Day Trading for Beginners. “You know what they say: every journey begins with a single step, and in your journey into the world of day trading, that first step is gaining knowledge. You’re on the cusp of uncharted territory, a financial landscape where fortunes can be made and lost in the blink of an eye. This isn’t a world you should enter lightly or without preparation.

Day Trading for Beginners

To make the most of your day trading endeavours, you’ll need to understand various strategies, how the stock market operates, and how to manage risks effectively. So, are you ready to take that first step and learn the ropes of day trading?”

Table of Contents

ToggleUnderstanding Stock Market Basics

Before you start day trading, it’s crucial to understand the basics of the stock market, including how stocks are bought and sold, the importance of market indices, and the role of supply and demand in determining stock prices.

This is where market analysis comes in. To anticipate stock movements, you’ll need to scrutinize market trends, patterns, and fluctuations. This involves both technical analysis, which examines price movements and patterns, and fundamental research, which delves into a company’s financials and industry position.

Risk assessment is another key element. Day trading involves substantial risk, and it’s essential to have strategies in place to manage this. This might include setting stop losses to limit potential losses, diversifying your portfolio, and only investing money you’re prepared to lose.

Choosing a Reliable Broker

Once you’ve grasped the fundamentals of the stock market and developed a sound risk management strategy, your next step in day trading is selecting a reliable broker. Broker selection is crucial as it determines your trading platform, account security, and the level of customer support you receive.

When choosing a broker, consider factors like the trading platform’s user-friendliness, the security measures to protect your account, and the quality of customer support. A good trading platform will have intuitive, easy-to-use tools and features that significantly enhance your trading efficiency.

Account security is another critical aspect of broker selection. Ensure the broker has robust security measures, including two-factor authentication, encryption, and timely software updates.

Customer support should be responsive, knowledgeable, and able to assist you promptly if any issues arise.

Your broker plays a significant role in your trading journey, affecting your risk assessment and overall trading experience. Choose wisely.

| Broker Selection Factors | Importance | Tips |

|---|---|---|

| Trading Platform | User-friendly interface, efficient tools | Test platform with demo account |

| Account Security | Protects your funds and personal information | Check for two-factor authentication, encryption |

| Customer Support | Assists with issues, provides guidance | Ensure they’re responsive, knowledgeable |

Setting Up a Demo Account

After selecting a reliable broker, it’s essential to set up a demo account. This invaluable tool lets you practice your trading strategies without risking real money. This step gives you the freedom to explore the trading platform and understand different market scenarios. Let’s dive deeper into the benefits of a demo account.

- It’s a risk-free environment where you can develop your trading skills.

- You’ll gain hands-on experience with the trading platform, learning to place trades, set stop losses, and take profits.

- The simulation advantages of a demo account allow you to understand market trends and volatility better.

- It offers practice advantages such as testing your trading strategies and refining them.

- Virtual trading benefits include boosting your confidence, which is essential when you start real trading.

Setting up a demo account also provides trial account perks like familiarising with market indicators, trading charts, and financial instruments. Hence, this step is critical before you dive into the real world of day trading. Remember, practice makes perfect, so take full advantage of a demo account to hone your trading skills.

Developing Your Trading Strategy

As you delve deeper into the world of day trading, developing a solid trading strategy that aligns with your financial goals, risk tolerance, and trading skills is crucial. A good strategy starts with a thorough risk assessment. Understand the amount of capital you’re willing to risk per trade, ensuring it’s a percentage you can afford to lose.

Market analysis is next. Analyzing market trends and news will help you identify opportunities and avoid pitfalls. Use technical indicators, like moving averages and the relative strength index, to provide insight into potential market movements.

Emotional control is a vital aspect of your strategy. Trading can be a roller coaster of highs and lows, but letting emotions drive your decisions can lead to rash and often detrimental moves.

Lastly, always keep an eye on the profit potential of your trades. It’s not enough to just make profitable trades; you need to make trades that provide enough profit to cover your losses and provide a net return. With these elements in place, you’re on your way to crafting a viable day trading strategy.

Making Your First Investments

If you’re considering entering the world of day trading, your first investments should be carefully selected, taking into consideration your trading strategy, market analysis, and the amount of capital you’re willing to risk. It’s important to understand that day trading is not about making quick, easy money; it’s about consistently making good decisions, understanding the market, and managing risk effectively.

To help guide your first investments, consider these key points:

- Investment diversification: Don’t put all your eggs in one basket. Diversify your investments across various assets to spread the risk.

