To pass a Prop Firm Challenge, grasp key trading fundamentals and prepare strategically. Prioritize risk management and maintain emotional control. Understand the structure and rules of the challenge, then develop a robust strategy. Review your trading history and learn from it. Emphasize trading discipline and regularly utilize market analysis techniques. Set appropriate stop-loss points and understand your risk tolerance. Sharpen your analytical skills and display patience in decision-making. If you continue exploring, you’ll gain more insights on optimizing your strategy, enhancing your skills, and overcoming challenges in the trading environment. Pass prop firm challenge.

Table of Contents

ToggleUnderstanding Prop Firm Challenges

Diving into the world of prop firm challenges requires a deep understanding of their structure, purpose, and the stringent rules they encompass. As a trader, you’ll face unique trials that necessitate solid risk assessment skills. Knowing when to enter or exit a trade, gauging potential gains against possible losses, and setting appropriate stop-loss points are all vital.

Performance evaluation is key too. You’ve got to regularly review your trading history, pinpointing both wins and losses to refine your strategy. This involves a good deal of emotional control. It’s easy to get swept up in the heat of the moment, but smart trading requires a cool head. Don’t let fear or greed dictate your decisions.

Market analysis goes hand in hand with emotional control. You’ll need to stay on top of market trends, interpreting data accurately to inform your trades. Lastly, profitability strategies are your bread and butter—finding a trading strategy that ensures consistent gains is the ultimate goal. Remember, in the world of prop firms, it’s not about making a quick buck, but about long-term, sustainable success.

Rules of Engagement

After understanding the complexities of prop firm challenges, it’s important to grasp the specific rules of engagement that govern these tests. These rules center around five key elements: trading psychology, emotional control, risk management strategies, trading discipline, and market analysis techniques.

Trading psychology is all about your mindset. It’s vital to stay rational and keep your emotions in check. Emotional control ties in closely with this, as maintaining a level head, especially during turbulent times, can be the difference between success and failure.

Risk management strategies are likewise essential in your trading journey. These strategies help you minimize potential losses and maximize gains. Trading discipline, akin to emotional control, is about sticking to your plan and not allowing distractions or fear to steer you off course.

Lastly, market analysis techniques are tools that help you make informed trading decisions. Understanding and utilizing these techniques can greatly improve your trading outcomes.

Here’s a brief overview in a tabular format:

| Key Elements | Description | Importance |

|---|---|---|

| Trading Psychology | Mindset in trading | Rational decision making |

| Emotional Control | Management of emotions | Level-headedness in volatility |

| Risk Management Strategies | Techniques to minimize losses | Optimal profit and loss balance |

| Trading Discipline | Adherence to trading plan | Consistency in trading |

| Market Analysis Techniques | Tools for informed decisions | Enhanced trading outcomes |

Mastering Your Trading Strategy

Mastering your trading strategy is a pivotal step towards passing the prop firm challenge, requiring a clear-eyed understanding of your approach and the ability to make informed decisions. It’s about developing consistency in your trading habits, which bolsters your understanding of market trends and strengthens your decision-making abilities.

Embracing adaptability is key in this dynamic world of trading. Markets are unpredictable, so your strategy must be flexible enough to adjust to sudden changes. Remember, a rigid strategy might work once, but it won’t always deliver the same results.

Improving discipline goes hand-in-hand with mastering your strategy. It’s about sticking to your plan, resisting the temptation to make impulsive decisions, and knowing when to exit a trade. This discipline can help you stay focused even amidst market volatility.

Enhancing your strategy involves continuous learning and improvement. Stay updated on market trends, learn from your trading mistakes, and tweak your strategy as required. This proactive approach can help you stay ahead of the game.

Importance of Risk Management

While honing your trading strategy is important, equally essential is the role of risk management in your journey to pass the prop firm challenge. It’s about understanding your trading limits and sticking to them, no matter what the market throws your way. You need to master risk management strategies that are tailored to your trading style and risk tolerance.

One key aspect of risk management is psychological control. Trading can be an emotional rollercoaster, and it’s easy to get swept up in the excitement and fear of the market. But to succeed, you have to keep your emotions in check. It’s about maintaining trading discipline, even when your trades aren’t going as planned.

Your market analysis techniques also play a critical role in risk management. By staying informed and understanding market trends, you can make better decisions and reduce unnecessary risks.

