Skilled navigators use lighthouses as beacons to guide their way when sailing in unfamiliar waters. In the world of forex trading, pivot points serve as your guiding light amidst the turbulent market seas.

Understanding how to trade pivots can help you navigate the ever-changing currents of the financial markets with confidence. By mastering the art of analyzing pivot levels, you can strategically plan your trades and make informed decisions based on market trends.

This introduction will provide insights into the importance of pivot points, how to calculate them, and effective strategies for incorporating them into your trading arsenal. Let’s set sail on this pivot trading journey together.

Importance of Pivot Points

Pivot points are crucial in your forex trading strategy as they help you identify key levels for potential price reversals. Regarding pivot point applications, they are significant markers of support and resistance levels, guiding your trading decisions.

By utilizing a pivot point indicator, you can swiftly assess market sentiment and make informed choices on entry and exit points. This tool aids in determining the overall trend direction, allowing you to capitalize on profitable opportunities.

Whether you’re a beginner or an experienced trader, integrating pivot points into your analysis can enhance your trading performance and boost your chances of success in the dynamic forex market.

Calculating Pivot Levels

To continue from the previous subtopic, incorporate pivot levels into your trading strategy by calculating key support and resistance levels for informed decision-making.

How to Trade Pivots

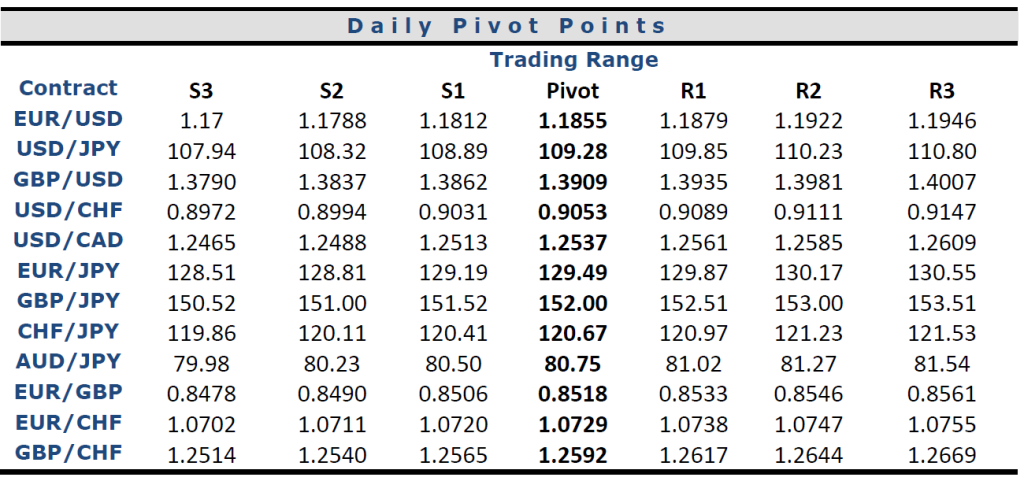

When it comes to calculating pivot levels, there are various methods you can use. The most common ones include the Standard Pivot Points, Fibonacci Pivot Points, and Camarilla Pivot Points. Each method has its way of determining these essential levels based on the previous day’s high, low, and close prices.

Additionally, historical pivot level analysis can provide insights into how price has reacted to these levels in the past, helping you anticipate potential future price movements.

Using Pivots for Market Analysis

Incorporate pivot levels into your market analysis for a deeper insight into potential price movements and informed decision-making. Pivot analysis helps you identify key levels where price may react, indicating possible support or resistance areas.

By utilizing pivot points, you can gauge the overall trend of the market and make more educated trading choices. When the price is above the pivot point, it suggests a bullish sentiment, while trading below the pivot point indicates a bearish outlook.

Additionally, pivot analysis can help you spot potential trend reversals, giving you an edge in anticipating market shifts. By integrating pivots into your analysis, you enhance your ability to interpret market dynamics and improve your trading strategies.

Strategies for Trading With Pivots

Enhance your trading approach by implementing effective strategies that leverage pivot points for informed decision-making in the forex market.

Regarding pivot trading psychology, it’s crucial to remain disciplined and not let emotions sway judgment. Stick to your predetermined trading plan based on pivot point analysis.

Additionally, consider incorporating advanced pivot techniques like using multiple time frames to confirm pivot levels or combining pivots with other technical indicators for a more comprehensive trading strategy.

By understanding the market sentiment around pivot points and mastering advanced techniques, you can gain a competitive edge in your forex trading.

Managing Risk With Pivot Trading

Mitigate potential losses and protect your capital by implementing risk management strategies while trading with pivot points in the forex market. Effective risk management is crucial in pivot trading to safeguard your investments.

One key aspect of risk management is setting stop-loss orders to limit potential losses. You can better manage your trades by defining your risk tolerance and position sizing based on the pivot levels.