- Risk assessment: Understand the potential losses of each trade and ensure they align with your risk tolerance.

- Market analysis: Study market trends and indicators to make informed investment decisions.

- Trading psychology: Stay disciplined, avoid emotional decisions, and stick to your trading plan.

- Profit potential: Consider the profit potential of each trade, but don’t let greed drive your decisions.

Learning Day Trading Strategies

After making your first investments, mastering several-day trading strategies becomes your next crucial step towards achieving consistent profitability in this high-paced financial endeavour. Understanding and implementing risk management techniques is vital. These techniques help you determine how much you’re willing to lose on a trade, keeping your potential losses in check.

Market analysis strategies, such as technical and fundamental analysis, help you understand market trends and price movements. Technical analysis focuses on previous market trends, while fundamental analysis considers economic factors. Both strategies are crucial for successful day trading.

Grasping trading psychology is equally important. Emotions like fear and greed can impact your trading decisions, so staying emotionally detached and disciplined is essential when trading.

Performance tracking is another fundamental part of your day trading strategy. It involves assessing your trades and identifying areas of improvement. This will help you refine your strategies for better outcomes.

Lastly, assessing risk-reward ratios is crucial. This involves comparing a trade’s potential profits to its potential losses. A high risk-reward ratio means higher potential returns but also greater potential losses. Balancing this ratio is key to trading success.

Scalping: A Quick Profit Strategy

One of the most popular strategies day traders use is scalping. This strategy aims to capitalize on minute price changes throughout the trading day for quick profits. It involves making numerous trades, each generating small returns, which can add to significant profit maximization over time.

However, scalping is not without its challenges. Its time-sensitive nature requires a strong understanding of market movements and the ability to make quick decisions. Moreover, it requires a keen eye for spotting trends and patterns in the market.

Here are some key points to keep in mind:

- Effective scalping techniques include the use of technical analysis and price action.

- It’s crucial to manage your risk well to protect your capital.

- Watch out for pitfalls such as overtrading and high transaction costs.

- Implementing stop-loss orders can help manage potential losses.

- Stay disciplined and stick to your trading plan.

Trend Following: Playing the Market’s Movement for Day Trading for Beginners

While scalping requires a keen focus on minute-by-minute market changes, trend following takes a broader view, aiming to capitalize on larger market movements that occur over longer periods. Trend following involves trend analysis to interpret market trends and track price movement over time to determine potentially profitable trades.

To excel in trend following, you must master trend identification. This involves identifying the direction of the market trend: upward, downward, or sideways. You’ll rely heavily on trend indicators, such as moving averages, Relative Strength Index (RSI), and Average Directional Index (ADX), which can help you identify and confirm trends.

Here’s a quick guide to these key trend indicators:

| Trend Indicator | Purpose |

|---|---|

| Moving Averages | Reflects average price over a specific period, helping identify the trend direction |

| RSI | Measures speed and change of price movements, indicating overbought or oversold conditions |

