The EURUSD has seen a significant drop, trading below 1.0500 following the release of better-than-expected U.S ISM Manufacturing PMI data which has reinforced the strength of the dollar.

The yield on the 10-year US Treasury bond has seen a significant rise, reaching multi-year highs of 4.7%. This increase in yield represents a marked shift in investor sentiment and has substantial implications for global financial markets.

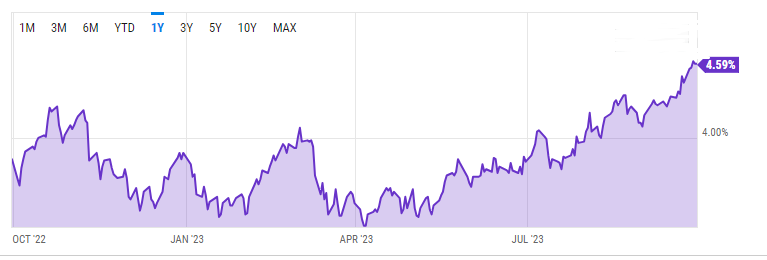

10-year Treasury yield

The surge in the 10-year Treasury yield reflects expectations of tightening monetary policy from the Federal Reserve amid rising inflation pressures. The higher yield is attracting investors to US government bonds, which in turn strengthens the US Dollar. A stronger US Dollar can impact global trade, making US exports more expensive and imports cheaper.

This development comes after comments from Wall Street giant Larry Fink, who anticipates that the 10-year Treasury yield could reach 5% or higher due to embedded and structural inflation. This view underscores the ongoing concerns about inflationary pressures in the US economy.

At the same time, the yield spread between India and the US has reached a 17-year low, reflecting the diverging economic outlooks and monetary policy stances of the two countries.

Investors looking for safer returns amid market volatility might be tempted by the 4.6% Treasury yields. However, some experts suggest that there may be ways to achieve better returns, given the right investment strategies and risk management.

Overall, the rise in the 10-year US Treasury bond yield is a critical development that traders and investors around the world need to monitor closely. It not only affects bond markets but also has wide-ranging implications for currency exchange rates, stock markets, and the global economy.

Table of Contents

ToggleUSDCAD Hovers Around 1.36602

In other news, USDCAD is hovering around 1.36600 after comments from Federal Reserve Chair, Jerome Powell, during the early morning American session.

Gold (XAUUSD) has continued its downward trajectory, hitting almost a 7-month low and currently trading at 1832.02.

Powell’s remarks have been perceived as moderately hawkish, acknowledging the progress made by the central bank but also emphasizing that inflation remains too high.

The Federal Reserve is prepared to further increase interest rates in order to combat inflation, which is currently exceeding the target of 2%. This comes after 11 rate hikes that have pushed the target to between 5.25% and 5.5%.

Dollar Index Predictions

The US Dollar Index, which closed September and the third quarter of 2023 on a downward trend, may be poised for a rebound. A dip in the dollar’s value has sparked buying interest among investors, which could drive the index upward.

Following a period of profit-taking at the end of September and Q3, there are signs that the index could surpass the 106.80 mark. If this happens, it could potentially replicate the highs seen in late November last year, marking a significant upturn for the dollar.

However, the road to a higher dollar index is not without potential roadblocks. A series of underwhelming US economic data could act as obstacles to the dollar’s growth. Particularly, less than stellar figures from the US ISM and NFP reports may hinder the upward momentum.

In addition, foreign exchange intervention by the Bank of Japan (BoJ) could also impact the dollar’s trajectory. Speculations suggest that the BoJ might involve selling USD, which could potentially dampen the dollar’s growth.

Meanwhile, investors are keeping a close eye on the bear steepening of the 2s/10s Treasury curve. This phenomenon has generated considerable interest, contributing to the inclination to buy dips in the dollar.

In September, the spread moved through -50 bps, indicating a shift in the market. The key resistance lies around the March low of approximately -40 bps, a benchmark watched closely by investors and analysts alike.

As we move into the final quarter of the year, the US Dollar Index stands at a critical juncture. Various factors, both domestic and international, will influence its trajectory, making the coming months a crucial period for the dollar. Whether the dollar can sustain its potential rebound amidst these influencing factors remains to be seen.

