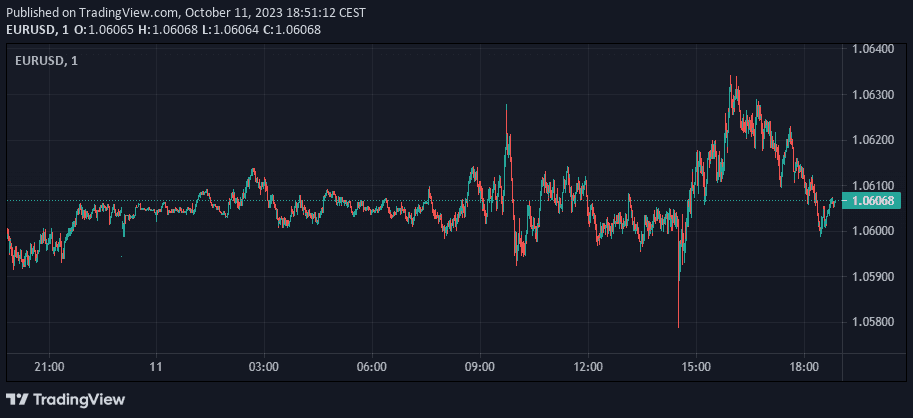

EUR/USD Experiences Decline

The EUR/USD pair has experienced a decline, hitting the 1.0600 mark after previously achieving a two-week high above 1.0630. The EUR/USD pair’s daily chart illustrates that it has registered a higher peak and a higher trough, even though it’s hovering around its initial level.

EURUSD Daily Chart

This shift is primarily due to heightened caution in the market, with investors eagerly anticipating the release of the minutes from the Federal Reserve’s September meeting, which has bolstered demand for USD and placed a cap on the pair’s upward progression.

Despite the volatility, financial markets have managed to find a stable footing, with the US Dollar relinquishing some of its fear-driven gains following dovish remarks from Federal Reserve officials. Currently, the EUR/USD pair is holding steady around the 1.0600 level, not far off from its weekly peak of 1.0628.

Impact of Global Events on USD

Earlier in the week, the USD saw a surge in strength, driven by the escalating conflict between Israel and Hamas. This was further bolstered by comments from Fed officials suggesting that an increase in bond yields could offset the need for a tightening of monetary policy. However, the likelihood of a further rate hike in the US before the year’s end has diminished, impacting the demand for USD.

Statements from Federal Reserve and ECB Officials

Federal Reserve Governor Michelle Bowman has noted that while progress has been made on inflation, there may be a need for further tightening of monetary policy to achieve price stability.

On the European front, ECB Governing Council member Klaas Knot emphasized the crucial role of financial stability in maintaining price stability and hinted at the possibility of implementing restrictive policies.

Currency Pair Movement and Economic Data

The major currency pairs have largely remained within a certain range due to a sparse economic calendar and public holidays in the US and Canada on Monday. However, some significant figures have been released, including Germany’s final estimate of the September Harmonized Index of Consumer Prices (HICP) confirming a year-on-year increase of 4.3%.

The US has also released the September Producer Price Index (PPI), indicating a month-on-month rise of 0.5% and a year-on-year increase of 2.2% in wholesale price pressures.

Trader Anticipation for FOMC Meeting Minutes

Traders are now eagerly awaiting the release of the FOMC meeting minutes from September, which, while unlikely to offer much in the way of new information, could still have a minor impact on financial markets.

Inflation on the Rise: PPI Indicates 2.2% Increase

The U.S. Bureau of Labor Statistics has reported that the Producer Price Index (PPI) for final demand saw an increase of 0.5% in September, after a rise of 0.7% in August and 0.6% in July, all figures being seasonally adjusted. The unadjusted index for final demand advanced 2.2% for the 12 months ended in September, marking the largest increase since April, which saw a 2.3% rise.

In September, the final demand index was primarily driven by a 0.9% increase in prices for final demand goods, while the index for final demand services also rose, but at a lower rate of 0.3%.

The price for final demand less foods, energy, and trade services increased 0.2% in September, marking the fourth consecutive advance. Over the 12 months ended in September, this index moved up 2.8%.

| Final Demand Category | Percentage Change |

|---|---|

| Final demand goods | +0.9% |

| Final demand services | +0.3% |

| Final demand less foods, energy, and trade services | +0.2% |

In September, the index for final demand goods rose 0.9%, with nearly three-quarters of the rise attributable to a 3.3% increase in prices for final demand energy. Prices for final demand foods and for final demand goods less foods and energy moved up 0.9% and 0.1% respectively.

Over 40% of the increase in prices for final demand goods can be traced back to a 5.4% rise in the index for gasoline. Other products like jet fuel, processed young chickens, meats, electric power, and diesel fuel also saw an increase in prices.

On the other hand, the index for final demand services rose 0.3% in September, following a 0.2% rise in August. Over 60% of the increase can be attributed to prices for final demand services less trade, transportation, and warehousing, which climbed 0.3%. Conversely, prices for final demand transportation and warehousing services declined by 0.4%.

The index for deposit services (partial) saw a significant 13.9% increase, contributing to the rise in prices for final demand services. Other services such as machinery, equipment, parts, and supplies wholesaling; health, beauty, and optical goods retailing; traveler accommodation services; outpatient care (partial); and application software publishing also saw an increase in prices. Conversely, prices for airline passenger services fell by 2.1%.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.