The US services sector continued its growth streak in August, marking eight consecutive months of expansion, according to the latest Services ISM Report On Business. With the sector showing signs of strength, the dollar has gained momentum and may have a significant impact on the euro.

Currency traders experienced a whirlwind of activity on Wednesday as the US dollar took center stage. Despite trading relatively placidly during European trading hours, the euro suddenly became the topic of discussion.

This shift in sentiment was driven by bullish statements from European Central Bank members, highlighting that the possibility of another interest rate hike in September was not being factored into the markets. As a result, the euro spiked momentarily.

The landscape changed drastically at 14:00 GMT, as the euro tumbled to its lowest level in three months while the US dollar index reached a six-month high.

This sudden turnaround was triggered by the latest data from the Institute for Supply Management (ISM), which revealed strong numbers across the board and a particularly impressive increase in the Purchasing Manager Index (PMI) from 52.7 to 54.5. This exceeded expectations, as analysts had predicted a slight decline to 52.5.

Table of Contents

ToggleBank Of Canada Maintains Rate at 5%

The Bank of Canada has announced its decision to maintain the policy interest rate at 5%. Despite facing a period of weaker growth, the central bank believes it is necessary to keep the current rate in place. This decision comes as global growth slows and inflation remains a concern.

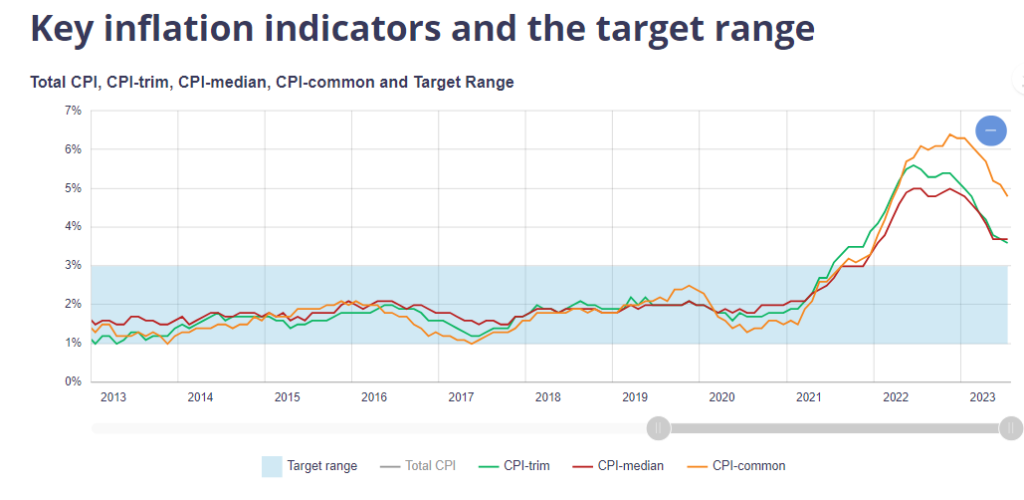

Inflationary Pressures Remain Broad-Based

While inflation in advanced economies has decreased, the Bank of Canada notes that inflationary pressures remain broad-based. Year-over-year and three-month measures of core inflation are running at about 3.5%, indicating persistent inflationary pressures. Achieving the 2% inflation target remains a priority for the central bank.

Factors Considered in Decision-Making

Various factors are taken into account by the Bank of Canada when making policy rate decisions. These include core inflation dynamics, CPI inflation, excess demand, inflation expectations, wage growth, and corporate pricing behavior. The central bank closely evaluates these factors to ensure price stability and make informed decisions.

Continuation of Quantitative Tightening Measures

Alongside maintaining the policy rate, the Bank of Canada has also decided to continue with its quantitative tightening measures. These measures aim to reduce the level of monetary stimulus in the economy. With household credit growth slowing due to higher rates, the central bank believes it’s important to further restrain spending.

Concerns about Weaker Growth

While wage growth has remained relatively strong at around 4% to 5%, the Bank of Canada has expressed concerns about the weaker growth in the Canadian economy. The central bank is prepared to raise the policy interest rate further if necessary to address these concerns and stimulate economic growth.

Future Outlook

The Bank of Canada’s next announcement for the overnight rate target is scheduled for October 25, 2023. Alongside this announcement, the central bank will release its next full outlook for the economy and inflation in the Monetary Policy Report. This report will provide insight into the Bank’s expectations and any associated risks.

Market Reaction: USD/CAD Surges Amid Bank of Canada’s Hawkish Stance on Inflation

The USD/CAD showed strong reaction, experiencing volatility as it soared to a daily high of 1.3676. This surge came after the Bank of Canada chose to keep interest rates unchanged while expressing concerns about underlying inflationary pressures.

Looking at the technical side, there is potential for further gains if the pair can reclaim its daily high. On the downside, support is expected at the 200-HSMA at 1.3584 and this week’s low of 1.3575.

During the North American session, the USD/CAD remained highly volatile in response to the Bank of Canada’s decision. As of now, the pair is trading within a wide range of 1.3630/70.

