Gold prices are making headlines as they climb to around $2,750 per ounce, nearing record highs. Recent geopolitical developments, including U.S. President Donald Trump’s tariff threats against Canada and Mexico, have spurred increased demand gold, seen as a safe-haven asset. Additionally, expectations of Federal Reserve rate cuts and declining U.S. Treasury yields have further buoyed gold’s performance. These factors, combined with a global flight to safety amid economic uncertainty, have driven gold’s bullish momentum.

Table of Contents

ToggleGold Price Today USD Chart

Gold Price News: Rally Continues

Gold prices have gained remarkable momentum, inching closer to their all-time high of $2,790. With a combination of economic, geopolitical, and technical factors driving the market, XAU/USD has emerged as a focal point for investors seeking stability amid global uncertainty. Several key developments are shaping the gold market, influencing price movements and trader sentiment.

Impact of US Tariff Plans on Gold Prices

Hours after taking the oath, US President Donald Trump announced his intention to impose 25% tariffs on Canada and Mexico, targeting early February for implementation. This move has reignited concerns over a global trade war, which could disrupt supply chains, raise production costs, and slow economic growth. The uncertainty surrounding these tariffs has significantly bolstered gold’s appeal, as investors frequently turn to safe-haven assets during periods of potential economic instability.

The announcement led to a surge in gold prices, pushing them to their highest level since early November. If these tariffs come into effect, the resulting ripple effects on global trade could lead to prolonged economic challenges, further enhancing gold’s status as a protective hedge.

Federal Reserve Rate Expectations and US Inflation Data

The US recently reported an inflation rate of 2.9%, signaling continued progress toward the Federal Reserve’s 2% target. This declining trend has revived speculation about the Fed’s potential pivot away from aggressive rate hikes. While inflation is moderating, it remains sufficiently elevated to keep the Fed cautious about loosening its monetary stance too soon.

The prospect of lower interest rates by year-end is contributing to downward pressure on US Treasury yields, a development that further supports gold. A declining yield environment makes non-yielding assets like gold more attractive for investors. However, the Fed’s decision-making remains complex. If inflation plateaus or core components such as housing and services remain sticky, policymakers may choose to maintain their restrictive stance, creating opposing forces for both the dollar and gold prices.

Geopolitical Developments Drive Market Sentiment

Gold’s recent rally also reflects the influence of geopolitical events. The ceasefire agreement between Israel and Hamas has eased tensions in the Middle East, contributing to a broader risk-on sentiment in global markets. Additionally, signs that President Trump may relax restrictions on Russia in exchange for progress toward resolving the Ukraine war have further encouraged investor optimism.

While such developments stabilize risk-sensitive markets, gold’s role as a safe haven underscores its relevance amid lingering geopolitical uncertainties. Any unexpected escalation in global conflicts could quickly reverse risk-on trends and refocus investor attention on gold as a protective asset.

Upcoming Bank of Japan Policy Announcement

The Bank of Japan (BOJ) will release its monetary policy this Friday, an event anticipated to introduce significant volatility into global financial markets. The BOJ has maintained ultra-loose monetary policies, but with inflationary pressure building, markets are keen to see whether the central bank signals a more hawkish stance. A policy adjustment could strengthen the yen, weakening the US Dollar and influencing gold prices indirectly.

For gold investors, changes in BOJ policy may create additional buying opportunities or short-term volatility, particularly as the yen remains a key player in currency markets. Gold, priced in USD, often reacts strongly to shifts in global currency dynamics.

ECB Governor Lagarde’s Remarks on Eurozone Policy

Today, investors await comments from ECB Governor Christine Lagarde regarding the Eurozone’s monetary policy. The euro has been under pressure from concerns over sluggish growth and persistent inflation. Lagarde’s comments could set the tone for the euro’s next moves, with dovish signals likely to weigh on the currency and hawkish indicators potentially driving its strength.

Given gold’s sensitivity to currency fluctuations, the euro’s movement in response to Lagarde’s guidance will have implications for XAU/USD. A weaker euro could boost the dollar, tempering gold’s ascent, while a stronger euro may provide indirect support for gold by limiting the dollar’s gains.

