The GBP/USD currency pair has managed to maintain a slightly elevated position above the 1.2300 mark, notwithstanding modest economic data from the United Kingdom.

GBPUSD Daily Chart

A decrease in Industrial and Manufacturing Production was observed in August, while the monthly GDP experienced a modest growth of 0.2%.

On the previous Wednesday, GBP/USD broke past the 1.2300 barrier for the first time since September 22, facing hurdles in maintaining its upward trajectory. The scope for additional gains by the pair might be restricted due to prevailing negative risk sentiment.

However, the robustness of the US Dollar could be jeopardized if policymakers decide on a more cautious approach.

EUR/USD Holds Near Multi-Week High

The EUR/USD currency pair is lingering near a several-week peak above 1.0600, in anticipation of the US Consumer Price Index (CPI). During Thursday’s Asian trading session, the pair experienced an uptick as it traded above 1.0600, attracting buyers.

EURUSD Daily Chart

The US Dollar’s defensive posture, owing to dovish expectations from the Federal Reserve, also lends support to the pair. Ahead of the US consumer inflation report, traders seem reluctant to make significant commitments.

Thursday Trading Dynamics

Early on Thursday, the EUR/USD pair keeps nudging higher toward 1.0650 following marginal daily gains on Wednesday. The near-term technical view suggests that the pair is approaching overbought territory, though investors might overlook this if US inflation data proves softer than expected.

Market Influences and Risk Flows

Risk flows continue to shape financial markets as the US Dollar battles to hold its ground. Furthermore, bearish remarks from Federal Reserve officials apply downward pressure on US Treasury bond yields, further burdening the currency. On Thursday, US stock index futures exhibit a positive trend, signalling market optimism.

Upcoming CPI Data Release

Market observers will keenly watch the US Consumer Price Index (CPI) data for September later in the day. Both the CPI and Core CPI (excluding fluctuating food and energy prices) are expected to rise by 0.3% on a monthly basis, according to investors.

Fed Expectations and Market Impact

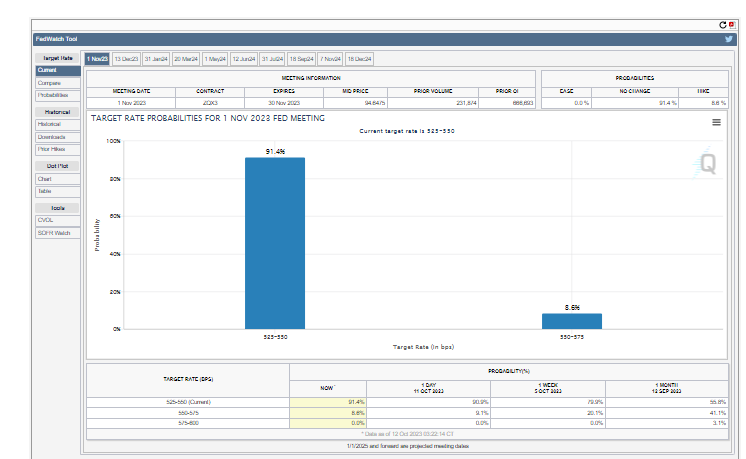

Based on the CME Group FedWatch Tool there is a 91.4% target probability that the Fed will change the policy rate in November.

Source: CME

Should the monthly Core CPI fall short of expectations, it might reinforce dovish Fed expectations and influence market dynamics.

In such a case, US stocks could prolong their weekly surge, while the USD might further soften. On the other hand, a robust Core CPI reading of 0.5% or higher might instigate a USD adjustment and potentially result in the EUR/USD wiping out a significant chunk of its weekly gains.

UK Economy Sees Modest Growth in August 2023 Amidst Sectoral Contractions

The UK economy experienced a slight expansion of 0.2% in August 2023, following a 0.6% contraction in July 2023, as per data from the Office for National Statistics (ONS).

The modest growth in gross domestic product (GDP) was primarily fueled by the services sector, which saw a 0.4% increase in output. However, consumer-facing services recorded a decline in output by 0.6% in August, remaining 4.3% below pre-pandemic levels.

GDP Growth Rate

| Month | GDP Growth Rate (%) |

|---|---|

| July 2023 | -0.6 |

| August 2023 | 0.2 |

The production sector witnessed a decrease of 0.7% in August, with manufacturing being the main driver of the fall. Nine out of thirteen manufacturing sub-sectors reported negative growth. The construction sector also shrunk by 0.5% in August.

Sector Growth Rate in August 2023

| Sector | Growth Rate (%) |

|---|---|

| Services | 0.4 |

| Consumer-Facing Services | -0.6 |

| Production | -0.7 |

| Manufacturing | -0.7 |

| Construction | -0.5 |

In the three months leading up to August 2023, the GDP increased by 0.3%, with all sectors observing growth.

Three-Month GDP Growth Rate

| Period | GDP Growth Rate (%) |

|---|---|

| June – August 2023 | 0.3 |

Despite the modest growth, the British Pound (GBP) remained lower, reflecting the mixed economic signals and uncertainties in the global market.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.