Enhancing Analytical Skills

To successfully navigate prop firm challenges, you need to sharpen your analytical skills and make them an essential part of your trading toolkit. Enhancing market analysis is an important element in this process. You’ve got to deeply understand market trends and interpret them swiftly. This doesn’t only increase your knowledge but also aids in improving decision making.

Effective risk management is another vital area you’ll want to focus on. The ability to evaluate and manage potential risks can be the difference between a successful trade and a disastrous one. So, learn to identify possible risks and devise strategies to mitigate them.

Moreover, you should develop skills for quick information interpretation. The trading world is dynamic and information-loaded. Being able to swiftly interpret and act upon this information can give you an edge over other traders.

The Power of Patience and Discipline

Harnessing the power of patience and discipline in trading can set you up for long-term success in prop firm challenges. The importance of discipline can’t be overstated. It’s the bedrock of your trading strategy, keeping you grounded when market volatility tempts you to stray. It’s about making calculated decisions, not impulsive ones.

Emotional control is another critical aspect of trading. The market can stir strong feelings of fear and greed, but you must keep a cool head. Your psychological strength will be tested, and it’s your duty to remain steady, making decisions based on data, not emotions.

Risk management is integral. Don’t put all your eggs in one basket. Diversify your trades and set stop-loss orders to limit potential losses. Understanding your risk-reward ratio is essential. It’s not just about making profits, but also about minimizing losses.

Patience, too, is fundamental. The market won’t always move in your favor, and that’s okay. Wait for the right opportunities to align with your strategy. Remember, trading is a marathon, not a sprint. Success comes to those who demonstrate patience and discipline consistently.

Continuous Learning in Trading

As you develop patience and discipline in trading, remember that the journey doesn’t stop there – continuous learning is just as vital for your success. In this volatile and dynamic world of trading, you’ll need to constantly enhance your knowledge and skills to stay ahead of the game.

- Trading psychology: This involves understanding what drives market movements and how emotions can impact your trading decisions. You’re not a robot, and emotional control is essential to keep your trading decisions objective and free from impulse.

- Strategy development: You should never stop refining and improving your trading strategy. Markets evolve, and so should your tactics. Continuously test, learn, and adapt your strategy to align with the current market conditions.

- Risk management: Mastering this skill is non-negotiable. It’s not just about making profitable trades, but also about protecting yourself from severe losses. A sound risk management strategy can make the difference between long-term success and failure in trading.

Adapting to Feedback

In the world of trading, receiving feedback isn’t just important – it’s essential for your growth and improvement. Feedback adaptation is an essential skill that helps you refine your strategy and enhance your overall trading performance.

Developing resilience is key in this process. Criticism, whether positive or negative, may initially sting, but it’s pivotal to your success. Bounce back from setbacks, learn from your mistakes, and face future challenges with renewed vigor. This resilience strengthens your psychological muscle, preparing you for the rigors of trading.

Emotional control is another critical aspect. Don’t let feedback overwhelm your emotions. Whether you’ve been complimented or corrected, remain level-headed. This emotional stability will enhance your trading discipline, keeping you on track even when things don’t go as planned.

Psychological strength, coupled with discipline, will help you take feedback in stride. Remember, every piece of criticism is an opportunity for improvement. Take it, adapt, and hone your trading skills. Your ability to absorb, understand, and implement feedback will set you apart in your quest to conquer the prop firm challenge.

Simulating Real Trading Conditions

Moving on from absorbing feedback, another important aspect of preparing for prop firm challenges is practicing under realistic trading conditions. It’s vital to replicate real-world scenarios to develop your trading psychology and gain confidence.

- Practice Simulations: It’s not just about the trades you execute, but the situations you’re in. Use practice simulations to create realistic scenarios. This helps you understand market trends and sharpens your analytical skills.

- Risk Management: Make sure to set trade limits. This is a part of the disciplined approach you need to maintain in the face of market volatility. Remember, every trade carries risk, so it’s important to have a plan to mitigate it.

- Emotional Control: Trading can be a rollercoaster of emotions. It’s essential to stay calm and composed, even in challenging situations. Developing emotional control is key to maintaining a steady mindset and making rational decisions.

How to Pass Prop Firm Challenge- Tips

To ace the prop firm challenge, you’ll need more than just a solid trading strategy; you’ll also need discipline, patience, and effective risk management.

First, maintain emotional stability. Trading can be a rollercoaster, but you must remain calm, even during turbulent market conditions. Don’t let fear or greed dictate your actions. Instead, rely on your strategy and market analysis.