| ADX | Quantifies the strength of a trend but doesn’t indicate its direction |

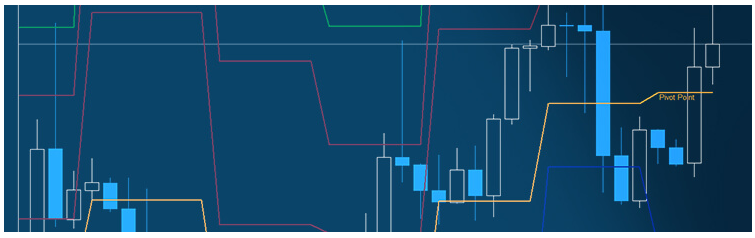

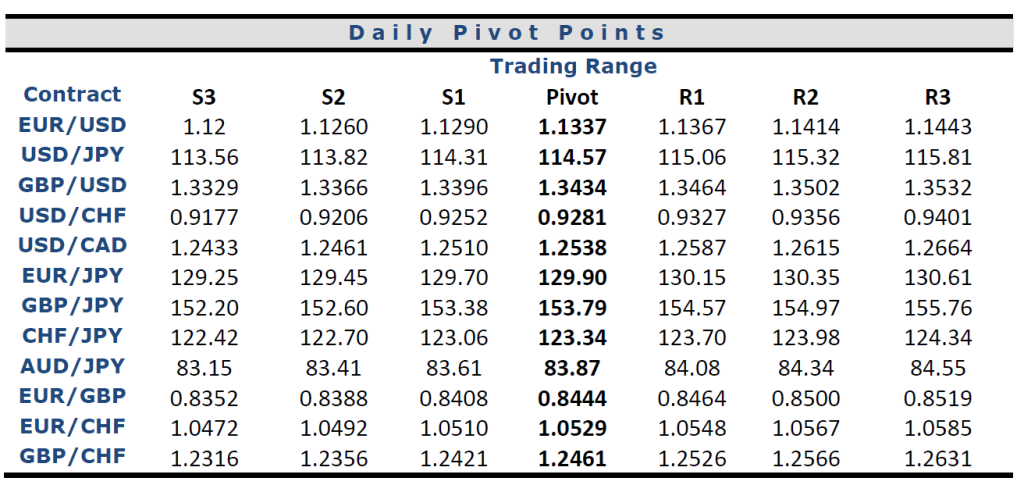

Mastering Pivot Points Strategy

Mastering the Pivot Points Strategy is a key skill you’ll need to develop to thrive in day trading. This popular method is used in technical analysis to determine potential support and resistance levels. It’s an advanced strategy requiring understanding market trends, but it can be incredibly effective when used correctly.

Here’s what you need to focus on:

- Understand the concept: Pivot points are calculated using the previous trading day’s high, low, and closing prices. These points are used as potential turning points for the market.

- Incorporate technical analysis: Combine pivot points with other technical indicators, such as moving averages or RSI, for more accurate predictions.

- Practice risk management: Always set stop-loss orders to limit potential losses.

- Enhance trading psychology: Stay disciplined and avoid emotional trading decisions.

- Refine your strategy: Backtest it and make necessary amendments to improve effectiveness.

Mastering pivot points can significantly improve your trading performance. It’s an essential part of your toolkit as a day trader, alongside other advanced strategies, risk management, and a solid understanding of trading psychology.

Momentum Trading: Riding the Wave

As you delve deeper into day trading, understanding momentum trading – a strategy that capitalizes on market volatility by focusing on stocks or other assets moving in a significant direction – becomes crucial to your success.

Momentum trading is all about riding the wave. You’ll use momentum indicators to identify assets showing strong upward or downward trends and then jump on board, hoping to catch some of the action. Volatility strategies come into play here, as you’ll need to be able to handle the rapid price swings that come with these trending assets.

However, with increased volatility comes increased risk, making risk management a vital component of any successful momentum trading strategy. By setting stop-loss orders and risking only a small percentage of your portfolio on any single trade, you can help limit your potential losses.

Range Trading: Profiting From Volatility

Building on momentum trading, range trading is yet another strategy to capitalize on volatility, although it requires a different approach. Here, the focus is on identifying stocks or assets that have established a clear high and low range. You’ll then aim to buy at the low end of the range and sell at the high end, effectively profiting from the price volatility within this range.

This method requires keen volatility management and strategy optimization. You need to constantly monitor the market, assess risks, and adjust your positions accordingly. Your market analysis skills help you identify suitable trading ranges and make informed decisions.

Key Aspects of Range Trading:

- Identifying clear trading ranges

- Proficient volatility management

- Rigorous market analysis for strategy optimization

- Careful risk assessment to protect your capital

- Intelligent position sizing to maximize profits

Familiarizing With Trading Terms

To navigate the world of day trading effectively, you’ll need to understand various trading terms that will frequently crop up in your journey. Understanding market trends is crucial. This involves analyzing the general direction in which the market moves, whether upward, downward, or sideways. This insight is key to deciding which securities to trade and when.

Next, you must master bid-ask spread analysis. This refers to the difference between the highest price a buyer is willing to pay for a security (the bid) and the lowest price a seller is willing to accept (the ask). A narrower spread often indicates higher liquidity, which is advantageous for day trading.

Candlestick chart interpretation is another essential skill. These charts provide visual insights into price movements within specified periods, revealing potential trading opportunities.

You should also be adept at leveraging opportunities. This means using borrowed capital to amplify potential returns, though be aware it also increases risk.

The Importance of Stop-Loss Orders

In the volatile landscape of day trading, understanding the importance of stop-loss orders becomes your safety net, helping to protect your investments from significant losses. They’re crucial tools for risk mitigation, providing a predetermined exit point if a trade goes against you. This safeguards your capital, ensuring you live to trade another day.

