Bullish momentum propels EUR/USD to a three-week high above 1.0800 as the US Dollar struggles to attract demand after disappointing CPI figures in May.

Technical indicators show increased buying interest, and the near-term outlook suggests a continuation of bullishness.

The pair faces resistance from the 200 SMA at 1.0840, while support levels are at 1.0785, 1.0745, and 1.0710.

The release of better-than-expected German data and hopes that US inflation softened further in May also contributed to the surge in the EUR/USD pair.

Meanwhile, Asian shares rose, supporting the Euro, and weakening US Treasury yields undermined demand for the USD.

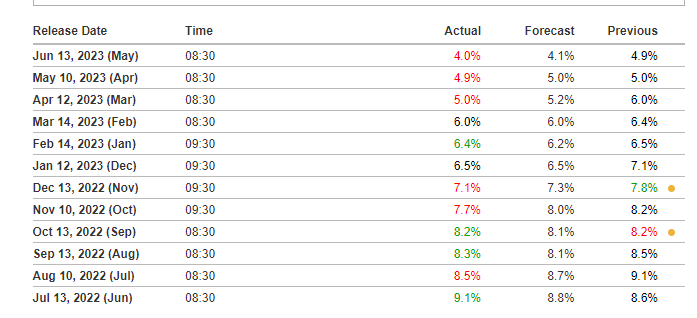

US CPI figures were released later in the day, revealing a decline in inflation to 4% YoY in May, slightly below market expectations.

The figures provide speculation that the Federal Reserve will not hike rates during their meeting on Wednesday, with odds for a no-change standing at 79.2%.

Market reaction to the weaker-than-expected data saw the US Dollar drop 0.5%, and the benchmark 10-year US Treasury bond yield fall below 3.7%.

Gold and stocks are expected to rally while the EUR/USD pair is poised to continue bullish momentum.

May Sees a Cooling Inflation Trend, With Consumer Prices at a Steady Pace- Bureau of Labor Statistics

Table of Contents

ToggleGBP/USD Approaches Key Level as USD Weakness Persists

GBP/USD made gains in early American trading on Tuesday and is now testing the important 1.2600 mark, largely due to USD weakness brought on by recently released US CPI inflation data.

Investors are anticipating that the US Federal Reserve will keep the policy rate unchanged in June, which is further adding to the downward pressure on the USD.

GBP/USD is currently trading in the upper half of an ascending regression channel that’s been in place for two weeks. The Relative Strength Index (RSI) indicates that a bullish bias is firmly established, with readings staying comfortably above 50.

The major resistance level to watch is 1.2600, which marks the upper limit of the channel and has the potential to pave the way for even greater gains if a four-hour close above that level is achieved. If progress continues, 1.2650 would be the next significant point up, marking the beginning of the latest downtrend.

Should GBP/USD return inside the lower half of the channel and break below the 1.2560 static support level, the Fibonacci 61.8% retracement of the latest downtrend (at 1.2520) could be the next point of interest before hitting the psychological level of 1.2500.

USD/JPY Plummets After US Inflation Data

The US dollar took a hit following the release of US CPI, causing USD/JPY to drop sharply and reach a low below 139.00.

Annual US inflation dropped to 4%, the lowest rate seen since March 2021, which provides the Federal Reserve with the opportunity to hold off on any rate hikes during their upcoming meeting.

The recent inflation data led to a decline in US bond yields, boosting the Japanese Yen and increasing equity prices on Wall Street. As current risks shift toward a bearish market trend, volatility is expected to remain high.

If USD/JPY falls below the support of 139.00, further losses are likely, with the first target set at 138.40.

On the other hand, resistance can be found at 139.75 and 140.00, with consolidation above this mark potentially leading to bullish market momentum.

Euro Surges Ahead of Central Bank Meetings Amid Inflation and Recession Fears

Investors are gearing up for anticipated central bank policy announcements, causing the Euro to gain momentum and climb above 1.0800 against the US Dollar for the first time in three weeks.

Despite concerns of a recession in Europe, the Euro is benefiting from the expected rate hike by the European Central Bank. Meanwhile, the US inflation data has resulted in markets fully pricing in a pause in Federal Reserve rate hikes in June.

While the German economy reported two consecutive quarters of contraction, ECB President Christine Lagarde is still expected to raise interest rates by 25 basis points to 4.25%.

With US lending conditions barricading inflationary pressures, the ECB’s rate hike could lead to further support for the Euro.

Technical analysis shows a confident drive by the Euro in a Rising Channel chart pattern, with each corrective move considered a buying opportunity.

However, the 200-period Exponential Moving Average may act as a barrier for Euro bulls.

“Unpacking the Distinction: Core CPI versus CPI”

When analyzing the Consumer Price Index (CPI), it’s important to distinguish between core prices and all-inclusive prices.

Core prices exclude volatile food and energy items and are better indicators of long-term trends.

Despite three consecutive months of a 0.4% increase in core prices, the annual increase has decreased from 5.5% to 5.3%, marking the lowest level since November 2021.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.