Next, understand your risk tolerance. It’s essential to know how much you’re willing to lose on each trade. This part of money management guarantees you don’t overexpose yourself to unnecessary risk.

Trading psychology comes into play when dealing with losses. Remember, every trader has losing trades. It’s your ability to learn from these and move forward that counts.

Money management is about more than just risk tolerance. It’s about managing your trades, your profits, and your losses effectively. Never risk more than a small percentage of your account on a single trade.

Finally, practice thorough market analysis. Use all available data to make informed decisions about your trades. The market may be unpredictable, but with careful analysis, you can make educated predictions about its movements.

Follow these tips, and you’ll increase your chances of passing the prop firm challenge.

Common Challenges in Prop Firm Trading

Despite your best efforts, you may encounter several obstacles when trading with prop firms. These challenges often revolve around emotional control, trading psychology, risk evaluation, strategy development, and trading discipline.

- Emotional control: Keeping your emotions in check is vital, particularly during market volatility. It’s easy to let fear or greed dictate your decisions, which often leads to irrational trading choices.

- Trading psychology: Understanding and mastering your psychological responses to winning and losing are key. It’s important to maintain a balanced mindset, regardless of your trading outcomes.

- Risk evaluation: Accurately evaluating risk and reward is a foundational skill in prop trading. You must be able to identify high-risk situations and manage them appropriately.

- Strategy development: Having a robust trading strategy is critical. You need to develop, test, and refine your strategy, ensuring it is compatible with your risk tolerance and trading goals.

- Trading discipline: This is the ability to stick to your trading plan, regardless of market conditions. It involves patience, adherence to your strategy, and the ability to ignore distractions.

Strategies for Challenge Success

After acknowledging the common challenges in prop firm trading, let’s now explore the strategies that can greatly increase your chances of success in these challenges.

First, harness your emotional intelligence. It’s key to staying focused and avoiding impulsive decisions when trading. You’ll need to remain calm, patient, and in control, even in the face of market volatility.

Risk assessment is another vital component of your strategy. Understanding and evaluating the potential risks involved in each trade will help you make more informed decisions.

Your trading psychology, the mindset you adopt when trading, is equally important. It’s about being disciplined, sticking to your strategy, and not allowing emotions to drive your decisions.

Next, make sure your market analysis skills are excellent. This involves studying market trends, interpreting charts, and using this information to predict future price movements.

Final Thoughts on Challenges

Exploring the world of prop firm challenges requires a well-honed trading strategy, an unwavering commitment to discipline, and a willingness to learn from each trade. These challenges are more than just a test of your trading skills—they’re a test of your mental toughness, resilience, and ability to bounce back from setbacks.

Developing resilience is essential in this game. You’ll face losses, but it’s how you react to these losses that will determine your success. Adopt a growth mindset, view each setback as an opportunity to learn and improve.

Next, mental toughness is non-negotiable. The pressure can be intense, but maintaining a positive attitude, even in the face of adversity, can help you navigate tough times.

- Overcoming setbacks is part of the journey. Don’t let a loss deter you from your path. Instead, analyze what went wrong and adjust your strategy accordingly.

- Growth mindset will be your best ally. Embrace challenges, persist in the face of setbacks, see effort as the path to mastering trading.

- A positive attitude can make all the difference. Stay optimistic, keep pushing forward, and never lose sight of your goals.

Forex Prop Firm Strategy for Beginners

Diving into the world of Forex prop firm trading, you need a robust strategy to navigate the waters successfully, especially if you’re a beginner. Recognizing the importance of trend identification, you should focus on the market’s direction. This will help you make informed decisions about your trades.

- Trend identification: Always follow the market trend. It’s easier to trade with the current than against it. Use technical analysis tools to help identify these trends.

- Risk percentage: Never risk more than a small percentage of your trading capital on a single trade. This keeps potential losses manageable while preserving your capital for future trades.

- Emotional control: Trading can be an emotional rollercoaster. It’s vital to keep your emotions in check, making decisions based on facts, not feelings. This ties closely with trading psychology.

- Trading psychology: Understanding your emotional reactions to wins and losses is important. It helps you maintain a level head, making reasoned trading decisions.

- Strategy discipline: Stick to your trading strategy even if you face a few losses. Consistency and discipline are key to long-term trading success.