Managing risk is at the core of trading psychology. It’s about maintaining control, even when the market seems chaotic. Mastering this aspect of trading helps you make rational decisions and avoid emotional trading blunders.

Let’s look at why stop-loss orders matter:

- They help position sizing, allowing you to determine how much of a particular security you can afford without risking too much.

- They’re a part of your trade execution process, acting as a predefined exit strategy.

- They allow you to conduct technical analysis effectively, providing room to reassess your strategy if the market moves against you.

- They manage your trading risk, limiting potential losses.

- They instil discipline in your trading routine, detaching emotions from your trading decisions.

Incorporating stop-loss orders into your strategy is crucial in becoming a successful day trader.

Coping With Trading Stress

While mastering stop-loss orders helps mitigate financial risks, managing the psychological stresses that come with the ebbs and flows of day trading is equally crucial. Stress management is key to maintaining your emotional control and overall psychological well-being. Effective coping strategies include taking regular breaks to clear your mind, practising mindfulness, and maintaining a balanced lifestyle outside trading.

Building mental resilience is another significant aspect of handling trading stress. A resilient mindset helps you navigate through losses and setbacks without losing sight of your overall strategy. Regular exercise, sufficient sleep, and a healthy diet can boost mental stamina.

| Stress Management Techniques | Benefits |

|---|---|

| Regular Breaks | It prevents burnout, refreshes the mind |

| Mindfulness Practice | Enhances focus, reduces anxiety |

| Balanced Lifestyle | Improves overall well-being |

| Mental Resilience | Encourages quick recovery from losses |

| Healthy Diet & Exercise | Boosts stamina, improves concentration |

Maintaining Discipline in Trading

Maintaining a high level of discipline is arguably the most crucial aspect of successful day trading, as it’s too easy to let emotions drive your decisions. This trading discipline is what separates the successful traders from the unsuccessful ones. It’s about making informed decisions based on market knowledge, not gut feelings.

Emotional control is key. You can’t let fear or greed dictate your trades. Instead, use your risk management strategies to protect your capital and secure consistent profits. This requires a disciplined approach to each trade and strict adherence to your trading plan.

Here are a few tips to help maintain discipline in your trading:

- Always stick to your trading plan.

- Don’t let emotions influence your decisions.

- Employ strict risk management strategies.

- Constantly update your market knowledge.

- Aim for consistent profits, not home runs.

Seeking Help and Resources

As a beginner in day trading, don’t hesitate to seek assistance and tap into various resources to expand your knowledge, enhance your skills, and stay updated with market trends. It’s imperative to leverage the vast amount of information and guidance available.

Start by seeking mentorship opportunities. Experienced traders can provide invaluable insights, guiding you through complex market scenarios and helping shape your trading strategy. Utilizing online forums is another effective way to gain diverse perspectives. Engage in discussions, ask questions, and learn from the experiences of others.

Further, consider joining trading communities. These platforms provide a rich environment for interaction, fostering learning through shared experiences. Attending webinars or workshops can also provide deep insights into the mechanics of trading and emerging trends and strategies.

Lastly, never underestimate the power of exploring educational resources. Books, online courses, and tutorials can provide a solid foundation in trading principles. Combining these resources with practical experience can significantly improve your trading proficiency. Remember, continuous learning is not optional but necessary for success in the world of day trading.

Being Patient and Realistic

In day trading, keeping your expectations grounded and demonstrating patience, understanding that sizable returns won’t materialize overnight is crucial. This journey is not a sprint; it’s a marathon. You’ve got to be comfortable with your risk tolerance. The market doesn’t care about your desires or your profit expectations. It’s unpredictable and can be ruthless.

Market psychology plays an essential role in your trading mindset. Recognize that losses are part of the game, and emotional control is vital. This isn’t a get-rich-quick scheme, so don’t let greed cloud your judgment.

Consider these points to keep your patience and realism intact:

- Understand your risk tolerance, and don’t invest more than you can afford to lose.

- Study market psychology to anticipate trends and make informed decisions.

- Cultivate a trading mindset that emphasizes discipline, patience, and continuous learning.

- Set realistic profit expectations. Aim for consistent returns rather than hitting it big.

- Practice emotional control. Don’t let fear or greed dictate your trading decisions.

Gradually Increasing Trading Positions

Once you’ve grasped your emotions and established realistic expectations, it’s wise to consider incrementally increasing your trading positions. This process, known as position sizing, is a critical aspect of trade management.