Upcoming Events

Monday, October 2, 2023: Reserve Bank Of Australia Cash Rate Announcement

The Reserve Bank of Australia (RBA) is set to announce its cash rate decision. This is a significant event because the cash rate impacts all interest rates in the country, and changes can affect the value of the Australian Dollar (AUD). A higher than expected rate could be bullish for the AUD, while a lower than expected rate could be bearish.

Tuesday, October 3, 2023: China’s CPI m/m, U.S. Jolts Job Openings, New Zealand Cash Rate Announcement

China’s monthly Consumer Price Index (CPI) will be released, providing important insight into inflation trends in the world’s second-largest economy. Inflation rates can impact the Yuan’s value, which can have a knock-on effect on global markets.

In the U.S., the JOLTS Job Openings data will provide insight into the labor market’s strength. High job openings could suggest a strong economy, potentially strengthening the USD.

The Reserve Bank of New Zealand (RBNZ) will announce its cash rate decision. Like the RBA’s announcement, this could significantly impact the NZD’s value.

Wednesday, October 4, 2023: ADP Non-Farm Employment Change, ISM Services PMI, Speech by ECB President Lagarde

The ADP Non-Farm Employment Change provides an early look at the U.S. labor market’s health ahead of Friday’s official government data. A strong report could boost the USD.

The ISM Services PMI is a key indicator of the U.S. service sector’s health. A high reading could bolster the USD, while a low reading could weigh on it.

ECB President Lagarde’s speech will be closely watched for any hints about future monetary policy decisions. Any dovish or hawkish sentiments could affect the Euro’s value.

Thursday, October 5, 2023: Unemployment Claims

The number of Americans filing for unemployment benefits will be released. Lower than expected claims could indicate a strong labor market, potentially strengthening the USD.

Friday, October 6, 2023: Canada Employment Change, Canada Unemployment Rate, US Average Hourly Earnings m/m, US Unemployment Rate, US Non-Farm Employment Change

Canada’s employment data will provide insight into the country’s economic health. Strong job growth could boost the CAD, while weak growth could weigh on it.

In the U.S., the Average Hourly Earnings data will give insight into wage inflation. A higher than expected reading could be bullish for the USD.

The U.S. Unemployment Rate and Non-Farm Employment Change figures will provide further insight into the labor market’s health. Strong data could bolster the USD, while weak data could weigh on it.

Traders should monitor these events closely as they can cause significant market volatility and opportunities for trading.

Footnotes: The 10-year Treasury Yield

The 10-year Treasury yield is a significant benchmark in the global finance sector. It’s used to set interest rates on many kinds of loans, including mortgages. Here’s a brief history:

The 10-year Treasury yield has seen highs and lows over the years, reflecting the changing economic conditions and monetary policy stances.

In the 1980s, the U.S. was grappling with high inflation. In response, the Federal Reserve, led by then-chairman Paul Volcker, raised benchmark rates to unprecedented levels. This aggressive monetary policy stance led the 10-year Treasury yield to reach an all-time high of 15.84% in 1981.

Following this peak, the 10-year Treasury yield has generally been on a downward trend over the following decades. This decline reflects a combination of lower inflation expectations, changes in monetary policy, and shifts in global economic conditions.

More recently, as of September 28, 2023, the 10-year Treasury yield stands at 4.59%. This is a significant increase compared to recent years when yields hit historic lows.

The 10-year Treasury yield is closely watched by investors and policymakers around the world. It serves as a key indicator of investor sentiment and expectations about future economic conditions and Federal Reserve policy. It also has wide-ranging implications for global financial markets, impacting everything from the value of the dollar to the cost of borrowing for governments and businesses.

Read These Next

Creating an Effective Forex Trading Plan

The Winning Mindset for Weekend Forex Trading

Essential Education for Taxes on Forex Trading

What is a Margin Level in Forex?

Forex Breakout Strategy: A Guide for Profitable Trading

Forex Consolidation Breakout Strategies for Traders

Master Forex Flag Pattern Strategy for Profit

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.