With these strategies, you’ll be well-equipped to tackle the Forex prop firm challenge successfully.

Frequently Asked Questions

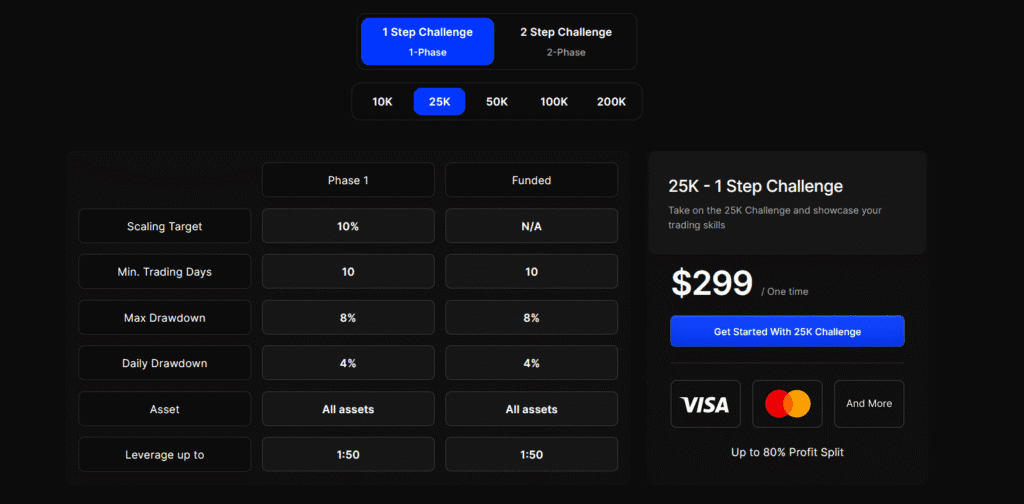

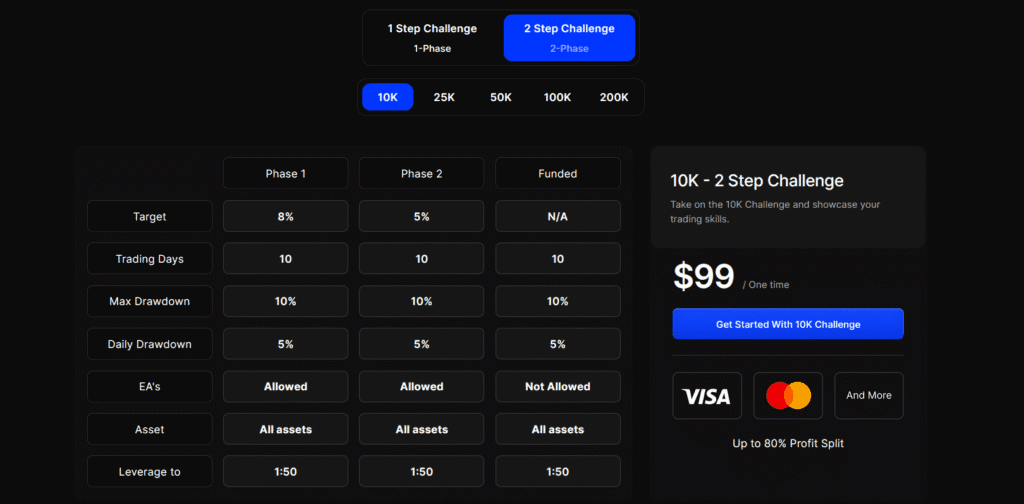

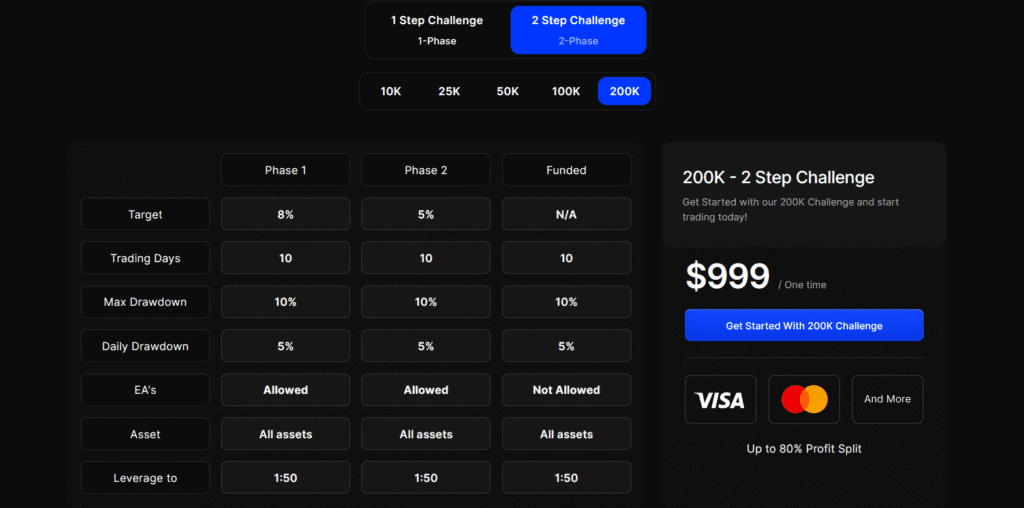

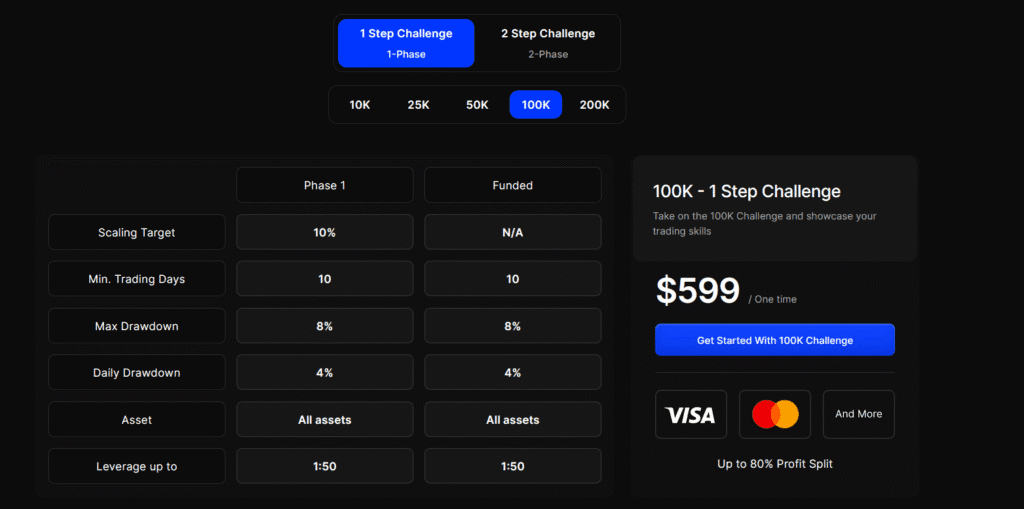

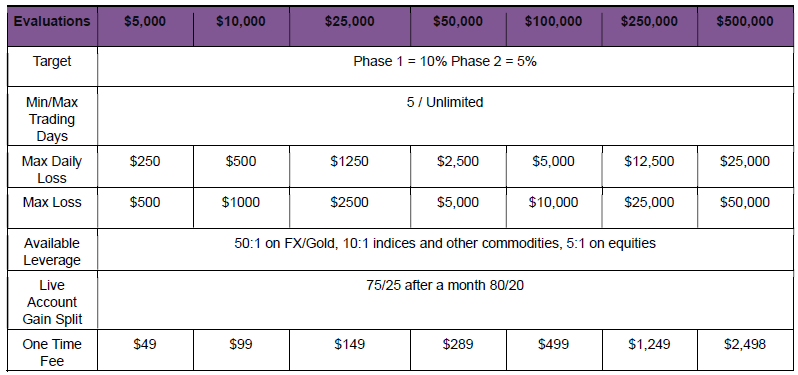

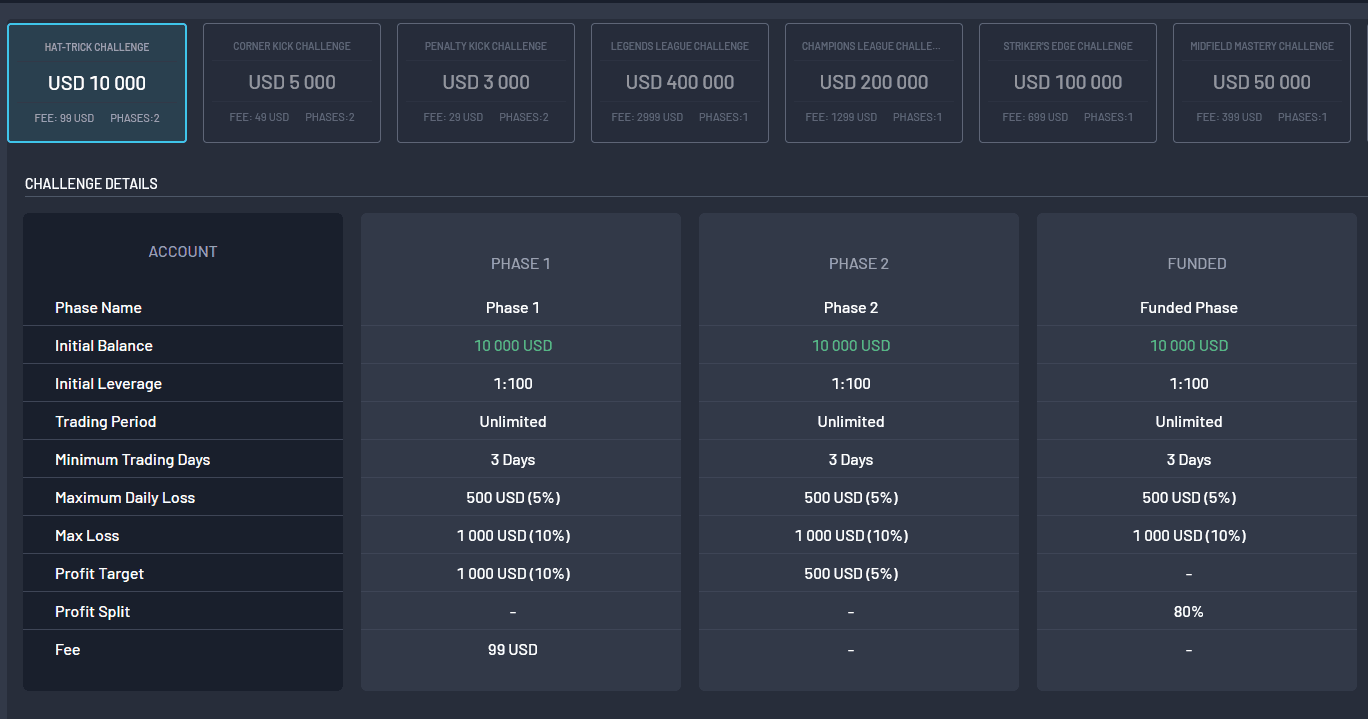

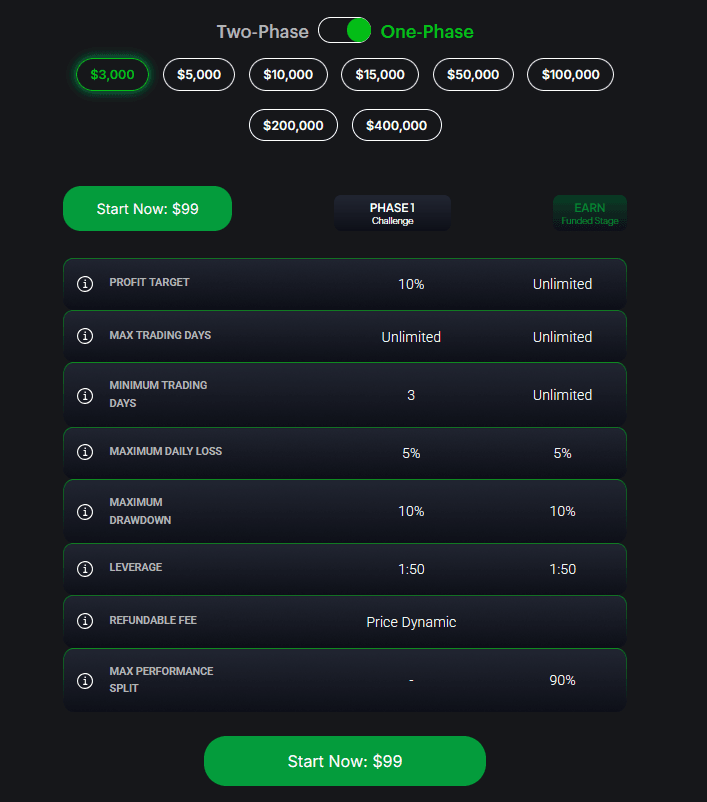

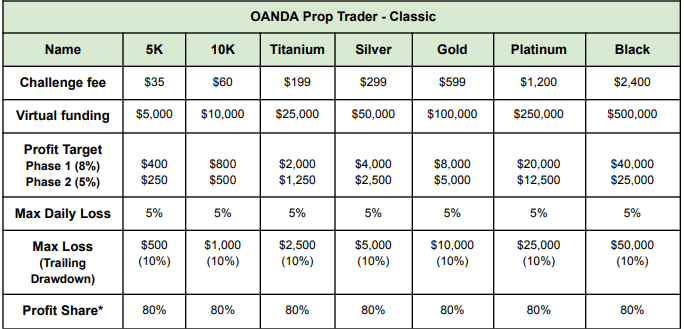

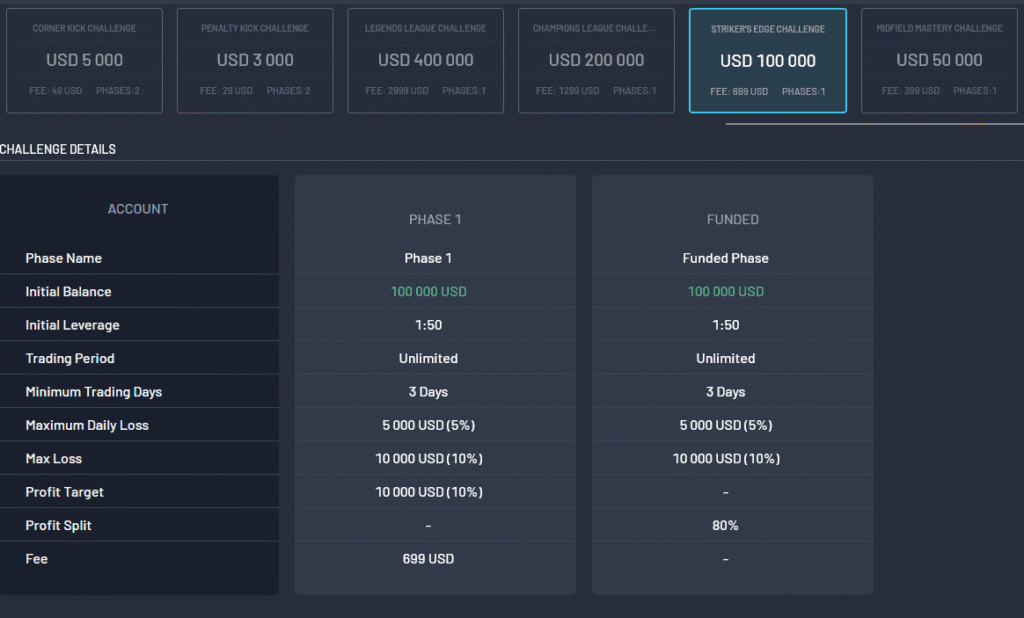

What Are the Fees Associated With Participating in Prop Firm Challenges?

