Forex traders are closely monitoring the GBPUSD pair which has shown reluctance to capitalize on its previous day’s rebound from just below mid-1.2700s—marking the weekly low—and has since been contained within a narrow trading band during Wednesday’s Asian session. Investors seem hesitant to make aggressive moves as anticipation builds ahead of the release of the UK’s monthly Gross Domestic Product (GDP) figures.

The pound’s struggles come at a pivotal moment, with forthcoming UK economic data that could significantly influence market sentiment. Analysts speculate that softer than expected growth numbers could amplify hardships for the currency, placing greater emphasis on the importance of the impending figures.

GBP/USD Eyes New Heights Amid Positive Sentiment Prior to UK Growth Data Release

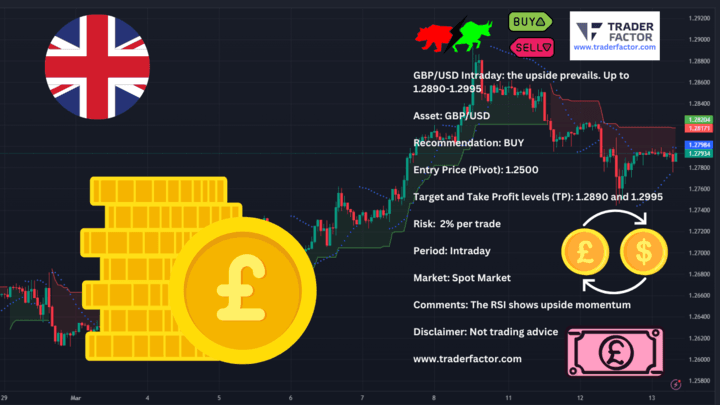

The GBP/USD currency pair is poised for a potential rise, with a buying recommendation issued at an entry pivot of 1.2500. The anticipated target levels are set at 1.2890 and 1.2995, reflecting a robust confidence in the pair’s ability to climb further. The recommendation, courtesy of market analysts at TraderFactor, is buoyed by a positive RSI reading, suggesting that the GBP/USD pair could maintain its upward momentum throughout the trading day. Traders are reminded to apply prudent risk management, capping potential exposure to 2% per trade amidst the inherent market fluctuations.

GBPUSD Daily Chart

GBPUSD Outlook

Forex markets now look ahead to the US Core Producer Price Index (PPI) and Retail Sales data, setting the stage for the next wave of potential volatility. Traders await clearer signals that could define short to medium-term trends for major currency pairs, particularly as central banks articulate their monetary policy strategies.

“With the UK GDP m/m data impending, the GBP/USD pair remains a focal point for Forex traders. Should the figures deviate from expectations, we might see a sharper movement, breaking the pair out of its recent trading,” said Zahari Rangelov, a currency strategist.

A decisive shift could catalyze reactions across markets, underlining the week’s key event risk for the Pound against the backdrop of broad macroeconomic developments.

Table of Contents

ToggleEUR/USD Wavers After Inflation Data, Eyes ECB Guidance

On the other side of the pond, EUR/USD is operating close to 1.0920 during Asian trading hours on Wednesday. The pair faced considerable volatility the day prior, with primary shifts steered by inflation data emanating from both Germany and the United States (US). While the German figures fell in line with forecasts, it was the US inflation numbers coming in beyond projections that rocked the boat.

“Germany maintained a steady HICP year-over-year at 2.7% in February, which matched market expectations and catered to some stability in EUR/USD. However, the tide turned with the US CPI, which asserted significant inflationary pressures, challenging the European currency,” Phyllis Wangui, a senior Forex analyst states.

EUR/USD Intraday: Bullish Momentum Continues

In recent trading sessions, the EUR/USD pair has shown significant bullish momentum, suggesting an upward trajectory in the short term. Analysts at TraderFactor have identified a pivotal entry point at 1.0690, with the currency pair expected to reach targets of 1.1015 and eventually 1.1150.

This optimistic forecast is supported by technical indicators such as the Relative Strength Index (RSI), which indicates sustained upside momentum. Investors are advised to consider a risk management strategy that does not exceed 2% per trade to navigate the anticipated intraday market volatility effectively.

EURUSD Daily Chart

Central Bank Voices Stirring the Market

A consensus appears to be forming within the European Central Bank (ECB) per comments from ECB Governing Council member Francois Villeroy de Galhau, who has hinted at interest rate reductions coming this spring. Additionally, Governor Robert Holzmann noted a preference for a June rate cut over April, emphasizing the high uncertainty currently shaping policies. This sentiment is echoed by Pierre Wunsch, Governor of the National Bank of Belgium, who alludes to an inevitable rate cut despite persistent wage inflation.

In contrast, US data seems to endorse a stronger Dollar, trailing an unexpected Consumer Price Index (CPI) report. February saw the US CPI rise by 3.2% year-over-year, overtaking estimates and fueling doubts about an imminent Federal Reserve rate reduction. The enduring strength of the Greenback poses a sustained challenge for the Euro.

WTI OPEC Outlook and Gold Price Movement

Energy commodities are also in play, with West Texas Intermediate (WTI) crude oil prices hovering near $77.70 per barrel amidst a positive global demand outlook from OPEC, suggesting robust growth through the coming years.

Crude Oil Faces Downward Pressure: A Short Opportunity

The Crude Oil (WTI) market is currently facing resistance, with a sell signal initiated at a pivot point of 78.40. The target levels for this bearish outlook are pegged at 77.35 and 76.80, indicating expectations of a slight downturn in prices. Analysis from TraderFactor highlights the RSI’s indication of potential downside, making a case for a strategic short position.

WTI Crude Oil Daily Chart

Given the unpredictable nature of oil markets, traders are advised to limit risk to 1% per trade to safeguard against unexpected market movements. This advisory comes amid a backdrop of fluctuating oil prices, where careful consideration of entry and exit points becomes paramount for traders looking to capitalize on these movements.

Gold prices, while gaining marginally, are caught in a standoff as markets ponder over the Fed’s rate trajectory. An anticipated central bank inclination towards maintaining high interest rates for the foreseeable future could set back the precious metal’s rally.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.