Additionally, consider diversifying your trades to spread risk across different currency pairs or assets. Regularly assess and adjust your risk management approach based on the market conditions and trading performance.

Frequently Asked Questions

Who Are the Best Forex Brokers?

Explore these trusted and multiregulated forex brokers, each tailored to diverse trading styles:

OneRoyal: Excel in social trading with OneRoyal Forex Broker, which offers an array of educational resources and a demo account for refined practice. Opt for a maximum leverage of 1:1000 and a 100% Deposit bonus. Tools like CopyTrading with Hoko Cloud, Trading Central, MT4 Accelerator, VPS Hosting, and Trading Calculators enhance your trading experience. OneRoyal adheres to regulations by AFSL-ASIC, CySEC, VFSC, and FSA.

IronFx: Known for its straightforward platform and effective risk management tools, IronFx allows traders to choose leverage up to 1:1000 and offers a 100% Deposit booster. Live account holders benefit from TradeCopier, Trading Central, AutoTrade, and VPS Hosting. IronFx complies with FCA, CySEC, FSCA, and BMA regulations.

Admirals: Admirals distinguishes itself with superior customer support and an extensive range of educational materials. Leverage options go up to 1:500, and VIP account conditions and CashBack on trades are available. Tools available include MetaTrader Supreme Edition, StereoTrader, Trading Central, Premium Analytics, and VPS Hosting. Admirals is regulated by FCA, CySEC, AFSL-ASIC, JSC, CIPC, and CMA.

ActivTrades: This broker offers a user-friendly platform, comprehensive educational resources, and versatile demo accounts. Professional traders can access leverage of up to 1:400, while retail traders have a maximum of 1:200. Benefits include CashBack and Interest on free margin funds. ActivTrades features TradingView on its ActivTrader platform and is regulated by FCA, CSSF, CMVM, SCB, and BACEN.

EightCap: In conclusion, EightCap provides an intuitive platform, exceptional educational content, and effective customer support. Enjoy the highest leverage of 1:500 and a 10% deposit bonus. Trading tools include TradingView, Crypto Crusher, Capitalise AI, FlashTrader, Acuity, and VPS Hosting. EightCap is regulated by AFSL-ASIC and SCB.

Each broker is uniquely equipped to support your trading journey with a blend of educational resources, trading tools, and regulatory compliance, ensuring a secure and efficient trading experience.

Can Pivot Points Be Used Effectively in All Market Conditions, Including Trending Markets?

In all market conditions, including trending markets, pivot points can effectively analyze price movements and determine potential support and resistance levels. Incorporating pivot strategies can enhance trading decisions.

How Often Should Traders Adjust Their Pivot Points Levels, and Is There a Recommended Timeframe for This Adjustment?

To enhance pivot point accuracy and adapt to market shifts, adjust levels daily for intraday trading and weekly for swing trading. Timeframe considerations vary, but consistency in adjustment frequency supports effective pivot trading strategies.

Are There Any Specific Indicators or Tools That Can Be Used in Conjunction With Pivot Points to Enhance Trading Decisions?

Combine pivot points with technical analysis indicators like moving averages or RSI for confirmation to enhance trading decisions. These tools can provide additional support and resistance levels, helping you identify potential trading signals more accurately.

How Do Traders Determine the Appropriate Stop-Loss and Take-Profit Levels When Using Pivot Points in Their Trading Strategies?

When using pivot points, determine stop-loss and take-profit levels based on risk management. Set stops below support or above resistance. Aim for profit potential by setting take-profit levels at key support/resistance areas. Use entry signals and price action for decision-making.

What Are Some Common Mistakes That Traders Make When Using Pivot Points, and How Can These Be Avoided?

Common mistakes when using pivot points include overtrading and poor risk management. To avoid these errors, stick to your trading plan, set realistic profit targets, and use stop-loss orders effectively. Stay disciplined for success.

Conclusion

In conclusion, mastering the art of trading pivots can greatly enhance your forex trading skills.

Understanding the importance of pivot points, calculating pivot levels, using pivots for market analysis, and implementing effective strategies can improve your trading success.

Remember to always manage your risk carefully when trading with pivots to protect your capital.

Keep practising and learning to become a more confident and successful forex trader.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.

Author

-

Zahari Rangelov is an experienced professional Forex trader and trading mentor with knowledge in technical and fundamental analysis, medium-term trading strategies, risk management and diversification. He has been involved in the foreign exchange markets since 2005, when he opened his first live account in 2007. Currently, Zahari is the Head of Sales & Business Development at TraderFactor's London branch. He provides lectures during webinars and seminars for traders on topics such as; Psychology of market participants’ moods, Investments & speculation with different financial instruments and Automated Expert Advisors & signal providers. Zahari’s success lies in his application of research-backed techniques and practices that have helped him become a successful forex trader, a mentor to many traders, and a respected authority figure within the trading community.

View all posts