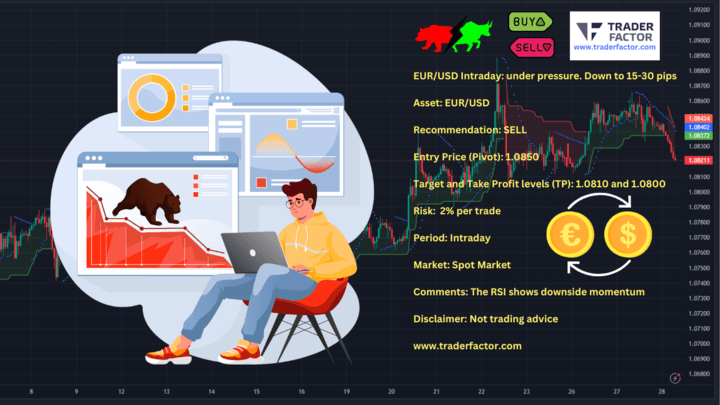

The EUR/USD pair is under significant pressure today, with a notable movement toward the 1.0800 mark in the European morning session. Analysts attribute this downward trend to a resurgence of the US Dollar strength, fueled by deteriorating risk sentiment across global markets.

Trading recommendations suggest a bearish outlook for the pair, with a pivot entry price set at 1.0850 and target levels aimed at 1.0810 and 1.0800 respectively. The suggested risk management strategy advises a limit of 2% per trade, highlighting the importance of cautious trading in the current volatile market environment. Technical indicators, such as the Relative Strength Index (RSI), further corroborate the bearish momentum, signaling potential continuation of this trend.

EUR/USD Daily Chart

The weakness of the US Dollar (USD) in the early hours of Tuesday contributed to an upward trend for the EUR/USD pair. Despite this, a mix of outcomes from Wall Street’s major indexes and the steadiness observed in US Treasury yields prevented the currency pair from securing a strong upward movement.

Amidst a cautious market sentiment underscored by declining futures on US stock indexes, the USD found some support midweek, exerting downward pressure on the EUR/USD.

Later today, attention will turn to the US Bureau of Economic Analysis (BEA) as it is set to publish the second estimate for the GDP growth rate in Q4 on an annualized basis. The preliminary estimate indicated a 3.3% expansion of the US economy. A significant adjustment downwards could negatively impact the EUR/USD. Conversely, if the GDP growth is confirmed or adjusted upwards, it might challenge the EUR/USD pair’s ability to advance, keeping the USD firm against its counterparts.

Additionally, the US will release data on the preliminary Goods Trade Balance and Wholesale Inventories for January. Speeches from key Federal Reserve officials are scheduled during the US trading session.

On Thursday, data on the Personal Consumption Expenditures (PCE) Price Index for January will be unveiled by the US Bureau of Economic Analysis (BEA).

The Personal Consumption Expenditures (PCE) Price Index is a critical measure that reflects the average increase in prices for all domestic personal consumption. It’s constructed and reported by the Bureau of Economic Analysis (BEA) and provides a comprehensive view of consumer spending on goods and services in the United States. This index is pivotal because it captures the changes in the cost of living, adjusting for consumer behavior and thus offering a broader inflation measure compared to other indices like the Consumer Price Index (CPI) .

The “core” PCE price index, which excludes volatile food and energy prices, offers a clearer view of underlying inflation trends and is closely watched by the Federal Reserve as an inflation gauge. This distinction is crucial as core measures provide a more stable basis for monetary policy decisions, aiming to mitigate short-term volatility in those categories.

Understanding the PCE is vital for forex traders and investors because it directly impacts interest rate expectations. Inflationary pressures signaled by a rising PCE can prompt the Federal Reserve to consider tightening monetary policy, which typically involves raising interest rates. Higher interest rates can lead to a stronger U.S. dollar as they attract foreign capital seeking higher returns, thereby influencing currency pairs involving the USD. Conversely, a lower-than-expected PCE reading can signal subdued inflation pressures, potentially leading to a dovish stance from the Fed and a weaker EUR/USD in the forex markets.

Therefore, the release of the PCE Price Index data on Thursday by the BEA is highly anticipated by market participants. It not only provides insight into consumer spending behavior and inflation trends but also has significant implications for forex trading strategies. A deviation from expected PCE figures can induce volatility in the forex market as traders adjust their positions in anticipation of shifts in U.S. monetary policy.