However, don’t rush into it. Carefully conduct risk assessments, evaluating the likelihood of negative outcomes against your profit potential. Look at market trends and your personal trading history to make informed decisions. Remember, the goal isn’t just to increase profits and preserve your capital.

Take small steps. Increase your trading volume bit by bit while continually reassessing and adjusting your strategy. This approach lets you build experience and confidence without risking large chunks of your capital.

Watch your trades closely. This helps you react quickly to market changes, minimizing losses and maximizing profit potential. Develop a system to monitor your trades, utilizing tools and resources to make this task manageable.

Lastly, don’t forget about capital preservation. Even as you increase your positions, always ensure you have a safety net. This is a cornerstone of smart trading, providing a buffer against market volatility.

Importance of Risk Management

Navigating the world of day trading, you’ll quickly realize that risk management isn’t merely an option but an absolute necessity for long-term success. It’s not just about making profitable trades but also about protecting yourself from crippling losses. This is where risk mitigation and portfolio diversification come into play.

- Risk mitigation involves setting stop-loss orders and monitoring your trades to limit potential losses.

- Portfolio diversification spreads your investments across different assets to reduce risk.

Understanding trade psychology is crucial, too. It helps you control your emotions, make rational decisions, and stay disciplined in your trading strategy.

Position sizing is another key aspect of risk management. It involves determining the amount of capital to invest in a single trade based on your risk tolerance and the trade’s risk-reward ratio.

Finally, effective fundamental and technical market analysis helps you make informed trading decisions. It allows you to assess market trends, identify potential trading opportunities, and manage risks effectively.

Risk management is an integral part of your trading strategy that can make or break your day trading journey. So, give it the attention it deserves.

Sustaining Success in Day Trading

Despite the challenges, you can sustain success in day trading with consistent practice, strategic planning, and a disciplined approach to risk management. The key is developing a trading mindset, prioritising emotional control and risk management over quick profits. Let’s break down the essential success factors in detail.

| Success Factors | Description | Importance |

|---|---|---|

| Emotional Control | Ability to keep emotions in check | Prevents impulsive decisions and maintains focus |

| Risk Management | Strategy to limit losses | Protects your capital and ensures long-term survival |

| Trading Discipline | Adherence to your trading plan | Ensures consistency and reduces the impact of mistakes |

Emotional control is crucial, as trading can be stressful, and decisions driven by fear or greed often lead to losses. Implement risk management techniques like setting stop losses and risking only a small percentage of your capital on each trade.

Moreover, it maintains trading discipline. Stick to your plan even when the market is volatile, and don’t let emotions dictate your decisions. Always remember that maintaining discipline is more challenging on winning than losing days.

To conclude, sustaining success in day trading isn’t easy, but it is achievable with the right mindset and strategies.

Frequently Asked Questions

How much money do I need to start day trading?

You typically need $25,000 or more to trade with multiple positions.

Which trade is best for beginners?

For beginners, starting with low-risk trades in well-known stocks is advisable.

Can you learn day trading on your own?

Yes, many successful traders have self-taught through online resources and practice.

What time of day should I start day trading?

Most day traders find the first hour after the market opens to be the most active and thus prefer starting then.

How do I learn to trade?

Use online courses, books, demo accounts, and follow market news to learn to trade effectively.

How much do day traders make per day?

Earnings vary widely, but successful day traders can make hundreds to thousands of dollars daily.

Which app is better for trading?

Traders commonly use popular trading apps like Robinhood, TD Ameritrade, and E*TRADE.

How do you practice day trading?

Practice using demo accounts, paper trading, and analyzing past trades to improve skills.

How can I learn to trade for free?

Free resources like Investopedia, YouTube tutorials, and financial blogs offer valuable insights for learning to trade.

How long does it take to learn day trading?

Learning varies, but consistent practice and education can lead to proficiency within a few months to years.

What are the golden rules of trading?

Key rules include setting clear goals, managing risk, maintaining discipline, and continuous learning.

How do I become a day trader from scratch?

Start by learning market fundamentals, practising strategies, opening a brokerage account, and gradually increasing trade size.

How hard is day trading?

Day trading requires dedication, discipline, continuous learning, and the ability to handle risks and losses.

Can I start day trading with 100 dollars?

While possible, starting with $100 limits trading options and increases risk due to limited capital.

Why do you need 25k to day trade?

FINRA requires the $25,000 minimum for pattern day traders to mitigate risks associated with frequent trading.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.