Get ready for a packed week in the markets! Keep an eye on the S&P 500, gold, and the US dollar. We’ll also be watching important economic reports from the Euro Area Retail Sales, Japan Econ Watchers RBA, China Inflation, and US ISM.

EUR/USD bounces back above 1.0700 on positive economic news from the US. The latest data reveals a slowdown in the US service sector and has weakened the value of the US dollar, leading to an upswing in favour of the EUR/USD pair.

Stay informed and stay ahead of the game.

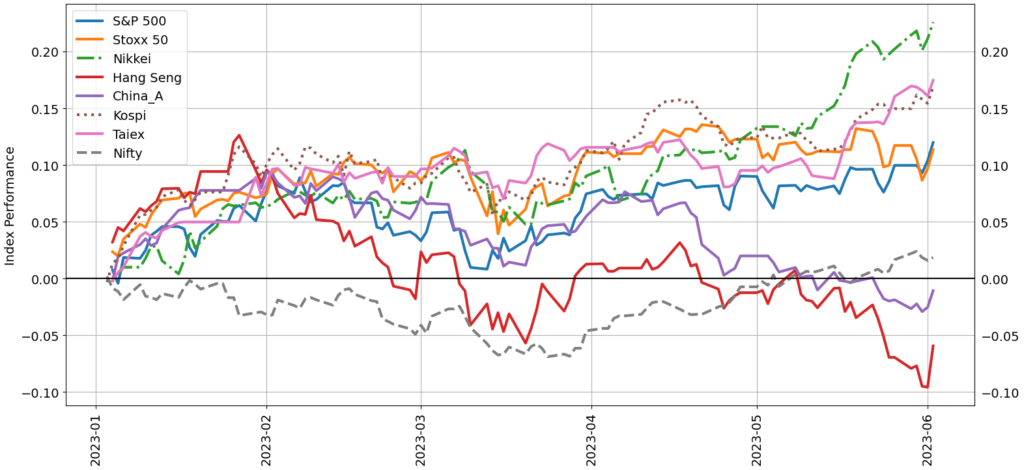

Markets around the world rallied, with US equities leading the charge. Investors breathed a sigh of relief upon hearing that a debt ceiling bill had been passed in Washington, which successfully avoided a potential US default.

Removing a major uncertainty, the passage of the legislation resulted in solid gains for the S&P 500 and Nasdaq 100 in the US, and the Hang Seng and Nikkei 225 indices in Asia. While the German DAX 40 saw a modest increase, the UK FTSE 100 slipped.

Good news for the US economy as recent data has exceeded expectations, particularly nonfarm payroll growth in May. This points to a strengthening labor market, combined with inflation moderation and economic growth, which has placed equities in an advantageous position.

The US Federal Reserve is expected to pause rate hikes, with the market now reflecting a 74% chance of this at the upcoming FOMC meeting.

While this may signal the end of the current tightening cycle, it’s important to note that Fed officials are still monitoring data and may adjust policy accordingly.

This week, watch for several key economic indicators including services PMI for the US and China, as well as interest rate decisions and GDP figures for Australia, Japan, and the Euro area.

Table of Contents

ToggleCurrency Forecast

The Euro had a disappointing week, losing ground to the GBP and JPY. With few upcoming catalysts, there is uncertainty about whether the Euro will bounce back.

The British Pound had a strong week, as the market expects UK interest rates to continue increasing.

The Australian Dollar experienced a slight increase, but the RBA’s role in the future is uncertain.

The US Dollar took a break last week, with a tight labor market possibly leading to more tightening by the Fed in July. With few economic reports this week, Wall Street is the primary focus.

Gold’s outlook appears to be bearish, as the US economy remains strong and the Federal Reserve may continue rate hikes later this year.

U.S. stocks had a favorable week, with a more dovish Fed and a debt ceiling deal. However, there are signs of overheating in the coming weeks.

Keep Watch on EUR/USD as it Falls Below 1.0700 Prior to Crucial Events and Lagarde’s Speech

Important Events This Week in the Euro Area:

Germany Final Services PMI/Balance of Trade,

EMU Final Services PMI/Sentix Index/Producer Prices on Monday;

Germany Construction PMI/Factory Orders, EMU Retail Sales on Tuesday;

Germany Industrial Production on Wednesday; and

EMU Flash GDP Growth Rate on Thursday.

Issues on the Horizon: ECB Hiking Cycle Continuation in June and July (and September?), Impact of Russia-Ukraine Conflict on Growth and Inflation Outlook in the Region, and Risks of Inflation Becoming Firmly Established.

Get Ahead with These Key EUR/USD Levels

The EUR/USD is currently experiencing a 0.13% decrease, sitting at 1.0692.

Watch out for a possible dip below support levels at 1.0635 (May’s monthly low) and 1.0516 (March’s low). The ultimate low lies at 1.0481 (last seen in January 2023).

However, an increase above 1.0779 (June’s weekly high) could spur an upward trend towards 1.0810 (100-day SMA) and 1.0885 (55-day SMA).

Focus Shifts To Fed’s Rate Forecast As Us Debt Ceiling Issue Resolved

The US debt default crisis has been averted, and investors may now shift their focus to the US Fed rate outlook. The latest US May non-farm payroll report has increased interest rate expectations, with the possibility of a 25 basis-point move from the Fed in July.

Despite this, the unemployment rate has slightly increased, and wage growth remains weaker than expected. The US dollar is on the rise, while gold and silver prices are under pressure due to a broader increase in Treasury yields.

Although reports of potential oil production cuts by Saudi Arabia in July initially boosted oil prices, the rally was short-lived, reminding investors of a similar event in April.

Brent crude prices may see a sustained upside, but will face several resistance levels, including the US$78.60 and US$80 levels, before reaching their April 2023 high.

“OPEC+ Production Cuts Trigger Crude Oil Price Surge – Will WTI Rise Higher?”

OPEC+ announced a cut in its output target effective from July 1st, causing crude oil to open at a 5-week high on Monday. While Saudi Arabia will bear the brunt with a reduction of 1 million barrels per day, other nations’ production targets remain mostly unchanged.

The move was hinted at earlier by the Saudi Arabia Minister of Energy. Meanwhile, strong US jobs data caused the US Dollar to strengthen, but uncertainty about Fed policy at the upcoming June 14th meeting may lead to volatility in oil prices.

Weekly Forecast for Japanese Yen: How the Fed’s Ambiguous Decision Affects USD/JPY, AUD/JPY and EUR/JPY

US Federal Reserve officials have made dovish remarks, causing a shift in rate hike expectations and leading to a potential pause in the June 13-14 FOMC meeting. This has caused a plunge in the Japanese yen, and market analysis predicts a 79% chance of a hiatus in the coming meeting.

While some see this as the end of the tightening cycle, others argue that it is still too early to say. What does this mean for USD/JPY, EUR/JPY, and AUD/JPY?” Keep it here for updates.

“USD Dominates as Crude Oil Fluctuates – Will it Stay on Top?”

The US Dollar is making slow but steady gains after Friday’s rally due to positive jobs reports. Currency markets have been relatively quiet, but APAC equity indices have had a positive day.

Wall Street gained last week after the resolution of the debt ceiling deal, and China’s Caixin services PMI May reading beat expectations.

The OPEC+ production cut agenda is also affecting the market. Crude prices spiked temporarily but have since settled. Treasury yields remain elevated, and the Federal Open Market Committee meeting is rapidly approaching.

The US can expect factory and durable goods orders data this week, followed by monetary policy decisions from the RBA and Bank of Canada.

Keep an eye on the TraderFactor’s calendar for more events.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.