Table of Contents

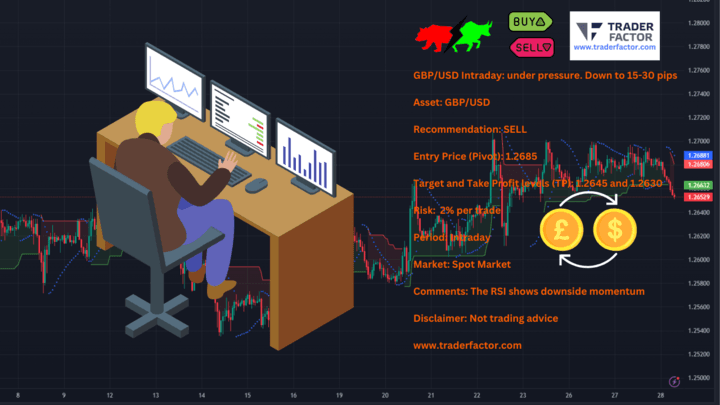

ToggleGBP/USD and AUD/USD Also Experience Selling Pressure

Similar bearish patterns are observed in the GBP/USD and AUD/USD pairs, both experiencing selling pressure amidst the prevailing market conditions. For GBP/USD, a sell recommendation is in place with an entry price of 1.2685 and targets at 1.2645 and 1.2630.

GBPUSD Daily Chart

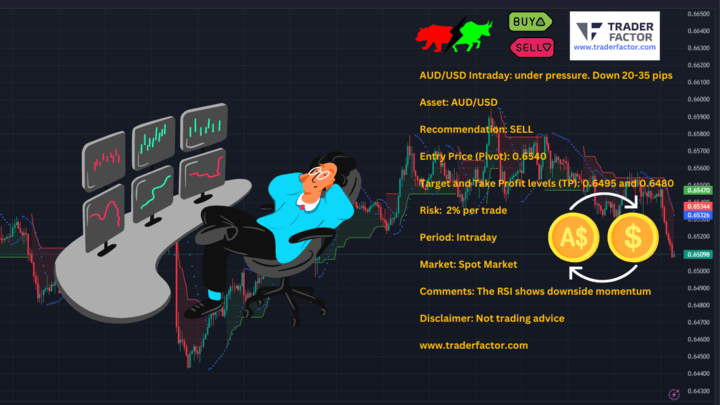

Navigating the AUD/USD Downtrend: Strategies Amid Economic Signals

Conversely, trading strategies for the AUD/USD pair suggest a bearish stance, with a proposed entry at 0.6540, targeting declines to 0.6495 and then potentially to 0.6480. The pair encountered significant selling pressure following disappointing Australian CPI data, further exacerbated by a surge in demand for the USD. Market participants are now shifting their focus towards the upcoming US Q4 GDP figures, anticipating further direction ahead of the US Personal Consumption Expenditures (PCE) Price Index report set for Thursday release.

On the domestic front, the Australian Dollar faces headwinds from stagnant consumer price inflation, which remained at its lowest point in two years through January, defying expectations for an increase. According to the latest figures from the Australian Bureau of Statistics (ABS), the headline Consumer Price Index (CPI) growth maintained a year-on-year rate of 3.4% in January, echoing the minimal increase first recorded in December 2021 since November of the same year.

Moreover, the core CPI, which filters out the more volatile components including energy, fresh produce, and seasonal travel costs, saw a slight deceleration to 4.1% year-on-year in January from 4.2% the month prior. This moderation in core inflationary pressures has sparked discussions around the potential for a quicker easing of price increases than previously anticipated, casting doubts on the likelihood of further interest rate adjustments by the Reserve Bank of Australia (RBA). Such developments exert considerable downward pressure on the AUD.

AUDUSD Daily Chart

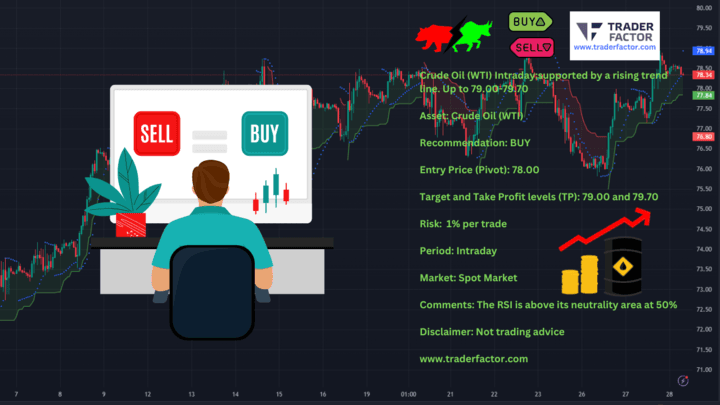

Crude Oil (WTI) Finds Support; Bullish Trend Anticipated

Contrasting the trend seen in the forex market, Crude Oil (WTI) demonstrates bullish signals, supported by a rising trend line that hints at upward price movements. A buy recommendation has been issued for WTI, with an entry point at 78.00 and targets set at 79.00 and 79.70. The commodity’s RSI standing above the 50% neutrality area suggests strong buying momentum, offering a potentially lucrative opportunity for traders in the commodities market. However, as with all trades, participants are urged to manage risks carefully, with a suggested risk cap at 1% per trade in anticipation of market volatility.

WTI Crude Oil Daily Chart

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.