It’s important to note that the platform does not allow Direct Fiat withdrawals.

Security

The Bybit exchange has multiple security features to protect your digital assets. For example, it stores up to 100% of your assets in an online facility on cold storage.

The Bybit blockchain exchange also has multiple layers for withdrawal to ensure authorized parties do not access your funds.

In addition, it is part of a bug bounty program whereby users may report suspicious activities in their Bybit accounts.

Further, the exchange also conducts thorough background appraisals for their employees. There is also two-factor authentication when you withdraw your cryptos.

Conclusion

Bybit crypto trading platform is one of the fastest crypto exchanges where you don’t have to worry about downtime. You can perform up to 100,000 trades every second besides conducting high-frequency Bybit trading on your platform. Therefore, this makes it suitable for advanced training. Everything is automated, and therefore, you don’t have to keep on checking the current prices for your digital assets. The exchange is highly recommended for margin trading thanks to the features such as 100X leverage. However, the only drawback is that it’s not available in the US since the country is very strict regarding derivatives trading.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.