You’ll encounter various fees in prop firm challenges. These include the challenge cost, hidden costs, and payment schedules. Always demand fee transparency and justification. Watch out for additional costs not clearly mentioned upfront.

How Does a Prop Firm Define ‘Consistent Profitability’?

A prop firm defines ‘consistent profitability’ as regularly achieving positive returns using your trading strategies, abiding by risk management principles, understanding market patterns, and routinely performing well in profitability metrics analysis. It’s about steady success, not occasional wins.

What Support Does a Prop Firm Provide to Traders During the Challenge?

A prop firm provides you with challenge guidance, trader mentoring, and psychological support. They’ll help you refine your trading strategies and improve risk management. It’s crucial to utilize these resources to succeed in the challenge.

Are There Specific Tools or Platforms Recommended for Prop Firm Challenges?

You’re advised to use tools that support strategy selection, risk management, and algorithmic trading. Platforms providing market analysis can aid your decision-making. Remember, mastering trading psychology is as crucial as tool proficiency.

How Do Prop Firms Handle Unsuccessful Traders in Their Challenges?

If you’re unsuccessful in a prop firm challenge, they’ll typically conduct a performance analysis and provide trader guidance for improvement. Challenge retakes may be offered, along with psychological support to address failure implications.

Disclaimer:

All information has been prepared by TraderFactor or partners. The information does not contain a record of TraderFactor or partner’s prices or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may read it. Past performance is not a reliable indicator of future performance.