U.S. GDP and PCE data expected. EUR/USD remains resilient above 1.0700 in today’s European trading session. Despite a risk-off sentiment permeating global markets, the Euro benefits from a renewed downturn in the US Dollar’s fortunes. Traders have set their sights on the impending release of pivotal US economic data, with expectations shaping market dynamics ahead of the announcement.

The upcoming US Bureau of Economic Analysis report is highly anticipated, promising the first glimpse at the annualized real Gross Domestic Product (GDP) growth for the first quarter.

Table of Contents

ToggleEUR/USD Holds Gains Amid US Dollar Weakness

Market consensus leans towards a projection of 2.5% growth, a slight deceleration from the 3.4% uptick observed in the last quarter of 2023. This key data point could steer the currency pair’s direction as market participants recalibrate their positions in response to the US economic pulse.

EUR/USD Intraday Analysis

- Asset: EUR/USD

- Recommendation: BUY

- Entry Price (Pivot): 1.0671

- Target and Take Profit levels (TP): 1.0793

- Stop Loss level (SL): 1.0631

- Comments: The currency pair has broken out of its prior triangle formation, signaling upside momentum.

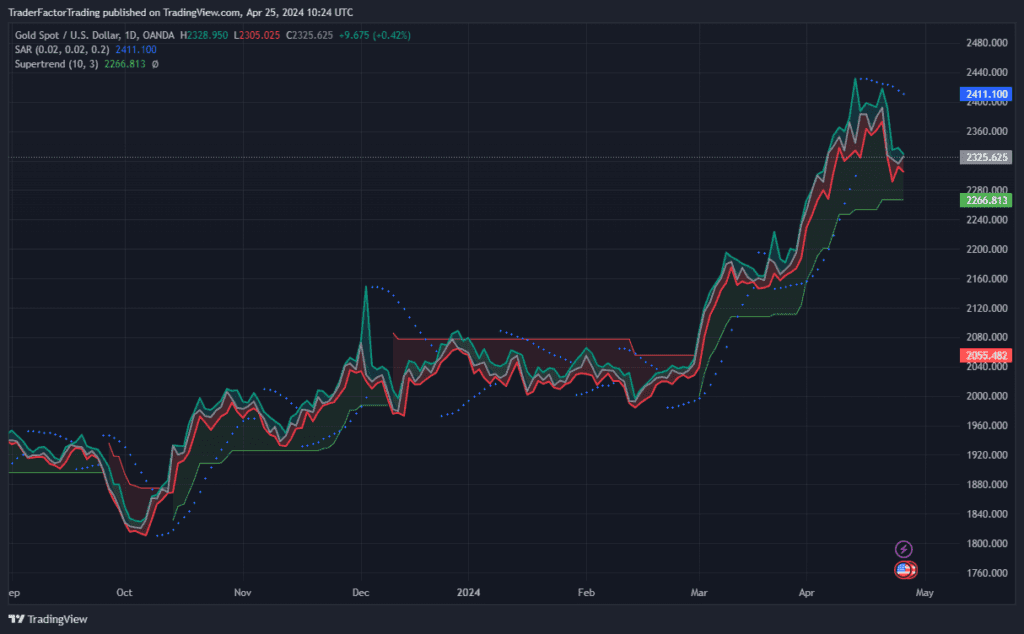

Gold Prices Edge Higher Amidst Dollar Downturn

Amid a backdrop of weakening USD and softening risk appetite, gold prices find themselves in a position of strength. The precious metal, currently orbiting the $2,300 mark, appears to be reversing a three-day downtrend thanks to bargain hunters. However, expectations for a substantial rally remain tempered as traders await further economic indicators.

Attention is firmly fixed on the duo of forthcoming US economic reports – today’s Advance Q1 GDP and tomorrow’s Personal Consumption Expenditures (PCE) Price Index. These figures not only provide insight into the health of the US economy but also serve to influence Federal Reserve policy expectations moving forward, hence shaping the trajectory for both the Dollar and gold prices.

Gold Intraday Analysis

- Asset: Gold

- Recommendation: BUY

- Entry Price (Pivot): 2291.3

- Target and Take Profit levels (TP): 2350.3

- Stop Loss level (SL): 2270.7

- Comments: Signs of a bottom-forming in price action hint at potential for upswing.

XAUUSD Chart

GBP/USD and USD/JPY Watch

In other currency news, GBP/USD extends its recent upturn, breaching 1.2500 as the Dollar retreats further. Market players are repositioning in anticipation of the US GDP data release, affecting sentiment and currency valuation alike.

Conversely, USD/JPY forges new highs, touching levels not seen since 1990. The Yen struggles against a strong Dollar despite concerns over potential intervention, with the focus also shifting towards the upcoming US GDP figures and the Bank of Japan’s decision this Friday.

Key US GDP and PCE Data in the Spotlight

Advance GDP q/q

This metric offers an early estimate of the country’s economic growth rate over the quarter. Strong or improving readings suggest economic expansion, likely bolstering the USD.

Pending Home Sales m/m

A key indicator of housing market health, changes in the number of homes under sales contracts can influence USD movement through implications on consumer confidence and spending patterns.

Unemployment Claims

Weekly data on the number of individuals filing for unemployment insurance for the first time. Rising claims can indicate worsening labor market conditions, potentially weakening the USD.

Each of these data points provides traders and investors with vital insights into the US economy’s performance, potentially swaying currency values and setting the tone for market activity in the sessions to follow.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.