If you’re wondering about the significance of Poi in Forex trading, let’s break it down for you. Poi, which stands for Point of Interest, is crucial in analyzing price movements and making informed trading decisions. By identifying key levels on price charts, you can better understand market dynamics and potentially enhance your trading strategies. It differs from traditional support and resistance levels, offering a unique perspective on market behavior. Learning how to utilize it effectively can provide you with valuable insights and help you navigate the complexities of the Forex market with more confidence.

Navigating the financial markets requires more than just a basic understanding of price movements. Successful traders use advanced concepts to gain an edge, and one of the most powerful tools in their arsenal is the Point of Interest, or POI. Understanding POI trading allows you to pinpoint optimal entry and exit points with greater precision. This guide will explain what POI trading is, how it differs from similar concepts like order blocks, and how you can use it to identify high-probability zones.

Table of Contents

ToggleWhat is a Point of Interest (POI) in Trading?

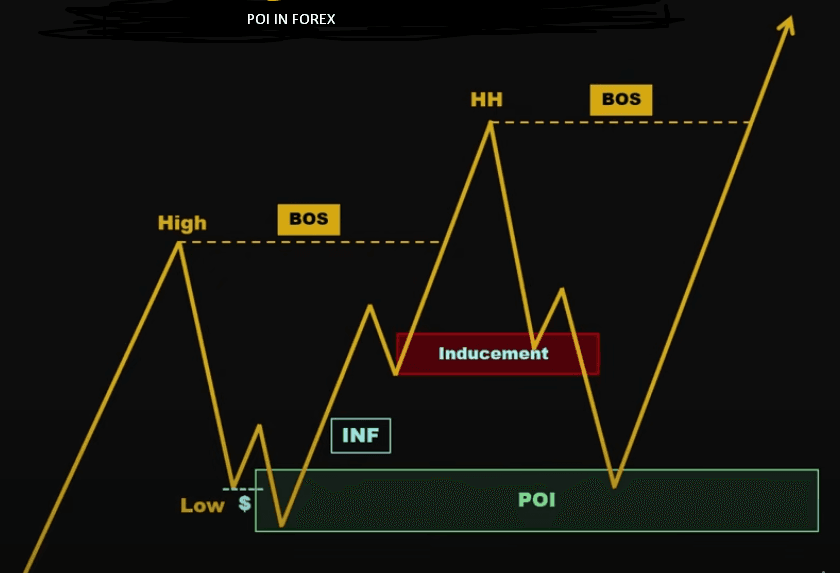

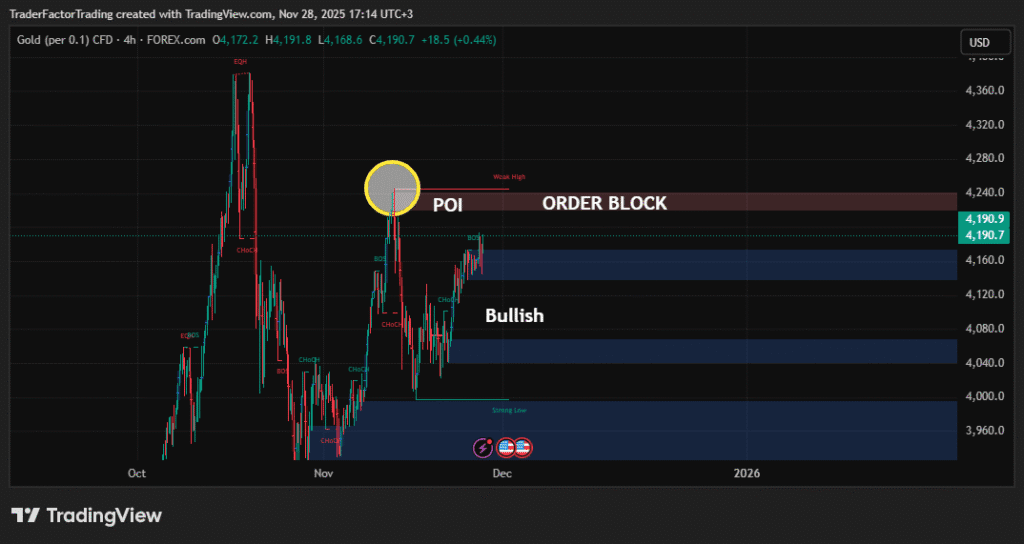

A Point of Interest (POI) is a specific price area on a chart where a significant market reaction is expected to occur. Unlike other zones, a POI is defined by its interaction with market liquidity. It is a specific zone, often created by a single candle, that has swept liquidity from a previous high or low before a strong price move.