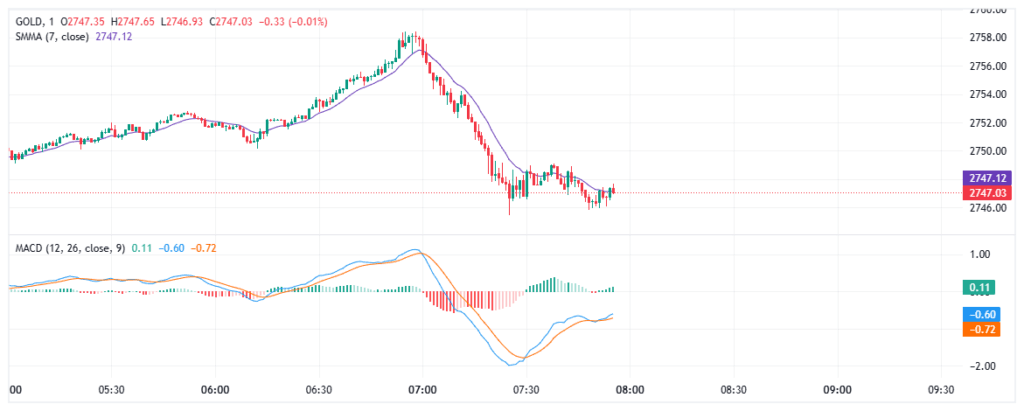

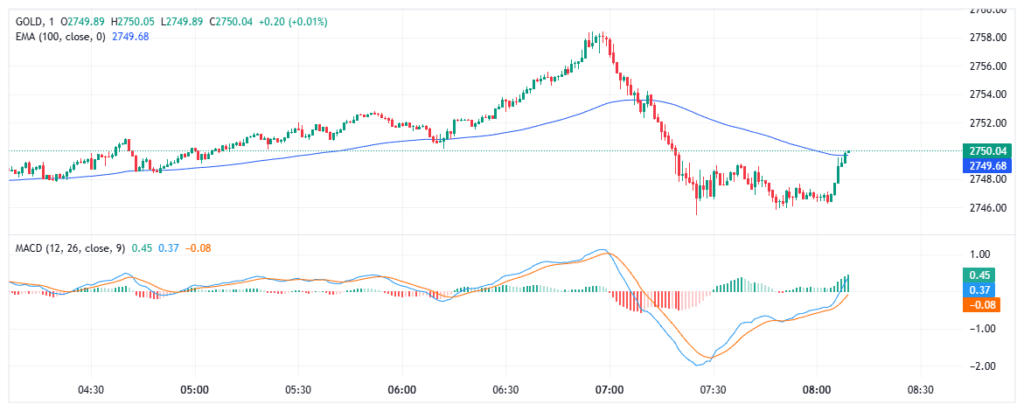

Technical Analysis of Gold Prices

From a technical standpoint, gold prices have breached the $2,720 supply zone, signaling strong bullish momentum. A sustained rally beyond the $2,750 resistance level could act as a springboard for gold to challenge its historic apex of $2,790, last recorded in October 2024. This milestone, often seen as a psychological barrier, could ignite further bullish sentiment, propelling prices into uncharted territory.

However, markets rarely move in a straight line, and short-term pullbacks could emerge as opportunities for dip buyers. Investors are likely to focus on critical support zones like $2,725–$2,720, which serve as near-term safety nets, followed by the deeper $2,700–$2,690 range. A slip below these levels may bring the $2,625 mark into play, a level fortified by the convergence of the 100-day Exponential Moving Average (EMA) and a sturdy ascending trend line. These technical cues are pivotal, offering both traders and long-term investors a clearer framework for navigating price retracements.

How These Factors Interact and Influence Gold

The interplay of these macroeconomic and geopolitical events is creating a complex and dynamic environment for gold traders. Key factors, such as the Federal Reserve’s reaction to inflation, potential shifts in BOJ and ECB policy, and trade tensions sparked by US tariffs, collectively shape the market outlook. Gold’s dual role as both a safe-haven asset and a protective hedge against currency fluctuations ensures its continued relevance in uncertain times.

A weaker dollar, lower interest rates, and escalating geopolitical risks all provide tailwinds for gold. On the other hand, any unexpected hawkish moves by central banks or easing of global uncertainties could challenge further upside. Traders will need to closely monitor inflation data, monetary policy announcements, and geopolitical developments to make informed decisions.

Outlook for XAU/USD

Gold’s recent rally positions it near critical resistance levels, with its all-time high in sight. Investors should keep a watchful eye on upcoming events such as the BOJ monetary policy release, Lagarde’s remarks on Eurozone dynamics, and further Fed developments influenced by inflation trends. Each of these factors will play a critical role in determining whether gold achieves its ultimate breakout or faces renewed consolidation.

For now, gold remains a key asset for balancing risk amid a volatile global landscape, with the potential to deliver gains for both short-term traders and long-term investors.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.