Impressive Earnings Report

Nvidia, the renowned technology company, has reported an exceptional earnings report that has surpassed all expectations. The company’s sales for the quarter reached a staggering $13.5 billion, exceeding analysts’ projections of $11.2 billion.

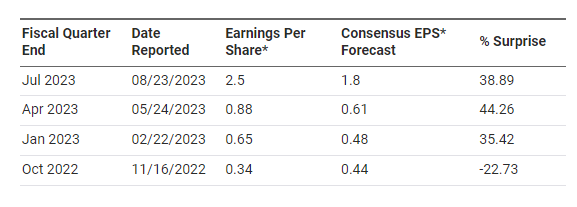

Similarly, Nvidia’s earnings per share came in at $2.45, surpassing estimates of $2.08. This remarkable performance highlights the company’s continued growth and success in the market.

One of the key factors driving Nvidia’s impressive earnings report is its datacenter unit. This division recorded revenue of $10.32 billion, representing a remarkable 171% year-over-year increase.

The demand for artificial intelligence (AI) applications, such as machine learning and data processing, has been a significant driver of this growth. Nvidia’s expertise in providing high-performance GPUs tailored for AI workloads has positioned the company as a leader in the industry.

Sales Projection

Looking ahead, Nvidia remains optimistic about its future sales. The company expects to achieve sales of $16 billion in the current quarter, outperforming analysts’ projections of $12.6 billion. This projection reflects the strong momentum and market demand for Nvidia’s products and services.

Stock Surge

Following the release of the impressive earnings report, Nvidia’s stock experienced a surge in after-hours trading. The share price rose by 7% to over $500, approaching its previous record high of $482. This surge signals investor confidence and recognition of Nvidia’s strong financial performance.

Valuation Soars

Nvidia’s outstanding earnings report has had a profound impact on its market valuation. The company’s market capitalization, which measures the total value of its outstanding shares, skyrocketed from under $300 billion to nearly $1.2 trillion. This represents a share price surge of over 300%.

Nvidia now joins the exclusive group of only six companies worldwide valued at over $1 trillion. The market’s response underscores the significance and potential of Nvidia’s AI-focused business.

Impact on the Market

Nvidia’s impressive earnings report not only validates the growing importance of AI in the technology sector but also brings optimism to the overall market.

The company’s success demonstrates the potential for companies specializing in AI technology to deliver robust financial results. It is likely to influence investor discussions, market trends, and inspire further investments in AI-related businesses.

Gaming Segment vs AI Focus

While Nvidia’s overall performance has been outstanding, its gaming segment faced a slowdown during the reported quarter. Revenues from the gaming division declined by 20%, primarily due to challenging market conditions and supply chain disruptions. As a result, gaming now accounts for only 19% of Nvidia’s total sales, down from 47% two years ago.

Nevertheless, Nvidia’s strong focus on AI-driven technologies and its thriving datacenter unit have more than compensated for the decline in the gaming segment.

The Evolution of Nvidia Stock: A Journey to Technological Dominance

Nvidia Corporation, a name synonymous with cutting-edge technology and innovation, has had a remarkable journey in the stock market. As one of the most influential players in the technology industry, Nvidia’s stock history tells a compelling story of growth, adaptation, and dominance.

Early Years

Paving the Way for Graphics Processing In the late 1990s, Nvidia made its mark with its initial public offering (IPO) in 1999. The company quickly gained attention for its graphics processing units (GPUs), which revolutionized the gaming and visual computing industries.

Collaborations with prominent computer manufacturers and game developers propelled Nvidia’s growth during this period, cementing its position as a leader in the graphics technology space.

Rise to Prominence

Expanding Horizons Between 2007 and 2015, Nvidia experienced a surge in prominence. The company continued to innovate its GPU technology, delivering powerful and efficient solutions. This led to expansions into new markets such as mobile devices and automotive industries. Partnerships with leading tech companies further solidified Nvidia’s influence, while its stock price soared, reflecting investor confidence and market recognition.

Expansion into AI and Data Centers

Seizing the Future The year 2016 marked a significant turning point for Nvidia. Recognizing the transformative potential of artificial intelligence (AI), the company shifted its focus towards developing high-performance GPUs specifically tailored for AI workloads. This strategic move proved to be a game-changer. Nvidia’s GPUs became indispensable tools for AI researchers and developers, driving the company’s growth in the datacenter business segment.

With the proliferation of AI applications in various industries, Nvidia’s stock performance surged. The company’s data center unit recorded exceptional revenue growth, reflecting the increasing demand for AI-driven technologies. Nvidia’s stock prices and market valuation skyrocketed during this period, propelling it into the elite club of trillion-dollar companies.

Recent Performance and Financial Highlights

A Testament to Success In recent years, Nvidia has continued to achieve remarkable milestones. The company’s earnings reports have consistently exceeded expectations, showcasing its ability to deliver strong financial performance. Stock price fluctuations have been closely monitored by investors, as Nvidia’s exceptional growth trajectory has attracted significant attention. The company’s market capitalization has soared, underscoring its position as a leading player in the tech industry.

A Legacy of Innovation and Success The history of Nvidia stock is a testament to the company’s unwavering commitment to innovation, adaptability, and technological prowess. From its early strides in graphics processing to its game-changing foray into AI and datacenters, Nvidia has consistently pushed boundaries and set new industry standards.

As we look ahead, the future appears bright for Nvidia. With its continued focus on AI-driven technologies, strategic partnerships, and a track record of success, Nvidia is poised to shape the future of technology and maintain its dominant presence in the stock market.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.