Many traders confuse POIs with order blocks. While they can sometimes overlap, they are not the same. An order block is simply the last up or down candle before a significant move in the opposite direction. A POI, however, is an order block that becomes highly significant after it has induced and then swept liquidity. This sweep is what gives the POI its high-probability nature, as it indicates that large institutional players have accumulated their positions.

The Critical Role of Liquidity Sweeps

The theory behind POI trading is that the market needs liquidity to move. Liquidity refers to the volume of buy and sell orders at various price levels. Areas with a high concentration of orders, such as above previous highs or below previous lows, act as magnets for price.

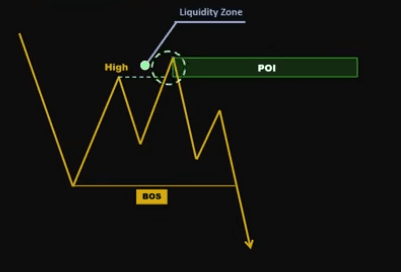

A liquidity sweep occurs when the price moves just beyond a key high or low to trigger the stop-loss orders of retail traders. Once these orders are triggered, institutional players can fill their large positions, causing a sharp reversal. A high-probability POI is formed when a candle performs this liquidity sweep before initiating a strong trend. This action clears out weaker hands and fuels the subsequent move, leaving behind a clear zone for a potential re-entry.

If a price level or order block has not been preceded by a liquidity sweep, it is more likely to become liquidity itself. The price will often break through such zones to hunt for the liquidity resting beyond them.

Identifying High-Probability POI Zones

Identifying a valid POI requires a keen eye for specific market behavior. The process involves looking for key characteristics that signal institutional activity.

Bullish POI Scenario

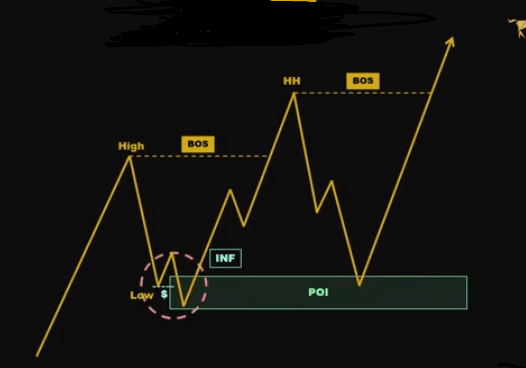

A bullish POI forms after the market has swept liquidity below a previous low. This indicates that sell-stop orders have been triggered, and large buyers have stepped in.

Here’s how to identify it:

- Look for a previous swing low in the market structure.

- Observe as the price moves below this low.

- The key is to find a single candle (the “last selling candle”) whose wick or body sweeps the liquidity below that low.

- Crucially, the price should immediately reverse and close back above the low within the same or next candle. The follow-up candle should not close lower than the sweep candle.

- This zone, created by the sweeping candle, becomes your high-probability bullish POI. Traders will watch for the price to return to this area to look for a long entry.

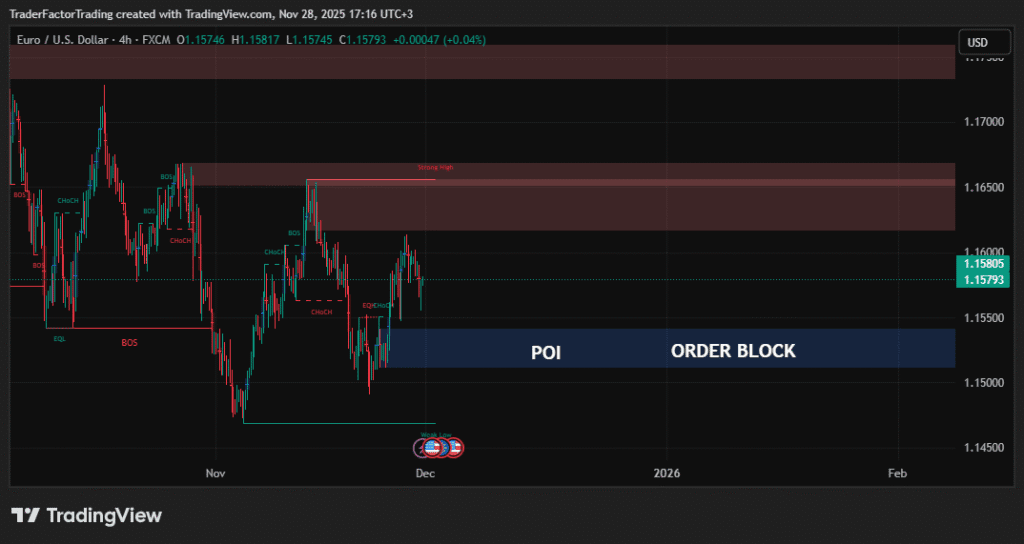

Bearish POI Scenario

A bearish POI is the mirror opposite. It forms after the market sweeps liquidity above a previous high, triggering buy-stop orders and allowing large sellers to enter the market.