Export-Driven Growth and Investment Fuel Australian Economy in Q2 2023

Economic Growth Driven by Exports and Investment

According to the Australian Bureau of Statistics (ABS), the Australian economy grew by 0.4% in the June quarter of 2023. This growth was primarily driven by exports and investment, with new investment increasing strongly across both private and public sectors.

However, households continued to cut back on discretionary spending, leading to a decrease in the household saving ratio from 3.6% to 3.2%.

Terms of Trade Decline and Export Increase

The terms of trade, which measure the ratio of export prices to import prices, fell by 7.9%. Despite this decline, exports increased for the fifth consecutive quarter, and production rose in 15 out of 19 industries. However, the operating surplus declined due to lower commodity prices.

Continued Growth in Compensation of Employees

The tight labor market contributed to continued growth in compensation of employees (COE). Final consumption expenditure (FCE) increased in various categories, indicating positive consumer activity. Additionally, gross fixed capital formation (GFCF) saw an increase in machinery and equipment, ownership transfer costs, and intellectual property products.

Changes in Industry Performance

While there were overall positive trends, several industries experienced changes in performance. Rises were observed in travel services, coal, other mineral fuels, non-monetary gold, and civil aircraft & confidentialized items. On the other hand, falls were observed in wholesale trade, mining, retail trade, farm, manufacturing, and several other sectors.

Regional Variations in Economic Performance

The states of Victoria, New South Wales (NSW), and Queensland experienced rises in economic indicators. However, there was a fall in mining, while dwellings owned by persons, financial corporations, and public non-financial corporations saw a rise.

Agriculture experienced growth, but forestry, fishing, mining, iron ore mining, oil and gas extraction, other mining, and exploration and mining support services experienced falls.

Utility and Construction Sectors Show Positive Trends

In terms of utilities, there were rises in electricity, gas, water and waste services, including electricity supply, water supply and waste services, and gas supply. The construction and construction services sectors also saw rises, particularly in heavy and civil engineering construction and building construction.

These developments highlight the complex dynamics of the Australian economy in the June quarter of 2023, with both positive and negative trends impacting various sectors.

Australian Bureau of Statistics

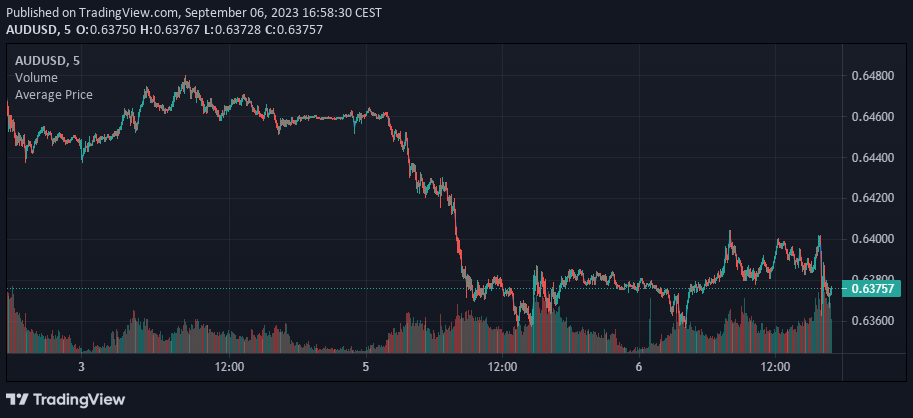

Market Reaction: Australian Dollar Surges as GDP Beats Expectations

Early Wednesday, the Australian Dollar experienced a surge in buying activity following positive Gross Domestic Product (GDP) data for the April-June quarter.

The economy maintained a steady growth rate of 0.4%, surpassing expectations of 0.3%. Although Q2 GDP declined to 2.1% from Q1’s 2.4% growth rate on an annualized basis, it still exceeded predictions of 1.7%.

Analyst Opinion

In the world of finance and trading, staying updated on market trends and economic indicators is crucial for making informed decisions. With fluctuating currency values, traders are closely monitoring the impact of various factors on different currencies.

Today, strong ISM data has significantly boosted the US dollar, causing the euro to decline in value. This shift can be attributed to positive economic indicators and investor confidence in the US economy.

Furthermore, central banks play a pivotal role in shaping monetary policies and influencing currency markets. For instance, the Bank of Canada’s decision to maintain its policy rate at 5% indicates a cautious approach amidst weaker growth prospects.

The central bank’s focus on managing inflationary pressures emphasizes their commitment to maintaining stability in the Canadian economy.

Meanwhile, the Australian economy has shown resilience, with export-driven growth and increased investment contributing to positive GDP growth. Despite some challenges in household spending, exports have continued to rise, supporting the overall economic performance. Traders are observing these developments and analyzing their potential impact on currency pairs like USD/CAD and AUD/USD.

As traders navigate through the ever-changing financial landscape, it is essential to consider a wide range of factors, including economic data, central bank decisions, and global market trends. Staying informed and adapting to market dynamics are key skills for successful trading in the world of finance.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.