Here’s how to identify it:

- Identify a previous swing high in the market structure.

- Watch for the price to move above this high.

- A single candle (the “last buying candle”) will sweep the liquidity with its wick or body.

- The price then immediately reverses and closes back below the high. The next candle should not close higher than the sweep candle.

- This area is now a high-probability bearish POI. Traders anticipate the price returning to this zone to seek a short entry.

POI Trading vs. Order Block Trading

The primary difference between POI trading and simple order block trading is context. Many traders will mark every order block they see after a break of structure and wait for the price to return. This often leads to losses because most of these zones are actually inducement traps.

Inducement is a market trap designed to lure traders into premature positions. For example, after a bullish break of structure, an obvious order block near the breakout point often serves as inducement. Retail traders will place buy orders there, creating a pool of sell-stop liquidity just below it. The market will often sweep this liquidity before moving to the true POI, which is typically located at a more extreme price level where a prior liquidity sweep occurred.

A true POI has already proven its strength by engineering a liquidity sweep. An ordinary order block, without this validation, is just a potential level that can easily fail. By focusing only on POIs that have swept liquidity, you filter out low-probability setups and avoid common market traps.

Actionable Tips for Effective POI Trading

Integrating POI analysis into your strategy can significantly improve your results. Here are some practical tips to get started:

- Prioritize Liquidity Over Everything: Always ask yourself, “Where is the liquidity?” before identifying a zone. Look for clean highs and lows where stop orders are likely to be resting. A POI is only valid if it has swept such a level.

- Use Multiple Timeframes: Identify a high-probability POI on a higher timeframe (e.g., 4-hour or 1-hour). Once the price returns to this zone, switch to a lower timeframe (e.g., 15-minute or 5-minute) to look for a confirmation entry, such as a change of character or a lower-timeframe break of structure.

- Distinguish Between Inducement and Valid POIs: Be skeptical of the most obvious levels. The first order block after a breakout is often an inducement trap. Look for the POI at the extreme of a move or a zone that has clearly taken out a previous swing point.

- Wait for the Single-Candle Sweep: The strongest POIs are formed by a decisive, single-candle sweep and an immediate reversal. If the price lingers above or below the liquidity level for several candles, the zone is weaker.

- Backtest Your Strategy: Before risking real capital, backtest the concept of POI trading at least 100 times. This will help you build confidence and train your eyes to spot these high-probability zones in real-time market conditions.

Importance of POI in Forex

Understanding the importance of Poi in Forex will help you make informed trading decisions based on key price levels. Market psychology plays a crucial role in determining these levels. Traders often gather around these points, creating clusters of orders that can influence price movements. Recognizing these points can give you an edge in your trading strategy. Additionally, it can serve as a significant level for implementing risk management techniques. You can effectively manage your risk exposure by setting stop-loss orders or profit targets near these levels. This strategic approach helps you protect your capital and optimize your trading performance.

Identifying Poi on Price Charts

To identify points of interest on price charts, you need to look for clusters of orders that indicate significant price levels. These clusters often signify areas where many traders have placed orders, making them crucial to watch.

When identifying trends, consider where these clusters form, as they can act as key support or resistance levels. You can gain valuable insights into potential market movements by analysing price action around these. Understanding the significance of price charts is essential for making well-informed trading decisions based on the behaviour of other market participants. Keep a keen eye on these areas to navigate the market more effectively.

Utilizing Poi in Trading Strategies

To implement successful trading strategies, incorporate its analysis into your decision-making process for improved market navigation. Its strategies utilize key trading indicators to identify potential entry and exit points in the market.

By analyzing Points of Interest on price charts, traders can gain valuable insights into market trends and potential price reversals. Integrating analysis into your trading strategies can help you make more informed decisions and increase the effectiveness of your trades.

These trading indicators serve as important tools in understanding market dynamics and predicting future price movements.

Support and Resistance Levels for Point of Interest

Incorporating its analysis into your trading strategy allows for comparing support and resistance levels, enhancing your ability to interpret market signals effectively. While support and resistance levels are based on historical price movements, Technical analysis identifies significant price levels based on clustering.

Unlike trendlines that connect swing lows or highs, it focuses on areas where the price has repeatedly reacted, indicating potential interest levels to traders. By understanding the differences between it and traditional support and resistance levels, you gain a more nuanced view of the market dynamics.

This comparative analysis can help you make more informed trading decisions by providing additional insights into the underlying market sentiment and potential price reversal points.

Tips for Using Points Effectively

To effectively use forex trading, familiarize yourself with common patterns and key price levels signifying potential trading opportunities. When using it effectively, it’s crucial to avoid common mistakes that can hinder your trading success.

One common error is relying solely on it without considering other technical indicators or fundamental analysis. It should complement your overall trading strategy rather than be the sole decision-making tool. Additionally, be cautious of overtrading based on signals alone, as it’s essential to maintain a disciplined approach to risk management.

Frequently Asked Questions

Can POI be used in conjunction with other technical indicators to improve trading strategies?

Yes, POI can be effectively used alongside other technical indicators to enhance trading strategies. By combining POI with tools like moving averages, RSI, or MACD, traders can confirm signals and improve the accuracy of their trades. This integration helps in developing a robust POI trading strategy that accounts for various market conditions.

How do traders determine the strength of a POI level compared to support and resistance levels?

Traders assess the strength of a POI level by analyzing its historical significance, trading volume, and frequency of price interaction. Unlike traditional support and resistance levels, a POI often incorporates additional factors such as market sentiment and order flow, offering a nuanced perspective on potential price movements.

Are there specific currency pairs or timeframes where it is more effective?

POI can be applied to various currency pairs and timeframes, but its effectiveness may vary. Traders often find it more beneficial in major currency pairs and during timeframes that align with their trading style—be it intraday, swing, or long-term trading. The adaptability of POI across different scenarios is a key advantage.

Can POI levels be used for both short-term and long-term trading strategies?

Absolutely, POI levels are versatile and can be tailored for both short-term and long-term trading strategies. Short-term traders may use POI to identify entry and exit points within a day, while long-term traders can leverage these levels to forecast broader market trends and significant price shifts.

Is there a specific way to adjust levels for volatile market conditions?

In volatile markets, traders can adjust POI levels by increasing their buffer zones or using dynamic indicators that account for rapid price changes. This flexibility allows traders to maintain the relevance of POI even under heightened market uncertainty, ensuring more stable trading decisions.

What does POI stand for in trading?

In trading, POI stands for Point of Interest. It refers to specific price levels or zones that are expected to influence market behavior due to historical data, psychological factors, or other trading dynamics.

What is a POI in forex?

In forex, a POI is a critical price point that traders monitor for potential market reactions. It signifies an area where price action could reverse, continue, or experience increased volatility, making it a focal point for forex trading decisions.

What does POI mean in money?

POI in the context of money refers to focal price areas that hold significance for traders, potentially affecting their financial decisions and strategies based on anticipated market movements.

What is POI in charts?

POI in charts denotes specific levels marked for their anticipated impact on price action. These points may correlate with historical highs or lows, trendlines, or other technical markers that suggest a potential change in market direction.

How to find POI in trading?

To find POI in trading, analyze historical price data to identify recurring levels where significant price movement occurred. Utilize technical analysis tools such as Fibonacci retracement and pivot points to pinpoint these areas effectively.

How to identify POI?

Identify POI by observing price patterns, volume spikes, and historical support/resistance levels. Traders can also refer to Point of Interest forex PDFs and resources that detail various types of POI in forex trading for further guidance.

How do I check my POI?

Checking your POI involves continuously monitoring identified levels for price action. Use charting software to set alerts and ensure that these points are actively influencing market behavior as expected.

What is the POI rule?

The POI rule refers to the guideline that traders should closely monitor and validate POI levels before making trading decisions. This rule emphasizes the importance of patience and confirmation to avoid premature market entries or exits.

How does POI work?

POI works by highlighting key price areas where traders anticipate significant reactions based on historical data and market psychology. These points guide decision-making and strategy formulation in various trading scenarios.

What is the purpose of POI?

The purpose of POI is to provide traders with strategic reference points that help in forecasting potential market movements. By focusing on these interest areas, traders can enhance their decision-making process and improve the precision of their trading strategies.

Who Are the Best Forex Brokers?

Here are some trusted multiregulated forex brokers suitable for all styles of trading :

M4 Markets: Learn how M4 Markets achieves competitive trading with low spreads and high leverage. Discover their unique account options and more.

OneRoyal: Known for its social trading platform, OneRoyal offers many educational resources and a convenient demo account for practice.

IronFx: This broker provides a simple platform and a risk management tool, helping you better control your trading risks.

MultiBank Group: Multibank stands out with exceptional customer support and a wide range of educational resources.

ActivTrades: Offers a user-friendly platform, extensive educational resources, and versatile demo accounts.

EightCap: EightCap wraps it up with an intuitive platform, top-notch educational materials, and an effective customer support team.

Conclusion

In conclusion, understanding the concept of Poi in forex trading is crucial for identifying key price action levels on charts. By utilizing Poi effectively in your trading strategies, you can make more informed decisions and potentially increase your chances of success in the market. Remember to use Poi alongside other indicators and tools to enhance your trading approach and maximize your potential. Happy trading!

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.